Shipping from US to Austria? Don't worry, it's not like leading a Viennese waltz! Many businesses find the intricacies of rates, transit times, and customs regulations extremely complex and often overwhelming. This destination guide will delve deep into these aspects, illuminating the nuances of different freight options - be it air, sea, road, or rail. We'll walk you through the labyrinth of customs clearance procedures, explain the ins and outs of duties, taxes, and offer sage advice tailored to businesses' individual needs, leaving no stone unturned. If the process still feels overwhelming, let DocShipper handle it for you! As your trusted international freight forwarder, we transform seemingly insurmountable shipping challenges into a resounding success story for your business.

Table of Contents

ToggleWhich are the different modes of transportation between US and Austria?

Choosing how your goods travel between the US and Austria is a bit like planning a cross-country road trip. Air freight is your speedy sports car, getting items there quickly while costing a bit more. Ocean freight is the family-friendly minivan, slower but economical for large volumes. Rail and road are only suitable within continents. Hence, they don't quite fit our journey this time, rather like your neighbor's bicycle on a trip to Disney World. The best choice aligns with your need for speed, budget, and shipment size - it's all about picking the right vehicle for your unique adventure.

How can DocShipper help?

Ship between the US and Austria trouble-free with DocShipper's expert assistance. We take care of everything from arranging transportation to handling customs clearances. Get rid of your shipping worries today! Dial up our consultants for a free chat or ask for a price estimate in less than 24 hours. Let us make your international trade journey smooth and easy.

DocShipper Tip: Sea freight might be the best solution for you if:

- You are shipping large volumes or bulky items, as sea freight offers the most space at a cost-effective rate.

- Your cargo doesn't have an urgent deadline, as sea freight typically has longer transit times compared to air or rail.

- Your shipping routes are between major ports, allowing you to leverage the extensive global network of sea shipping lanes.

Sea freight between US and Austria

Embarking on the ocean voyage of shipping goods between the US and Austria? Let's dive in. Trade between these two industrial powerhouses continuously flows through major cargo ports, like the buzzing Port of Los Angeles and the bustling Port of Vienna. Ocean shipping emerged as a heavyweight in the ring – trading quick punches for slow, yet cost-effective jabs, especially for high-volume goods. But, just like learning to swim, diving into the deep sea of international shipping comes with its fair share of obstacles.

Many businesses unexpectedly tread water, tangled in a confusing net of common shipping mistakes. But fear not, this guide holds your lifebuoy. We've charted the sea of best practices and specifications that ensure your goods sail smoothly to their destination. So whether you're a seasoned captain or a novice sailor, you're about to embark on a smoother shipping voyage between the US and Austria. Prepare to set sail!

Main shipping ports in US

Port of Los Angeles

Characterized as the busiest container port in the United States, the Port of Los Angeles is located in San Pedro Bay, 20 miles south of downtown Los Angeles. This port handles over 9 million TEU annually, asserting its pivotal role in global trade.

Port of Long Beach

The Port of Long Beach is the second busiest container port in the United States. Considerably important due to its location along the trans-Pacific trade route, it takes care of about 8 million TEU every year. The shipping links primarily involve East Asia and hence, the port is a cornerstone of trans-Pacific trade.

Port of New York and New Jersey

Located on the East Coast of the United States, the Port of New York and New Jersey manages over 7 million TEU per year. As the busiest port on the Eastern seaboard, it has a diverse set of trading partners including China, Europe, and several countries throughout the Americas.

Port of Savannah

The Port of Savannah is rapidly growing, and it's now the fourth busiest container port in the United States. It's located in Georgia and handles over 4 million TEU annually. Its strategic location makes it an ideal choice for serving the southeast United States and Midwest.

Port of Houston

As the largest port in the southern United States, the Port of Houston, located in Texas, sees over 2 million TEU annually. Its location provides direct access to the large consumer markets in the central and southern United States. A key part of the Gulf Intracoastal Waterway, this port focuses heavily on trade with Latin America and Europe, but also maintains broad worldwide trading links.

Port of Seattle

The Port of Seattle, located in the Pacific Northwest, helps manage nearly 4 million TEU on a yearly basis. It serves as a critical nexus for trade between Asia and the northern and central parts of the United States. Not only does it provide significant value for importers and exporters in these regions, but it also plays a crucial role in international trade with the Asian market.

Main shipping ports in Austria

Port of Vienna

Location and Volume: Centrally located in Austria's capital, Vienna, this port plays a crucial role in the country's inland and maritime trade, boasting a shipping volume of over 12 million tons annually.

Key Trading Partners and Strategic Importance: The Port of Vienna trades predominantly with countries in the European Union, especially Germany and Hungary. Its strategic significance lies in its geographic location, as it serves as a vital link between the Adriatic Sea and North Sea.

Context for Businesses: If you're looking to grow your footprint in the European market, the Port of Vienna might serve as a critical asset considering its vast connectivity and shipping volume.

Port of Linz

Location and Volume: Located in Upper Austria, the Port of Linz holds a significant share in the country's shipping industry, processing over 8 million tons annually.

Key Trading Partners and Strategic Importance: Encompassing a rich variety of goods, the port's main trading partners are the member states of the European Union. With a modern container terminal and outstanding connections to main European rail and road networks, it is of high strategic value for foreign trade.

Context for Businesses: If your goal is to achieve rapid transportation times throughout Europe, the Port of Linz's prime location and advanced facilities may be instrumental in fulfilling your shipping needs.

Port of Krems

Location and Volume: The Port of Krems, situated in Lower Austria, is a significant logistics hub, handling about 1.8 million tons of freight per year.

Key Trading Partners and Strategic Importance: The port primarily trades with Eastern European countries, including Hungary and Slovakia. Its strategic importance lies in providing direct access to the Eastern European markets, using both the Danube River and an extensive hinterland transport network.

Context for Businesses: Should your business plan on venturing into the Eastern European commodities market, shipping through the Port of Krems could offer a direct and efficient route to these relative markets.

Port of Enns

Location and Volume: Placed ideally in the inner part of Austria, the Port of Enns transports an impressive 6.2 million tons of cargo every year.

Key Trading Partners and Strategic Importance: The Port of Enns has a diverse portfolio of trading partners within the EU. Strategically located on the Danube River, it serves as a prominent logistics hub between the North Sea and the Black Sea.

Context for Businesses: The Port of Enns could play a pivotal role in your supply chain strategy if your business is looking to tap into diverse European markets, as it has extensive connections to trade routes.

Please note, though Austria may not have the world's busiest or largest ports, its strong internal network and well-developed infrastructure make it a convenient and efficient country for shipping. The mentioned ports are ideal for businesses planning to explore or expand in European markets, thanks to their strategic locations and modern facilities. Make sure to evaluate your specific logistics requirements and choose a port that best suits your needs.

Should I choose FCL or LCL when shipping between US and Austria?

Diving into the world of sea freight, the question arises: Consolidation or full container? Let's uncover the mystery. Your choice will shape the cost, the delivery timeline, and ultimately, the efficiency of your shipment from the US to Austria. Both Full Container Load (FCL) and Less than Container Load (LCL) have their perks and limitations. Ready to understand these options better? Let's delve into the nuances to help you craft a shipping strategy that perfectly suits your business needs. Hold on tight, because every choice you make in sea freight matters immensely!

LCL: Less than Container Load

Definition: LCL (Less than Container Load) shipping is a method of transporting goods that do not fill an entire container. It is the consolidation of smaller shipments into a single container.

When to Use: LCL shipping is a cost-effective solution for low volume cargo, typically less than 13, 14, or 15 CBM (cubic meters). It offers flexibility since it doesn't require a full container load.

Example: Imagine you are an exporter of handcrafted furniture based in the US, shipping to a small boutique in Austria. Your shipment is only about 10 CBM. Booking a whole 20ft container, which typically fits about 33 CBM, would not be cost-effective. Instead, you'd choose an LCL shipment, allowing your goods to share space with others, thus optimizing freight costs.

Cost Implications: Shared transportation in an LCL freight evaluates cost based on the volume of your cargo in the container, not the whole container. This way, you only pay for the space you use, leading to significant savings if your cargo is below the recommended volume for FCL (Full Container Load). But remember, LCL might include additional charges like LCL Fees or Consolidation Fees. So, it's crucial to factor these into your total cost.

FCL: Full Container Load

Definition: Full Container Load (FCL) shipping is an international freight shipping method where a container is filled with goods from a single shipper. This means your goods won't be consolidated with others, hence the container is sealed from origin to destination for maximum safety.

When to Use: Typically, utilize FCL shipping when your cargo volume exceeds 13/14/15 cubic meters (CBM). This option could be budget-friendly for high-volume shipments as you pay a flat rate for space usage in a 20ft or 40ft container.

Example: For instance, let's say you’re a manufacturer from Ohio sending automobile parts to Austria. If your shipment fills more than half a 20ft container, the most effective method to choose would be FCL shipping. This ensures safe transport of your large-scale consignment without other goods interrupting.

Cost Implications: Now, on to the key expenditure involved. When you ask for an FCL shipping quote, you'll find it is cost-effective for larger shipments because the cost per unit is reduced as the volume increases. It's like buying bulk goods in a supermarket - the more you buy, the cheaper each product becomes! Do take note, however, the cost may fluctuate depending on the route and season. You'll also need to consider port charges, customs, and inland transportation fees.

Unlock hassle-free shipping

Looking for the smoothest way to ship from the US to Austria? Let DocShipper simplify the process for you. As experienced freight forwarders, we're here to take the guesswork out of the consolidation vs. full container decision. We consider factors like cargo volume, urgency, and budget to recommend the most cost-effective and efficient shipping option. Let our ocean freight experts guide you through the process. It all starts with getting a free estimation today. Reach out now and experience age-old reliability with modern day convenience!

How long does sea freight take between US and Austria?

The typical sea freight shipping time from the United States to Austria averages around 24-31 days. Please keep in mind that these durations are estimated and actual transit times can depend on a variety of factors. These include the specific ports of origin and destination, the weight and volume of the cargo, and the type of goods being shipped. For a more specific quote perfectly tailored to your needs, a consultation with a freight forwarding expert like DocShipper is recommended.

| Ports in the US | Ports in Austria | Average Transit Time (Days) |

| Port of Los Angeles | Port of Vienna | 30 |

| Port of Long Beach | Port of Linz | 30 |

| Port of Savannah | Port of Vienna | 35 |

| Port of Houston | Port of Linz | 25 |

*Please note, Austria is a landlocked country but has excellent intermodal transportation infrastructure, so goods are typically shipped to the nearby seaports and then transported to Austria by road or rail.

How much does it cost to ship a container between US and Austria?

Ocean freight rates can be as unpredictable as the sea itself, with shipping costs per CBM swinging widely based on multiple variables. What's your Point of Loading or Destination? Which carrier will you use? What type of goods are you shipping? And let's not forget those monthly market fluctuations that can toss shipping plans off course. While we wish we could provide a simple, one-size-fits-all price tag, it's the nature of international logistics that every case is unique - just like your business. But don't fret - our knowledgeable shipping specialists are ready to navigate these waves with you, ensuring tailored quotes for the best rates possible on your US to Austria shipping journey.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge (OOG) containers are specifically designed to carry oversized cargo that doesn't fit into standard sea containers. They typically have open tops or flat racks for greater accessibility.

Suitable for: This shipping method would best serve businesses dealing with oversized items, heavy machinery or large-scale industrial equipment.

Examples: Think wind turbines, tractors, or large machinery parts - these could all be considered out of gauge cargo.

Why it might be the best choice for you: If standard container dimensions limit your shipping aspirations, OOG containers provide the flexibility required for such bulky items.

Break Bulk

Definition: Break bulk is a shipping method used when cargo is too big or heavy to fit into containers and needs to be loaded individually onto the vessel.

Suitable for: Businesses shipping large items that cannot be disassembled into smaller parts, such as machinery or construction equipment, would greatly benefit from this method.

Examples: Items like generators, engines, or yachts would typically be shipped as break bulk.

Why it might be the best choice for you: If you need to ship large, heavy items in one piece, break bulk could be the optimal solution.

Dry Bulk

Definition: Dry bulk involves the transportation of non-packaged goods that are transported in large quantities and loaded directly into a ship's hold.

Suitable for: Businesses dealing with large volumes of unpackaged dry materials would be served best.

Examples: Commodities like grain, coal, or iron ore would be shipped as Dry bulk or as a loose cargo load.

Why it might be the best choice for you: If you're transporting large volumes of loose, dry materials, Dry bulk is the most efficient and cost-effective method.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-Ro is a method where vehicles and machinery can be driven on and off a ro-ro vessel, making the loading and unloading processes faster and less complicated.

Suitable for: This service is perfect for businesses involved in the automobile industry who need to transport vehicles, tractors, or trailers.

Examples: Cars, trucks, construction vehicles, or even trailers can be loaded into a ro-ro vessel.

Why it might be the best choice for you: With convenient loading and unloading, and no need for disassembly, Ro-Ro can provide a seamless shipping experience for wheeled cargo.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers used for transporting temperature-sensitive goods.

Suitable for: Businesses that deal with perishable goods, pharmaceutical products, or any goods that require controlled conditions would benefit most.

Examples: Fresh fruits, vegetables, fish, meat, dairy products or medicines are typically shipped in reefer containers.

Why it might be the best choice for you: If you need to maintain specific temperatures for your goods during transit, a reefer container can ensure your products reach their destination without losing their value or quality.

When it comes to determining the most efficient and cost-effective ways to ship your goods from the US to Austria, DocShipper's expert team is always ready to provide tailored solutions. Don't hesitate to contact us - we can provide you with a free shipping quote in less than 24 hours!

DocShipper Tip: Air freight might be the best solution for you if:

- You are in a hurry or have a strict deadline requirement, as air freight offers the fastest transit times.

- Your cargo is less than 2 CBM (Cubic Meter), making it more suitable for smaller shipments.

- Your shipment needs to reach a destination that is not easily accessible by sea or rail, allowing you to tap into the extensive network of global airports.

Air freight between US and Austria

Air freight from the US to Austria is like a speedboat in a sea of cargo ships. It's quick and reliable, making it the go-to for small, valuable items - think electronics or medical devices, not bulky machinery. Besides speed, you enjoy added perks like high security, regular departures, and fewer handling stages.

But, like driving a speedboat, there's a bit of know-how needed to avoid sinking your budget. This is where many shippers stumble. It's like packing for a plane ride; you would pay a huge fee if your suitcase is too heavy. The same is the case with air freight. There's a special formula to calculate the weight but some people miss this, leading to an unexpected, hefty price. Then, there's the need to get familiar with certain best practices to dodge excessive costs. Stick around, and we'll look into this a bit more. (Additional information to follow in the next section.)

Air Cargo vs Express Air Freight: How should I ship?

If you're planning to fly your goods from the US to Austria, weigh your options. Choosing Air Cargo, you're reserving a spot in a commercial airline, sharing space with passengers and their luggage. Meanwhile, Express Air Freight flies your goods on a dedicated plane. Overwhelmed? Let's compare both, factoring in speed, cost, reliability, and your unique business requirements to help you make an informed decision. Find out what's the best fit for your cross-Atlantic journey!

Should I choose Air Cargo between US and Austria?

As you explore freight options between the US and Austria, air cargo stands as a noteworthy choice. Major players like American Airlines and Austrian Airlines offer reliable services. For cargo over 100/150kg, the cost-effectiveness becomes more attractive. Despite longer transit times due to fixed schedules, these airlines assure dependable delivery. Keep in mind that balancing your budgetary needs against timing is crucial in making the most advantageous choice.

Should I choose Express Air Freight between US and Austria?

If your shipment from the US to Austria is under 1 cubic metre (CBM) or weighs 100/150 kg (220/330 lbs), express air freight offers a speedy, specialized solution. Tailored for cargo, express freight uses dedicated planes—no passengers. Known as next-flight-out service, it's quick and reliable, with global firms like FedEx, UPS, and DHL. These carriers provide comprehensive tracking, making it ideal for time-sensitive deliveries, ensuring your goods arrive exactly when needed. Pondering on express air freight? It might just be the efficient shipping service you need.

Main international airports in US

Los Angeles International Airport

Cargo Volume: Over 2.2 million metric tons in 2020

Key Trading Partners: Asia, Europe, and Latin America

Strategic Importance: Known as the 'Gateway to the Pacific Rim', this airport's location makes it a crucial link for trade with Asia.

Notable Features: With 8 air cargo terminals and particular strength in handling perishable goods, LAX is well-equipped for diverse shipping requirements.

For Your Business: If you're focused on trans-Pacific routes or handle perishable goods, LAX's strategic location and extensive facilities may benefit your shipping strategy.

John F. Kennedy International Airport

Cargo Volume: Handled over 1.3 million metric tons of cargo in 2019

Key Trading Partners: Europe, Asia, and South America

Strategic Importance: JFK is a major hub for international trade on the East Coast, with a prominent role in transatlantic shipping.

Notable Features: Boasts the renowned 'JFK Air Cargo Center,' which facilitates efficient cargo operations.

For Your Business: Its prime location and seamless air cargo connectivity across continents make JFK a valuable asset if your shipping strategy involves transatlantic or general international routes.

Chicago O’Hare International Airport

Cargo Volume: Handled over 1.8 million metric tons of cargo in 2019

Key Trading Partners: Western Europe and East Asia

Strategic Importance: Situated in the heartland of America, O'Hare serves as a significant hub for domestic interstate cargo and connects the Midwest to the world.

Notable Features: Home to a massive 'Northeast Cargo Center', this airport handles a wide range of cargo types, including e-commerce shipments.

For Your Business: If your business requires frequent domestic shipping or you focus heavily on e-commerce, O'Hare's location and specialized capabilities could enhance your supply chain efficiency.

Miami International Airport

Cargo Volume: Over 2 million metric tons of cargo in 2019

Key Trading Partners: Latin America and the Caribbean

Strategic Importance: As the top U.S. airport for international freight, Miami dominates in cargo operations to/from Latin America and the Caribbean.

Notable Features: Miami houses the largest concentration of international banks in the U.S., facilitating smooth financial operations for your cargo.

For Your Business: MIA is the go-to airport if your shipping strategy focuses on Latin America and the Caribbean. Its banking resources may also simplify your financial transactions.

Memphis International Airport

Cargo Volume: Handled over 4.6 million metric tons of cargo in 2020

Key Trading Partners: Domestic markets, Asia, and Europe

Strategic Importance: As FedEx's super hub, Memphis is the busiest cargo airport in the U.S., and it's key for both domestic and international shipping.

Notable Features: The FedEx super hub operates 24/7, enabling constant movement of your goods.

For Your Business: Ideal for businesses seeking rapid domestic and international shipping, particularly if you're leveraging express courier services. FedEx's round-the-clock operations can optimize your time-sensitive deliveries.

Main international airports in Austria

Vienna International Airport

Cargo Volume: With a capability to handle 295,700 tonnes of cargo annually, it's one of Austria's busiest cargo airports.

Key Trading Partners: Apart from major European economies, destinations in Asia and the Middle East such as China, UAE, and Japan are significant counterparts.

Strategic Importance: Located in the country's capital, this airport serves as a primary connection to Europe and beyond. Its favorable location makes it a strategic hub for international air freight.

Notable Features: Vienna International Airport boasts advanced cargo facilities, including dedicated cargo terminals and a cool chain facility for pharmaceutical products.

For Your Business: If your operations rely on timely delivery to or from European markets, and especially if you trade pharmaceutical items, Vienna International Airport could be a crucial asset in your logistics strategy.

Graz Airport

Cargo Volume: This airport handles more than 12,700 tonnes of cargo per year.

Key Trading Partners: It serves mostly European capitals, with Germany being a major trading partner.

Strategic Importance: Positioned in Austria's second-largest city, Graz, it provides easy access to central and southern Europe.

Notable Features: The airport's cargo facilities are compact but efficient. They provide a comprehensive range of services, including warehousing and customs, for both national and international freight.

For Your Business: If you're looking to expand your operations into central or Southern Europe efficiently, Graz Airport could be an invaluable asset.

Linz Airport

Cargo Volume: Roughly 42,500 tonnes of cargo are processed at Linz Airport every year.

Key Trading Partners: Primarily serves European locations, with Germany, Switzerland, and Belgium as key trade destinations.

Strategic Importance: Situated in the heart of Europe, Linz Airport significantly contributes to efficient logistics chains, especially in the high-tech and automotive industries.

Notable Features: The airport has specialized in express freight and is a hub for TNT Express.

For Your Business: If your company operates in the high-tech or automotive sectors and you value speedy deliveries, Linz Airport and its robust express freight capabilities will be a significant asset to your shipping strategy.

Salzburg Airport

Cargo Volume: The airport handles approximately 6,300 tonnes of cargo per year.

Key Trading Partners: Primarily serves European countries, including Germany, France, and the UK.

Strategic Importance: Located close to the German border, Salzburg Airport is a gateway to numerous locations in Central and Eastern Europe.

Notable Features: What sets Salzburg apart from other airports is its compact size, quick turnaround times, and personalized customer service.

For Your Business: If your shipments require quick turnaround times and personalized service, Salzburg Airport provides an optimal solution for your import-export activities.

Innsbruck Airport

Cargo Volume: Handles several thousand tonnes of air freight annually.

Key Trading Partners: Primarily connects European locations, including France, Germany, and Italy.

Strategic Importance: Innsbruck Airport serves Tyrol and its sizeable industrial and commercial sector.

Notable Features: Its location in the heart of the Alps makes it an attractive gateway to many surrounding countries.

For Your Business: If your business serves Alpine regions and requires a flexible, efficient logistics partner, Innsbruck Airport may be the ideal choice for your freight forwarding needs.

How long does air freight take between US and Austria?

Shipping between the US and Austria via air freight typically takes between 1 to 3 days. However, the transit time is not always fixed and can fluctuate depending on the specific airports of departure and destination, the weight of your goods, and the nature of the goods being shipped. For a precise estimate, companies should directly consult with a knowledgeable freight forwarder like DocShipper.

How much does it cost to ship a parcel between US and Austria with air freight?

Estimating a singular air freight cost between the US and Austria is challenging due to various factors. Costs per kg can widely range from around $3 to $7, but this can fluctuate based on the distance from airport departure and arrival, dimensions, weight, and the specific nature of your goods. Rest assured, our team aims to provide the most competitive rates, tailoring each quote to your individual shipping needs. Remember, there's no 'one size fits all' approach in freight forwarding. We recommend contacting us directly for your free and personalized quote, typically provided within 24 hours.

What is the difference between volumetric and gross weight?

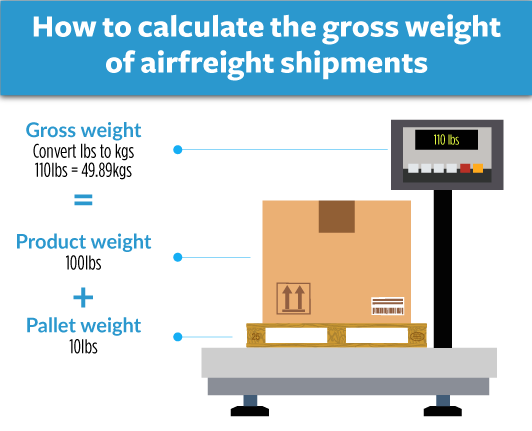

In air freight shipping, gross weight refers to the actual physical weight of your shipment, while volumetric weight, also known as dimensional weight, is calculated on the space your goods take up in the aircraft.

To calculate gross weight in Air Cargo services, it's a simple matter of weighing your shipment in its transport-ready state. For instance, if your package weighs 50kg, that's its gross weight (approximately 110lbs for those more accustomed to the imperial system).

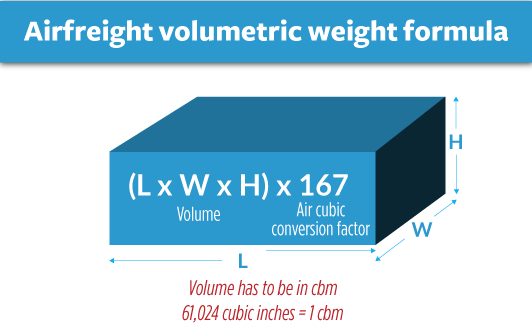

Volumetric weight calculation is a bit different. It considers the space your shipment occupies. For Air Cargo, this is computed by multiplying the parcel's length, width, and height (all in cm) and then dividing the result by 6000.

Let's say your package is 50cm long, 40cm wide, and 30cm high. The calculation becomes (504030)/6000, giving you a volumetric weight of 20kg (roughly 44lbs).

In Express Air Freight, the denominator changes. The same multiplication of the parcel's dimensions is divided by 5000. Repeating the earlier example, the result is now 24kg (52.9lbs) for Express Air Freight.

Now, why do these calculations matter? Well, freight charges are not simply based on the gross weight. If your package's volumetric weight exceeds the gross weight, then the freight charges are determined by the volumetric weight. This is because bulky items can take up much more space compared to their actual weight, thereby influencing transport logistics and costs. This ensures fair pricing and efficient utilization of space on the aircraft.

DocShipper tip: Door to Door might be the best solution for you if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You prefer a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want to minimize the handling of your goods, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between US and Austria

Unpacking the idea of 'Door to Door', it's a shipping method that handles all the legwork, from pick-up in the US to delivery in Austria. It's efficient, cost-effective, and a real time-saver, removing the hassle of coordinating with multiple courier services. Perfect for businesses that prioritize convenience and reliability. Now, let's saddle up and dive deep to explore this comprehensive option.

Overview – Door to Door

When shipping freight from the US to Austria, logistics complexities can be daunting. Why not eliminate stress with our most-sought out service: door-to-door shipping? This full-package solution handles everything – from pickup, customs clearance, to final delivery, reducing your workload significantly. It's advantageous for its convenience and ease but drawback lies in its cost relative to other options. However, its popularity among DocShipper's clients cements its worth considering the potential challenges of international freight. Practical, straightforward, stress-free – that's door-to-door shipping.

Why should I use a Door to Door service between US and Austria?

Ever lost a game of Tetris? Well, door-to-door services are a bit like a no-fail version! Seriously, there’s a reason businesses favor it for US-Austria journeys, and it's not just because of alphabetic order. Let's nail down five big reasons:

1. Stress-Busting: Coordinating multiple transport stages from the warehouse in the US to a shop or office in Austria can be like trying to juggle on a unicycle. Door-to-door service de-stresses your logistics by keeping it all under one roof.

2. Time-Saving: Have a time-sensitive shipment you can't afford to be held up? Door-to-door service prioritizes timely delivery by eliminating the need for transfers between different transporters.

3. Specialized Care: Got valuable, fragile, or complex cargo? Don't sweat! This service ensures specialized handling to keep your goods safe, making it the choice for businesses with unique shipping needs.

4. One-Stop Convenience: Just like we love one-stop shopping, door-to-door service provides one-stop shipping convenience. From the initial pickup to last-mile delivery, every part of the journey is handled for you.

5. End-To-End Responsibility: In the unlikely event that something goes wrong on the road from Montana to Salzburg, this service means the provider remains liable, offering you that additional peace of mind.

Think of door-to-door like hiring a personal shipping valet: it streamlines, swiftens, and simplifies your international shipping. Now, isn't that a breath of fresh Austrian mountain air?

DocShipper – Door to Door specialist between US and Austria

Ease your shipping journey from the US to Austria with DocShipper! We provide a seamless door-to-door service, managing all aspects of your shipment - packing, transport, customs clearance, and choosing the right shipping method. Our experienced team ensures a hassle-free experience and a dedicated account executive is assigned to cater to your needs. Get your free estimate within 24 hours! Have questions? Feel free to reach out to our consultants anytime. Experience the DocShipper difference today.

Customs clearance in Austria for goods imported from US

Customs clearance is a key part of importing goods from the US to Austria. It's a complex process filled with potential pitfalls such as unexpected fees and charges. Knowledge of customs duties, taxes, quotas, and licenses is crucial to avoid the risk of your goods getting stuck at customs. Each country has its own rules and regulations to follow. Misunderstandings can lead to delays or additional costs. The following sections will give you a deeper understanding of these issues. Let DocShipper take the stress off these processes for you. We can assist with any type of goods and any location worldwide. Just provide us with the origin, value, and HS Code of your goods so we can offer a precise estimate for your project.

How to calculate duties & taxes when importing from US to Austria?

Understanding how to calculate customs duties and taxes is crucial when importing goods from the US to Austria. It is a dynamic process that relies on several key pieces of information - the country of origin, the Harmonized System (HS) Code of the product, the customs value (which is the basic cost of the goods plus any additional shipping and insurance costs), the applicable tariff rate, and any other taxes and fees that might apply to the product.

Knowing the exact country where the goods were produced or manufactured forms the basis of this calculation, serving as the first piece of the puzzle. Identifying this information is your first step towards an accurate duty and tax estimate, setting the foundation which allows you to navigate the customs clearance maze more efficiently. Remember that knowledge is power and understanding the dimensions of this process can potentially save you from costly surprises and penalties down the line.

Step 1 - Identify the Country of Origin

Step 1 in the import process is pinning down the goods' Country of Origin. Why? Let's have a look:

1. Impact on Duties: Trade agreements between the US and Austria can offer lower import duties. The catch? These perks are for items originating in the US only.

2. HS Code Verification: Knowing where your product comes from verifies the HS code you're using is correct and up-to-date.

3. Product Compliance: Certain items face stringent compliance regulations depending on their origin. Being sure of your product's source can prevent future headaches.

4. Import Restrictions: Austria has a list of import restrictions specific to countries. By confirming origins, you know what to prepare for.

5. Tacit Information: Last but not least, knowing the country of origin offers valuable insights into the product's quality, labor conditions, and environmental impact.

In the world of international trade, never underestimate the power of 'where.' It's as crucial as 'what.' Remember, understanding trade agreements between the US and Austria, like the WTO agreements, could mean substantial savings on duties, so get acquainted. As for import restrictions, keep an eye on rules related to your commodity type. Do things right from the start; your freight journey will be smoother. You got this!

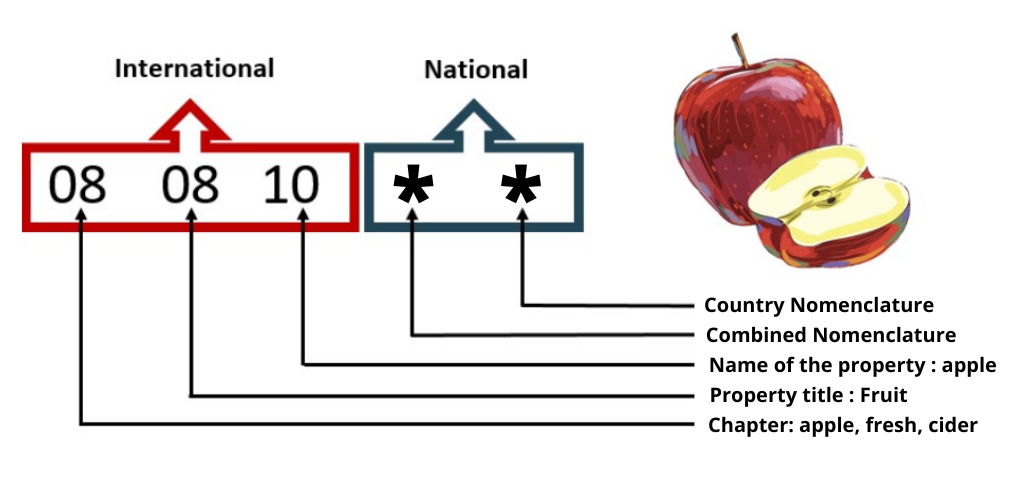

Step 2 - Find the HS Code of your product

Understanding the Harmonized System Code (HS Code) is a critical aspect of shipping goods internationally. The HS Code is a standardized numerical method of classifying traded products. It's used by customs authorities around the world to identify products and apply the necessary tariffs. Everything from individual tax rates to statistics are governed by these codes, making them vital to the shipping process.

Typically, the easiest way to obtain the HS Code of your product is to ask your supplier. They interact with these regulations daily and should be able to provide you with the code for the goods they're exporting.

If you're unable to get the HS Code from your supplier, don't worry. We've got you covered with a simple step-by-step guide to find it yourself. First, you'll need to use an HS lookup tool, like the Harmonized Tariff Schedule. Now, all you need to do is to search for your product in the search bar. The results will show up under the Heading/Subheading column, and that’s where you can find your HS code.

One thing to note: accuracy is paramount when identifying your HS code. An incorrect code can cause significant issues in the shipping process, leading to delays and possibly fines. So always double check to ensure you have it right.

Here's an infographic showing you how to read an HS code. Familiarize yourself with its structure as it will come handy when dealing with your supplier or customs authorities.

Step 3 - Calculate the Customs Value

If you're importing goods from the US to Austria, understanding how to calculate customs value is crucial. Think of it as the 'price tag' on your shipment for customs purposes. Unlike the value of the goods alone, the customs value encompasses more. Specifically, it's the CIF value, meaning it includes the price of your goods, the cost of international shipping, and insurance costs. For instance, if your goods cost $2000, shipping costs $300, and insurance amounts to $100, your customs value or CIF value is $2400. This total value helps determine the customs duties payable upon entering Austria. Grasping this concept can help you avoid surprises and maximize your shipping efficiency.

Step 4 - Figure out the applicable Import Tariff

Import tariffs are essentially tax imposed on imported goods, playing a crucial role in the cost of importing items from one country to another. In Austria, as part of the European Union, import tariff rates are standardized across all member nations.

To determine the tariff applicable to your goods, you'll have to utilize the TARIC System - European Customs, a comprehensive database directly linked to the EU's common customs tariff.

Here's how to use it:

1. Visit the TARIC System - European Customs, enter the HS code (for example, 62052000 for men's cotton shirts) identified earlier and the United States as the country of origin.

2. Review the duties and taxes that apply to the product you are importing.

For instance, let's consider you're importing men's cotton shirts from the US with an HS code of 62052000. After entering these details in TARIC, you might find a tariff rate of 12%. Assuming your total CIF (Cost, Insurance, and Freight) costs amount to $10,000, your import duties would be calculated as $10,000 x 12/100 = $1,200.

This level of understanding will help streamline your business's import activities, enhance predictability of costs and ultimately increase profitability. Be sure to verify duty rates regularly as they can change.

Step 5 - Consider other Import Duties and Taxes

When you import goods into Austria from the US, besides paying standard tariff rates, you might face other kinds of import duties and taxes. The nature of these charges can vary based on several factors including the product classification and country of origin.

One such tax is the 'Excise Duty', which is applicable predominantly on goods like tobacco, alcohol, or energy products. For instance, if you're importing whisky, you might have to pay an excise duty rate of $6 per liter, however, this is just a typical example, actual rates may vary.

In some scenarios, 'Anti-Dumping Taxes' come into the picture. They are levied to protect domestic industry from foreign-made products sold below fair market value. Here's an illustration: If your imported stainless steel at $1000 per metric ton has an anti-dumping duty rate of 20%, you would pay an additional $200 (20% of $1000) in duties.

Arguably the most significant is VAT (Value Added Tax), which is applied to the sum total of goods value, shipping cost, standard tariff rate, excise duty, and anti-dumping tax. Let's say the VAT rate is 20% (rates may fluctuate), and your combined costs are $1500, your VAT charge would be $300 (20% of $1500).

In essence, the cost of importing goods can surpass initial expectations due to these extra charges, emphasizing the importance of anticipative budget planning.

Step 6 - Calculate the Customs Duties

When it comes to importing goods from the US to Austria, calculating customs duties forms an essential part of the process. This figure is determined by the combination of the customs value, VAT, and potential anti-dumping taxes and excise duties.

Let's break them down in simple terms:

Example 1 – When there's no VAT involved, the customs duties are determined purely by the customs value of your product. Say, you're importing goods worth $10,000, at a duty rate of 5%, your customs duty will be $500.

Example 2 – If VAT is also applicable, it is added on top of the sum of the goods' customs value and the customs duties. If the VAT is 20% in Austria, for an item with a customs value of $10,000 and customs duty of $500, you'd owe $2,100 in duties and VAT.

Example 3 – In cases where anti-dumping taxes and excise duties apply along with VAT and customs duties, all these are added together. For a product with a customs value of $10,000, a customs duty of $500, anti-dumping tax of $200, excise duty of $100 and VAT of 20%, your total dues would rise to $2,400.

Remember, with each step comes complexity. But why navigate this daunting labyrinth alone? At DocShipper, we handle your customs clearance processes worldwide, ensuring you're never overcharged. We're only a click away, promising you a free quotation within less than 24 hours. Delegate your customs concerns to us, and focus on what you do best—running your business.

Does DocShipper charge customs fees?

Rest assured DocShipper, as a customs broker in the US and Austria, won't charge you customs duties. Clear on this—there's a difference between customs clearance fees that we handle and customs duties & taxes that you'll directly pay to the government. Why? Think of it like a service fee for paperwork we handle on your behalf. Proof? Absolutely! You'll get all the documents from the customs office verifying that you've paid exactly what was owed to the government. Just like a restaurant bill, where service charge and tax are separate, but clearly stated.

Contact Details for Customs Authorities

US Customs

Official name: U.S. Customs and Border Protection (CBP)

Official website: https://www.cbp.gov/

Austria Customs

Official name: Customs Administration - Republic of Austria

Official website: https://www.bmf.gv.at/en/public-customs.

Required documents for customs clearance

Getting your goods through customs doesn't have to be a maze of confusion. In this section, we're going to demystify the key documents you'll need, such as the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). It's about making your shipping process smooth and hassle-free.

Bill of Lading

In any freight forwarding scenario between the US and Austria, the Bill of Lading (BOL) is your new best friend - this official doc secures the shift of ownership from shipper to consignee. Think of it as a pivotal baton-pass in this global relay race. Consider the benefit of an electronic release, or 'telex,' which removes the need for physical paperwork; everything’s online, quicker and eco-friendly. Plus, got air cargo on your radar? You'll need an Airway Bill (AWB) for that. Being savvy about these forms empowers you to navigate this complex journey with confidence. So, embrace your digital prowess, cut transit times and enhance your shipping efficiency. With these in hand, you're one step closer to mastering US-Austria trade.

Packing List

When shipping goods from US to Austria, a Packing List is your lifeline. Think of it as the ticket for your shipment's entry into Austria, whether it's through sea or air cargo. As a shipper, you're required to provide a comprehensive Packing List detailing every single item in your freight - from bulky machinery to smallest component. Accuracy is king here. An incorrect, vague, or incomplete Packing List can lead to delays or even rejections at customs. Picture this, you're a manufacturer shipping components for wind turbines. If there's a discrepancy between what's documented on the Packing List and what's physically in the cargo, your entire shipment could be stalled at the port, throwing off project timelines. So, take time to nail down the accuracy of your Packing List - your shipment's smooth journey depends on it.

Commercial Invoice

Navigating the customs clearance between the US and Austria can be daunting, especially when it comes to the Commercial Invoice. This crucial document isn't merely a bill but a direct map of your shipment's journey. It should meticulously detail the good's description, its Harmonized System (HS) code, country of origin, value, plus the seller and buyer's valid info. Think about it like a truthful disclosure that enables smooth customs clearance and accurate duty assessment. For instance, if your business is shipping Austrian crystal decor, ensure the HS code, typically starting with '70', aligns with the item on all documents. Avoid cross-border snags by placing importance on the consistency and completeness of your Commercial Invoice - it literally pays to get it right!

Certificate of Origin

Transporting goods between the US and Austria? A Certificate of Origin is a passport for your shipment, pinpointing its birthplace. Why does it matter? Customs officials refer to this document to determine if your goods qualify for preferential duty rates under trade agreements Austria shares with the US. Imagine shipping artisanal chocolates made in Brooklyn – this certificate helps validate these delectable treats have been authentically made in the US. But never go vague with the country of manufacture - a mishap can delay clearance, shoot up duty rates, or even lead to a shipment being rejected! Nintendo once had shipments delayed when customs questioned the origin! So, always keep your Certificate of Origin detailed and accurate. It's not just a simple form; it's your ticket to a swift, pocket-friendly shipping experience to Austria!

Certificate of Conformity (CE standard)

When you're shipping goods from the US to Austria, the Certificate of Conformity (CE standard) is instrumental. This document signifies that your product meets European health, safety, and environmental standards. Remember, it's not just about quality assurance; it's a legal requirement for market access in Austria and greater Europe. The CE marking is somewhat similar to the FCC Declaration of Conformity in the US, though it covers a more extensive range of regulations. You certify, through this document, that your shipment complies with all relevant EU directives. This step can extend your product's market reach while mitigating the risk of import refusal. Obtain this before you ship to save time and avoid any hiccups in your logistics process. Enjoy smoother sailing, or, in this case, shipping!

Your EORI number (Economic Operator Registration Identification)

In your journey to ship goods between the US and Austria, obtaining an EORI number is crucial. Think of it as your business's ID in the world of imports/exports within Europe and other EORI-required destinations. This unique identifier means smooth tracking of your shipments and smoother customs procedures. To get yours, you'll register with the Customs and Tax Office in Austria if you're an EU-based trader, or with the EU member state where you first lodge your declaration for traders based outside the EU. This may seem like just another step in your shipping procedure, but it's the one that can save you a lot of hassle down the road! Remember, every shipment matters, and your EORI number keeps them flowing smoothly.

Get Started with DocShipper

Struggling with customs clearance between the US and Austria? That's our expertise! Hand over the complicated procedures, documentation, and associated headaches to DocShipper. Gain peace of mind and save valuable time for your business. Why drain your resources when we can handle it all? Contact us today for a free quote delivered in less than 24 hours!

Prohibited and Restricted items when importing into Austria

Knowing what you're allowed to bring into Austria can feel like a tricky puzzle. Throw in potential fines for getting it wrong and it can quickly turn into a high-stakes guessing game. In this section, we eliminate the guesswork and clarify what items are strictly off-limits or have tight restrictions when importing into Austria.

Restricted Products

If you're planning to ship these restricted items to Austria, here's what you need to know:

- Dangerous Goods: You have to apply for a special permit from the Federal Ministry for Climate Action, Environment, Energy, Mobility, Innovation and Technology. These goods include chemicals, radioactive materials, and biological substances.

- Pharmaceuticals, Drugs, and Biologics: A license from the Austrian Agency for Health and Food Safety is required before shipping these products.

- Tobacco and Alcohol: Before transporting these substances, ensure to register with the Federal Ministry of Finance.

- Firearms and Other Weapons: Permission from the Federal Ministry of the Interior is a must if you're planning to ship any firearms.

- Live Animals and Animal Products: Obtain a veterinary inspection certificate from the Federal Ministry of Agriculture, Regions, and Tourism.

- Works of Art, Antiques, and Cultural Properties: For these items, register with the Federal Ministry for Arts, Culture, Civil Service, and Sport.

Remember, it's your responsibility to make sure that you fully comply with all Austrian import regulations, even those not mentioned above. Always verify the latest rules and regulations before shipping, and ensure you've secured the necessary permissions for your goods.

Prohibited products

- Narcotic drugs, unless holding a special permit

- Goods bearing false trademarks or lacking the indication of origin

- Counterfeit currency and counterfeit negotiable instruments

- Indecent or obscene prints, paintings, photographs, books, cards, lithographic reproductions, films, tapes, etc.

- Products resembling or having the function of weapons, like toy guns or knives

- Live animals from countries affected by infectious animal diseases

- Some protected species of plants and animals, including their parts or products thereof, like ivory or coral

- Shaving brushes made in Asia

- Potato products from Egypt, certain non-European countries, and the region of Guilan in Iran

- Biocidal products

- Hazardous waste

- Radar detection equipment

- Radioactive contaminated material

- Unauthorized gaming machines

- All products containing the biocide dimethylfumarate (DMF)

Please note that this list is not exhaustive and import regulations may change frequently. Ensure to check the latest customs regulations before shipping goods to Austria.

Are there any trade agreements between US and Austria

Yes, the US and Austria enjoy a robust trade relationship under the European Union (EU)-U.S. trade agreement. These terms allow a more effortless exchange of goods, potentially benefiting your business with decreased duties. However, remember that Austria follows the EU's common customs tariff. Currently, there isn't any specific US-Austria infrastructure project or trade association, but growth in bilateral economic ties may present future opportunities. Consider staying updated on trade policy changes and discussions to leverage potential benefits.

US - Austria trade and economic relationship

The US-Austria trade relationship has a rich history, reflected in their robust economic ties. From resolved wine disputes in the 2000s to the robust exchange of specialized manufactured goods, their bond has grown stronger. Today, industrial machinery, pharmaceuticals, and vehicles are key sectors for US exports, while Austrian imports largely revolve around machinery, including computers. Experiencing a 14.2% increase compared to 2022, the USA emerged as Austria's second-largest export destination, surpassing Italy and trailing only behind Germany. Accounting for 7.4% of Austria's total exports, the USA retains its position as the most significant sales market for Austria, both outside the EU and beyond Europe. Notably, Austria's export share to the USA is three times higher than that of China.

Your Next Step with DocShipper

Is the prospect of shipping goods from the US to Austria overwhelming? Managing transportation, customs, and duties can seem daunting, even for the seasoned businessman. But fear no more - DocShipper is here! Let our team of logistics experts ease your burden and optimize your shipping process. Connect with us today - because shipping should be smooth sailing!

Additional logistics services

Discover how we simplify supply chains! Beyond shipping and customs, DocShipper offers a suite of services, making your international logistics worry-free. Stay tuned to learn more!

Warehousing and storage

Warehousing can be tricky, especially when storage conditions matter. Finding the right spot to store perishable or delicate goods? It’s a job that requires top expertise. A controlled environment might just be your knight in shining armor.

Packaging and repackaging

Whether you're shipping delicate machinery or bottles of fine wine between the US and Austria, packaging matters. Keep your consignment safe and intact with our top-line packaging and repackaging services. Trust is key, for example, you wouldn't want your Moravian Silesian crystal wrap packed like garden tools.

Cargo insurance

While fire insurance protects your assets on land, cargo insurance offers cover while your goods travel the globe. This kind of prevention is key - imagine a rough sea journey damaging your precious cargo. With this insurance, you aren't left grappling with financial loss. Take the stress out of potential hiccups or worst-case scenarios with our Cargo Insurance.

Supplier Management (Sourcing)

Shipping from US to Austria is a snap when you have the right partners like DocShipper to guide you. Procurement process a bother? We can assist! We help companies find suppliers in Asia and East Europe, handling everything right from sourcing through the complete procurement process, bridging any language gaps along the way. Say goodbye to sourcing woes.

Personal effects shipping

When moving your prized possessions from the US to Austria, ensuring their safe arrival is our main goal. Whether it's your grandmother's antique piano or a bulky piece of art, our Personal Effects Shipping service handles it with utmost care. Real-world example? A family heirloom handled with kid gloves across the Atlantic.

Quality Control

Ensuring impeccable product quality is paramount, especially when exchanging goods between the US and Austria. Quality inspections during manufacturing or customization prevent costly oversights such as faulty design or poor material. Picture this - You've ordered custom machinery, but a quality mishap deems them non-compliant according to EU standards upon arrival in Austria. Through close supervision of product quality, you sidestep such hurdles.

Product compliance services

Safeguarding your business means ensuring your goods meet both US and Austria's strict compliance regulations. With our Product Compliance Services, we'll run exhaustive laboratory tests for certification, saving you from unforeseen regulatory issues. Avoid the hassle and enjoy seamless shipping experiences. Gain peace of mind knowing your products are fully compliant.

FAQ | For 1st-time importers between US and Austria

What is the necessary paperwork during shipping between US and Austria?

For a smooth shipping process from the US to Austria, certain documents are vital. For sea freight, we'll handle the bill of lading, while for air freight, we manage the airway bill. You should supply us with essential documents, including the packing list and commercial invoice. Depending on your goods, additional documents might be necessary, such as Material Safety Data Sheet (MSDS), certifications, among other things. Rest assured, we're here to assist every step of the way, ensuring your shipment's success.

Do I need a customs broker while importing in Austria?

While it's not compulsory, employing a customs broker for your imports to Austria is strongly advised. The customs process is intricate, involving strict procedures and a list of required details and documents. A customs broker holds the specialist knowledge to navigate such complexities, ensuring all necessary protocols are followed accurately. We, at DocShipper, offer this expertise. Acting as your representative, we handle the majority of your customs interactions, mitigating the characteristic risks and difficulties. This way, you can focus more on your core business operations and less on the nuances of international shipping customs.

Can air freight be cheaper than sea freight between US and Austria?

While we're often asked if air freight is less costly than sea freight between the US and Austria, the reality depends on various factors such as the route, weight, and volume of your cargo. As a rule of thumb, if your cargo weighs under 300 kg (660 lbs) or less than 1.5 cubic meters, air freight might be a more affordable choice. At DocShipper, you don't have to figure this out on your own - your dedicated account executive is here to ensure you're always getting the most competitive option tailored to your specific needs.

Do I need to pay insurance while importing my goods to Austria?

While insurance is not a compulsory aspect of shipping your goods to Austria, we at DocShipper highly recommend taking it into consideration. This stems from the simple fact that various unforeseen incidents - including damage, loss, or theft - can occur during transit. Securing insurance gives you peace of mind by protecting against financial losses associated with these potential mishaps. It's better to stay on the safe side when dealing with cargo of any kind.

What is the cheapest way to ship to Austria from US?

We recommend sea freight for cost-effective shipments from the US to Austria, especially for large or not time-sensitive consignments. Although transit times may be longer, ocean shipping offers substantial savings compared to other transport modes. However, take note that additional costs may arise such as customs duties and taxes on arrival to Austria. Always consider the full picture when choosing a shipping method, factor in both cost and delivery time requirements.

EXW, FOB, or CIF?

Deciding between EXW, FOB, or CIF largely depends on your relationship with your supplier. Remember, they might not be well-versed in logistics operations. This is where we, at DocShipper, come into play. Our expertise lies in handling the intricate processes of international freight and final destination procedures. Generally, suppliers operate under EXW or FOB terms, taking charge of all local costs up to the origin terminal. Irrespective of your supplier's terms, we can step in and offer a seamless door-to-door service, ensuring your goods arrive safely and on time. Trust in us to simplify this complex journey for your business.

Goods have arrived at my port in Austria, how do I get them delivered to the final destination?

When CIF/CFR incoterms manage your cargo, it's your responsibility to locate a suitable customs broker or freight forwarder for customs clearance, import charges, and final delivery. But, we can completely manage this process for you if you opt for our DAP incoterms. Please confirm these details with your dedicated account executive for clarity.

Does your quotation include all cost?

We pride ourselves on transparency — our quotation covers all costs with the exception of duties and taxes at the destination. Rest assured, there are no hidden fees that would spring up a surprise. To estimate potential duties and taxes, don't hesitate to reach out to your dedicated account executive at DocShipper.