Freight Shipping between the US and Turkey | Rates – Transit Times – Duties & Taxes

Whether you’re a seasoned importer/exporter or a business exploring international trade opportunities, understanding the intricacies of shipping between these two countries is vital for establishing efficient and successful supply chains. In this article, we’ll delve into the crucial aspects of freight shipping, including rates, transit times, and duties & taxes. By the end, you’ll be equipped with the knowledge to navigate the complexities of this shipping route, empowering you to make informed decisions and optimize your shipping operations. Let’s embark on this journey of exploration and discovery in the world of freight shipping between the US and Turkey.

Overview – Trade Relations between Turkey and US

Both opportunities and challenges have marked trade relations between the United States and Turkey. In recent years, the total trade between the two countries has reached significant figures. In 2021, U.S. exports to Turkey totaled $8.4 billion, a 9.5% increase from 2020, while U.S. imports from Turkey amounted to $9.6 billion, a 4.8% increase. The trade deficit was $1.2 billion, a 3.7% increase.

The energy sector stands out as a crucial component of the bilateral trade relationship. From 2020 to 2021, several key commodity sectors of U.S. exports to Turkey increased in absolute terms. In 2021, U.S. exports of machinery, aircraft, and vehicles increased by 12.4% ($408 million) from $3.3 billion in 2020 to $3.7 billion.

However, it is important to acknowledge that the Covid-19 pandemic and subsequent restrictions have introduced complexities and hurdles in the trade relationship. These measures have affected certain sectors and industries, necessitating businesses to navigate through regulatory challenges and adapt their trading practices accordingly. Additionally, geopolitical tensions and trade disputes have also impacted trade flows between the two countries.

Despite these challenges, both the United States and Turkey recognize the importance of maintaining economic ties and continue to work towards finding common ground to facilitate trade and cooperation. Efforts are being made to address trade barriers, enhance market access, and promote fair and balanced trade between the two nations.

Docshipper Note:

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat us on WhatsApp Fill the formNote DocShipper :

How can DocShipper help?

Transporting goods from China to Thailand? Simplify your journey with DocShipper! We handle everything, from organizing the transport to ensuring smooth customs procedures. Enjoy hassle-free logistics allowing you to focus on what really matters – your business. Need a hand? Reach out for a free quote in 24 hours or dial our consultants for free advice.

Sea freight between the US and Turkey

Sea freight plays a significant role in facilitating trade between Turkey and the United States. These two countries have robust maritime connections, and sea transportation is widely used for the exchange of goods and commodities. The volume of sea freight between Turkey and the USA is substantial, with a diverse range of products being transported, including machinery, automotive parts, textiles, electronics, and agricultural goods.

The utilization of sea freight between Turkey and the USA is highly prevalent due to several factors. Firstly, it allows for the cost-effective transportation of large cargo volumes over long distances. Secondly, maritime transportation provides reliable and efficient logistics solutions, ensuring the smooth flow of goods between the two countries. Key ports such as Istanbul, Izmir, and Mersin in Turkey, and ports along the eastern and western coasts of the United States, serve as vital gateways for sea trade.

The strong trade relations between Turkey and the USA, coupled with the advantages of sea freight, contribute to the significant usage of maritime transportation between these two countries. It enables businesses to meet their import and export needs, enhances supply chain efficiency, and fosters economic cooperation on a global scale.

Mains ports of the US and Turkey

The three main ports of the US are:

- Port of Los Angeles: The Port of Los Angeles is the largest container port in the United States and a major hub for global trade. Located in Southern California, it offers state-of-the-art facilities and handles various cargo, including containers, automobiles, and bulk cargo.

- Port of New York and New Jersey: The Port of New York and New Jersey is the largest port on the East Coast of the United States, serving as a crucial gateway for international trade. It features multiple terminals, including Port Newark and Port Elizabeth, and handles diverse cargo types, such as containers, bulk cargo, and automobiles.

In summary, the ports of New York, New Jersey, and Los Angeles are critical gateways for international trade in the United States. They provide extensive infrastructure, handle a wide range of cargo, and serve as key hubs for connecting the country to global markets. These ports play a vital role in supporting trade flows, contributing to the economic growth and development of their respective regions.

The three main ports of Turkey are:

- Port of Istanbul: Situated on the Bosporus Strait, the Port of Istanbul is the largest and busiest port in Turkey. It serves as a crucial international trade hub, connecting Europe and Asia. The port consists of multiple terminals, including Haydarpasa, Ambarli, and Pendik, and handles a wide range of cargo, including containers, bulk cargo, and liquid bulk.

- Port of Mersin: Located on the eastern Mediterranean coast, the Port of Mersin is one of the largest and most important ports in Turkey. It serves as a major gateway for international trade, particularly for containerized cargo, bulk cargo, and Ro-Ro (roll-on/roll-off) shipments. The port has modern facilities and excellent infrastructure, making it a preferred choice for various industries.

- Port of Izmir: Situated on the Aegean Sea, the Port of Izmir is another significant port in Turkey. It serves as a major trade gateway for the western part of the country and handles diverse cargo types, including containers, bulk cargo, and general cargo. The port’s strategic location and efficient operations contribute to its importance in regional and international trade.

These three ports, Istanbul, Mersin, and Izmir, are key maritime gateways that facilitate a significant portion of Turkey’s import and export activities. They have well-developed infrastructure, efficient logistics operations, and connect Turkey to global trade networks.

About DocShipper:

DocShipper is an international freight forwarder that arranges the transportation of goods from a supplier’s

warehouse to its final destination. Regardless of the transportation method

(air, ship, road, rail), we will handle everything from packaging to transportation arrangements,

customs clearance, and paperwork. Contact us to receive a free quote within 24 hours.

Do you have any questions? Contact us for free.

Maritime consolidation or LCL (Less than Container Load)

Maritime consolidation, also known as Less Than Container Load (LCL), is a shipping method that combines smaller shipments from multiple shippers into a single container. With LCL, businesses or individuals who have smaller quantities of goods to ship can share container space and split the cost with other parties. This option is particularly beneficial when the cargo volume does not fill an entire container, allowing for cost-effective transportation of smaller shipments. LCL offers flexibility, affordability, and convenience for those who do not require a full container for their goods.

Full Container or FCL (Full Container Load)

When it comes to sea freight, there are two main options for transporting goods: Full Container Load (FCL) and Less Than Container Load (LCL). The primary difference between the two lies in the consolidation of cargo.

FCL involves shipments where an entire container is filled with goods from a single party. This option is ideal for businesses with high-volume items or large quantities of products that require dedicated container space.

Advantages of LCL

- Cost efficiency through sharing container space and splitting transportation costs.

- Flexibility for smaller cargo volumes and irregular shipping needs.

- Accessible in major ports and shipping routes.

Disadvantages of LCL

- Longer transit times due to consolidation and deconsolidation processes.

- Increased risk of damage or loss when sharing container space.

- Limited control over timing and handling of goods.

Advantages of LCL

- Cost efficiency through sharing container space and splitting transportation costs.

- Flexibility for smaller cargo volumes and irregular shipping needs.

- Accessible in major ports and shipping routes.

Disadvantages of LCL

- Longer transit times due to consolidation and deconsolidation processes.

- Increased risk of damage or loss when sharing container space.

- Limited control over timing and handling of goods.

DocShipper Tip:

If you’re looking to import or export goods, we highly recommend getting help from a knowledgeable

professional like Docshipper. Consolidation can be a somewhat risky choice when it comes to transportation

options for your goods. However, rest assured that your needs will be met quickly thanks to Docshipper’s

expertise in import and export processes, especially his FCL and LCL consolidation.

Get in touch now via our contact form or give us a call. Our experienced professionals will respond quickly.

Container Options for Specialized Shipping: Reefer? Ro-Ro? Bulk? OOG?

When determining the appropriate container for your shipment, several factors come into play, including the size of your cargo and the nature of the goods. Various container options are available to accommodate specific needs:

- Reefer Container: These refrigerated containers are ideal for temperature-sensitive products such as meat, fruits, vegetables, dairy products, pharmaceuticals, and chemicals. They ensure that goods maintain a stable temperature throughout their journey.

- Ro-Ro (Roll-on/Roll-off): Ro-Ro vessels are used for shipping vehicles and are loaded via ramps. They provide a straightforward and cost-effective method for transporting vehicles. The vehicles are driven onto the vessel’s car decks and securely fastened.

- Bulk Cargo: Bulk goods are directly loaded into the ship’s hold or designated facilities. There are two types of bulk goods: solid bulk goods (e.g., coal, ores) and liquid bulk goods (e.g., petroleum products). Specialized bulk carriers, such as ore carriers or coal carriers, are used for transporting bulk cargo.

- OOG (Out of Gauge): OOG cargoes are non-standard in dimensions or weight and cannot fit into standard containers. They are typically loaded onto platforms or trailers for transportation. Open Top Containers have no rooftop, while flat-rack containers lack roofs and partitions on the sides, allowing for the shipping of heavy or oversized items in terms of height and/or width.

Considering the specific requirements of your cargo, selecting the appropriate container type ensures the safe and efficient transportation of your goods.

How much does the ocean freight cost between Turkey and Russia?

The average cost of shipping a 20-foot container (FCL) from Turkey to Russia ranges from $500 to $1,500, while the cost of a 40-foot container (FCL) can range from $800 to $2,500. The cost of shipping a Less than Container Load (LCL) shipment can vary depending on the volume and weight of the cargo. Please note that these are approximate estimates, and the actual cost may vary based on the specific details of your shipment.

How is the freight cost between Turkey and Russia calculated?

The weight/volume ratio, or volumetric weight, is the most used method to calculate sea freight costs between Turkey and Russia. It determines the chargeable weight of a shipment, used by carriers to calculate costs.

The formula for calculating volumetric weight involves multiplying the length, width, and height of the shipment, then dividing by a volumetric weight factor. The resulting volumetric weight is compared to the actual weight, and the higher is used as the chargeable weight for shipping costs.

For example, if you have a shipment from Turkey to Russia with a physical weight of 500 kg but a volume of 2 cubic meters, and the volumetric weight factor is 5000 cubic centimeters per kg, you can calculate the volumetric weight as follows:

Volumetric weight (kg) = Volume (m3) / Volumetric weight factor (m3/kg)

Volumetric weight (kg) = 2 m3 / 5000 m3/kg = 0.4 kg

In this case, the volumetric weight of 0.4 kg is higher than the actual weight of 0.5 kg. Therefore, the shipping costs would be based on the volumetric weight of 0.4 kg, as it would be considered the chargeable weight for the shipment.

Using the weight/volume ratio allows for accurate calculation of shipping costs based on space occupied, ensuring efficient utilization of cargo space and appropriate charges for larger but lighter shipments, reflecting actual space occupied in the shipping vessel.

Air freight between Turkey and the US

Air freight between Turkey and the United States is often preferred for urgent shipments requiring a fast delivery time.

What are the different types of airfreight?

There are two main types of air freight services available:

- Conventional air cargo: Utilizes space on conventional airlines (such as Air France, Air China…) and cargo carriers for larger quantities of goods. Ideal for non-time-sensitive shipments following regular airfreight schedules.

- Express air freight: Relies on courier companies like DHL, FedEx, TNT, UPS, and others for smaller shipments, typically parcels or packages. Designed for expedited delivery of time-sensitive items such as documents, perishable goods, or high-value items. Offers faster transit times, tracking, insurance, and priority handling.

Classic or express air freight?

Classic and express air freight are two options for shipping goods by air, each with its own advantages and considerations.

- Classic air freight, also known as standard air freight, refers to the traditional method of shipping goods by air. It offers a balance between cost and speed, making it suitable for less time-sensitive shipments. Classic air freight typically operates on scheduled flights and has longer transit times compared to express services.

- Express air freight, on the other hand, is a faster shipping option that prioritizes speed and time-critical deliveries. It is commonly used for urgent or time-sensitive shipments that require quick delivery. Express air freight services often operate on dedicated or chartered flights, allowing for faster transit times and expedited handling.

When choosing between classic and express air freight, several factors come into play. The urgency of the shipment, budget constraints, and the nature of the goods are essential considerations. Classic air freight offers a more cost-effective solution for non-urgent shipments, while express air freight ensures faster delivery but may come at a higher cost.

It is important to work closely with logistics providers or freight forwarders to determine the most suitable option based on your specific needs, timeline, and budget. They can provide guidance on transit times, and pricing and help navigate the complexities of air freight to ensure your goods are transported efficiently and reliably.

Main airports of Turkey

Here is a list of the three main airports in Turkey:

Mains airports of the U.S.

The United States is home to numerous airports, but three of the busiest and most significant airports are:

Transit time between the airports of Turkey and the airports of the US

| Turkey/USA | O’Hare International Airport | Los Angeles International Airport | Hartsfield-Jackson Atlanta International Airport |

| Istanbul Airport | 15 hours | 14 hours | 16 hours |

| Atatürk Airport | 12 hours | 12 hours | 11 hours |

| Ankara Esenboğa Airport | 13 hours | 11 hours | 13 hours |

What are the advantages of air transport?

Air freight offers several advantages that make it a preferred choice for certain types of goods:

- Speed and Reliability: Air transport is known for its speed, allowing goods to be transported quickly across continents. This is particularly beneficial for perishable items, live animals, and time-sensitive goods.

- Safety: Airports have strict regulations and security measures in place, ensuring the safety and protection of air cargo. This reduces the risk of theft or damage during transit.

- Extensive Coverage: Air freight can reach even the most remote locations by utilizing airports as transportation hubs. Goods can then be efficiently transported to their final destination by road or other means.

- Tracking Capabilities: Many air cargo service providers offer online tracking systems, allowing shippers to monitor the status of their shipments in real-time. This provides transparency and peace of mind throughout the transportation process.

- Cost-effective Packaging: Due to the lightweight nature of air shipments, packaging requirements are often minimal. This reduces the need for excessive packaging materials and containers, resulting in cost savings for shippers.

In summary, air freight provides fast and reliable transportation, enhanced security measures, extensive coverage to remote areas, tracking capabilities, and cost-effective packaging options for certain types of goods.

How much does it cost to transport air freight between Turkey and Russia?

Shipping costs from China to the US can vary depending on various factors such as the chosen mode of transport, shipment size, weight, and applicable taxes and customs duties.

When it comes to air freight, rates typically range from $100 to several thousand dollars.

The International Air Transport Association (IATA) establishes a tariff structure for air freight. The basic rate is determined based on weight bands, with prices decreasing as the weight increases.

There is usually a minimum charge for very small shipments. Here is an example:

- Price per kilo: $6

- 1000 to 2500 kg: $5/kg

- 2500 to 3500 kg: $4/kg

- More than 3500 kg: $3/kg

- Minimum collection: $600

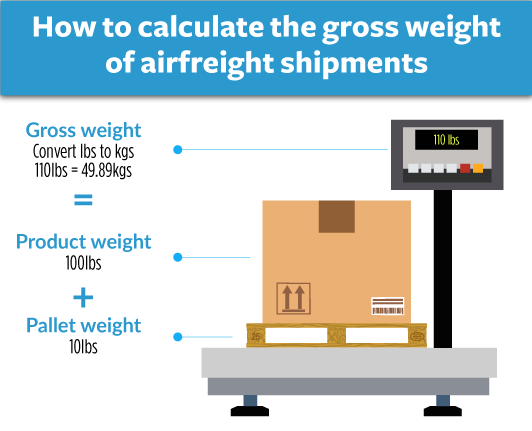

It’s important to note that the calculation of the tariff is not solely based on the gross weight of the goods but also takes into account the volumetric weight.

Additionally, airlines and airports may apply additional fees and taxes such as airport tax, AWB (Airway Bill) fees, security tax, risk insurance tax, and fuel tax.

These additional charges and taxes vary depending on the specific airline, airport, and the nature of the shipment.

It’s advisable to consult with a freight forwarder or shipping agent to get accurate and up-to-date information on the total cost of air freight from China to the US, including any applicable fees and taxes.

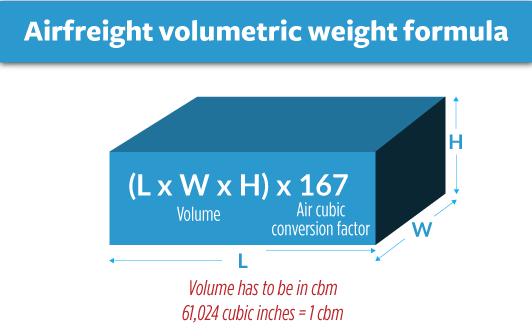

How to calculate the volumetric weight of your shipment?

Just like the sea freight previously, an equivalency rule is applied as well by all air carriers to calculate the volumetric weight. The greatest of the volumetric weight and the gross weight of your goods will be used. Please note the following rules:

Classic airfreight : 1 CBM = 167 Kgs (1:6)

Express airfreight : 1 CBM = 200 kgs (1:5)

Door-to-door delivery between the US and EuropeaDoor-to-door delivery between Turkey and Russia?

Door-to-door delivery between Turkey and the United States offers a seamless and hassle-free shipping experience. With this service, customers can enjoy the convenience of having their goods transported from the point of origin in Turkey to the final destination in the United States without any intermediate handling or coordination.

Our door-to-door service includes comprehensive logistics management, starting from the pickup of the goods from your location in Turkey, handling all necessary customs documentation and clearance procedures, arranging the appropriate mode of transportation (such as air or sea freight), and finally delivering the goods directly to your specified address in the United States.

By opting for door-to-door delivery, you can save time and effort as our experienced team takes care of the entire shipping process. Whether you’re shipping personal belongings, commercial goods, or e-commerce packages, our door-to-door service ensures smooth and efficient delivery, allowing you to focus on other aspects of your business or personal life.

What are the advantages of door-to-door services?

Advantages of Door-to-Door Services:

- Convenience: Door-to-door services provide a high level of convenience as the shipping company takes care of the entire transportation process, from pickup at the origin to delivery at the destination. This saves the customer from the hassle of coordinating multiple parties and handling logistics.

- Time-Saving: Door-to-door services are typically faster compared to other shipping options. The shipping company takes responsibility for managing the entire process, ensuring timely pickup, transportation, and delivery of the goods.

- Reduced Risk of Damage: With door-to-door services, the shipping company is accountable for the safe handling and transportation of the goods throughout the entire journey. This reduces the risk of damage or loss compared to multiple transfers between different modes of transport.

- Improved Tracking and Visibility: Door-to-door services often include advanced tracking systems that provide real-time updates on the shipment’s location and estimated delivery time. This allows customers to have better visibility and peace of mind regarding the status of their goods.

DocShipper info :

Looking for a safe and dependable door-to-door service between Turkey and Russia? We will gladly assist you in locating the best comprehensive package for you. DocShipper is here to assist you from A to Z and ensure the smoothest possible shipment, with no intervention required from your side as our team will take care of everything. Please do not hesitate to contact us.

Customs Clearance in Spain for Goods between the US and Turkey

When importing goods between the US and Turkey, customs clearance is an essential step in the shipping process. It involves the submission of necessary documents, payment of customs duties and taxes, and compliance with relevant regulations.

Categories of Tariffs

Tariffs for goods imported into Turkey and the US can be classified into different categories:

- Tariff Classification based on Commodity Flow: Goods are categorized based on their nature and purpose, such as raw materials, finished products, or capital goods

- Tariff Classification based on Tariff Purpose: Goods are classified according to their intended use or function, such as consumer goods, intermediate goods, or capital goods

- Tariff Classification based on Tariff Treatment: Goods are categorized based on specific tariff treatment, such as preferential tariffs or special exemptions

Preferential Tariffs

Preferential tariffs are offered under trade agreements or arrangements between countries to promote bilateral trade and provide cost advantages for specific goods. These tariffs are typically lower or exempted, subject to certain conditions and eligibility criteria.

Most-favored-nation Treatment Tariffs

Most-favored-nation (MFN) treatment tariffs are applied to goods that are not eligible for preferential treatment. MFN tariffs are the standard tariff rates applied to all countries with which those country does not have preferential trade agreements.

Special Preferences

Certain industries or sectors may receive special preferences, such as tax exemptions or reduced tariffs, to promote growth, innovation, or economic development. For more information, click here.

Generalized System of Preferences Tariffs

Under the Generalized System of Preferences (GSP), certain developing countries may benefit from reduced or zero tariffs on specific goods when exporting to those countries. GSP tariffs aim to support economic growth and trade cooperation with eligible countries.

What are the customs duties and taxes between Turkey and the US?

The customs duties and taxes between Turkey and the United States are specific to the products being imported and can vary significantly. However, here are some general examples of customs duties that may apply.

Turkey to the United States:

- Textiles and apparel: Customs duties can range from 7% to 32%.

- Steel products: Customs duties can range from 0% to 25%, depending on the type of steel.

- Agricultural products: Customs duties vary widely depending on the specific product and can range from 0% to 350%.

United States to Turkey:

- Vehicles: Customs duties for automobiles can range from 40% to 60%.

- Electronics: Customs duties for electronic goods can range from 3% to 12%.

- Machinery and equipment: Customs duties can range from 2% to 10% depending on the type of machinery.

How to calculate customs duties and taxes

To find out the rate of duty applied to your products, information is available online for free. You will be able to select the date, country of origin, destination and all related data to get the information you are interested in. We will guide you in this search a little further down.

In Turkey

When shipping items internationally or importing goods from abroad, it is important to consider the taxes and duties that may apply. These charges are determined by several factors, including the weight, value, and type of the shipment, as well as the country from which it is being imported or transported.

The tax rates for imported goods depend on the origin of the consignment. If the order is placed within the European Union (EU) or sent from an EU country, the tax rate is typically 18%. However, if the consignment is from a non-EU country like China, the tax rate increases to 20%. Additionally, certain products listed under the Special Consumption Tax (SCT) number 4 list are subject to an additional 20% SCT.

Let’s consider an example where you purchased a “luxury” item worth TL 200. With a 20% customs tax rate for products imported from China, you would need to pay an additional TL 40. Additionally, the Special Consumption Tax (ÖTV) of 20% would be applicable to the product price plus customs tax, resulting in an extra TL 48. Other charges to be aware of include a customs presentation fee of TL 8 and a stamp duty of TL 0.70, regardless of the item’s value. In total, the amount payable would be TL 296.70.

In the US

The customs duties and taxes applied when importing goods into the United States vary depending on the product category and the country of origin. The duty rates for specific products can be found in the Harmonized Tariff Schedule (HTS), which is maintained by the U.S. International Trade Commission (USITC).

On average, the customs duty rates for most goods imported into the United States range from 0% to 5%. However, certain products may have higher duty rates, especially for items such as textiles, apparel, and certain agricultural products. For example, the duty rate for some textiles can be as high as 16% to 32%, while certain agricultural products may have rates ranging from 10% to 350%.

In addition to customs duties, imported goods may also be subject to other taxes and fees. The Merchandise Processing Fee (MPF) is one such fee, which is based on the value of the goods being imported. The MPF rate is typically 0.3464% of the entered value, with a minimum fee of $27.23 and a maximum fee of $528.33.

What are the customs duties and taxes between Turkey and the US?

The customs duties and taxes between Turkey and the United States are specific to the products being imported and can vary significantly. However, here are some general examples of customs duties that may apply.

Turkey to the United States:

- Textiles and apparel: Customs duties can range from 7% to 32%.

- Steel products: Customs duties can range from 0% to 25%, depending on the type of steel.

- Agricultural products: Customs duties vary widely depending on the specific product and can range from 0% to 350%.

United States to Turkey:

- Vehicles: Customs duties for automobiles can range from 40% to 60%.

- Electronics: Customs duties for electronic goods can range from 3% to 12%.

- Machinery and equipment: Customs duties can range from 2% to 10% depending on the type of machinery.

How to calculate customs duties and taxes

To find out the rate of duty applied to your products, information is available online for free. You will be able to select the date, country of origin, destination and all related data to get the information you are interested in. We will guide you in this search a little further down.

In Turkey

When shipping items internationally or importing goods from abroad, it is important to consider the taxes and duties that may apply. These charges are determined by several factors, including the weight, value, and type of the shipment, as well as the country from which it is being imported or transported.

The tax rates for imported goods depend on the origin of the consignment. If the order is placed within the European Union (EU) or sent from an EU country, the tax rate is typically 18%. However, if the consignment is from a non-EU country like China, the tax rate increases to 20%. Additionally, certain products listed under the Special Consumption Tax (SCT) number 4 list are subject to an additional 20% SCT.

Let’s consider an example where you purchased a “luxury” item worth TL 200. With a 20% customs tax rate for products imported from China, you would need to pay an additional TL 40. Additionally, the Special Consumption Tax (ÖTV) of 20% would be applicable to the product price plus customs tax, resulting in an extra TL 48. Other charges to be aware of include a customs presentation fee of TL 8 and a stamp duty of TL 0.70, regardless of the item’s value. In total, the amount payable would be TL 296.70.

In the US

The customs duties and taxes applied when importing goods into the United States vary depending on the product category and the country of origin. The duty rates for specific products can be found in the Harmonized Tariff Schedule (HTS), which is maintained by the U.S. International Trade Commission (USITC).

On average, the customs duty rates for most goods imported into the United States range from 0% to 5%. However, certain products may have higher duty rates, especially for items such as textiles, apparel, and certain agricultural products. For example, the duty rate for some textiles can be as high as 16% to 32%, while certain agricultural products may have rates ranging from 10% to 350%.

In addition to customs duties, imported goods may also be subject to other taxes and fees. The Merchandise Processing Fee (MPF) is one such fee, which is based on the value of the goods being imported. The MPF rate is typically 0.3464% of the entered value, with a minimum fee of $27.23 and a maximum fee of $528.33.

How to calculate applicable tariff with the HS code?

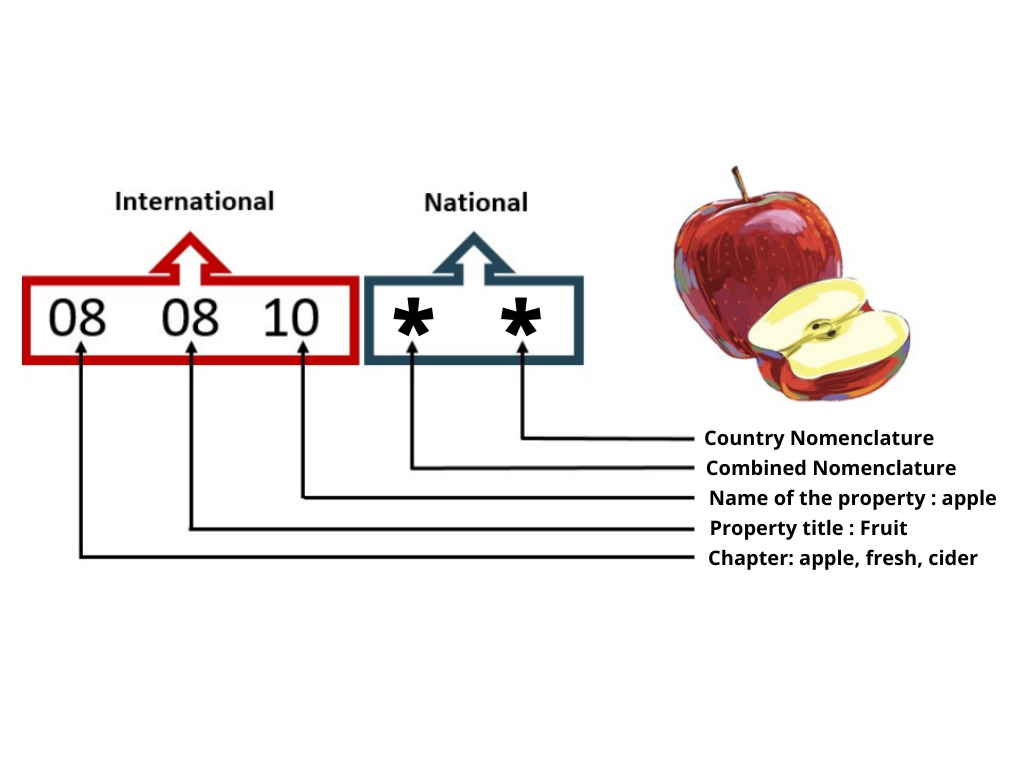

When importing goods between Turkey and US, it is important to follow the customs procedures and regulations to ensure smooth clearance of your goods.

The first step is to determine the Harmonized System (HS) code of the product you are importing. The HS code is an internationally recognized system for classifying goods based on their nature, composition, and intended use. The HS code, together with the country of origin, will determine the applicable customs duty and tax rates.

This is how the HS code is composed :

How do I find the HS Code?

If you intend to import or export goods, you must first determine the correct HS code for your products. There are two basic methods for determining the HS code for your products.

To begin, you can check an HS code directory, which is categorized by product type or industry and is available online or in print. The second alternative is to obtain advice from a customs broker or freight forwarder, both of whom can be invaluable in international trade matters. While conducting online research or using a third-party website can be beneficial, but it can also be time-consuming and perplexing.

How to calculate the applicable tariff with the HS code?

Here are the steps to find the customs duties of each product using the HS code on the website related to the Turkish HS code:

- Visit the Turkish Customs Tariff Guidelines

- Copy the HS Code you looked up in the last step

- Use Ctrl + F to search for the duty rate in Turkey

DocShipper info:

At DocShipper, we do not charge customs duties directly. Customs duties and taxes are paid directly to the government. However, we do charge customs clearance fees for our services, which cover the administrative tasks and expertise involved in the customs clearance process.

Customs Clearance duties: Does DocShipper Charge Them?

Customs duties and taxes are charges levied by customs authorities and are payable by the importer. Customs clearance, on the other hand, refers to the process of fulfilling all necessary requirements and formalities to gain approval from customs authorities for the import of goods. Logistics service providers like DocShipper may assist with customs clearance but do not charge customs duties or taxes.

So, please notice this: No agent has the right to charge you duty!

Customs Contact for Turkey

Republic of Turkey Ministry of Trade

Website: https://www.gtb.gov.tr/

Email: info@gumrukticaret.gov.tr

Phone: +90 312 204 99 99

Customs Contact for the United States

U.S. Customs and Border Protection (CBP)

Website: https://www.cbp.gov/

Phone: 1-877-CBP-5511 (1-877-227-5511)

DocShipper Advice:

As you can see, Docshipper is far from being just an international forwarder. In fact, we take care of many other logistics operations such as customs clearance, or even packing and insurance! For more information, contact our experts via our form or directly by phone, you will receive a free quote within 24 hours.

What documents are required for customs clearance?

The specific documentation required for customs clearance in United States and Turkey may differ based on the type of commodities being imported or exported, as well as the customs authority’s specific criteria. However, the following are some frequent documents that may be required :

- Commercial invoice: This document provides a description of the goods being imported, as well as their value.

- Bill of lading: This is a legal document that provides evidence of the shipment of goods and includes details such as the type of goods, quantity, and destination.

- Packing list: This document provides a detailed list of the contents of each package being shipped.

- Import declaration: This is a document that declares the details of the imported goods, including their HS code, quantity, value, and country of origin.

- Certificate of origin: This document confirms the origin of the goods being imported and may be required to claim preferential treatment under a free trade agreement.

- Insurance certificate: This document provides evidence of insurance coverage for the goods being transported.

- Permits and licenses: Depending on the type of goods being imported or exported, various permits and licenses may be required, such as import permits or phytosanitary certificates.

Contact DocShipper if you need help clearing customs. We have agents all around the world ready to take care of every step of your customs clearance process. Fill out this easy form.

Restricted and Prohibited Products

Restricted and prohibited products vary between the United States and Russia. Here is an overview of the restrictions and prohibitions in each country:

United States:

In the United States, there are certain products that are restricted or prohibited from import or export. Here are some examples of products that may fall under these categories:

- Controlled Substances: Import and export of illegal drugs and narcotics, including recreational drugs and controlled substances, is strictly prohibited.

- Weapons and Firearms: Import and export of certain weapons, firearms, ammunition, and explosive materials are regulated and require special permits and licenses.

- Counterfeit Goods: Import and export of counterfeit or pirated goods, including fake brand-name products, copyrighted materials, and unauthorized copies, is illegal.

- Endangered Species and Wildlife: Import and export of products made from endangered species, wildlife, or protected plants and animals, including their parts, skins, or derivatives, is restricted and requires special permits from the U.S. Fish and Wildlife Service.

- Cultural and Historical Artifacts: Import and export of cultural and historical artifacts, such as archaeological items, antiques, and artworks, may require special permits and documentation from the U.S. Customs and Border Protection and other relevant authorities.

- Hazardous Materials: Import and export of hazardous materials, chemicals, and substances that pose risks to health, safety, and the environment are subject to strict regulations and require compliance with international standards.

For detailed information on restricted and prohibited products in the United States, you can refer to the CBP website.

Turkey:

In Turkey, there are certain products that are restricted or prohibited from import or export. Here are some examples of products that may fall under these categories:

- Firearms and Ammunition: The import and export of firearms, ammunition, and explosive materials are strictly regulated and require special permits and licenses.

- Drugs and Narcotics: Import and export of illegal drugs and narcotics, including recreational drugs and controlled substances, is strictly prohibited.

- Counterfeit Goods: Import and export of counterfeit or pirated goods, including fake brand-name products, copyrighted materials, and unauthorized copies, is illegal.

- Endangered Species and Wildlife: Import and export of products made from endangered species, wildlife, or protected plants and animals, including their parts, skins, or derivatives, is restricted and requires special permits from the relevant authorities.

- Cultural and Historical Artifacts: Import and export of cultural and historical artifacts, such as archaeological items, antiques, and artworks, may require special permits and documentation from the Ministry of Culture and Tourism.

- Hazardous Materials: Import and export of hazardous materials, chemicals, and substances that pose risks to health, safety, and the environment, are subject to strict regulations, and require compliance with international standards.

For detailed information on restricted and prohibited products in Turkey, you can refer to the Republic of Turkey Ministry of Trade.

Your Next Step with DocShipper

Additional logistics services

Discover DocShipper's holistic approach to supply chain management, covering not just shipping and customs, but a full suite of additional logistics services tailored to streamline your global operations effectively.

Warehousing and storage

Securing a reliable warehouse in a foreign land could be a mountain to climb. Your goods, especially temperature-sensitive ones, need perfect conditions to stay market-ready. Imagine the peace of mind that a well-managed, temperature-controlled storage would bring! Your quest for such reliable warehousing ends here. More info on our dedicated page: Warehousing.

Packaging and repackaging

Protecting your products for the journey from China to Thailand requires expert packing and repackaging. Looking for items that defy the odds? Our network of trustworthy agents can handle everything from electronics to fragile ceramics. They ensure safe transport, perfect for businesses shipping diverse goods. Want to dive deeper? Find more at our dedicated page: Freight Packaging

Cargo insurance

Cargo insurance acts as your safety net during your shipping journey. Ever considered a scenario where your shipment gets damaged by incidents other than fire? This is where cargo insurance comes into play, covering physical losses or damages from external causes. Think of a heavy storm tossing your ocean freight; cargo insurance has your back! Our customized coverage mitigates such risks. Need more insights? Visit our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Looking to manufacture in Asia or East Europe? The supplier management service from DocShipper seamlessly handles it all - right from finding reliable suppliers to overseeing the entire procurement process. Forget language limitations or complex sourcing steps - DocShipper guides you through it all. For instance, if you strive to create a new toy line in China, we connect you with the best manufacturers and handle all purchasing details. More info on our dedicated page: Sourcing services

Personal effects shipping

Moving special items from China to Thailand? Your precious or oversized belongings deserve safe and efficient shipping. That's where we come in, with expertise in handling fragile and bulky cargo with utmost care. Consider the time we secured a customer's antique Chinese vase; it arrived in Bangkok unscathed! Craving more insights? More info on our dedicated page: Shipping Personal Belongings.

Quality Control

Ensuring the excellence of your products is our priority. Our Quality Control service eliminates your worries over manufacturing errors in your China-to-Thailand shipping. Imagine unboxing your Thai order only to find unsuitable items - a nightmare avoided with our pre-shipment inspection. Don't gamble with your business reputation; let us protect it. More info on our dedicated page: Quality Inspection

Product compliance services

Ensuring your merchandise arrives safely is essential, but have you considered if it meets local compliance standards? Our Product Compliance Services handle this crucial aspect, conducting rigorous laboratory tests for certification and verifying that your goods abide by the destination's regulations. Suppose true peace of mind in international shipping means no surprises at customs. In that case, our specialized expertise might be invaluable to you. More info on our dedicated page: Product compliance services

FAQ - Freight Shipping between the US and Turkey

The main ports for maritime trade between Turkey and the US include the Port of New York and New Jersey, the Port of Los Angeles, and the Port of Long Beach.

Customs duties and taxes for goods imported from Turkey to the US are determined based on factors such as the product type, value, and country of origin. The U.S. Customs and Border Protection (CBP) website provides resources and tools to calculate customs duties and taxes accurately.

Both Turkey and the US have regulations on restricted and prohibited products. It is essential to review the regulations provided by the respective customs authorities to ensure compliance with import/export restrictions.

Door-to-door delivery services are available for shipping goods between Turkey and the US. Logistics providers can handle the entire process, including pickup, customs clearance, transportation, and delivery to the final destination in both countries.

For more detailed information on customs regulations, trade requirements, and specific import/export guidelines between Turkey and the US, it is recommended to consult the official websites of the Republic of Turkey Ministry of Trade and the U.S. Customs and Border Protection (CBP).