Let's face it, shipping between the US and the Philippines can feel like trying to translate your cat's meows - a tad mysterious and quite challenging! That's why understanding aspects like transit times, tariffs, and customs regulations can be major hurdles for businesses, big and small. This guide's aim is to shed light on these issues, providing practical information on all freight options available, whether it's via sea, air, or ground. We'll dive into customs clearance, duty and tax guidelines, and offer some expert advice tailored specifically for your business needs. If the process still feels overwhelming, let DocShipper handle it for you! We are a specialized international freight forwarder that turns these shipping challenges into nothing but success for your business.

Table of Contents

ToggleWhich are the different modes of transportation between US and Philippines?

Choosing the ideal mode of transportation to ship your goods from the US to the Philippines, tucked over 8,000 miles away, can be like selecting the quickest route in a marathon. Factors like distance and international borders pose challenges and rule out certain options—think how a marathon runner can't simply fly over buildings! Consequently, the practical choices revolve around sea and air freight. The key is to align your choice with your specific shipping needs and challenges, akin to a marathoner adjusting their strategy based on the race’s terrain and their stamina. This choice will ultimately determine the speed and cost of delivering your cargo.

DocShipper Tip: Sea freight might be the best solution for you if:

- You are shipping large volumes or bulky items, as sea freight offers the most space at a cost-effective rate.

- Your cargo doesn't have an urgent deadline, as sea freight typically has longer transit times compared to air or rail.

- Your shipping routes are between major ports, allowing you to leverage the extensive global network of sea shipping lanes.

Sea freight between US and Philippines

Trading goods via ocean shipping between the US and Philippines opens up a myriad of possibilities. It's a thriving route that connects significant industrial centers - from New York to Manila, San Francisco to Cebu, and beyond. This channel, albeit slow, is your trusty workhorse, magically translating your high-volume shipping needs into a cost-effective solution.

But just as a seasoned sailor, we know that calm seas never made a skilled mariner. Shipping between these territories isn’t a breezy sail in the park. Mistakes are common and difficulties abound, from misreading customs procedures to underestimating logistics requirements. Feeling adrift already? Fear not! Consider this guide as your trusty compass, leading you through these choppy waters. Whether it's handling complex paperwork or complying with specific regulations, this guide promises to shed light on the murkiness, turning potentially stormy shipping into a smoother voyage. So tie down the hatches and set sail with us to alleviate these challenges, for smooth sailing in international trade waters.

Main shipping ports in US

Port of Los Angeles

Location and Volume: Situated in Southern California, the Port of Los Angeles is the largest in the U.S by container volume, processing over 9.2 million TEU in 2019 alone.

Key Trading Partners and Strategic Importance: The Port has a significant economic impact, and connects the U.S with major trading partners like China, Japan, and South Korea. As the port with the highest TEU capacity in the U.S, strategic importance is considerable.

Context for Businesses: If you're planning to expand your reach to Asia, the Port of Los Angeles could be paramount in your logistics, thanks to its strong associations with Asian trading partners and immense capacity.

Port of Long Beach

Location and Volume: Located adjacent to the Port of Los Angeles, the Port of Long Beach ranks second in the U.S with a yearly volume of over 7.6 million TEU.

Key Trading Partners and Strategic Importance: Besides being one of the country’s premier gateways for trans-Pacific trade, its important trading partners include China, South Korea, and Japan.

Context for Businesses: Those pursuing amplified exposure in Asian markets could view Port of Long Beach as imperative, influenced by its proximity to the Asian continent and capacity to manage heavy cargo loads.

Port of New York and New Jersey

Location and Volume: Situated on the East Coast, this port is the third largest in the U.S, with an annual volume exceeding 7.4 million TEU.

Key Trading Partners and Strategic Importance: The port is a vital trade gateway for North America and Europe, with Italy, Germany, and China being key trade partners. It is crucial for trans-Atlantic trade routes, boasting one of the world's largest natural harbors.

Context for Businesses: If your enterprise aims to amplify its presence in European markets, the Port of New York and New Jersey could be central to your strategy due to its coastal location facilitating direct access to the Atlantic Ocean and Europe.

Port of Savannah

Location and Volume: Nestled in Georgia, the Port of Savannah had a record volume of 4.35 million TEU in 2019, making it the fourth largest port in the U.S.

Key Trading Partners and Strategic Importance: It is a significant player for trans-Atlantic trade, collaborating chiefly with China, Germany, and Vietnam across various goods.

Context for Businesses: If you're trying to penetrate European and Asian Markets, the Port of Savannah’s high cargo-processing capacity and well-established regular shipping routes could make it indispensable to your distribution network.

Port of Houston

Location and Volume: Located in Texas, the Port of Houston stands fifth in the U.S, with volume exceeding 2.99 million TEU annually.

Key Trading Partners and Strategic Importance: Its significant trading partners include China, Mexico, and Brazil. The port offers diversified commerce, including petrochemical shipments.

Context for Businesses: If you operate in the oil, gas or chemical industries, the Port of Houston could be crucial for your logistics, given its close affiliation with these industries.

Port of Seattle

Location and Volume: Situated in the state of Washington, the Port of Seattle handles around 2 million TEU each year.

Key Trading Partners and Strategic Importance: The port is a key link for US trade with Asia, with main trading partners like China, Japan, and South Korea.

Context for Businesses: If you're considering broadening your business into Asian markets, the strategic location of Port of Seattle, along with its cargo handling capacities, could be a crucial aspect of your logistics.

Main shipping ports in Philippines

Port of Manila

Location and Volume: Situated at the heart of the capital city of Manila, the port is the Philippines' largest and busiest, handling over 4.1 million TEUs as of 2019, making it the preferred sea freight gateway for businesses.

Key Trading Partners and Strategic Importance: The Port of Manila plays a critical role in the trade relations between the Philippines and key partners, such as Japan, China, USA, and Singapore. Besides, it is a major hub for regional shipping lines across Southeast Asia.

Context for Businesses: If you're planning to penetrate the Southeast Asian markets, the Port of Manila's optimal location and high throughput volume make it a preferred and strategic logistics hub.

Subic Bay Port

Location and Volume: Located in the province of Zambales, the Port of Subic Bay holds a strategic geographic advantage, making it accessible for shipping routes worldwide. It has a capacity of approximately 600,000 TEUs.

Key Trading Partners and Strategic Importance: It is a key destination for shipments from China, South Korea, Taiwan, and several Southeast Asian countries. The port is known for its free port zone, attracting many businesses due to tax advantages.

Context for Businesses: If you're planning to explore Asian markets while utilizing tax advantages, Subic Bay can be your strategic choice.

Davao International Containers Terminal

Location and Volume: Located in Panabo City, this terminal is a primary gateway to the region of Mindanao, moving approximately half-million TEUs of cargo.

Key Trading Partners and Strategic Importance: It primarily deals with countries like China, Japan, South Korea, and several ASEAN countries. It is vital for the region's agriculture sector, loading bananas and pineapple.

Context for Businesses: If your goal is to distribute agricultural goods across Asia, Davao International Containers Terminal is the suitable logistics hub to consider.

Batangas Port

Location and Volume: Located in Batangas City, the port primarily caters to ro-ro vessels and passenger ferries with an approximate annual cargo volume of 8 million MT.

Key Trading Partners and Strategic Importance: The Port of Batangas serves as a major link for the trade between the Philippines and numerous countries such as China, Taiwan, South Korea, and Singapore.

Context for Businesses: If your shipping strategy involves ro-ro vessels, Batangas Port might be a great choice due to its specialized handling of such freight.

Cagayan de Oro Port

Location and Volume: The Port of Cagayan De Oro is located in Northern Mindanao. Known as the 'gateway to Northern Mindanao', it can accommodate approximately 2 million MT cargo per year.

Key Trading Partners and Strategic Importance: This port serves Indonesia, Malaysia, Vietnam, and Thailand amongst others, playing a crucial role in the trade of goods within the BIMP-EAGA Brunei-Indonesia-Malaysia-Philippines East ASEAN Growth Area.

Context for Businesses: If you're keen on expanding operations in Southeast Asia, especially within the BIMP-EAGA, the location, and accessibility of Cagayan de Oro Port can be a strategic asset.

General Santos Port

Location and Volume: Located in South Cotabato, the port of General Santos is known as the 'Tuna Capital of the Philippines', managing about 1.2 million MT of cargo annually.

Key Trading Partners and Strategic Importance: It has crucial trading ties, particularly with ASEAN nations like Indonesia, Malaysia, Thailand, and Vietnam. The port specializes in Tuna exports.

Context for Businesses: If your business involves the shipment of seafood, especially Tuna, the Port of General Santos is an ideal gateway for your logistic needs.

Should I choose FCL or LCL when shipping between US and Philippines?

Choosing between consolidated shipping (LCL) and a full container load (FCL) for your sea freight to the Philippines can feel like navigating tricky waters. But fear not! This decision is a game-changer, influencing not only your costs but also delivery times and the success of your shipment. In this section, we delve into the ins and outs of both options, equipping you with the necessary knowledge to select the shipping method that best suits your specific business needs. Get ready to become a master in sea freight decisions!

LCL: Less than Container Load

Definition: LCL (Less than Container Load) shipment refers to a method of ocean freight where multiple consignments from different shippers are consolidated into a single container. It is a cost-effective option often preferred by businesses shipping small volumes.

When to Use: LCL proves advantageous when your cargo volume is less than 13/14/15 CBM, where CBM stands for cubic meters. If you have a low-volume shipment, you pay only for the space you use in the container, offering both price benefits and flexibility.

Example: Suppose a U.S. based small business needs to ship 10 CBM of handmade crafts to the Philippines. A full container load may not be economically viable. Opting for LCL shipping ensures they only pay for the 10 CBM space they occupy, making their shipping more affordable and efficient.

Cost Implications: While the lcl shipping quote may vary based on various factors, generally, the cost per CBM for lcl freight will be higher than that of a full container load. However, for shipments less than half the container's size, the total cost remains lower than booking an entire container. This illustrates the financial advantage of LCL shipping for smaller shipments.

FCL: Full Container Load

Definition:FCL, or Full Container Load, is a term in fcl shipping where the entire container, either a 20'ft container or a 40'ft container, is used by a single shipper for their cargo.

When to Use:FCL is typically the best option when your cargo volume exceeds 13/14/15 CBM. It offers cost-efficiency for higher volume loads and enhanced safety, as your fcl container remains sealed from the origin to the destination, reducing potential risks and damages to your goods.

Example:For instance, an electronics manufacturer in Ohio, shipping a high volume order of televisions to a retailer in Manila, would opt for FCL. As their order fills up more than 15 CBM, they would secure an fcl shipping quote, provide, and transport their cargo safely in a sealed 40'ft container from start to end.

Cost Implications:Though the upfront cost of FCL shipping might be higher, it becomes cheaper per CBM as the volume increases, making it a cost-effective choice for larger shipments. It is, therefore, crucial to assess your cargo volume before confirming your fcl shipping quote.

Unlock hassle-free shipping

As your dedicated freight forwarder, DocShipper puts ease back into shipping, from the U.S. to the Philippines and beyond. Making cargo shipping hassle-free is our forte. Our ocean freight experts will guide you in choosing between consolidation or a full container. We'll consider factors like your budget, delivery timeframe, and cargo's nature. Ready to make your shipping decision stress-free? Contact us now for your free estimation.

How long does sea freight take between US and Philippines?

Sea freight from the United States to the Philippines typically takes between 19 to 25 days on average, as a rough guide. This is, however, an estimate with actual transit times varying depending on several factors including the specific port of origin and destination, the overall weight of your goods, and the nature of the items being shipped. For a more accurate shipping quotation that's tailored to your exact requirements, consider using the services of an experienced freight forwarder like DocShipper.

Here's a quick rundown of the average transit times between some of the main freight ports in the US and Philippines:

| US Ports | Philippines Ports | Average Transit Time |

| Port of Los Angeles | Port of Manila | 25 |

| Port of Long Beach | Port of Subic Bay | 20 |

| Port of Seattle | Port of Cebu | 24 |

| Port of Houston | Port of Davao | 30 |

*Remember, these are just averages, individual shipments can take longer or shorter depending on a variety of factors.

How much does it cost to ship a container between US and Philippines?

While shipping a container from the US to the Philippines, ocean freight rates can vary widely. Estimating an absolute cost is challenging due to different factors that play a significant role, including the Point of Loading and Destination, selected carrier, nature of the goods, and fluctuations in the market. However, our dedicated shipping specialists provide personalized quotes, aiming to give you the best value on a case-by-case basis. Rest assured, we are committed to streamlining your shipping cost while ensuring smooth sailing for your goods.

Special transportation services

Out of Gauge (OOG) Container

Definition: An Out of Gauge (OOG) container typically refers to those containers that exceed the standard dimensions. Carrying over-dimensional, overweight, or awkwardly shaped goods, they provide versatile solutions for atypical cargo.

Suitable for: Items that exceed the standard ISO container dimensions in either length, width, or height.

Examples: These are ideal for transporting oversized machinery, large industrial parts, boilers, turbines, or large vehicle parts.

Why it might be the best choice for you: If your cargo is unusually shaped or oversized for traditional packaging, an OOG container provides the flexibility you might require.

Break Bulk

Definition: Break bulk refers to goods that are transported in packages, typically bags or boxes, and loaded individually rather than in a container.

Suitable for: Fragile items that need individual handling, or goods that are not suitable for containerization.

Examples: Bags of coffee beans, timber, steel rods, or equipment parts are commonly shipped using this method.

Why it might be the best choice for you: If your goods do not fit into standard containers or are not compatible with the more mechanically intense loading process of container shipping, opting for break bulk could be advantageous.

Dry Bulk

Definition: Dry bulk refers to the transportation of unpackaged, loose cargo that is loaded directly into the ship's hold, like grain or coal.

Suitable for: Commodities in large quantities, or products that are free-flowing.

Examples: Typical dry bulk goods include iron ore, coal, grains, or minerals.

Why it might be the best choice for you: For businesses dealing in large volumes of unpackaged products, dry bulk shipping ensures cost-efficiency and ease of handling at destination ports.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off (Ro-Ro) method involves cargo that rolls onto and off the ship, meaning it's self-propelled or on wheels.

Suitable for: Vehicles like cars, trucks, trailers, and railway carriages.

Examples: If you're exporting automobiles, tractors, buses, or large construction equipment, Ro-Ro shipping is ideal.

Why it might be the best choice for you: Ro-Ro vessels are purpose-built, which means they provide secure and efficient transportation for your wheeled cargo. It's one of the safest and most cost-effective ways to ship vehicles overseas.

Reefer Containers

Definition: Reefer containers are refrigerated containers designed for transporting perishable goods.

Suitable for: Foodstuffs (fruits, meat, dairy products), pharmaceuticals, or any other cargo that requires temperature control.

Examples: If you're shipping products like fresh produce, frozen food, or delicate pharmaceuticals, reefer containers are ideal.

Why it might be the best choice for you: With precise temperature control capabilities, reefer containers ensure your perishable cargo arrives in optimal condition ensuring product quality from origin to destination.

Looking to ship goods from US to the Philippines? Depending on your specific needs, one of these shipping options could be an excellent fit. Please note that customs requirements and documentation are a crucial part of international shipping. The team at DocShipper provides a comprehensive service, including freight forwarding, customs services, and documentation assistance. Contact us today to get a free shipping quote in less than 24 hours.

DocShipper Tip: Air freight might be the best solution for you if:

- You are in a hurry or have a strict deadline requirement, as air freight offers the fastest transit times.

- Your cargo is less than 2 CBM (Cubic Meter), making it more suitable for smaller shipments.

- Your shipment needs to reach a destination that is not easily accessible by sea or rail, allowing you to tap into the extensive network of global airports.

Air freight between US and Philippines

When speed is the name of your business game and you're shipping from the US to the Philippines, air freight is your top contender. A champion for small, high-value cargo like luxury goods or vital medical supplies - it delivers your shipments swiftly and reliably, precious time that justifies its higher price tag.

However, it's not a walk in the clouds if you dive head-first without proper planning. Shippers often stumble on a common misstep - underestimating the shipping cost due to incorrect weight calculation. It’s like packing for your vacation and not minding the suitcase’s weight- it might cost you a pretty penny at the airport. Sometimes, a lack of knowledge can inflate your budget faster than a jet takes off. No worries, in this guide we’re going to tackle these potholes in your air freight journey. Let's help you soar confidently in the shipping skyline, without any unexpected turbulence.

Air Cargo vs Express Air Freight: How should I ship?

When you're moving goods between the US and the Philippines, two options pop up – air cargo and express air freight. In a nutshell, air cargo is a friendly neighbor sticking a ride on a commercial airline while express air freight is that high-flyer who charters an entire plane. Time crunch or budget, bulk or urgency – let’s dive into the nooks and crannies to see which airborne route fits your business best.

Should I choose Air Cargo between US and Philippines?

Choosing air cargo for shipping between the US and the Philippines can be a wise decision if you're concerned about reliability and cost-effectiveness, the heavier your freight, the more attractive it becomes, especially over 100/150 kg. Airlines like Delta Airlines and Philippines Airlines regularly ply these routes offering competitive rates. Though, anticipate longer transit times due to set schedules. Investigating these options could align with your shipping budget and timeline. Remember, every choice in freight forwarding can make a substantial impact on your bottom line.

Should I choose Express Air Freight between US and Philippines?

Express air freight, a service using dedicated cargo planes without passengers, could be the right choice for shipments under 1 CBM or 100/150 kg (220/330 lbs) of cargo. This method is faster, reliable, and trackable. Companies like FedEx, UPS, or DHL specialize in this service. If you're transporting small, high-priority shipments between US and Philippines, opting for express air freight can ensure quick and secure delivery. The higher costs may be justified by the time sensitivity and critical nature of your goods. Evaluate your requirements and choose wisely.

Main international airports in US

Los Angeles International Airport (LAX)

Cargo Volume: With an impressive cargo volume of over 2 million metric tonnes annually, it ranks among the top 10 busiest cargo airports globally.

Key Trading Partners: Key trading partners include China, Japan, South Korea, and many Southeast Asian countries, facilitating robust import and export networks.

Strategic Importance: Strategically located on the West Coast, LAX serves as a significant hub for trans-Pacific freight, connecting the US to major Asian markets.

Notable Features: It is equipped with specialized freight terminals and has a dedicated cargo area for efficient operations.

For Your Business: If your business involves a significant amount of trade with Asia or requires robust global connections, utilizing LAX can be a strategic advantage.

John F. Kennedy International Airport (JFK)

Cargo Volume: Being the largest international air cargo gateway in the US, JFK handles over 1.5 million tonnes of cargo every year.

Key Trading Partners: Europe and South America are the major trading partners, with regular cargo flights to major cities in these continents.

Strategic Importance: JFK's strategic location in New York aids in serving northeastern US, key for businesses targeting this dense region.

Notable Features: The airport boasts of modern cargo facilities equipped for handling a wide range of goods including temperature-sensitive products.

For Your Business: If you're dealing in specialized goods requiring unique handling, JFK's advanced facilities can be crucial for your shipping requirements.

Miami International Airport (MIA)

Cargo Volume: MIA handles over 2.3 million tonnes of cargo annually, known for its high-volume cargo operations.

Key Trading Partners: Main trading partners include Latin American and the Caribbean nations, with numerous direct cargo flights to these regions daily.

Strategic Importance: MIA, located in South Florida, is an essential hub for shipments between North America, Latin America, and the Caribbean.

Notable Features: MIA hosts the world's largest concentration of international freight forwarders and Customs brokers.

For Your Business: If your operations heavily involve Latin American markets, MIA can provide a gateway for efficient and fast shipping routes.

Chicago O’Hare International Airport (ORD)

Cargo Volume: ORD deals with more than 2 million tonnes of cargo annually, making it one of the busiest cargo airports in the US.

Key Trading Partners: Main partners are China, Germany, and Japan, facilitating vital transatlantic and transpacific trade routes.

Strategic Importance: Its central location makes it ideal for connecting to various domestic and international markets efficiently.

Notable Features: ORD provides specialized handling services for various freight types.

For Your Business: If you're a business seeking efficient connections across multiple markets, ORD's comprehensive network might prove beneficial.

Dallas/Fort Worth International Airport (DFW)

Cargo Volume: DFW handles more than 900,000 tonnes of cargo every year.

Key Trading Partners: It facilitates trade routes majorly with Asia, Europe, and Mexico.

Strategic Importance: Being situated in the Texas region, DFW serves as a major economic engine for the southern US.

Notable Features: DFW houses cargo facilities catering to diverse needs: ranging from perishable goods to oversized cargo.

For Your Business: If your shipping requirements include diverse goods types or you're aiming for Mexican and southern US markets, DFW can be a strategic choice.

Main international airports in Philippines

Ninoy Aquino International Airport (MNL)

Cargo Volume: Approximately 2.3 million tonnes per annum.

Key Trading Partners: Japan, China, USA, Hong Kong, and South Korea.

Strategic Importance: As the main international gateway to the Philippines, Ninoy Aquino International Airport plays a significant role in the movement of goods to and from the country. It's conveniently located in the capital city Manila, which is a major business hub.

Notable Features: The airport hosts Cargo City, a complex dedicated to cargo operations and houses major air freight players. The facility offers modern cargo handling resources including cold storage and heavy freight capabilities.

For Your Business: If you frequently trade with countries in the East Asia region, leveraging MNL’s connectivity could potentially expedite your supply chain process. Plus, your goods benefit from world-class handling due to the airport's modern amenities.

Mactan-Cebu International Airport (CEB)

Cargo Volume: Approximately 1 million tonnes per annum.

Key Trading Partners: South Korea, China, Singapore, Japan, and Hong Kong.

Strategic Importance: It's the second busiest airport of the country and is strategically located near the Visayas region’s major business centers.

Notable Features: The airport has dedicated cargo and storage facilities with the capacity to handle bulky and temperature-sensitive shipments.

For Your Business: You might want to consider CEB if your business is situated in or around the Visayas region or your goods need specialized storage during transit. The airport's robust network can ensure seamless connectivity to major Asian markets.

Francisco Bangoy International Airport (DVO)

Cargo Volume: About 200,000 tonnes annually.

Key Trading Partners: China, Japan, USA, and Singapore.

Strategic Importance: Situated in the major commercial city of Davao, this airport can serve as a promising node for businesses situated in the southern Philippines.

Notable Features: With recent upgrades, the airport has expanded its cargo facilities to accommodate larger freight.

For Your Business: If your trade route primarily involves the southern part of the Philippines and neighboring countries, you can benefit from the airport's strategic location and modern facilities.

Clark International Airport (CRK)

Cargo Volume: About 700,000 tonnes per annum.

Key Trading Partners: China, Singapore, South Korea, and Japan.

Strategic Importance: Vying as an alternative to MNL, Clark International is situated near the Clark Freeport Zone, which offers opportunities for business expansion.

Notable Features: The airport has advanced cargo facilities and capitalizes on its proximity to the Subic-Clark Cargo Railway.

For Your Business: If you plan on leveraging the business-friendly regulations of the freeport zone or need rail transport for your goods, CRK can be an ideal choice.

Subic Bay International Airport (SFS)

Cargo Volume: More than 200,000 tonnes annually.

Key Trading Partners: USA, Hong Kong, South Korea, Taiwan, and Japan.

Strategic Importance: The airport is part of the Subic Bay Freeport Zone, a significant commercial area ensuring convenient access to key Pacific routes.

Notable Features: It provides modern cargo facilities and is linked to a seaport for multi-modal freight capabilities.

For Your Business: The airport is a viable option if you're shipping high-volume goods or require seaport connections, thanks to its multi-modal logistics capabilities and accessible Pacific routes.

How long does air freight take between US and Philippines?

Typically, the duration for air freight between the U.S. and the Philippines averages around 5 to 10 days. This time frame, however, is subject to variance depending upon multiple factors. The specific airports involved, the weight of the cargo, and the nature of your goods can all significantly influence transit times. For an accurate, in-depth calculation, it’s advised to consult with a freight forwarder like DocShipper.

How much does it cost to ship a parcel between US and Philippines with air freight?

Air freight shipping costs per kg between the US and the Philippines broadly average between $4-$10. However, an exact price is elusive as factors such as distance from airport departure and arrival, parcel dimensions, weight, and nature of goods significantly influence the final cost. Rest assured, our team commits to providing the best rates unique to your shipping requirements, quoting on a case-by-case basis. Streamline your shipping procedures while optimizing cost - Contact us and receive a free quote within 24 hours.

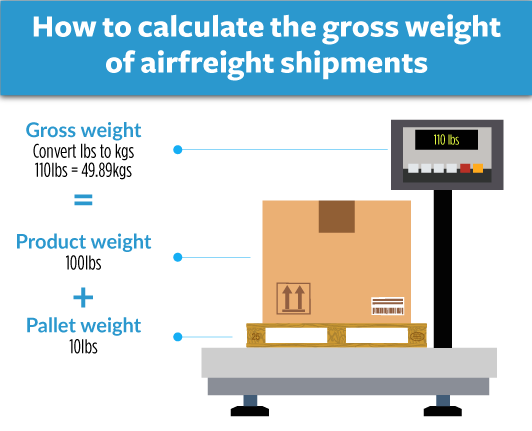

What is the difference between volumetric and gross weight?

Gross weight refers to the actual physical weight of the freight shipment, including the packaging materials. On the other hand, volumetric or dimensional weight is a pricing technique used by shipping providers. It takes into account the space a package occupies in relation to its actual weight.

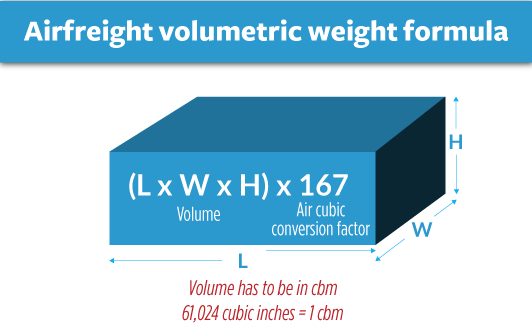

For air cargo, the 'volumetric weight' is calculated using the formula: Length (cm) x Width (cm) x Height (cm) / 6000. For example, a shipment with dimensions of 100cm x 100cm x 100cm would have a volumetric weight of ((100 x 100 x 100) / 6000) = 166.67 kg or approximately 367 lbs.

In contrast, to calculate 'gross weight', you simply weigh the shipment. For instance, the same package might weigh 200 kg or 440 lbs gross.

Express air freight services follow a similar calculation, but with a different denominator—5000 instead of 6000. This means the same shipment's volumetric weight would be ((100 x 100 x 100) / 5000) = 200 kg or 440 lbs.

Freight charges matter because shipping is charged based on whichever is higher - the gross or volumetric weight. This method ensures that carriers are compensated for space-hogging yet lightweight cargo. If your package's dimensional weight exceeds its actual weight, you're billed for the former, and vice versa.

DocShipper tip: Door to Door might be the best solution for you if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You prefer a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want to minimize the handling of your goods, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between US and Philippines

International door-to-door shipping is a complete solution where your cargo is picked up from its origin and delivered right to your chosen destination, fully navigating US to Philippines logistics. There's real charm in this hands-off approach, offering ease and precision. So, all aboard as we dive in and decode the benefits of door-to-door shipping, just for you!

Overview – Door to Door

Shipping goods from the US to the Philippines can feel daunting, right? That's where door-to-door shipping comes in, providing a stress-free logistics solution that allows businesses to avoid complexities. Your goods are transported from their source to the final destination with minimal involvement, saving you from the headaches of transit and customs. It's widely favored by our clients at DocShipper for its simplicity and efficiency. However, it may come with a higher cost and less control over the transit process. Still, for seamless and hassle-free logistics, many agree the trade-off is worth it. Try it and see for yourself!

Why should I use a Door to Door service between US and Philippines?

Door to Door service between the US and Philippines is like having a personal concierge for your cargo, without the fancy uniform or posh accent! Let's dive into five reasons why this might be your go-to shipping approach.

1. Stress-Be-Gone: Just imagine - no more pacing by the window, waiting for that pickup truck. Door to Door service includes goods pickup from your premises, sparing you the logistics headache.

2. Tick-Tock, Beat the Clock: Got an urgent shipment? This service ensures timely pickup and delivery, so you'll hit your deadlines without breaking a sweat.

3. Pampered Packages: From Fragile Fred to Heavy-Duty Harold, different cargos have different needs. Door to Door service caters to the quirks of your cargo, ensuring each package is privy to specialized care.

4. All-Rounder: With Door to Door, your goods aren't passed around like hot potatoes. The service includes trucking until the final destination, reducing the risk of lost or misrouted cargo due to multiple transfers.

5. Convenient as They Come: Streamlined and efficient, Door to Door service helps you avoid the chaos commonly associated with cargo shipping.

In a nutshell, Door to Door service between the US and Philippines could be your red-carpet experience, minus the paparazzi, of course.

DocShipper – Door to Door specialist between US and Philippines

Experience the ease and proficiency of DocShipper's all-inclusive services as we masterfully arrange your door-to-door shipment from the US to the Philippines. No need to fret over logistics—we cover packing, transport, customs, utilizing all shipping methods for optimal efficiency. Your dedicated Account Executive stands ready to navigate you through each step. Solicit a free estimate within 24 hours or feel free to dial up our consultancy at your convenience. Relieve your shipping stress with DocShipper.

Customs clearance in Philippines for goods imported from US

Customs clearance entails authorizing goods for entry or exit across a country's borders. In the context of trading goods from the US to the Philippines, it's a complex process filled with potential costly surprises and delays. Understanding customs duties, taxes, quotas, and licenses is paramount to prevent your cargo from being held up. Being unfamiliar with these essential details could result in unexpected charges and even stall your shipment altogether. Don't fret though, help is here. Peruse through our guide for comprehensive insights into each of these areas. Plus, our expert team at DocShipper can handle the entire process for your goods, no matter their origin or type. To kickstart the process, share with us your goods' origin, their value, and the HS Code. Armed with these, we can provide an accurate estimate that will help you effectively budget your project.

How to calculate duties & taxes when importing from US to Philippines?

Understanding the calculation of customs duties is pivotal to successful overseas shipping. This requires essential data such as the origin country of the goods, the Harmonized System (HS) Code, the customs value, and the tariff rate applicable as part of Philippines' customs laws. Additional taxes and fees that typically relate to the specific products might also come into play.

Embarking on this calculation journey, the very first checkpoint is to ascertain the country where your goods were produced or manufactured. This step establishes your products' 'Country of Origin', which is crucial as it impacts the import duties you will need to pay in the Philippines. Your journey to full customs compliance starts here, setting you on the right track for your shipping voyage from the US to Philippines.

Step 1 - Identify the Country of Origin

Identifying the Country of Origin, while seemingly obvious, is the foundation in predicting your import duties and taxes. Here's why:

1. Trade Agreements: The US and the Philippines have beneficial trade agreements that can help lower your taxes. Understanding these deals is crucial.

2. HS Codes: The Harmonized System code shifts based on the country of origin, which directly affects your duties.

3. Import Restrictions: Knowing origin can tip you off to particular import restrictions that apply, helping prevent costly hitches.

4. Customs Duty Rates: Rates vary depending on the country of origin. You can't accurately assess duties without this piece of the puzzle.

5. Product Regulations: these might alter according to origin.

Understanding trade agreements between the US and the Philippines is your secret weapon. For instance, duty reductions or eliminations under the Generalized System of Preferences can save you a hefty sum if you qualify. Meanwhile, check for specific restrictions, like the Philippines' particular laws on certain agricultural products from the US. Stay diligent to maximize your trade benefits and keep customs clearance smooth.

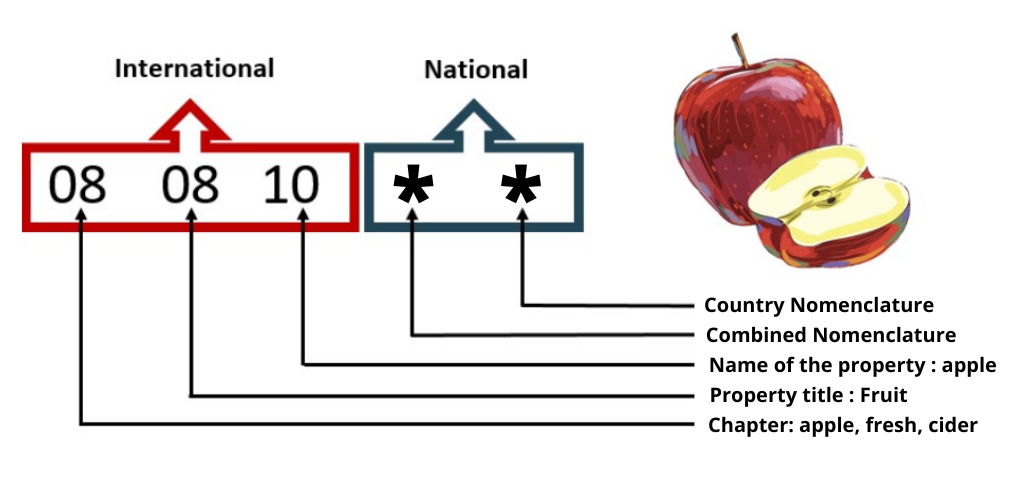

Step 2 - Find the HS Code of your product

The Harmonized System (HS) Code is an internationally standardized coding system, simplifying the way countries classify products for customs tax and tariff purposes. When shipping goods internationally, it's crucial to correctly identify and declare the HS Codes for your items. This is not just because it's a mandatory prerequisite in import-export documentation, but it also aids in calculating duties and taxes.

So, how do you find your HS Code? Often, the most straightforward route is to seek information from your supplier. They should be well acquainted with the products they're exporting and the relevant customs regulations.

In the event this isn't a viable option, you shouldn't worry. We have a simple, step-by-step process to help you out:

1. First, turn your browser to the Harmonized Tariff Schedule, a handy HS lookup tool provided by the United States International Trade Commission.

2. Then, simply type the name of your product into the search bar.

3. Subsequently, review the Heading/Subheading column in the search results - your HS Code should be there!

An essential aspect to consider here is the accuracy of the HS Code. If a wrong code is used, it may lead to unnecessary delays, interrupting your seamless shipping experience, and potential fines. Therefore, nothing substitutes thorough due diligence.

To wrap things up, here's an infographic showing you how to read an HS code.

Step 3 - Calculate the Customs Value

Calculating the Customs Value might seem intimidating, but it doesn't have to be. While you might initially believe it's simply the price of the products you're shipping, that's not the case. Customs Value extends beyond just product prices; it incorporates three key elements — the price of the goods, the cost of international shipping, and the insurance cost. This is known as the CIF value (Cost, Insurance, Freight). Let's say you're shipping furniture anywhere from the US to the Philippines. If you paid $10,000 for the furniture, $1,000 for shipping, and $200 for insurance, your CIF value would be $11,200. This total is the Customs Value you'll declare for customs clearance. Understanding this difference and knowing how to calculate it will add clarity to your shipping process and make international freight transportation a seamless experience.

Step 4 - Figure out the applicable Import Tariff

An import tariff is essentially a tax that countries impose on imported goods to protect domestic industry. In the Philippines, the type of tariff system used is the Harmonized System (HS) Code. To identify the import tariff applicable for your goods that are imported from the US to the Philippines, the process is as follows:

1. Find the corresponding HS code for your product. This code is a standardized numeric code used around the globe to classify products. Let's say we’re importing wool sweaters, which has an HS code of 6110.11.

2. After identifying the HS code, you would proceed to the Philippines' official tariff database, where you can search by the HS code to find your specific tariff rate. For example, wool sweaters may have a tariff rate of 10%.

Now, let's calculate how much you would pay for duties. Assuming the cost, insurance, and freight (CIF) price was $1,000, the calculation would be $1,000 10/100 = $100. Hence, you would pay $100 as import duties for the wool sweaters.

Remember, understanding the correct tariff rate for your product is critical to avoid unexpected costs or delays.

Step 5 - Consider other Import Duties and Taxes

After crossing the hurdle of standard tariffs, you might find yourself facing additional import duties and taxes. These extra charges can vary significantly based on the nature of the product and the country of origin. For instance, there might be an excise duty, applicable to certain goods such as alcohol or tobacco. This is generally a percentage of the cost, insurance, and freight (CIF) value of the goods, though the rates can fluctuate.

Anti-dumping taxes could also apply if your goods are sold in the Philippines at a significantly lower price compared to the US. This is to prevent market distortions and protect local industries. The rate will depend on the product and circumstances, but it's crucial to factor this in your import cost calculations.

Parsing these additional costs might seem like a tax labyrinth, but the one levy you must never overlook is the Value Added Tax (VAT). Currently, the Philippines has a standard VAT rate of 12% applied on the CIF value plus the duty. So, if your goods have a CIF value of $1,000, and the duty is $100, the VAT would be $132 ($1,100 x 12%). The actual rates may vary, and these figures are just hypothetical examples meant to clarify this point.

Remember, every penny counts in international shipping. By considering these additional costs, you avoid nasty surprises and keep your budget on track. Because, after all, forewarned is forearmed.

Step 6 - Calculate the Customs Duties

In the world of global shipping, calculating customs duties for the Philippines when importing from the US involves several factors. First, there's the customs value, essentially the purchase price of the product. Second, you might encounter Value Added Tax (VAT), and third, anti-dumping taxes may apply under certain circumstances. It may seem daunting, but let's break it down with a few examples:

1. A product worth $1000 with a duty rate of 3%, but no VAT, would incur $30 in customs duties.

2. If that same product also fell under the 12% VAT, the total charges would then become $150 (i.e., $30 in customs duties, plus $120 in VAT).

3. Now, imagine a high-value product, like a luxurious car worth $50,000. Suppose it falls under the 30% customs duty, 12% VAT, 3% anti-dumping taxes, and 20% Excise Duty. You'd end up with an added cost of $32,500.

The savviest businesses leave nothing to chance. Here at DocShipper, we handle every step of your customs clearance journey around the globe, saving you the risk of excess charges. Don't hesitate to get in touch for a free quote delivered in under 24 hours. Shipping needn't be a headache; let us offer you peace of mind.

Does DocShipper charge customs fees?

As your customs broker in the US and the Philippines, DocShipper charges customs clearance fees, but we don't impose any customs duties. These duties, along with taxes, are paid to the government. It's essential to differentiate between these two costs to avoid confusions. For your peace of mind, we provide all documents from the customs office confirming you've only been charged governmental fees. Think of it as a restaurant charging you for your meal, not the tax that appears on the bill. We streamline the process, ensuring your shipment isn't slowed by red tape.

Contact Details for Customs Authorities

US Customs

Official name: U.S. Customs and Border Protection (CBP)

Official website: https://www.cbp.gov/

Philippines Customs

Official name: Bureau of Customs of the Republic of the Philippines

Official website: https://customs.gov.ph/

Required documents for customs clearance

Successful shipping hinges on understanding and correctly preparing the essential customs documentation. Let's unravel the complexities of the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity, eradicating the dread and confusion commonly tucked between their lines. We're here to demystify and simplify, easing your journey towards seamless international trade.

Bill of Lading

The Bill of Lading (B/L) is your golden ticket in the shipping world. It's like a baton in a relay race marking the shift in cargo ownership from your US warehouse to your recipient in the Philippines. The beauty of the B/L is that it can be electronic (Telex), which leads to less paperwork, quicker processes, and lower risk of loss – a win-win! On the other hand, if you're dealing with air cargo, think of the Air Waybill (AWB) as your B/L equivalent. A noteworthy tip: always double-check your B/L or AWB details, a small error can cause major shipment delays. Your B/L isn't just documentation; it's your peace of mind for a secure and efficient transaction.

Packing List

Navigating customs between the US and Philippines? Don't underestimate the importance of your Packing List! It's your detailed map, orchestrating what's inside your shipment, from electronics to apparel. Whether sending a container by sea or a parcel in the sky, this document is your universal passport. Regulators use it to sort, inspect, and levy duties on your goods.

Say you're shipping a batch of California wines. Your Packing List should accurately detail the number of wine crates, their weight, and even the specific type of grape used. A mismatch between the list and the actual content can cause delays, fines, or worse, confiscation.

So, be meticulous when creating your Packing List - it's more than an inventory. It's your guarantee of a smoother and faster customs journey between the US and the Philippines. And in freight, time is truly money!

Commercial Invoice

Navigating a Commercial Invoice for U.S.-Philippines shipping can seem daunting, but think of it as a detailed shopping list. It describes what you're shipping, where it's from, where it's going, and how much it's worth. It's paramount to both countries' customs clearance because it helps determine if the goods are legally allowed to enter and how much duty needs to be paid.

Ensure it aligns with the Packing List. If you're shipping 100 laptops but your invoice only mentions 95, expect hiccups at customs. An example of a challenge? Let’s say, product descriptions - be as specific as possible. Swap 'Assorted Clothing' with '5 cotton summer dresses, 7 silk blouses'.

Your Commercial Invoice is the cornerstone of successful customs clearance – ensure it's accurate, detailed, and consistent to experience a smoother shipping journey.

Certificate of Origin

Navigating the customs process between the US and the Philippines often hinges on the Certificate of Origin, a vital document that clearly states where your goods were produced. Without it, your shipment may face delays or increased duty rates. Including the country of manufacture in the certificate can unlock preferential customs duty rates under bilateral trade agreements. Imagine shipping artisanal chocolates from a US-based chocolatier. The Certificate of Origin that highlights USA as the place of manufacture can smooth the customs process in the Philippines, ensuring your delicacies arrive intact and on time. Remember: every detail counts in international freight!

Your EORI number (Economic Operator Registration Identification)

In your US to Philippines shipping journey, an EORI number is not necessary, as the Philippines is outside the European Union. The EORI, while invaluable for businesses trading within the EU, is an irrelevant step in your shipping process to the Philippines. This resilient nation on the Pacific Ring's edge has its own import and export regulations. Thus, for a frictionless, hassle-free shipping experience, it's crucial to focus your efforts on complying with those specific regulations, which can range from local duties to obtaining an Importer's Clearance Certificate. Ever thought of shipping auto parts, electronic gadgets, or even fresh fruit? Each product category may come with its own regulatory surprises. Peek into your cargo boxes, align your business model with the Filipino customs terrain, and you've got a green signal for your shipping adventure.

Get Started with DocShipper

Struggling with complex customs paperwork? Let DocShipper streamline your US-Philippines shipping for you! We'll handle every meticulous detail of the customs clearance, ensuring a smooth and hassle-free process. Why wait? Get relief from logistics headaches - Contact us for your free quote today, and expect a response within just 24 hours.

Prohibited and Restricted items when importing into Philippines

Understanding what's off-limits is crucial to ensuring your goods clear customs without a hitch when importing into the Philippines. Let's unpack the complexities of prohibited and restricted items.

Restricted Products

- Drugs and medications: You have to apply for a Certificate of Product Registration (CPR) from the Food and Drug Administration (FDA) Philippines.

- Radioactive materials: You need to secure a permit from the Philippine Nuclear Research Institute (PNRI).

- Telecommunication devices: These goods require an Import Certificate from the National Telecommunications Commission (NTC).

- Used second-hand vehicles: To bring these in, you must get a permit from the Bureau of Import Services (BIS).

- Firearms and explosives: These products demand both an import license and a permit from the Philippine National Police (PNP), specifically the Firearms and Explosives Office.

- Plant species: For these goods, you need a Quarantine Clearance Certificate from the Bureau of Plant Industry (BPI).

- Hazardous substances: These require an importation clearance from the Environment Management Board (EMB). .

- Live animals and animal products: You need to acquire a Veterinary Quarantine Certificate from the Bureau of Animal Industry (BAI).

Keep in mind this information can change, so always check the linked websites for the most up-to-date procedures, regulations, and requirements.

Prohibited products

Here are the key products which are completely banned from import into the Philippines:

- Narcotic drugs or any substances used to manufacture dangerous drugs

- Pornographic materials or objects with erotic content

- Roulette wheels, loaded dice, marked cards, machines, apparatus or mechanical devices used in gambling

- Lottery and sweepstakes tickets except those authorized by the Philippine Government

- Radioactive, explosive or combustible substances

- Firearms and ammunition, parts, and components thereof

- Adulterated or misbranded articles of food or drugs

- Agricultural products infested with diseases

- Used clothes and rags

- Hazardous waste, even in transit

- Products containing harmful substances

- Pirated goods or counterfeit goods

- Lottery or gambling devices not authorized by a recognized Philippine authority

This list is not exhaustive, and regulations may change over time, so be sure to verify from the Philippines customs authority or a reliable logistics partner. Also, make sure to refer to the specifics of your cargo to determine if additional requirements or restrictions may apply. Shipping laws, customs duties, and fines for non-compliance can be extensive, so due diligence is key.

Are there any trade agreements between US and Philippines

Indeed, navigating trade relations can be a make-or-break point for your shipping endeavors. Currently, there is no established Free Trade Agreement (FTA) or Economic Partnership Agreement (EPA) between the US and Philippines. However, both countries are still operating under the Generalized Scheme of Preferences (GSP), offering certain duty-free benefits. Keep your ears open for progressing discussions around an FTA, potentially paving the way for enhanced trade benefits. Understanding these dynamics not only helps in the customs clearance process, but can open up space for strategic decision-making.

US - Philippines trade and economic relationship

The US and the Philippines have shared a crucial trade and economic relationship dating back to 1898 when the US established colonial rule. Over a century of political, military, and economic relations have undoubtedly fostered a lasting partnership. Key sectors include semiconductors, electronic equipment, and transport, with major commodities involving electrical machinery and mineral fuels. In recent years, the US foreign direct investment (FDI) in the Philippines reached $7.2 billion, marking an upward trend.

The trade and investment ties between the United States and the Philippines remained robust, with a total goods trade amounting to $22.6 billion in 2023 and an estimated $10.6 billion in trade in services in 2022.

Your Next Step with DocShipper

Shipping between the US and Philippines? Avoid customs pitfalls and transport headaches. Trust DocShipper to handle your freight logistics, end-to-end. Our experts ensure a smooth, cost-effective transit of your goods, leaving you free to focus on making the business thrive. Let's make international trade easy together. Contact us now!

Additional logistics services

Discover DocShipper's extensive range of logistics services. From insurance to packaging, compliance checks to warehousing - we're your ultimate supply chain solution, supporting your business every step of the way.

Warehousing and storage

Warehousing can make or break your products' journey from the US to the Philippines. Picture this: your temperature-sensitive goods melting in a hot warehouse. Avoid this by choosing the right storage conditions. Get to know more about our reliable solutions that demystify this complex process.

Packaging and repackaging

Choosing the right packaging and repackaging method is crucial when sending goods from the US to the Philippines. Your products‘ integrity depends on it. That’s why trusting your precious cargo to a dependable agent is key. Take, for instance, antique furniture. Without proper repackaging, the travel could result in irreversible damage. We tailor our service to cater to various products, ensuring safe delivery.

Cargo insurance

Proper cargo insurance can be your sailor in a storm. It's not just a fireman, quenching the risks after the blaze, rather it's about nipping potential threats in the bud. For example, if your freight, maybe an art masterpiece, sits in a hot container, it’s covered. With us, don’t just weather the storm – avoid it!

Supplier Management (Sourcing)

Struggling to source goods from East Europe or Asia to the Philippines? DocShipper streamlines the process for businesses like yours. We eliminate language obstacles, discover reliable suppliers, and handle the whole procurement procedure, ensuring a smooth production to delivery timeline. Picture your cargo managed without a hitch, thanks to our expertise.

Personal effects shipping

Relocating between US and the Philippines? Manage your delicate or hefty goods with our expert Personal Effects Shipping service. Perfect for those prized heirlooms or that colossal corner couch, we'll handle them like our own. With flexible options, stress is off the menu.

Quality Control

When shipping goods from the US to the Philippines, conducting quality inspections is crucial. These checks ensure your merchandise, whether it's machinery or electronics, meet both countries' standards, saving you from costly returns and reputational damage. Think of it like a reassurance stamp before the long haul. For instance, we once caught subpar metal parts that could have resulted in major recalls for our client.

Product compliance services

Shipping goods without proper compliance? Your business risks costly delays and rejections. Imagine trying to export electronics with untested safety standards - a total no-go. We slap on the lab coats for you, running necessary tests to gather proper certifications, ensuring your goods comply with destination rules. Say goodbye to customs nightmares and hello to smoother logistics.

FAQ | For 1st-time importers between US and Philippines

What is the necessary paperwork during shipping between US and Philippines?

To ship from the US to the Philippines, there's some necessary paperwork. The mandatory document will differ based on your chosen transport method; for sea freight, a bill of lading is required - but opted for air freight? You’ll need an air waybill. Typically, we handle these directly at DocShipper. You, however, will need to supply us with a minimum of a packing list and commercial invoice. Depending on the nature of the goods you're shipping, additional documents such as Material Safety Data Sheets (MSDS) or certifications may also be needed.

Do I need a customs broker while importing in Philippines?

Indeed, engaging a customs broker for importing into the Philippines is a wise decision due to the intricacies of the process and the compulsory paperwork involved. Here at DocShipper, our expert team performs this task for you in most cases, representing your cargo at customs. We navigate the complexities, ensuring all documents and details are correctly provided and followed to the letter. We provide a seamless experience for you while ensuring compliance with all regulations and laws to prevent unnecessary delays. Hence, we highly recommend the use of a customs broker for worry-free importation.

Can air freight be cheaper than sea freight between US and Philippines?

While it depends on several factors including route, weight, and volume, generally, if your cargo is less than 1.5 Cubic Meters or weighs under 300 kg (660 lbs), air freight could potentially be a more cost-effective choice for you. However, it's important to consult with an expert. At DocShipper, our dedicated account executives will dive into the specifics of your shipping needs, always ensuring that we provide you with the most competitive, beneficial options whether that's air, sea, or other methods of transport between the US and the Philippines.

Do I need to pay insurance while importing my goods to Philippines?

While we don't enforce insurance for your imports to the Philippines, we strongly advise it. Shipping goods inherently carries some risk, regardless if the transport is local or international. Incidents such as damage, loss, or theft can occur. Having insurance protects your goods financially from these unpredictable circumstances. The decision ultimately rests with you. But remember, safeguarding your shipment through insurance could save you from unforeseen complications and costs.

What is the cheapest way to ship to Philippines from US?

In general, the most cost-effective way to send shipments from the US to the Philippines is through ocean freight, primarily due to the geographical distance. This method, which uses container ships, is the least expensive, especially for bulk or heavy shipments. However, it requires more transit time. You should also remember customs duties, handling fees, and local charges can impact your overall costs. It's always best to consult us at DocShipper for personalized advice based on your unique shipment needs.

EXW, FOB, or CIF?

Determining whether to use EXW, FOB, or CIF largely depends upon your relationship with your supplier. It's important to remember that suppliers aren't logistics professionals, so it's usually beneficial to let us, at DocShipper, oversee the logistics process. More often, suppliers sell under the terms EXW, which includes any charges up to the factory door, or FOB, which covers all local charges up to the original terminal. Regardless of the terms you choose, we're able to provide a comprehensive door-to-door service, ensuring your freight is taken care of every step of the journey.

Goods have arrived at my port in Philippines, how do I get them delivered to the final destination?

When we ship your goods under CIF/CFR incoterms to the Philippines, you'll need to engage a custom broker or a freight forwarder to clear goods at the terminal, pay import charges, and arrange final delivery. Alternatively, you can opt for our DAP incoterms service where we manage the entire process. Please consult your dedicated DocShipper account executive for more details.

Does your quotation include all cost?

Absolutely, our quotation encompasses all expenses, save for the duties and taxes at your destination. Rest assured, we do not harbor any hidden fees to shock you later. If you need an estimate of the duties and taxes, feel more than welcome to reach out to your dedicated DocShipper account executive. We pride ourselves on transparency.