Why did the parcel go to therapy? Because it had too much 'baggage'! Now let's lighten yours. Understanding rates, transit times, and customs regulations when shipping between the USA and Poland can be a hefty task. This comprehensive guide is designed to alleviate those pain points. By exploring a variety of freight options, delving into customs clearance intricacies, and examining the duties and taxes impacting your decisions, we aim to offer tailored advice for businesses. Expect a thorough education on how to ship your goods, be it by air, sea, road, or rail. If the process still feels overwhelming, let DocShipper handle it for you! As an international freight forwarder, we turn challenges into success for businesses by managing every step of the shipping process.

Table of Contents

ToggleWhich are the different modes of transportation between US and Poland?

When you're shipping goods from the US to Poland, geographical considerations play a crucial role in deciding the transport method. Spanning over 5000 miles, and with no land connection, road and rail aren't suitable options. But don't worry! You can still reliably move those packages across the pond, with two practical choices - Air and Sea. Think of them as a VIP jet versus a passenger ship. The Jet, (Air freight) - speedy, but it comes with a premium tag. The Passenger ship (Ocean Freight) - slower, yet far more economical. Your choice should align with your priority - speed or cost!

How can DocShipper help?

Moving goods from the US to Poland can be complicated, but not with DocShipper! We're experts in managing transportation, customs clearance, and administrative procedures across all shipping methods. Need help or a free estimate? Reach out to our consultants – we’re ready to guide you every step of the way in less than 24 hours.

DocShipper Tip: Sea freight might be the best solution for you if:

- You are shipping large volumes or bulky items, as sea freight offers the most space at a cost-effective rate.

- Your cargo doesn't have an urgent deadline, as sea freight typically has longer transit times compared to air or rail.

- Your shipping routes are between major ports, allowing you to leverage the extensive global network of sea shipping lanes.

Sea freight between US and Poland

Experience a seamless journey as we explore the world of ocean shipping from the bustling docks of the USA to the historic ports of Poland. From electronics to agricultural goods, the sea route is a lifeline for the robust trade relations between these powerhouses, intertwining robust industrial centers like New York and Gdansk. Embrace sea freight as a cost-effective aid for transporting high-volume goods, despite being a champ at playing the long game compared to its faster counterparts.

Don't distress over the common pitfalls many shippers face when embarking on this maritime route. Much like avoiding road bumps on a tedious car journey, understanding the nuances of this ocean highway can save you from turbulent tides. This guide is set to unravel these complexities. From packing best practices to critical customs specifications, it offers practical insights to anchor your shipping strategy and make the journey as smooth as sailing through calm waters. Your voyage in mastering the ABCs of US-Poland ocean shipping begins here.

Main shipping ports in US

Port of Los Angeles

Location and Volume: Based in Los Angeles, California, this port is a crucial gateway for trade with the Asia-Pacific region, boasting a shipping volume of approximately 9.46 million TEUs in 2020.

Key Trading Partners and Strategic Importance: The major trading partners consist of China, Hong Kong, Japan, South Korea, and Vietnam. The port features the latest technology for efficient and eco-friendly operations, underlining its strategic significance.

Context for Businesses: If you aim to extend your reach into Asian markets, the Port of Los Angeles could be pivotal due to its heavy traffic flow and state-of-the-art facilities.

Port of Long Beach

Location and Volume: Situated adjacent to the Port of Los Angeles, the Port of Long Beach facilitates significant trade movement with a massive shipping volume – around 8.11 million TEUs in 2020.

Key Trading Partners and Strategic Importance: It primarily engages in commerce with China, South Korea, Japan, Vietnam, and Taiwan. Notably, it hosts the Green Port Policy for sustainable, efficient operations.

Context for Businesses: Leveraging the Port of Long Beach might be a promising move for businesses wishing to tap into the robust trade activity throughout Asia while favoring green and modern port operations.

Port of New York and New Jersey

Location and Volume: The Port of New York and New Jersey, located on the East Coast, stands as the busiest port in the Eastern United States. It handled nearly 7.6 million TEUs in 2020.

Key Trading Partners and Strategic Importance: It plays an essential role in trade with China, India, Germany, Italy, and the Netherlands, amongst others. Its strategic geographical position provides effortless access to the densely populated Northeastern US.

Context for Businesses: If your enterprise seeks better access to the North-Eastern US or European markets, then including the Port of New York and New Jersey as part of your logistics strategy could add significant benefits.

Port of Savannah

Location and Volume: Positioned in Georgia, this port is critical for facilitating trade within the South-East US region, recording an impressive shipping volume of approximately 4.6 million TEUs in 2020.

Key Trading Partners and Strategic Importance: Its key trading partners include India, China, Germany, Vietnam, and Honduras, reinforcing its important role in international trading routes.

Context for Businesses: Should your business be looking to expand your operation to or from the South-East US, opting for the Port of Savannah may assist in enhancing your logistical capabilities given its significant trade volume and diverse trading partners.

Port of Houston

Location and Volume: The Port of Houston, Texas is one of the largest in the US Gulf region, having processed about 2.99 million TEUs in 2020.

Key Trading Partners and Strategic Importance: This port's primary trading partners feature China, Mexico, Germany, Brazil, and the Netherlands. It’s distinctly valued for its considerable contribution to the petrochemical industry.

Context for Businesses: If you're in the petrochemical industry, or you wish to explore markets in Latin America or Europe, the Port of Houston can become a significant element in your shipping strategy given its industry-specific facilities and access to key markets.

Port of Oakland

Location and Volume: Located in California, the Port of Oakland serves as an essential passage for the region, with a shipping volume of around 2.41 million TEUs in 2020.

Key Trading Partners and Strategic Importance: It engages predominantly with China, Japan, South Korea, Vietnam, and Taiwan for trade, providing a valuable connection with Asian markets.

Context for Businesses: For businesses ready to bolster their presence in Asian markets, the Port of Oakland can provide this channels through its extensive Asian trading partnerships and substantial trade volume.

Main shipping ports in Poland

Port of Gdansk

Location and Volume: Located on the southern edge of Gdansk Bay, this port is crucial for businesses dealing in GDP-impacting commodities including coal, crude oil, and containerized goods. With a shipping volume surpassing 52 million tons annually, the Port of Gdansk is Poland’s largest and one of the busiest ports in the Baltic Sea.

Key Trading Partners and Strategic Importance: The Port of Gdansk actively trades with countries, including Russia, Germany, Sweden, and the Netherlands, reinforcing Poland's economy. Its deep-water container terminal has the capacity to serve mega container ships, enhancing its strategic importance minimizes shipping time for large loads.

Context for Businesses: If your business is looking to extend operations to Europe, especially Eastern Europe, the Port of Gdansk may fit perfectly into your logistics plan due to its high capacity and efficient handling of containerized goods.

Port of Gdynia

Location and Volume: Situated on the western coast of Gdansk Bay, the Port of Gdynia is essential for businesses with TEU-based container traffic and other goods like paper, steel, and ro-ro traffic. Handling over 24 million tons of cargo per year, Gdynia ensures a robust flow of goods.

Key Trading Partners and Strategic Importance: Primary trading partners include Germany, Sweden, Russia, the Netherlands, and the UK. Its ro-ro terminal and Broad-Gauge terminal, unique to this port, meet varied shipping requirements and offer accessibility for rail and road transport.

Context for Businesses: Looking at penetrating European markets via Poland or managing large volumes of ro-ro traffic? The Port of Gdynia could be integral to your shipping strategy due to its well-connected terminals and diverse cargo handling.

Port of Szczecin and Świnoujście

Location and Volume: These two ports, managed as a single entity, are situated along the Pomeranian Bay and the Szczecin Lagoon. With a collective shipping volume over 25 million tons per annum, they cater to businesses dealing in different types of cargo including coal, fuels, grain, and containerized goods.

Key Trading Partners and Strategic Importance: Key trading partners include Germany, Russia, the Netherlands, and the United Kingdom. The ports' locations allow for increased interaction and exchange with Europe via inland waterways, boosting their strategic value.

Context for Businesses: If your business aims to tap into the Eastern European market through river-canal systems or wants to benefit from versatile cargo handling, integrating the ports of Szczecin and Świnoujście into your shipping plan could be beneficial.

Should I choose FCL or LCL when shipping between US and Poland?

Are you pondering the most effective sea freight option to transfer goods between the US and Poland? The decision of choosing Full Container Load (FCL) or Less than Container Load (LCL)/Consolidation could make or break your shipping success. It's your call to ace the balance between cost and delivery time. In the following section, you'll decipher the nitty-gritty of these two modalities, enabling you to make an informed decision that aligns perfectly with your shipping needs. Let's embark on this voyage of unraveling your optimal shipping solution!

LCL: Less than Container Load

Definition: Less than Container Load (LCL) is a shipping term indicating your cargo occupies less than a full container, and will share space with other shipments.

When to Use: LCL is ideal when your cargo volume is less than 13/14/15 Cubic Meters (CBM). Its flexibility comes from not needing to fill a whole container, making it cost-effective for businesses shipping smaller volumes.

Example: For instance, your company might manufacture boutique handcrafted furniture in Ohio, only shipping a few pieces to a vendor in Warsaw, Poland, every month. Given the volume, using LCL shipping allows you to reduce costs, as you only pay for the space used.

Cost Implications: Though LCL freight cost per unit is higher, total expenses remain low due to paying for your precise volume. However, keep in mind the extra handling involved from sharing a container, increasing the risk of damages and delays, which could indirectly increase costs. Therefore, it's crucial to get an accurate LCL shipping quote that factors in these risks to make an informed decision.

FCL: Full Container Load

Definition: FCL, or Full Container Load, is a type of shipping where you reserve an entire container for your goods alone. The key words here are 'Full', meaning the container is earmarked exclusively for your shipment, and 'Load', referring to the cargo inside.

When to Use: FCL shipping is cost-effective for large volumes, typically when your cargo exceeds 13/14/15 CBM. It offers safety; as the container is sealed at the origin and goes straight to its destination, the chances of mishandling are significantly reduced.

Example: Consider a Chicago-based furniture company shipping twenty 3-CBM sectional sofas to Krakow. They would require at least 60 CBM. FCL shipping would be the best choice because they can get a 40'ft container tailored to such high-volume items, ensuring secure and efficient transport.

Cost Implications: While the initial FCL shipping quote might seem high, it becomes more economical with increasing volume. FCL containers' price doesn't change based on the amount of cargo, so for large shipments, the cost per unit goes down, making it cheaper than LCL (Less Container Load) for the same volume. Always consider your cargo volume against container sizes (20'ft and 40'ft are typical) when computing costs.

Unlock hassle-free shipping

Confused between consolidation and full container shipping from the US to Poland? Let DocShipper guide you smoothly through this ordeal. Our team of ocean freight experts will assess your cargo size, budget, and timeline to determine the most efficient option. With our commitment to facilitating businesses, we aim to streamline your shipping process. Contact us now for a free estimation, and let us tailor the best shipping strategy to fit your needs. Act today for hassle-free cargo shipping!

How long does sea freight take between US and Poland?

Typically, sea freight transit times from the United States to Poland average between 15 to 35 days. This estimated duration is subject to variables including the precise departure and arrival ports, the weight of the shipment, and the nature of the goods. We suggest reaching out to a reputable freight forwarding company like DocShipper for an accurate, tailored quote.

Here's a glimpse into the average transit times, in terms of days, from some of the busiest sea freight ports in both countries:

| US Ports | Poland Ports | Average Transit Time (Days) |

| Port of Los Angeles | Port of Gdansk | 25 |

| Port of Houston | Port of Szczecin | 25 |

| Port of New York and New Jersey | Port of Gdansk | 20 |

| Port of Savannah | Port of Szczecin | 30 |

*Please note that these are only approximations and real transit times are liable to vary. Reach out to your chosen freight forwarder for a more precise timescale.

How much does it cost to ship a container between US and Poland?

Transporting a container from US to Poland can cost anywhere between $50 to $500 per CBM, but the ocean freight rates hinge on a multitude of variables. Factors such as Point of Loading, Point of Destination, carrier choice, nature of the goods, and current market conditions make pinpointing an exact shipping cost a complex task. But, fear not! Our dedicated team of shipping specialists will navigate these variables alongside you, assuring personalized, best-value quotes for every shipment. We offer a case-by-case approach, tailoring solutions to suit your specific needs. Let's make your global freight forwarding journey smoother and more cost-effective.

Special transportation services

Out of Gauge (OOG) Container

Definition: OOG containers are unique shipping units offering an open top or side for items exceeding standard dimensions.

Suitable for: Oversized goods such as construction equipment, large machinery, or components for wind-energy plants which can stretch beyond the standard box limits.

Examples: Tractors, turbines, cranes and construction pipes.

Why it might be the best choice for you: If your cargo dimensions exceed regular containers (‘Out of gauge cargo’), the OOG container fills the gap seamlessly, accommodating your unique cargo with the benefit of convenience in loading with a crane or on the top.

Break Bulk

Definition: The method of transporting goods that aren't containerized, either in bags, boxes, crates, drums, or barrels, referred to as break bulk.

Suitable for: goods that are packaged and can be handled separately.

Examples: construction materials (like cement in bags), palletized cargo, or drums of liquid.

Why it might be the best choice for you: If you have loose cargo load that's individually marked and counted, break bulk shipping allows efficient loading and unloading processes.

Dry Bulk

Definition: Dry Bulk shipping usually refers to raw material commodities shipped in large unpackaged quantities.

Suitable for: Mass commodities like coal, grains, or metals.

Examples: Iron ore, grains, coal, or sugar.

Why it might be the best choice for you: If your business entails transferring large quantities of unpackaged dry materials called 'Dry bulk', this shipping method is ideal.

Roll-on/Roll-off (Ro-Ro)

Definition: The Ro-Ro service transports vehicles that can be driven on and off the ship on their own wheels.

Suitable for: Cars, trucks, trailers, and machinery that can roll off and onto the vessel (hence, ro-ro vessel).

Examples: Cars, construction machinery, or large trucks.

Why it might be the best choice for you: If your shipment involves vehicles or dealt with heavy rolling machinery, Ro-Ro service ensures the items are driven on at the origin and driven off at the destination.

Reefer Containers

Definition: Reefer containers are refrigerated boxes designed to carry temperature-sensitive cargo.

Suitable for: Perishable goods like food, pharmaceuticals, and certain chemicals that require a controlled environment.

Examples: Fresh fruits, vegetables, dairy products, or medicines.

Why it might be the best choice for you: If your merchandise includes perishable items demanding constant temperatures, reefer containers provide the most effective temperature-controlled solution.

Tailoring perfect shipping solutions for your needs is our specialty at DocShipper. We would be thrilled to provide personalized advice on the best methods for shipping your specific goods from US to Poland. Let's discuss your shipping needs further! Contact us for a free shipping quote in less than 24h. We're eagerly waiting to make your shipping process seamless and economical.

DocShipper Tip: Air freight might be the best solution for you if:

- You are in a hurry or have a strict deadline requirement, as air freight offers the fastest transit times.

- Your cargo is less than 2 CBM (Cubic Meter), making it more suitable for smaller shipments.

- Your shipment needs to reach a destination that is not easily accessible by sea or rail, allowing you to tap into the extensive network of global airports.

Air freight between US and Poland

Air freight between the US and Poland - it's like an eagle swift, reliable and perfect for small yet valuable loads. Let's say you're shipping high-tech devices or designer garments - air freight ensures your cargo lands promptly and safely, saving on storage fees and security woes. But here's the kicker - many businesses stumble in the cost estimate.

Ever tried to fit a big teddy bear into a small box? A common error shippers make - they miscalculate the weight, and just like our squished teddy, the freight cost balloons. A few innocent errors, and the cost-effective shipping fades into a pricey affair. Don't fret though, we're here to ensure you don't repeat these blunders! Stay tuned for some priceless air freight wisdom coming your way.

Air Cargo vs Express Air Freight: How should I ship?

Picking the best aviation option can feel like selecting your in-flight meal - confusing and critical. Here's the scoop: if standard air cargo is a casual shared ride in a commercial plane, express air freight is your VIP ticket aboard a dedicated aircraft. The latter zooms your goods from the US to Poland even faster, so let's probe into which method will really take your business to new heights.

Should I choose Air Cargo between US and Poland?

Air cargo from the US to Poland is a reliable and cost-effective transportation method, especially for a cargo load above 100/150 kg (220/330 lbs). Major players in this space include FedEx and LOT Polish Airlines - they offer fixed schedules. However, be prepared for longer transit times. If budget is your primary concern, air cargo should suit your needs well, despite the extended delivery time. It's time to consider air cargo; it could fit perfectly into your shipping strategy.

Should I choose Express Air Freight between US and Poland?

If you're shipping cargo less than 1 CBM or weighing under 100/150 kg (220/330 lbs), express air freight may be a practical option. Services like FedEx, UPS, and DHL offer these specialized services, using dedicated cargo planes that exclusively transport goods—no passengers. Some perks of this choice include faster delivery and priority handling. For smaller, time-sensitive shipments, this could be your ideal solution. Don't forget to evaluate these services according to your specific shipping requirements.

Main international airports in US

Los Angeles International Airport (LAX)

Cargo Volume: Approximately 2.21 million tons (2020)

Key Trading Partners: Asia (especially China), Europe, and South America.

Strategic Importance: As one of the busiest cargo airports in the US, LAX's strategic location on the West Coast provides easy access to Asia and the Pacific.

Notable Features: LAX has sophisticated handling facilities suited to a wide variety of cargo, including goods requiring refrigeration and special handling.

For Your Business: If you frequently deal with goods requiring special care or your main market lies in Asia, leveraging LAX's strategic location and facilities can significantly improve your shipping efficiency.

John F. Kennedy International Airport (JFK)

Cargo Volume: Over 1.3 million tonnes (2020)

Key Trading Partners: Europe, South America, and the Middle East.

Strategic Importance: Located in New York, JFK serves as a critical international aviation hub, connecting businesses to trading points across the globe.

Notable Features: JFK hosts a dedicated Cargo Area, further solidifying its role as a major hub for international trade in the US.

For Your Business: If your business deals extensively with European or Middle Eastern markets, JFK's wide network can promise extensive reach and efficient goods transit.

Chicago O’Hare International Airport (ORD)

Cargo Volume: Over 2.2 million tonnes (2020)

Key Trading Partners: Europe, Asia, and Mexico.

Strategic Importance: Chicago O'Hare's central position in the US makes it an optimal hub for both international and domestic cargo traffic.

Notable Features: ORD has a comprehensive cargo handling system, including automated facilities for faster, error-free processing.

For Your Business: With ORD's automation and central location, your inland transit times can be minimized, allowing quicker delivery times and increased customer satisfaction.

Miami International Airport (MIA)

Cargo Volume: Over 2.3 million tonnes (2020)

Key Trading Partners: Latin America, Caribbean, and Europe.

Strategic Importance: With its proximity to South America and the Caribbean, MIA serves as a gateway to these regions.

Notable Features: MIA is especially equipped for perishable goods cargo, making it a leader in the import/export of flowers, fruits, and vegetables.

For Your Business: If your business involves perishable goods or your main market is in Latin America or the Caribbean, MIA's niche services and location can ensure faster, safer shipment of your goods.

Memphis International Airport (MEM)

Cargo Volume: Approximately 4.61 million tons (2020)

Key Trading Partners: Canada, China, and Europe.

Strategic Importance: Besides being one of the busiest cargo airports, MEM is the global 'SuperHub' for FedEx, enabling efficient multi-modal shipping solutions.

Notable Features: MEM can handle vast amounts of diverse cargo types with its robust facilities, including a sorting hub for courier heavyweight FedEx.

For Your Business: If your business model aligns with courier services or immediate shipping needs, MEM’s FedEx hub provides an opportunity for expedited deliveries globally.

Main international airports in Poland

John Paul II Kraków-Balice International Airport

Cargo Volume: In 2019, the airport handled 23,000 tonnes of cargo.

Key Trading Partners: Major trading partners include Germany, Russia, and the UK.

Strategic Importance: As the second busiest airport in Poland, it's an important hub for international cargo, playing a significant role in supporting the thriving regional economy.

Notable Features: The airport boasts a cutting-edge cargo terminal with modern and efficient infrastructure, helping to ensure smooth and reliable cargo handling.

For Your Business: Located in the southern region of Poland, this airport could be an ideal choice if you've got customers or suppliers in this area. It's well-connected with several destinations and offers a full suite of logistics services to support smooth and efficient shipping operations.

Warsaw Chopin Airport

Cargo Volume: As the largest airport in Poland, it handled over 100,000 tonnes of cargo in 2019.

Key Trading Partners: Major trading partners include the USA, China, and Germany — three of the world's leading economies.

Strategic Importance: As Poland's main international gateway, the airport plays a critical role in connecting the country's businesses with global markets.

Notable Features: Features a dedicated cargo terminal equipped with cold storage for temperature-sensitive shipments and offers extensive ground handling services.

For Your Business: If your operation heavily relies on international trade, especially with major economies such as the US or China, this airport should be on your radar. With its advanced facilities and extensive connectivity, it can help your business expand its global reach.

Wrocław-Copernicus Airport

Cargo Volume: It handled around 10,000 tonnes of cargo in 2019.

Key Trading Partners: Key trade activities are with European countries such as Germany, the UK, and France.

Strategic Importance: As an emerging economic zone in western Poland, the airport provides vital connectivity for local businesses to European markets.

Notable Features: Provides 24/7 cargo handling operations and has facilities for handling hazardous goods.

For Your Business: For businesses looking to penetrate the European market, especially Western Europe, this airport promises robust connectivity and efficient handling services that can support your logistics needs effectively.

Poznań-Ławica Airport

Cargo Volume: Handles nearly 6,000 tonnes of cargo annually.

Key Trading Partners: Main trading partners are European nations, primarily Germany and the UK.

Strategic Importance: Located in the economic heartland of the Greater Poland region, it supports local businesses by connecting them to crucial European markets.

Notable Features: Notable for its excellent customer service and efficient freight handling, with particular emphasis on fragile and valuable goods.

For Your Business: Its strategic location and well-rated services make this airport a viable choice for businesses located in northern and western Poland, or those with supply chains focused on Europe.

Gdańsk Lech Wałęsa Airport

Cargo Volume: Handled 12,000 tonnes of cargo in 2019.

Key Trading Partners: Key trading partners include European countries such as Germany, Scandinavia and the UK.

Strategic Importance: The airport’s location on the Baltic Sea makes it vital for trade with Scandinavia and Northern Europe.

Notable Features: Specializes in handling large and heavy cargo, and provides services such as cargo preparation and final cargo checks.

For Your Business: If your business specializes in heavy products or frequently trades with North European countries, this airport’s unique capability and strategic location can provide a significant boost to your shipping logistics.

How long does air freight take between US and Poland?

Average transit times for air freight between the US and Poland typically range from 2-5 business days. However, exact durations can vary, depending on factors such as the specific departure and arrival airports, the weight, and the nature of the goods being shipped. For precise transit times tailored to your specific needs, a consultation with a freight forwarder like DocShipper would be beneficial.

How much does it cost to ship a parcel between US and Poland with air freight?

Shipping an air freight parcel from the US to Poland can cost broadly between $2.5 to $7 per kg. However, arriving at an exact price can be complex as it depends on various factors such as the distance from departure and arrival airports, parcel dimensions, weight, and the nature of goods. Rest assured, our dedicated team tailors rates on a case-by-case basis to provide you with the most competitive quote. Don't hesitate to reach out to us! Contact us and receive your free quote in less than 24 hours.

What is the difference between volumetric and gross weight?

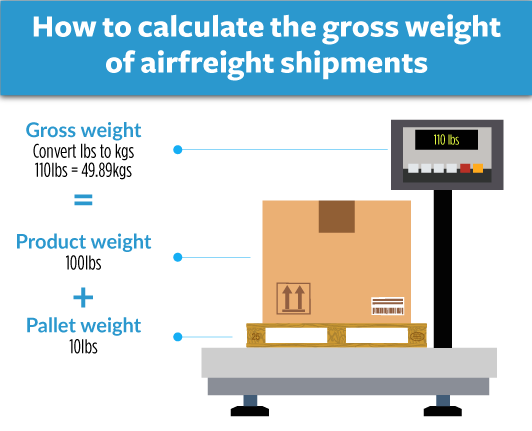

Starting with the basics, gross weight is your shipment's actual weight measured in kilograms, while volumetric weight reflects the parcel's density, taking its size into consideration. Both play different but crucial roles in the world of air freight shipping.

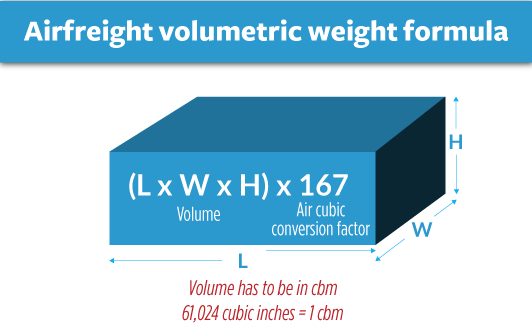

In air cargo, the volumetric weight is determined by multiplying the package's length, width, and height (in centimeters), then dividing the result by 6,000. Considering a hypothetical parcel with dimensions of 40cm x 30cm x 20cm, the calculation would be (40 x 30 x 20)÷6,000, resulting in a volumetric weight of approximately 4kg. In lbs, this converts to 8.8 lbs.

Conversely, the actual gross weight is simpler. If our hypothetical parcel weighs 2kg, it converts to approximately 4.4 lbs.

Express Air Freight services use a similar calculation but with a slight difference. The factors in the formula change; instead of dividing by 6,000, you divide by 5,000. So let's use the same dimensions for our hypothetical shipment. Instead, the resulting volumetric weight would be (40 x 30 x 20)÷5,000, equating to 4.8kg or nearly 10.6 lbs.

Now, why is all this important? Freight charges are generally determined by comparing the gross and volumetric weights, with the higher value being chosen. This calculation ensures that packages are fairly priced for their space, not just their actual weight. In our example, despite the actual weight being 2kg, the freight charges would be based on the volumetric weight of 4kg for Air Cargo or 4.8kg for Express Air Freight, making these calculations a pivotal part of your shipment planning.

DocShipper tip: Door to Door might be the best solution for you if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You prefer a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want to minimize the handling of your goods, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between US and Poland

Imagine the simplicity of shipping straight from your warehouse in the U.S., right to your customer's doorstep in Poland. That's the beauty of International Door-to-Door delivery. It's hassle-free, time-saving, and offers full visibility over your shipment. The pros are countless, but don't just take our word for it. Grab your shipping blueprints – let's dive in and explore!

Overview – Door to Door

Fed up with the intricate shipping processes between the US and Poland? Door-to-door shipping might just be your respite. It offers unrivaled ease that seals its status as a favorite amongst our DocShipper clientele. The service quashes challenges like pesky paperwork, customs snags, and logistical intricacies, actively replacing them with a seamless, efficient, one-step solution. While globally loved, it does call for some extra investment, but the payoff in minimized stress and maximized peace is immeasurable. So, why juggle tasks when you can reap benefits from a simplified shipping process, all under one single service? Think door-to-door. Think peace of mind.

Why should I use a Door to Door service between US and Poland?

So you've been puzzling over logistics like it's your daily crossword, huh? Well, let's clear up the mystery. Here are five compelling reasons to choose a Door to Door service when shipping goods between the US and Poland:

1. Worry-Free Logistics: With Door to Door service, there's no need for you to lose sleep over organizing pick-ups, drop-offs, or interim transit. A dedicated agency handles everything from your doorstep to the recipient's. Sip your coffee, and leave the hassles to us.

2. Timely Deliveries: Got an urgent shipment? Timeliness isn't just about setting your watch right. Door to Door services prioritize punctuality, ensuring swift and efficient delivery right on schedule.

3. Specialized Cargo Care: Shipping complicated cargo between the US and Poland? Wipe that sweat off; Door to Door services specialize in handling complex shipments with top-notch care and attention to protect your valuable goods.

4. Complete Convenience: Say goodbye to coordinating trucking until the final destination. Door to Door service providers take care of this too. So, buckle up and enjoy a smooth ride towards convenient shipping.

5. Stress Alleviator: Ever seen stress evaporate? With Door to Door services, shipping goods internationally feels as breezy as a walk in your favorite park. Kick back, relax, and watch as we handle shipping logistics from start to end.

So there you have it! Clear those furrowed brows and let Door to Door services simplify your international shipping journey from the US to Poland.

DocShipper – Door to Door specialist between US and Poland

Experience seamless door-to-door shipping from the US to Poland with DocShipper. Our all-inclusive service ensures a worry-free transaction - from packing and transportation to customs clearance, using any preferred shipping method. With a dedicated Account Executive at your disposal, we guarantee hassle-free logistics solution tailored to your needs. Contact us today for a free estimate within 24 hours or get free consultation from our experienced consultants. Trust DocShipper for efficient, expertly managed international shipping. We move, you relax.

Customs clearance in Poland for goods imported from US

Customs clearance is the pivotal process of importing goods into Poland from the US, ensuring your merchandise meets all requirements and avoids unexpected fees. A potential labyrinth, missteps such as not understanding customs duties, taxes, quotas, or licenses can snag your items in red tape and skyrocket costs. Image your goods, caught up in customs while costs climb and delivery deadlines whiz by. This guide will unmask the intracies of this part, making it easier for you to navigate. Rest assured, DocShipper can guide you through, regardless of your cargo, its origin or destination. To start the estimate process, drop us a line with details on the origin of your goods, the value, and the HS Code. We'll then be able to assist with your project budgeting.

How to calculate duties & taxes when importing from US to Poland?

Estimating duties and taxes for imports from the US to Poland may seem daunting, but with the right information, you'll be able to arrive at a close approximation. Knowing your product's country of origin, the Harmonized System (HS) Code, the Customs Value, and the Applicable Tariff Rate, as well as any other additional fees specific to your goods, are core to calculating the cost of customs duties. Kicking off this process begins with identifying the country where your goods were originally manufactured or produced.

Step 1 - Identify the Country of Origin

First off, why fuss about identifying the country of origin, you might ask. Well, having the U.S as your goods' country of origin plays a crucial role. Firstly, it aids in categorizing your goods using the HS code, a global standard for defining and identifying products. Secondly, slight changes in the product or its manufacturing process can sway your products' classification.

Now, onto trade agreements. The U.S and Poland adhere to a range of treaties, impacting any customs duties you might owe. For example, the U.S-EU agreement offers lowered tariffs for many U.S goods. Diving into these deals can give you a pretty great fiscal leg-up!

Unfortunately, some bumps in the road exist. Certain goods face import restrictions into Poland from the U.S. If your product falls into regulated categories like food or chemicals, pay extra attention and invest time in learning about these specific limitations.

Remember, spare no effort when it comes to paperwork and credentials. Ensuring they are thorough and accurate puts customs clearance on cruise control, making your importing process smooth and stress-free! Trust us, it saves headaches down the line.

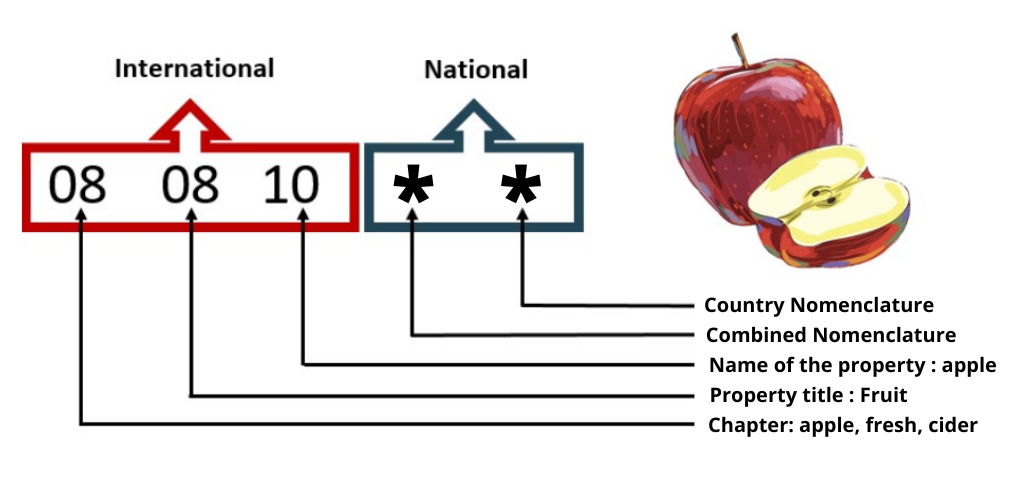

Step 2 - Find the HS Code of your product

The Harmonized System (HS) Code is a universally accepted identification system for goods used in international trade. Developed by the World Customs Organization (WCO), it is an essential part of the process of shipping goods across borders. The code allows customs to quickly comprehend what they're dealing with, calculate duties, and enforce regulations.

One of the most straightforward and efficient ways to obtain this crucial piece of information is to ask your supplier directly. They are typically well versed in the regulations relevant to their products and should have this information readily available.

Should this method not prove fruitful, do not worry! You can find the HS code by yourself using a simple, step-by-step process. First, access the Harmonized Tariff Schedule and type in your product's name in the search bar. The HS code can then be found under the Heading/Subheading column.

NOTE: Accuracy when determining the HS code for your goods is paramount. A mistake could potentially result in customs delays or fines.

Finally, we've put together a visually-rich guide on how to decode an HS code. Here's an infographic showing you how to read an HS code. Remember, shipping shouldn't be complicated, and with the correct guidance, you'll become a pro in no time!

Step 3 - Calculate the Customs Value

You might be wondering, why does the customs value differ from the actual item value? In simple terms, the customs value is calculated based on the CIF value, which encapsulates not only the price of the goods, but also the cost of international shipping and insurance fees. Let's say you're shipping a $500 product. If your shipping charges are $100 and insurance costs $10, the CIF value totals to $610. Consequently, this is the amount that customs will consider while assessing duties and taxes. Remember, each penny counts when you're dealing with customs, so avoid any potential surprises by keeping a clear tab on these figures. The key is to anticipate these costs for smoother customs clearance in Poland.

Step 4 - Figure out the applicable Import Tariff

An import tariff can be understood as the tax imposed on goods when they are transported across international borders. In the context of shipping to Poland from the US, Poland being a member of the European Union, uses the Common Customs Tariff (CCT) system.

You can find the exact tariff applicable to your product with the TARIC System - European Customs tool. You have to enter the Harmonized System (HS) code of the goods you are importing along with the country of origin. This will help you ascertain the duties and taxes applicable to your goods.

For example, let's say you're importing a bicycle made in the US to Poland. The HS code for bicycles is 871200 (you are expected to know this from your previous steps in the customs process). You enter these details into the TARIC system and find that the CCT for bicycles made in the USA is 14%.

Let's say the Cost Insurance and Freight (CIF) value of your bicycle shipment (the cost of the goods plus insurance and freight costs) is $1000. The customs value on which the duty will be calculated thus is:

Import duty = ($1000 14%)

Hence the import duty would be $140.

This example helps visualize how these tools can simplify the tax calculation process and support your business in cost-effectively managing international shipments.

Step 5 - Consider other Import Duties and Taxes

Beyond the regular tariff rate, you might find additional import duties applied based on a product's origin and type. For instance, excise duties might apply to alcohol, tobacco, or petroleum products. Another import cost to prepare for is potential anti-dumping taxes, which could be levied if your goods are priced below market value or if they're detrimental to the Polish economy.

However, one of the major charges that you'll definitely want to keep in mind is the Value-added Tax or VAT. Any goods imported into Poland come with a standard VAT rate.

Let's dive into a real-world example, remember that duties and taxes may vary based on your actual product and this is hypothetical:

You're importing artisanal coffee valued at $10,000 into Poland from the US. Let's assume a tariff rate of 12%, resulting in $1,200 in tariffs. Now, if there's an excise duty of 1%, it adds another $100. Sum up the value of goods, tariff, and excise duty ($10,000+$1,200+$100=$11,300), that's the taxable amount for VAT. If the VAT is 23% in Poland, you're looking at a VAT charge of $2,599 ($11,30023%).

So, the product cost isn't the only factor influencing your import taxes. Keep these additional charges in mind when budgeting for your shipment.

Step 6 - Calculate the Customs Duties

In 'Step 6 - Calculate the Customs Duties', working out your shipment's customs duties involves three key components: the customs value, VAT (Value Added Tax), and anti-dumping taxes.

Here's a simple formula to follow: Duties = (Customs value + VAT + anti-dumping taxes) duty rate (%)

Consider these real-world examples:

1. A shipment with a customs value of $10,000 and a duty rate of 10% would attract duties of $1,000 (no VAT involved here).

2. Incorporating VAT, a shipment value of $10,000 with a 10% duty rate, and 23% VAT would have duties of $1,300.

3. Including anti-dumping taxes and Excise Duty, a shipment worth $10,000 carrying a 10% duty rate, 23% VAT, 5% anti-dumping tax, and $50 excise duty would result in total duties of $1,350.

Keep in mind, calculations can get complex with more variables involved. That's where DocShipper steps in. As customs clearance experts, we ensure you don't pay more than necessary in duties no matter where in the world you're shipping. Get in touch for a free, no-obligation quote in less than 24 hours.

Does DocShipper charge customs fees?

At DocShipper, we separate customs clearance fees from customs duties and taxes. As a customs broker in the US and Poland, we charge for the service of clearing your shipment, yet any import duties or taxes are directly paid to the government. To ensure transparency, we provide documentation from the customs office stating the exact charges. Remember, the customs duties are not our fees – it's essentially the 'entry ticket' for your goods into a new country. You're only paying us for making the clearance process smoother.

Contact Details for Customs Authorities

US Customs

Official name: U.S. Customs and Border Protection (CBP)

Official website: https://www.cbp.gov/

Poland Customs

Official name: The Customs Service of the Republic of Poland

Official website: https://www.mf.gov.pl/en/customs-service

Required documents for customs clearance

Clearing customs can feel like an obstacle course, but with the right documents, it doesn't have to be! In this piece, we'll dive into the specifics of the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity—your ticket to a smooth, hassle-free customs experience. Knowledge is power, and we're here to arm you with it!

Bill of Lading

In the world of shipping goods between the US and Poland, the Bill of Lading holds the baton. It's your proof of ownership, cementing that moment the shipment officially becomes yours as it crosses oceans. Picture this: you've got a container of electronics headed for Warsaw. Without a Bill of Lading, customs would be like a restaurant without a reservation system. Chaotic, right? So remember, this document is mandatory for ocean and road shipments.

Now, let's introduce the concept of 'telex' release, a form of electronic Bill of Lading. It's a game-changer for speed, cutting out the downtime of waiting for physical papers. Imagine receiving your shipment documents as swiftly as an email. Convenient, huh?

Considering air cargo? That's where an Air Waybill (AWB) comes in. It's your air-friendly version of the Bill of Lading.

Get the hang of these documents and you're one step closer to mastering the US-Poland shipping lane.

Packing List

The Packing List is your trusty sidekick in the epic journey of shipping goods from the US to Poland. You, as the shipper, hold the responsibility to compile this crucial document with utmost accuracy—it's like your goods' ID, listing their weight, dimensions, and nature. Imagine sending a mystery box to a friend without telling them what's inside. Well, that’s what transacting without a packing list looks like to your freight carrier and customs officials, for both sea and air freight. So, to navigate this voyage smoothly, ensure your packing list is thorough. Think of it like this: 'If it's in the container, it's on the paper'—everything will result in a seamless clearance and expedited transit times. Just remember, a well-detailed packing list paves the way for a swift delivery. Don't underestimate its power!

Commercial Invoice

When shipping goods from the US to Poland, your Commercial Invoice is crucial. This document details your shipment's value, description, and HS codes. Say you're shipping car parts; your invoice would include the brand, model, and quantity. It's the Customs' window into your shipment. If there's a mismatch between your Commercial Invoice and other documents like the Bill of Lading, expect unnecessary delays, fees, or even refusal at Polish customs. Always triple-check the information for accuracy and consistency across all documents, helping to avoid unexpected obstacles during the customs clearance process. A clear, precise Commercial Invoice ensures your goods flow smoothly across borders, leaving no room for ambiguities or misunderstandings.

Certificate of Origin

Navigating US-Poland freight? You'll need a Certificate of Origin (CO). This crucial document attests that your goods were indeed manufactured in the country mentioned. Let's say you're shipping watches made in the USA to Poland. Your CO confirms this, making your shipment eligible for preferential duty rates under the USA-Poland trade agreement. So, you could save a pretty penny on customs duties! It's like having an express VIP pass for your goods. Ensure your CO is in order before shipping - it's not just paperwork, it's your ticket to streamlined, cost-efficient shipping.

Certificate of Conformity (CE standard)

When shipping goods between the US and Poland, it's vital to understand the importance of the Certificate of Conformity (CE standard). The CE standard is an acknowledgment that your product meets the European Union's health, safety, and environmental standards. It's crucial not for quality assurance, but product safety.

For example, if you're exporting toys from the US, they must carry the CE marking. This certificate doesn't align one-on-one with any US standard. However, think of it as equivalent to the Consumer Product Safety Commission (CPSC) approval needed for toys sold within the US.

To avoid hiccups, ensure your goods have the essential CE marking as part of your pre-shipment process. It's a regulatory necessity, keeping the European Market – Poland included – safe and robust. So, remember: No CE, no entry!

Your EORI number (Economic Operator Registration Identification)

When trading goods between the US and Poland, obtaining an EORI Number is crucial. Think of it as your business's passport, giving you the right to import or export in the bustling EU marketplace. Simply put, it's a unique number assigned to your company, which customs officials use to keep track of all goods moving in and out of the EU — and yes, Poland is part of this network. Don't think this is just a formality; missing or wrong EORI details can lead to shipment delays or even fines! Hook up with the Poland Customs office or HM Revenue and Customs for your EORI and get ready to expand your business horizons!

Get Started with DocShipper

Navigating customs between the US and Poland can be a maze! Don't let complicated paperwork derail your commerce. Let DocShipper's expert team deftly handle every step of the customs clearance process. Cut through confusion and streamline your shipping strategy today. Contact us, and receive a complimentary, no-obligation quote in under 24 hours. Your hassle-free shipping solution is just a click away.

Prohibited and Restricted items when importing into Poland

When importing goods into Poland, you may face unexpected hurdles due to restrictions and prohibitions on certain items. Avoid frustrating delays and unnecessary costs by understanding what you can't send and what needs extra paperwork. Let's simplify this complex process for you.

Restricted Products

- Pharmaceuticals: You'll need to secure a Pharmaceuticals Import License from the Office for Registration of Medicinal Products, Medical Devices, and Biocidal Products .

- Fireworks: Ensure you have the Pyrotechnic Articles Import License awarded by the Ministry of Economy .

- Chemicals: A Chemicals Import License from the Bureau for Chemical Substances is necessary.

- Live Animals: Secure the Veterinary Import License from the General Veterinary Inspectorate .

- Firearms and Ammunition: You have to apply for the Firearms and Ammunition Import License via the National Police .

- Plant Products: You'll need a Plant Health Certificate from the Research Institute of Horticulture .

- Alcohol and Spirits: An Alcohol Import License from the Ministry of Finance is required.

- Tobacco Products: Get the necessary license from the State Revenue Administration.

- Radioactive substances: These demand a permit from the National Atomic Energy Agency .

- Cultural goods: They require a license from the Ministry of Culture and National Heritage .

Prohibited products

- Drugs and narcotics, unless for medical purposes and with required permissions.

- Explosives and fireworks, unless there's explicit permission by the Ministry of Economy.

- Offensive weapons, firearms, and related equipment without the proper licensing and documentation.

- Counterfeit money and goods.

- Tobacco and alcohol to minors under 18 years.

- Endangered animals, plants, and their by-products, disproportionately conforming with CITES regulations.

- Soil and certain agricultural and horticultural products.

- Pornographic materials.

- Cultural goods originating in the territory of the Republic of Poland after 1945.

- Radioactive materials without the appropriate permits and licenses.

- Certain hazardous chemicals and substances.

- All types of veils that cover the face (burqas, niqabs).

Are there any trade agreements between US and Poland

Yes, trade relations between the US and Poland are governed by the US-EU trade agreements given Poland's EU membership. No specific FTAs exist, but the ongoing Transatlantic Trade and Investment Partnership talks may create future opportunities. Also, the Three Seas Initiative, focusing on infrastructure development, could enhance trade dynamics. Essentially, these relations offer you a solid foundation for trading and growth, but it’s vital to stay updated on developments.

US - Poland trade and economic relationship

The US-Poland trade relationship has flourished since the end of the Cold War, with remarkable milestones that have fostered economic synergy. Poland's pharmaceutical industry and American tech sector are key trade sectors, enveloped by a healthy exchange of commodities such as machinery and vehicles.Over the past 27 years, United States exports to Poland have shown a steady growth, with key products including Petroleum Gas ($2.45B), Gas Turbines ($1.34B), and Crude Petroleum ($967M). During this period, exports have increased at an annualized rate of 9.48%, rising from $1.01B in 1995 to $11.7B in 2022.

Your Next Step with DocShipper

Unsure about import/export paperwork, customs, or transport between the US and Poland? Permit DocShipper to simplify your shipping process. With our seasoned expertise and comprehensive solutions, we illuminate mysterious shipping jargons, clear regulatory hurdles, and handle the logistics. Ready to make international trade feel like a neighborhood delivery? Contact us today for a seamless shipping experience.

Additional logistics services

From inventory management to distribution center operations, we've got you covered. Explore our holistic approach to handle your complete supply chain needs, supplementing shipping and customs processes with seamless end-to-end services.

Warehousing and storage

Finding the right storage partner isn't always easy! Storing goods, especially those needing temperature control, can present challenges. Your needs might range from wines that demand specific conditions, to electronics that need dust-free environments. The key is partnering with a reliable warehouse that understands your specific requirements.

Packaging and repackaging

If you're shipping goods from the US to Poland, remember, it's not just about moving boxes. The importance of proper packaging and repackaging can't be overstated. It safeguards your goods from gnarly weather, tough handling, and long journeys that freight can often experience. For instance, electronics demand different packaging compared to pottery art. That's where a trusty agent comes into play - managing your varied needs while ensuring compliance.

Cargo insurance

Cargo insurance, unlike fire insurance, is tailored to transport. It's the safety net you need when freight journeys aren't hitch-free, protecting you from damage or loss risks. Take an ocean freight scenario: rough seas can cause unexpected damage to your goods. This insurance covers such eventualities, making it a proactive step towards risk mitigation.

Supplier Management (Sourcing)

Ever sourced products from Asia or East Europe and faced language barriers or daunting procurement processes? With DocShipper, these worries evaporate. We expertly handle supplier search and the entire procurement process, mitigating any hiccups along the way. Experience hassle-free sourcing with us, a real game-changer!

Personal effects shipping

Moving from the US to Poland with mammoth or delicate items? No worries! Our Personal Effects Shipping service ensures professional handling and adaptability for your unique belongings. Picture this, your grand piano or precious art collection, safely transported across the Atlantic, hassle-free.

Quality Control

Quality control is key when shipping from the US to Poland. Pre-shipment inspection safeguards your business, ensuring products meet both market standards and customer expectations. Imagine shipping an electronics batch only to find out, upon arrival in Poland, that half don't work! Major upset avoided with quality control.

Product compliance services

Mastering product compliance can be tricky when shipping goods overseas. Our service eases the process, conducting comprehensive lab tests to secure essential certifications, ensuring your cargo meets all destination regulations. An invaluable tool, it saves businesses from costly hold-ups at customs. Need a real-world example? Imagine your electronics shipment held up because of certification issues! Dodge this hassle with our services.

FAQ | For 1st-time importers between US and Poland

What is the necessary paperwork during shipping between US and Poland?

When shipping from the US to Poland, there are several key documents you'll need. First off, you will require either a bill of lading for sea freight or an air waybill for air freight; rest assured, we at DocShipper will handle this for you directly. It's essential for you to furnish us with a packing list and the commercial invoice. Take note that additional documents may be necessary depending on the nature of your goods. If your cargo includes specific items, you might also need to provide Material Safety Data Sheets (MSDS) or certain certifications. It's always best to be prepared to avoid delays!

Do I need a customs broker while importing in Poland?

Yes, using a customs broker while importing goods into Poland is indeed beneficial due to the intricate process and key document requirements. Here at DocShipper, we routinely represent your cargo during the customs clearance process. As your chosen international freight forwarder, we efficiently tackle the complexities of import regulations on your behalf, ensuring you navigate all procedural requirements effectively. This ultimately saves you time and effort, allowing you to focus on your core business activities. Trust us to aid your smooth entry into the Polish market.

Can air freight be cheaper than sea freight between US and Poland?

The cost between air and sea freight for shipping goods from the US to Poland varies, influenced by factors such as route, weight, and volume of the cargo. Generally, if your shipment is less than 1.5 Cubic Meters or weighs less than 300 kg (660 lbs), air freight can emerge as a competitive option. We understand that each business has unique shipping needs, so at DocShipper, your dedicated account executive will evaluate these factors and help you select the most cost-effective and efficient transport method. Our primary goal is to provide you with a shipping solution that best fits your requirements.

Do I need to pay insurance while importing my goods to Poland?

While we don't require you to purchase insurance for your imports to Poland, we strongly advise it. Many unforeseen incidents may occur during transportation, such as damage, loss, or theft of goods. By insuring your cargo, you protect your investment and ensure you're covered financially if such incidents occur. At DocShipper, we provide comprehensive insurance options tailored to your specific needs, providing peace of mind throughout the shipping process.

What is the cheapest way to ship to Poland from US?

The cheapest way we recommend for shipping from the US to Poland is through ocean freight, particularly for larger shipments. While it takes longer than air freight—approximately 4-6 weeks—it's significantly more cost-effective. However, if you're shipping small volumes or time-critical items, air freight might be a more appropriate, albeit more expensive, option.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF largely depends on your relationship with your supplier. They might not be well-versed in logistics so it's advisable to let us, at DocShipper, manage the international freight and destination process. Predominantly, suppliers offer EXW, which means goods are acquired directly from their factory, or FOB that covers all local costs up to the origin terminal. Whatever your supplier's preferred term, we can assure you a seamless door-to-door service. Thus, regardless of the Incoterm you select, our team is ready to ensure a smooth, hassle-free logistics process for your business.

Goods have arrived at my port in Poland, how do I get them delivered to the final destination?

At DocShipper, if your goods are under CIF/CFR incoterms, you'll require a customs broker or a freight forwarder for clearance and final delivery. You'll also be responsible for import charges. Alternatively, opt for our DAP services where we handle everything for you. It's best to verify these details with your dedicated account executive for clarity.

Does your quotation include all cost?

Indeed, our quotation incorporates all costs apart from duties and taxes at your destination. However, your dedicated account executive is always available to provide an estimation of these fees for you. At DocShipper, transparency is key. We make every effort to prevent hidden charges, ensuring no surprising expenses for you.