Cargo insurance offers protection against physical loss or damage to commodities. At the same time, they are being transported from and to the U.S. It covers losses brought on by various events, including aviation crashes, mishaps, fires, theft, and other natural calamities. The financial loss brought on by these damages is protected by cargo insurance, which can also spare you the expense of replacing or fixing pricey items.

Due to the complexity of international shipping laws and regulations compared to domestic shipping, cargo insurance is crucial when sending products overseas. Having cargo insurance is crucial if you're shipping expensive or delicate items because it will enable you to recover the costs of doing so.

The type of cargo being sent, the form of transportation, the value of the cargo, and the distance the cargo is being shipped are all variables that affect the cost of cargo insurance. To guard against potential losses, proper cargo insurance must be in place.

What is Cargo insurance?

A type of insurance called cargo insurance can shield the value of your items from physical harm, theft, or everyday wear and tear.

In general, it guards against shipments being lost, broken, or stolen while in transit.

Cargo insurance can assist in preventing financial loss by paying you the amount you're insured for in the case of a covered occurrence, such as damage or theft.

It's crucial to compare the expenses of insurance with the possible losses and collateral harm that could happen in the absence of insurance.

The type of cargo being sent, the form of transportation, the value of the cargo, and the distance the cargo is being shipped are all variables that affect the cost of cargo insurance. To guard against potential losses, proper cargo insurance must be in place.

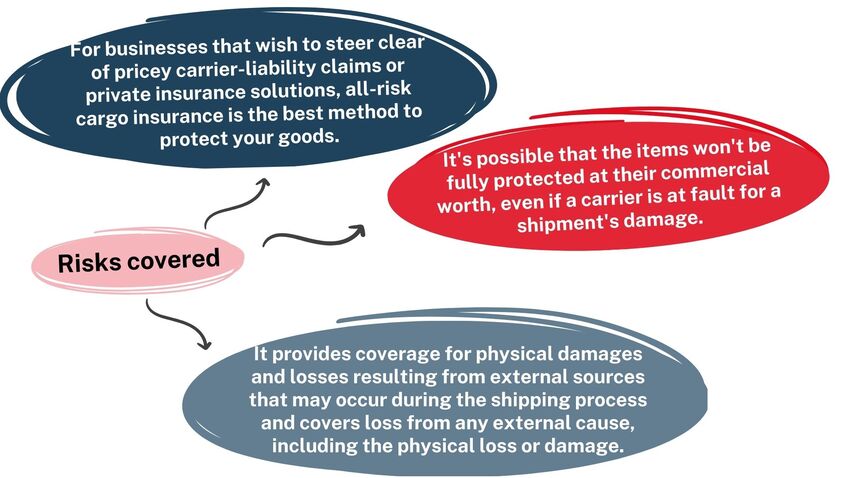

Risks covered

Cargo insurance is a type of marine insurance that covers the loss or damage to goods that are transported by sea, land, or air. It protects the goods from a variety of risks that can occur during the shipment, including theft, loss, damage, delay, and destruction. The main risks covered by cargo insurance are loss or theft by an outside party, damage caused by an accident or natural disaster, and delay due to an unexpected event. In addition, cargo insurance also covers legal costs associated with any dispute that may arise. To summarize, the main risks covered are:

- For businesses that wish to steer clear of pricey carrier-liability claims or private insurance solutions, all-risk cargo insurance is the best method to protect your goods.

- It's possible that the items won't be fully protected at their commercial worth, even if a carrier is at fault for a shipment's damage.

- It provides coverage for physical damages and losses resulting from external sources that may occur during the shipping process and covers loss from any external cause, including the physical loss or damage.

Peace of Mind for Your Freight: The Benefits of Cargo Coverage

Any business owner can profit from cargo coverage in a variety of ways. Cargo coverage can be a priceless instrument for safeguarding your shipments, providing you with protection in both your finances and your mind. You can be certain that your items will arrive at their destination unscathed and in good condition if you have the appropriate coverage :

- A priceless tool for protecting your shipments, cargo insurance can give you both financial and psychological security. If you have the proper coverage, you can be sure that your belongings will reach their destination undamaged and in good condition.

- Financial Protection: If something goes wrong while in transportation, cargo insurance can offer financial security. It can provide compensation for any resulting losses or damages, assisting you in recovering any monetary losses related to the cargo.

- Peace of Mind: As a business owner, having cargo coverage in place can help to provide you peace of mind. A lot of the stress that comes with delivering products can be reduced by knowing that your cargo is protected.

Any business owner can profit from cargo coverage in a variety of ways. Cargo coverage can be a priceless instrument for safeguarding your shipments, providing you with protection in both your finances and your mind. You can be certain that your items will arrive at their destination unscathed and in good condition if you have the appropriate coverage.

Who Needs Cargo Insurance?

E-COMMERCE OWNERS

E-commerce businesses typically need shipping insurance to protect their customers from unfortunate shipment-related losses and disputes.

CONSUMERS

Consumers can also purchase shipping insurance when sending a valuable package, such as a jewelry gift to a friend, or when shipping items when moving to another city.

COMPANIES

Companies that ship products internationally also require insurance to protect their goods against transportation risks.

How to Choose the Right Cargo Insurance?

Choosing the appropriate cargo insurance is crucial to operating a successful business since it can shield your products from theft or damage. The following advice will help you select the best cargo insurance for your requirements:

- Know what kind of coverage you require. The level of protection provided by various types of cargo insurance varies, so it's crucial to pick a plan that includes the commodities you regularly transport.

- Think about the worth of your products. Consider the value of the cargo you're sending when choosing cargo insurance, and pick a plan that offers the appropriate level of protection.

- Do some research on the insurer. To be sure you can rely on the provider if you need to file a claim, look into their track record and financial soundness.

- Think about the deductibles. Many cargo insurance contracts have deductibles, which can both lower the cost of the coverage and raise your financial responsibility in the event of a claim.

- Verify the policy's current status. Make sure your policy is current and that you have the right coverage for your shipments because cargo insurance policies frequently have expiration dates.

You can select the appropriate cargo insurance for your company's needs by paying attention to these pointers.

FAQ | CARGO INSURANCE

Which goods are covered by transportation insurance?

Numerous items, such as electronics, furniture, machinery, medical equipment, and other valuables, can be covered by transportation insurance. It is crucial to remember that while some insurance policies may exclusively cover specific commodities, others may cover all types of goods. Since transportation insurance is intended to safeguard cargo during transit, it's crucial to buy protection that will pay for lost or damaged cargo. Depending on the level of coverage chosen, it may cover the loading and unloading, transportation, and storage of products, giving customers peace of mind while their items are in transit.

What kind of protection does cargo insurance offer?

Businesses are protected by cargo insurance from losses caused by things like damage, additional shipping fees, and non-delivery. There are many forms of cargo insurance that each offer varying levels of protection. All-risk protection, which offers complete coverage for numerous unfavorable circumstances, is the most comprehensive type of cargo insurance. This kind of insurance is designed for companies with high risk exposure who need complete security for their goods.

What are the prices of the insurance for cargo?

Truckers and carriers cargo insurance frequently costs between $425 and $2,000 annually. Cargo insurance typically costs between $400 and $1,800 per year. Several large shipping firms, including FedEx, UPS, and USPS, charge $2 per $100 of the shipment's insured value for cargo insurance. It's critical to remember that prices vary from insurer to insurer and that a variety of factors might impact the cost of cargo insurance.

What distinguishes inland cargo insurance from maritime cargo insurance?

Inland cargo insurance is made to protect against losses that happen while products are transported across land, typically by train or truck. Compared to maritime cargo insurance, which covers losses sustained when transporting products through ships or other vessels, this sort of insurance is often significantly more economical. Additionally, maritime cargo insurance frequently has a higher premium because it typically covers a greater geographic area. In addition, losses resulting from severe weather or other unforeseen events are frequently covered more thoroughly under maritime cargo insurance.

DocShipper U.S. | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!