Comprehending freight transportation between the US and France can feel like a daunting task, especially when you get caught up in understanding rates, transit times, and customs regulations. That's why we've crafted this guide, featuring extensive details on various shipping options including air, sea, road, and rail. Expect thorough information on customs clearance procedures, duties, taxes, and personalized advice to ensure a smooth shipping experience for your business. If the process still feels overwhelming, let DocShipper handle it for you! With our expertise in international freight forwarding, we'll morph every challenge into a success for your business.

Table of Contents

ToggleWhich are the different modes of transportation between US and France?

Are you planning to ship goods from the US to France? Imagine unfurling a giant map. The blue Atlantic Ocean between the countries can seem daunting but it's just a part of the journey. There's Air, Sea, Road, and Rail transport available, yet each option comes with its own pros and cons. It's kind of like choosing shoes for a trip - you wouldn't wear flip-flops for hiking, right? The same goes for picking the right transport mode. Ensuring a smooth journey isn't just about the 'how', but also about balancing costs, speed, reliability, and cargo type. All aboard for a deep dive into your best options!

How can DocShipper help?

Stressed out about shipping goods from the US to France?DocShipper is your ultimate solution! Our experts manage all logistics, from organizing transport to customs clearance. We simplify the complicated for you, keeping you stress-free. Ready to harness the expertise of our consultants? Call us for a free estimate in less than 24 hours!

DocShipper Tip: Sea freight might be the best solution for you if:

- You are shipping large volumes or bulky items, as sea freight offers the most space at a cost-effective rate.

- Your cargo doesn't have an urgent deadline, as sea freight typically has longer transit times compared to air or rail.

- Your shipping routes are between major ports, allowing you to leverage the extensive global network of sea shipping lanes.

Sea freight between US and France

The dynamic maritime line between the United States and France is a bustling highway of products, connecting significant industrial areas such as Los Angeles and Le Havre. Despite being the slowest route, ocean freight is the most cost-effective choice for heavy-duty, high-volume cargo. However, this knight's responsibilities are riddled with difficulties.

Many businesses hit sour notes as they try to perform their part in this global symphony, meeting problems and making blunders. Not to worry, there are solutions! Shippers can learn their craft by understanding best practices and requirements for this unique route, just as a musician masters their instrument through approaches specific to its design. Dive into this goldmine of practical ideas to avoid potential bottlenecks, smooth out wrinkles in your shipping route, and choreograph a more harmonic, efficient shipping process between the United States and France. It'll be like listening to music!

Main shipping ports in US

Port of Los Angeles

The Port of Los Angeles handled 2.9 million loaded imports and 1.9 million loaded exports in the first nine months of 2023. This represents a decrease of 21% and 13%, respectively, from the same period in 2022. The total number of TEUs handled by the port was 5.6 million, down 21% from the previous year.

Port of Long Beach

Situated adjacent to the Port of Los Angeles, the Port of Long Beach handled 1.72m TEUs in Q1 2023, down 30% from Q1 2022. This decline is due to the normalization of container trade, high inventory levels, lower consumer spending, and a resulting drop in exports from China.

Port Authority of New York and New Jersey

Serving the eastern seaboard, The Port of New York and New Jersey is the busiest in the nation for July 2023, processing a total of 725,479 TEUs. This is a 16.2% increase from June 2023. The port also moved 9.4% more cargo this July 2023 compared to July 2022.

The strong performance of the Port of New York and New Jersey is attributed to a number of factors, including the peak shipping season, the port's deep relationships with all links of the regional supply chain, and the current congestion at West Coast ports.

Port of Savannah

Nestled in the state of Georgia along the Atlantic Ocean, The Port of Savannah handled a total of 3,236,290 TEUs in 2023. This represents a 11.2% decrease from the 5,892,131 TEUs handled in 2022. The decline is attributed to a number of factors, including the normalization of container trade, high inventory levels among US importers, lower US consumer spending, and a resulting drop in exports from China.

Despite the decline, the Port of Savannah remains one of the busiest ports in the United States. The port is well-positioned to handle future growth, with a number of expansion projects underway.

Port of Houston

The Port of Houston is the largest Gulf Coast container port, handling 73% of U.S. Gulf Coast container traffic. The port is a major economic engine for the region, supporting 1.54 million jobs in Texas and 3.37 million jobs nationwide.

In 2023, the Port of Houston handled a total of 12,915,046 container imports, down 4% from the 13,445,979 container imports handled in 2022. The decline is attributed to a number of factors, including the normalization of container trade, high inventory levels among US importers, lower US consumer spending, and a resulting drop in exports from China.

Port of Seattle

Positioned in Washington State along the Pacific Northwest, the Port of Seattle handles a shipping volume of about 1.6 million TEU. Its trading partners primarily consist of China, Japan, South Korea, and Vietnam. As the gateway to Asia and Alaska, it's strategic for businesses related to seafood and timber, among other commodities. If your business seeks a reliable avenue to Asian-Pacific or Alaskan markets, the Port of Seattle's advantageous location and modern facilities can help streamline your shipping strategy.

Main shipping ports in France

Port of Le Havre

Location and Volume: The Port of Le Havre, located on the English Channel coast of France, is part of the HAROPA port complex, which also includes the ports of Rouen and Paris. In 2022, the Port of Le Havre handled 3.1 million TEUs, achieving relatively steady volumes compared with 2021 numbers. The port's liquid bulk throughput reached 40.1 million tonnes, up 5% from 2021, while dry bulk throughput reached 14.2 million tonnes, up 3% from 2021. Ro-ro traffic fell back by 11% to 265,000 vehicles.

Despite the challenging economic environment, the Port of Le Havre is consolidating its position as a major European port. The port's strong performance is attributed to its strategic location, its modern infrastructure, and its efficient operations.

Key Trading Partners and Strategic Importance: Key trading partners include China, the United States, and Korea. Its importance lies in its strategic location on the Seine estuary and its comprehensive port capabilities that offer various modes of transport.

Context for Businesses: If you're looking to expand your business reach into North France or the wider European region, the Port of Le Havre, with its strong global partnerships, could prove beneficial for your logistics.

Marseille Fos Port

Location and Volume: In 2022, the port of Marseille Fos had a 3% rise in maritime trade, totaling 1.53 million TEUs (twenty-foot equivalent units). This is the fastest rate of growth among the top 15 European ports. Container traffic was boosted by increased activity in the electronics, apparel, and food industries. Due to an increase in liquefied natural gas imports, liquid bulk traffic climbed by 5%.

In 2022, the Marseille Fos port invested 60 million euros in decarbonization, specifically in the development of an LNG bunkering station for ships. In 2023, the port intends to invest 80 million euros to continue its decarbonization initiatives.

Key Trading Partners and Strategic Importance: Major trading partners are Italy, Spain, and other Mediterranean countries. Its strategic location and Ferriol refinery make it the most significant oil port in the Mediterranean.

Context for Businesses: Given its proximity to Mediterranean markets and dominance in the oil trade, businesses in the energy sector or those looking to expand into Southern Europe can consider integrating Marseille Fos Port into their logistics strategy.

Port of Dunkirk

Location and Volume: The Port of Dunkirk, located in France, is one of the busiest ports in Europe. In 2022, the port handled a total of 745,000 TEUs, marking its 10th consecutive year of growth. The port's success is attributed to its strategic location, its modern infrastructure, and its efficient operations.

In 2023, the Port of Dunkirk is expected to continue its growth trajectory. The port is investing heavily in its infrastructure, including the expansion of its rail terminal and the construction of a new double-deck gangway. These investments will enable the port to handle even more cargo in the future.

The Port of Dunkirk is also committed to sustainability. The port is investing in a number of initiatives to reduce its environmental impact, such as the development of a CO2 hub and the production of low-carbon hydrogen. These initiatives will help the port to meet its goal of becoming a carbon-neutral port by 2050.

Key Trading Partners and Strategic Importance: It plays a crucial role in the trade with the UK, Germany, and Netherlands, and it's well-known for its large harbor and multiple terminals.

Context for Businesses: Whether you're shipping bulk goods, containers, or heavy lift cargo, you might consider the Port of Dunkirk due to its various facilities and close proximity to major European markets.

Port of Nantes Saint-Nazaire

Location and Volume: In 2023, the Port of Nantes Saint-Nazaire experienced a 3% increase in total cargo traffic, reaching 25.4 million tonnes, with diverse goods contributing the most at 40%, followed by strong growth in petroleum products and liquid bulk, establishing its pivotal role as the fifth-largest maritime port in France and a vital distribution center for goods in the western region of France and Northern Europe.

Key Trading Partners and Strategic Importance: Some significant trading partners include Spain and the UK, with the port holding strategic importance for local industries such as agri-food, aeronautics, and shipbuilding.

Context for Businesses: Diverse industries looking for cost-effective, multi-modal transport options may find the Port of Nantes Saint-Nazaire a suitable choice.

Port of Bordeaux

Location and Volume: In 2017, the Port of Bordeaux handled significant cargo traffic, totaling 7.265 million tonnes. Diverse goods constituted 43% of the traffic, with Europe being the primary origin and destination. As the sixth largest French maritime port, Bordeaux plays a vital role in the regional and European economies.

Key Trading Partners and Strategic Importance: Primary trading partners are African countries, predominantly in the western region. Its strategic importance is linked to wine export, as Bordeaux is globally recognized as a leading winemaking region.

Context for Businesses: If you're in the wine or similar industries, leveraging the Port of Bordeaux's trade routes could be effective for reaching markets in Western Africa and beyond.

Port of Rouen

Location and Volume: The Port of Rouen is located on the River Seine in northern France, is a major European port with over 12,600 meters of quayage. The port's main specialties are cereals, fertilizers, refined petroleum products, forestry and paper products, heavy parcels, and containers.

In 2023, the Port of Rouen is expected to handle a significant volume of TEUs. The port's modern infrastructure and efficient operations make it a well-positioned to handle the growing demand for containerized cargo.

The Port of Rouen is also committed to sustainability. The port is investing in a number of initiatives to reduce its environmental impact, such as the development of renewable energy sources and the electrification of its port equipment.These investments will help the Port of Rouen to maintain its position as a leading European port in the years to come.

Key Trading Partners and Strategic Importance: Major trading partners include the Netherland and Belgium. Known as one of the largest grain ports in Europe, it holds strategic importance for grain and agri-food businesses.

Context for Businesses: Businesses in the agri-food sector, particularly those involved with grains, could consider the Port of Rouen as a strategic point for reaching European markets.

Should I choose FCL or LCL when shipping between US and France?

Shipping products between the United States and France? Knowing whether to go with a full container load (FCL) or a consolidation (LCL) is critical; the decision you make will have a big impact on the cost, delivery time, and general smoothness of your shipping procedure. Let's get into the intricacies of these sea freight choices, describing the distinctions so you can make an informed decision geared to your company's specific shipping requirements. Following that, we will debunk FCL and LCL, making international shipping a little easier. Prepare to confidently control your shipping plan.

LCL: Less than Container Load

Definition: LCL (Less than Container Load) shipping refers to a method where several businesses share a single container to transport their goods. Each pays only for the space their freight uses.

When to Use: LCL is ideal when your cargo is less than 13/14/15 CBM. This option provides flexibility, especially for businesses that don't have enough goods to fill an entire container, allowing for cost savings.

Example: Suppose you're a boutique furniture store importing unique pieces from France. Your inventory is relatively small, say 10 CBM. Instead of renting a whole container, which might be half-empty, you opt for LCL shipment. That way, you only pay for the actual space your furniture occupies in the shared container, making it a cost-effective choice.

Cost Implications: While LCL freight offers affordability due to shared costs, it may involve additional handling fees at the ports for consolidating and deconsolidating the cargo. However, these costs are often substantially lower than booking a full container for a small volume of goods. A detailed LCL shipping quote can provide a precise estimate.

FCL: Full Container Load

Definition: FCL, or Full Container Load, is a type of ocean freight transport where a whole container is exclusively dedicated to a single shipment.

When to Use: If your cargo exceeds around 13 to 15 cubic meters (CBM), an FCL shipment might be the right choice for you. This is because FCL shipping is generally more cost-effective for larger volumes and the sealed container from origin to destination ensures the safety and integrity of your goods.

Example: Imagine you're a furniture manufacturer exporting 65 CBM of sofas to France. Choosing FCL shipping allows you to reserve a 40'ft container solely for your product, ensuring the goods are securely sealed and undisturbed during the journey.

Cost Implications: It's also important to note that an FCL shipping quote typically covers the rental and movement of a 20'ft or 40'ft container. While the initial cost might seem higher than LCL (Less-than Container Load) shipping, the cost per unit can be significantly lower when shipping high volumes, thus more economical overall.

Keep in mind, with FCL, the entire container must be filled for maximum efficiency regardless of weight. FCL offers more control over your freight but a careful cost-benefit analysis is crucial before deciding on it.

Unlock hassle-free shipping

Shipping goods between the US and France can be a maze. But, don't worry! With DocShipper by your side, we aim to make the journey hassle-free for you. Our ocean freight professionals are experts in determining whether consolidation or full container shipments are optimal, considering factors such as volume, weight, nature of goods, and timeline. Take the guessing game out of your logistics process, contact our experts today and get a free shipping estimation tailored to your needs!

How long does sea freight take between US and France?

On average, sea freight shipments between the US and France usually take about 22-23 days, depending on a wide variety of factors such as the specific ports used, the weight of the shipment, and the nature of the goods. For a tailored quote that takes all these details into account, it’s highly recommended to connect with a trusted freight forwarder, such as DocShipper.

Relating to transit times from major ports in both countries, please see the given table below:

| US Port | France Port | Average Shipping Time (days) |

| Port of Los Angeles | Port of Le Havre | 20-25 |

| Port of Houston | Port of Marseille | 22-27 |

| Port of New York | Port of Dunkirk | 23-28 |

| Port of Charleston | Port of Fos | 24-29 |

*Bear in mind, these times are averages and can vary depending on specific circumstances.

How much does it cost to ship a container between US and France?

In the realm of global trade, pinpointing an exact shipping cost between the US and France is a tricky task. Ocean freight rates per CBM offer a vast price range, reflecting variables like loading points, destinations, carriers, the type of goods, and global market fluctuations. Truth is, only a seasoned shipping professional can sift this complexity to estimate a cost tailored to your unique scenario. Rest assured, our shipping specialists are equipped to do just that, delivering meticulously customized quotes down to the last cent for your unique shipping scenario. Because no two shipments are alike - we invigorate each quote with this understanding.

Special transportation services

Out of Gauge (OOG) Container

Definition: The Out of Gauge (OOG) container, also referred to as an OOG cargo, is a specially designed shipping container that exceeds the standard measurements, tailored to accommodate oversized and odd-shaped cargo.

Suitable for: This shipping option is ideal for oversized goods that don’t fit in regular containers due to their height, length, or width.

Examples: Large machinery parts, structural steel equipment, and industrial machinery are examples of goods that typically need an OOG container for shipping.

Why it might be the best choice for you: If your goods are not standard size and have dimensions exceeding regular shipping containers, OOG containers provide perfect solution, ensuring safety and security during transportation.

Break Bulk

Definition: Break bulk shipping is a method where individual cargo or goods are loaded onto a ship without any containerization. Each piece of cargo is loaded, shipped, and unloaded separately.

Suitable for: Best for shipments that are too large or heavy to be loaded into a single container. It's also beneficial for cargo that needs to be loaded and unloaded at multiple locations.

Examples: Examples of break bulk goods include construction equipment, heavy machinery, timber, or steel beams.

Why it might be the best choice for you: If your cargo is too heavy or bulky for traditional shipping methods, implementing break bulk can help ensure your items are moved effectively.

Dry Bulk

Definition: Dry bulk transportation refers to the shipping of unpackaged and non-liquid commodities in large quantities.

Suitable for: Ideal for loose cargo load like grains, coal, metal ores, cement, and other similar goods.

Examples: Common goods shipped using dry bulk include sand, fertilizers, and agricultural commodities like wheat and corn.

Why it might be the best choice for you: If your business involves transporting loose cargo in massive quantities, dry bulk shipping is convenient, cost-effective, and ensures seamless transportation from source to destination.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off, often referred to as a ro-ro vessel, is a ship designed to carry wheeled cargos, such as trucks, cars, trailers, that are driven on and off the ship on their own wheels.

Suitable for: Best for vehicles and easily mobile equipment that needs to be shipped in a functional state and fast offloading post-arrival.

Examples: Automobiles, trailers, railroad cars, and bulldozers are typically transported this way.

Why it might be the best choice for you: If your cargo includes items that can be driven on and off the ship, ro-ro services can provide you with a swift and efficient shipping solution.

Reefer Containers

Definition: Reefer containers, or refrigerated containers, control the temperature to transport temperature-sensitive cargo.

Suitable for: Ideal for perishable goods such as vegetables, fruits, dairy products, and pharmaceutical products that require specific temperature settings during transit.

Examples: Meat, wine, flowers, and medical supplies are common goods shipped in reefer containers.

Why it might be the best choice for you: If your business deals with perishable or temperature-controlled goods, reefer containers ensure they are transported at the right temperature, maintaining their quality and freshness.

At DocShipper, we are proud to offer all these varied shipping options and more. We invite you to contact us for a fast, free shipping quote in less than 24 hours.

DocShipper Tip: Air freight might be the best solution for you if:

- You are in a hurry or have a strict deadline requirement, as air freight offers the fastest transit times.

- Your cargo is less than 2 CBM (Cubic Meter), making it more suitable for smaller shipments.

- Your shipment needs to reach a destination that is not easily accessible by sea or rail, allowing you to tap into the extensive network of global airports.

Air freight between US and France

For businesses needing speed and reliability, shipping goods via air freight from the US to France is a proven winner. Imagine you're a tech company with delicate equipment or a fashion retailer with a hot new line. You don't have mountains of merchandise, but what you do have is high-value and time-sensitive. That's where air freight shines.

However, let's turn a page. Like a careful baker who must get all the ingredients and quantities spot on, many shippers often stumble on factors that influence cost. From correctly estimating the weight of goods to not leveraging best practices, these overlooked details can inflate your shipping costs, like adding too much yeast to our metaphorical dough. Let's dive in and address these common missteps.

Air Cargo vs Express Air Freight: How should I ship?

Ready to send a shipment from the US to France and tangled up in options? Don't fret! Let's simplify: Think of Air Cargo as a group cab ride where your goods share space in a common airline. In contrast, Express Air Freight is like booking a private jet for your goods, whisking them away on a dedicated plane. Both have their perks - read on to decipher what suits your business best.

Should I choose Air Cargo between US and France?

When shipping from the US to France, air cargo, through carriers like American Airlines or Air France, may suit your budget better. Though this means longer transit times due to carriers' fixed schedules, the reliability and cost-effectiveness are enticing. Notably, beginning from 100-150 kg (220-330 lbs) of cargo, air cargo becomes a more attractive option. Make an informed decision considering your budget and time constraints.

Should I choose Express Air Freight between US and France?

Choosing Express Air Freight, a service provided by dedicated cargo planes without passengers, could be an advantageous option for your small shipments under 1 Cubic Meter or below 100/150 kg (220/330 lbs). It's perfect for ensuring speedy, reliable delivery. You've likely heard of major international courier firms like FedEx, UPS , or DHL. They specialize in this type of air freight, providing efficient tracking systems and a network of global warehouses. So if speed and reliability are crucial for your US-France shipments, consider Express Air Freight.

Main international airports in US

John F Kennedy International Airport

Cargo Volume: Over 2.3 million tonnes of cargo in 2020.

Key Trading Partners: Primarily Europe, China, Japan, India, and Brazil.

Strategic Importance: Located in New York, it plays a critical role in connecting the East Coast of the US with the rest of the world.

Notable Features: It has sizable freight terminals, cold storage, and special facilities for perishables.

For Your Business: JFK presents a massive market reach due to its geographic location and significant number of international connections. This makes it efficient for importing or exporting goods, especially if your business involves high-value, time-sensitive goods.

Los Angeles International Airport

Cargo Volume: Over 2.2 million tonnes in 2019.

Key Trading Partners: Primarily Asia (China, Japan, South Korea, Taiwan), as well as Europe, Australia, and New Zealand.

Strategic Importance: A vital link in the Pacific Rim, LAX connects the US to Asia and Australia, making it a crucial hub for trans-Pacific trade.

Notable Features: It has extensive cargo handling services and capabilities, including massive shipment capacities and special cargo handling.

For Your Business: LAX is the preferred airport for businesses seeking a fast and reliable link with Asian markets, easing the logistics of trans-Pacific trade.

Miami International Airport

Cargo Volume: Handled around 2.3 million tonnes of freight in 2020.

Key Trading Partners: Latin America and the Caribbean primarily, followed by Europe and Asia.

Strategic Importance: Serving as a gateway to Latin America, this airport is a major hub for businesses engaged in trade with these regions.

Notable Features: It has one of the largest concentrations of international airlines and the US’s only 24/7 perishable cargo facility.

For Your Business: If you’re dealing with perishables or your trade primarily revolves around Latin America and the Caribbean, Miami International Airport’s constant operations and comprehensive specialist facilities could be invaluable.

Chicago O’Hare International Airport

Cargo Volume: Handled over 1.8 million tonnes of air cargo in 2019.

Key Trading Partners: Europe and Asia, with China being a significant partner for both imports and exports.

Strategic Importance: Located in the heartland of America, the airport conveniently links both the East and West coasts.

Notable Features: It's one of the busiest cargo airports in the world and offers direct flights to over 200 cities.

For Your Business: The airport’s central location provides a strategic advantage to businesses with nationwide distribution needs and those dealing with European and Asian markets.

Memphis International Airport

Cargo Volume: Over 2.6 million tonnes of cargo in 2020.

Key Trading Partners: Primarily North America, Asia, and Europe.

Strategic Importance: It is the global hub for FedEx and notably deals with a large volume of e-commerce traffic.

Notable Features: It's known as the busiest cargo airport in the world by volume, majorly due to the presence of FedEx's super hub.

For Your Business: If you're involved in e-commerce or looking for quick domestic distribution, leveraging Memphis International Airport’s considerable capacity, particularly its overnight delivery, could give your logistics strategy an edge.

Main international airports in France

Paris Charles de Gaulle Airport

Cargo Volume: Paris CDG handles over 2 million tons of cargo annually.

Key Trading Partners: Major trade partners include the USA, China, Germany, and the UAE.

Strategic Importance: Paris CDG is the second-largest cargo airport in Europe and the largest in France, acting as a hub for global trade.

Notable Features: The airport operates a dedicated cargo terminal and offers direct trade links to more than 300 destinations.

For Your Business: The extensive connections and capacity mean your business can efficiently distribute products globally and access emerging markets.

Lyon-Saint Exupéry Airport

Cargo Volume: Lyon-Saint Exupéry Airport handles over 60,000 tons of cargo annually.

Key Trading Partners: Significant trading partners include Germany, Spain, Italy, and Switzerland.

Strategic Importance: The airport acts as a strategic logistic point in Southern France, connecting the region to major European economic and trading hubs.

Notable Features: The airport boasts excellent road and rail links, enabling easy onward transport.

For Your Business: Your business can utilize these exceptional transport links for swift, smooth operations in Southern France and neighboring countries.

Marseille Provence Airport

Cargo Volume: Marseille Provence Airport handles about 80,000 tons of cargo every year.

Key Trading Partners: Top trading partners include Algeria, Germany, the UK, and Tunisia.

Strategic Importance: The airport is a major gateway to the Mediterranean and North Africa, acting as a strategic logistic point for these regions.

Notable Features: The airport features specialized cargo infrastructure and has streamlined customs procedures.

For Your Business: If your business trades with North Africa, using Marseille Provence Airport could significantly simplify your logistics and reduce transit times.

Le Havre Octeville Airport

Cargo Volume: The airport handles several thousand tons of cargo annually.

Key Trading Partners: Exports majorly from Le Havre Octeville cater to the European market.

Strategic Importance: It is a secondary hub which works in combination with the nearby Le Havre maritime port, one of the busiest ports in Europe.

Notable Features: The airport's proximity to the Le Havre port offers a unique air-sea freight advantage.

For Your Business: If your business employs sea freight and air freight in tandem, utilizing Le Havre Octeville could increase the efficiency of your operations.

Toulouse Blagnac Airport

Cargo Volume: Toulouse Blagnac Airport processes over 60,000 tons of cargo per year.

Key Trading Partners: Key trading partners include Germany, the UK, Spain, and Italy.

Strategic Importance: It is an important hub serving a dynamic economic region, and additionally, it is home to Airbus headquarters.

Notable Features: The airport includes a dedicated freight terminal and special facilities for the aerospace industry.

For Your Business: If your business is involved in aerospace or operates within Southwest France, Toulouse Blagnac Airport's specialized facilities and connectivity could offer you a competitive advantage.

How long does air freight take between US and France?

On average, air freight shipping from the US to France takes approximately 1-3 days. However, transit times can fluctuate based on factors such as specific departure and destination airports, the weight of the shipment, and the type of goods being transported. If you're seeking pinpoint accuracy for your delivery times, engaging a freight forwarding specialist like DocShipper will ensure you have a precise schedule tailored to meet your unique shipping needs.

How much does it cost to ship a parcel between US and France with air freight?

Air freight rates between the US and France may fluctuate, however on an average, it may cost around $3-$8 per kilogram. Providing an exact quote is a complex task as each shipment is unique, with factors such as distance, shipment dimensions, weight, and the nature of goods influencing the final cost. Despite this, you can rest assured that our dedicated team will secure optimal shipping rates, as our quotes are tailored on a case-by-case basis. For us, each delivery is special, as is every client. Contact us and receive a free quote tailored to your needs within 24 hours.

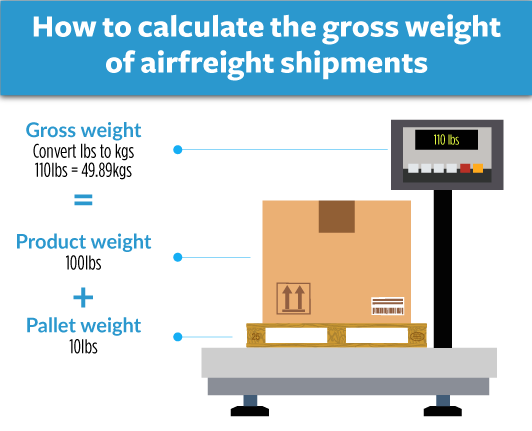

What is the difference between volumetric and gross weight?

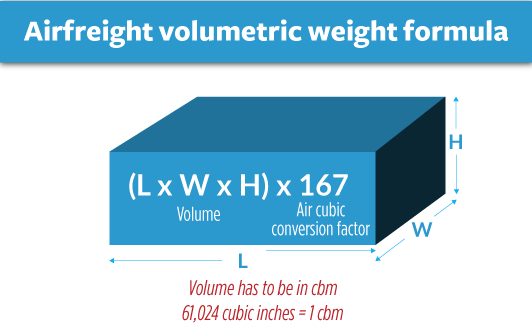

Gross weight refers to the actual weight of your shipment, including the goods and their packaging, measured in kilograms (kg). Volumetric weight, on the other hand, reflects the amount of space your shipment occupies in the aircraft, not just its actual weight.

Sure, let's dive into how each is calculated. In the air cargo industry, volumetric weight is determined by multiplying the length, width, and height of each package in centimeters (cm), then dividing the total by 6000. So if you have a box that measures 50cm x 40cm x 30cm, your calculation would be: (50cm x 40cm x 30cm) / 6000 = 10kg. This box would have a volumetric weight of 10kg, which converts to around 22 lbs.

However, Express Air Freight services use a different divisor; they divide the total by 5000 instead. Using the same measurements for your box, the calculation would be: (50cm x 40cm x 30cm) / 5000 = 12kg, giving a volumetric weight of 12kg, converted to about 26.4 lbs.

For gross weight, it's simply the physical weight of your shipment, as it is, on a scale. So if our box weighed 15kg on a scale, that's about 33 lbs, that's your gross weight.

These calculations matter because freight charges are based on whichever is higher between the gross and volumetric weight. It ensures shippers pay a fair price for the space their goods occupy within the aircraft, not just their weight.

DocShipper tip: Door to Door might be the best solution for you if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You prefer a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want to minimize the handling of your goods, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between US and France

International door-to-door shipping bridges the gap from your American doorstep all the way to the heart of France. A seamless service, it takes your cargo directly to where it needs to go, bypassing all the logistics hassle in between. Let's explore how this efficient service can offer you convenience, security, and time-saving benefits. Ready to unpack the details? Let's dive in!

Overview – Door to Door

Experience the simplicity of our most sought-after service: Door to Door shipping between the US and France. Why stress over the complexities of shipping when you could have it all - customs clearance, transport organization, and administrative procedures, neatly packaged in one place? This all-inclusive process, while slightly pricier, shields you from logistical nightmares. However, service delays could occur due to customs inspections. With DocShipper, sit back and let your shipping worries sail away!

Why should I use a Door to Door service between US and France?

Cracking the code of international shipping is easier than deciphering French wines! Simplify your logistics with Door-to-Door service from the US to France, and here are five reasons why:

- Stress-Free Logistics: Leave the hassle to us. From initial pickup to final delivery, we handle every step, allowing you to focus on your business without drowning in paperwork or struggling with confusing logistics.

- Timely Deliveries: Got urgent shipments? No problem! Our robust network ensures your goods are delivered on time. Say goodbye to delays and hello to dependability!

- Specialized Care: Whether shipping French antiques or American tech, intricate cargo needs extra caution. Door-to-Door service ensures sensitive goods are handled with precision and care, minimizing the risks of damage or loss.

- End-to-End Coverage: Our job doesn't end at the seaport or airport. We oversee trucking until your goods are securely delivered to the final destination. Consider us the reliable chain that keeps your cargo moving smoothly.

- Ultimate Convenience: Shipping overseas can be as easy as buying a croissant! A fully integrated service means you're buying peace of mind, knowing your goods are taken care of from start to finish.

So, why not sit back, enjoy a good espresso, and let Door-to-Door service handle the hard shipping work for you?

DocShipper – Door to Door specialist between US and France

Relieve your shipping worries with DocShipper's seamless door-to-door service between the US and France. Our skilled team manages everything from packing to customs, with every shipping method at your disposal. Experience stress-free shipping as your dedicated Account Executive takes on all the heavy lifting! Submit an inquiry today and receive a free estimate in less than 24 hours, or speak directly with our consultants for immediate assistance. Let DocShipper handle A to Z, while you focus on what matters most.

Customs clearance in France for goods imported from US

Customs clearance triggers visions of complex paperwork and unexpected costs. It's the critical bridge between the US and France, transporting goods while navigating duties, taxes, quotas, and licenses. Slip up, and you risk goods languishing in French customs. Unforeseen fees can also add up, raining on your logistics parade. But fear not! We'll break down this process, providing you a roadmap to hurdle those bureaucratic barriers. Plus, we at DocShipper stand ready to assist, regardless of your goods' nature or origin. Share your goods' origin, value, and HS Code with us and we'll help you budget your project effectively. Dive into the sections below for concrete guidance on smooth, hassle-free customs clearance in France.

How to calculate duties & taxes when importing from US to France?

When you're importing goods from the US to France, it's crucial to understand how to estimate the applicable duties and taxes. Here lies the essence of a savvy importer. Duties, invariably, get determined by an amalgamation of factors like the country of origin or production, the Harmonized System (HS) code of your product, its customs value, and the applicable tariff rate. Adding to this, other additional fees and taxes might apply based on the product or goods you're importing.

Your first step in this calculation process is to pinpoint the country where the goods were manufactured or produced. This is paramount as it sets the basis for further calculations and procedures on the way to successful importing. Indeed, a misstep or miscalculation at this stage can have a domino effect on subsequent processes and your final import costs. So, plan wisely, start correctly!

Step 1 - Identify the Country of Origin

Understanding your goods' country of origin, in this case the US, is a cornerstone in estimating duties and taxes for four key reasons. First, it defines the applicable trade agreements. Between the US and France, the Transatlantic Trade and Investment Partnership (TTIP) plays a crucial role in minimizing duty rates.

Second, it determines import restrictions. For instance, certain agricultural goods from the US face strict regulations due to European Union standards.

Third, it influences the calculation of Value Added Tax (VAT), which is based on the total cost, insurance, and freight (CIF) value of your shipment. This includes the cost of the goods, shipment, and any duty applicable.

Lastly, it's a fundamental part of obtaining the Harmonized System (HS) code; an internationally standardized system of names and numbers for classifying traded products. This code directly impacts the amount of duty you'll owe.

So, first pinpoint your good's country of origin. This information empowers you to estimate your import duties and taxes more accurately, saving you from potential surprises down the line.

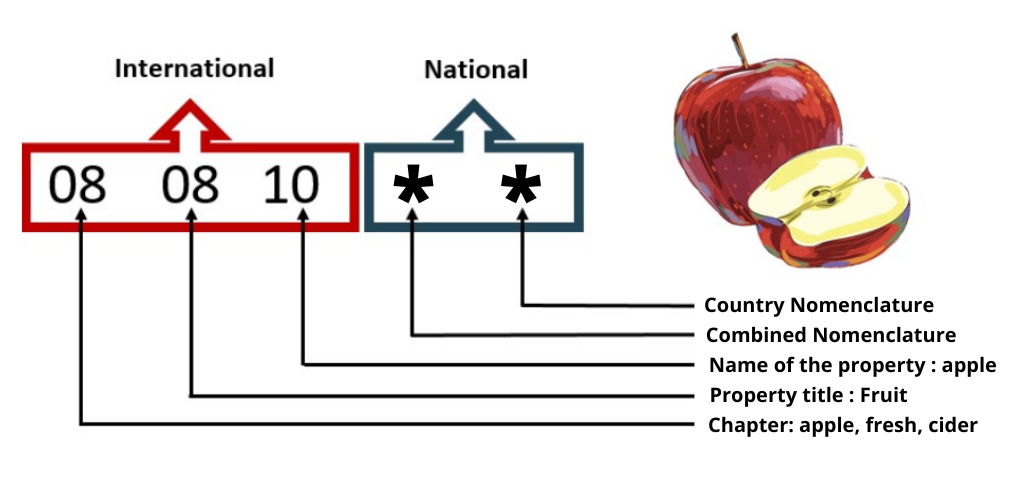

Step 2 - Find the HS Code of your product

The Harmonized System (HS) Code is a standardized system of names and numerical identifiers used by customs authorities worldwide to classify traded products. It facilitates the engagement in international trade by ensuring uniformity in the classification of goods. Now, if you're wondering how to find the HS Code for your product, the information is often readily available from your supplier, who is generally well-versed with import regulations and codes for their products.

However, if this information is not readily available from your supplier, fear not. Here's an easy step-by-step process for you to follow:

- Begin by accessing the Harmonized Tariff Schedule tool.

- Enter the name of your product in the search bar.

- Next, review the Heading/Subheading column to find the HS code for your product.

A word of caution - it's critically important to ensure accuracy when determining your HS Code. Inaccuracies could potentially lead to unforeseen delays and even fines, so it's best to be vigilant during this process.

In case you find the codes a bit confusing, don't worry. Here's an infographic showing you how to read an HS code. Following this guide will make it a lot simpler to find the correct code for your products.

Step 3 - Calculate the Customs Value

Knowing the customs value of your goods is vital, because it impacts how much you'll need to pay in duties when importing into France from the U.S. Think of customs value as the total landed cost, somewhat different from the mere product value. It's calculated using the CIF (Cost, Insurance, Freight) method which includes the price of the goods, cost of international shipping and insurance.

In this case, if the price of your product is $100, shipping charges are $20, and insurance is $10, your customs value is $130. Completely understanding this calculation is key to maintain the budget and keep your business flowing efficiently. In the coming sections, we'll dive deeper into applying this knowledge to accurately estimate your customs duties.

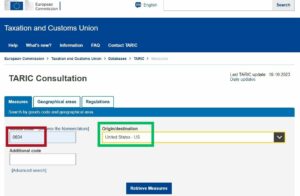

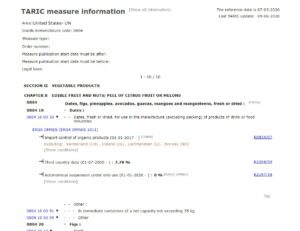

Step 4 - Figure out the applicable Import Tariff

An import tariff is a type of tax that a country imposes on foreign goods to protect domestic industries, regulate goods flow, and generate revenue. When importing goods from the US to France, which is part of the European Union, the relevant tariff information can be found by utilizing the TARIC System - European Customs.

Simply input the earlier identified HS code and US as the country of origin. Here, you can fetch details about duties and taxes applicable to your product. For instance, let's say we're importing leather jackets, whose HS code is 4203.10. This tool allows you to locate the associated tariff rate - let's assume it's 6.5%.

Now, to calculate the import duties, consider the Cost, Freight, and Insurance (CIF) value of your shipment. Suppose this totals to $5000. Your import duty would be 6.5% of $5000, which equals $325.

Take note that import tariffs can impact the final cost of your goods, and planning accordingly can help you mitigate any financial surprises. Understanding how to calculate these tariffs makes for smoother, more predictable transactions.

Please carry out the tasks as what we implied above, fill out the blanks with:

- Your HS Code

- Origin of goods

Step 5 - Consider other Import Duties and Taxes

Upon satisfying standard tariff rates, it's crucial to be aware of additional import duties that can vary based on the country of origin and product type. For instance, you might face excise duties on certain goods like alcohol or tobacco, or anti-dumping taxes designed to protect domestic industry from unfairly low-cost imports.

A vital aspect to consider is also the Value-Added Tax (VAT). In France, the standard VAT rate is 20%, but it can drop to 5.5% or even 2.1% for some goods and services. The calculation for VAT is based on the combined value of your goods, the shipping cost, and any custom duties. For example, if goods cost $10,000, shipping fee is $1,000 and custom duty comes to $700, then the VAT will be calculated as 20% of ($10,000+$1,000+$700)=$2,340. Remember, this is just an illustrative example; actual rates can vary.

While dealing with import duties can feel complex, understanding these additional costs helps you anticipate and manage your shipping expenses more efficiently. Be sure to consult with a customs expert or your freight forwarder to review your specific scenario and confirm all applicable fees.

Step 6 - Calculate the Customs Duties

As you navigate towards step 6 of Customs clearance in France for goods imported from US, it's time to compute your Customs Duties. The calculation hinges on specifics like the Customs Value (value of your goods), Value Added Tax (VAT), Anti-Dumping Taxes, and Excise Duty.

Consider these real-world examples:

- With only Customs Duties: If your goods' worth is $10,000, and the customs duty rate is 5%, you'll pay $500 in customs duties.

- With Customs Duties and VAT: Let's say your goods cost $6000, the customs duty rate is 5%, and French VAT is at 20%. Your customs duties would be $300, and VAT would be $(6000+300)20% = $1260. Total = $1560.

- With Customs Duties, VAT, Anti-Dumping Taxes, and Excise Duty: If the cost of your goods is $4000, with a 5% customs duty, 20% VAT, 12% anti-dumping tax, and a 2% excise duty. Here, your customs duty is $200, anti-dumping tax is $(4000+200)12% = $504, excise duty is $(4000+200+504)2% = $94.08, and VAT is $(4000+200+504+94.08)20% = $959.62. Total = $1757.70.

Eager to avoid excess charges and understand duties better? DocShipper's customs clearance services can help. We ensure a seamless clearance process worldwide. Contact us for your free quote within 24 hours.

Does DocShipper charge customs fees?

While DocShipper acts as your trusted customs broker in the US and France, remember it doesn't charge any customs duties. These are separate from our customs clearance fees and directly go to your government. We prioritize transparency: you'll receive documents authenticating from your customs office that you've paid only what's required. It's similar to how a restaurant bill works—service charge is to the restaurant, while that VAT goes to the government—but here the 'menu' is your international shipment!

Contact Details for Customs Authorities

France Customs

Official name: French Customs Administration

Official website: http://www.douane.gouv.fr/

Required documents for customs clearance

Overwhelmed by cryptic customs paperwork? We're demystifying key documents - Bill of Lading, Packing List, Certificate of Origin, and conformity docs (like CE standard). Avoid surprises and delays - we illuminate what's needed for a smooth clearance process.

Bill of Lading

When your goods set sail from US shores to France, the Bill of Lading is your lifeline. Think of it as a handover note – it marks the moment your shipment's ownership officially transitions. Opt for an electronic, or 'telex', release to accelerate this process and keep your supply chain humming. But remember, if your merchandise took flight, come prepared with an Air Waybill (AWB) instead. It works just like a Bill of Lading but for air cargo. Don't overlook these critical documents - they're your golden tickets for a slick customs clearance. Using them right ensures your goods breeze their way through French port authorities without a hassle. So, keep on top of your bills and waybills; they're the first step in conquering transatlantic trade.

Packing List

When you're shipping goods from the US to France, preparing a detailed Packing List is essential. This document outlines exactly what goods are in the shipment, including descriptions, quantities, and weights. So, imagine you're an exporter of wine; your Packing List would record the exact number of cases and their total weight. It's your responsibility to ensure the accuracy of this list. Why? Customs officers rely on it to efficiently clear your goods, whether you've chosen air or sea freight. If discrepancies arise, your shipment can be delayed, which might mean your French customers waiting longer for that Californian Merlot. Keep it precise and your goods will flow smoothly between the US and France.

Commercial Invoice

Shipping goods from the US to France? The Commercial Invoice will be your lifeline. This document details your shipment from product descriptions to HS codes. But remember, it's not just a rundown; it’s your declaration to Customs about the goods you're importing or exporting, directly influencing clearance time and duty calculation. The secret weapon? Alignment. Each item on your Commercial Invoice needs to match its counterpart on packing lists or bills of lading. Incorrect or vague descriptions can lead to delays or fines. Here's a pro tip: specify origin details if your product qualifies for preferential treatment under the EU-US trade agreement. It could lead to reduced or zero duties. Keep it clear, keep it accurate, and you'll keep your shipment moving.

Certificate of Origin

Dealing with customs when shipping from the US to France? The Certificate of Origin can make your life easier. Think of it as a 'birth certificate' for your goods, detailing their country of manufacture. Why does it matter? Because it could help you snag preferential customs duty rates – and who doesn't love cost-saving? Let's take a practical example. Imagine you're shipping craft furniture made in Alabama to a chic Parisian boutique. By accurately mentioning 'USA' as the country of manufacture, your unique American-made pieces could benefit from favorable trade agreements, tactically reducing your customs duties. Remember though, errors can lead to costly delays, so precision is paramount. It's a simple document that can pack a powerful punch in your freight forwarding journey.

Certificate of Conformity (CE standard)

As you prepare to ship goods between the US and France, note this: the Certificate of Conformity, or the CE mark, plays a pivotal role. This certificate shows that your product ticks all the boxes for European health, safety, and environmental standards- it isn’t your average quality assurance. Unlike the American UL standards, the CE mark is universally recognized in the European market, including France. Before arranging shipment, ensure your merchandise meets CE standards, saving you time, and money in denied entries or returns. Remember, compliance isn't just bureaucracy, it's a ticket to seamless shipping. Act by cross-referencing your products with the EU’s CE product-groups list, and arranging for the appropriate tests or inspections if required.

Your EORI number (Economic Operator Registration Identification)

If your business is shipping goods from the US to France, you'll need an EORI Number. Why? Because the EORI (Economic Operator Registration Identification) is a key player in the customs clearance process within the EU. Think of it as your business's unique identifier - a sort of passport for your goods. It helps track imports and exports within not just France, but the entire EU, making customs procedures smoother. Registering for an EORI number might seem like another task on your to-do list, but it's well worth the effort. It's an essential step that opens the door to seamless trading with France and other EU nations. So be sure to add this to your checklist when planning your next shipment.

Get Started with DocShipper

Navigating US-France customs clearance can be tricky. Let DocShipper handle the legal jargon and paperwork for you. From documentation to customs brokerage, we ensure a hassle-free shipping experience. Contact us for a free quote – we promise a 24-hour turnaround. Turn your international shipping worries into a smooth voyage with DocShipper.

Prohibited and Restricted items when importing into France

Understanding which items are restricted or outright banned is crucial when shipping to France. After all, it's frustrating when your shipment gets stuck at customs due to unawareness. This guide will help demystify the process, giving you a clear picture of prohibited and restricted items, avoiding those hold-ups.

Restricted Products

- Firearms and Ammunition: Before you go planning to export firearms or ammunition to France, remember that you'll need an authorization from the French Ministry of Interior. You can apply for the authorization on their official website French Ministry of Interior.

- Drugs and Pharmaceuticals: In your pursuit to ship drugs or pharmaceuticals to France, you're mandated to obtain an Import Authorization released by the French Agency for the Safety of Health Products (ANSM). Peruse their site for the necessary information and guidance ANSM.

- Animals and Animal Products: Shipping animals or animal products to France requires your due diligence in getting an import permit from the Ministry of Agriculture, Agrifood, and Forestry. Here is their website Ministry of Agriculture, Agrifood, and Forestry.

- Plants and Plant Products: To get your plants or plant products to France, you have to go through the process of securing a Plant Health Certificate from the Ministry of Agriculture, Agrifood, and Forestry. It's a necessary step, and you can find all the details here Ministry of Agriculture, Agrifood, and Forestry.

- Radioactive Materials: Whoa there! If you are planning to export radioactive materials, you definitely need to get an authorization from the French Nuclear Safety Authority. Make sure to print and fill out all necessary documents found here French Nuclear Safety Authority.

- Cultural Goods: For your cultural goods shipment, don't forget to knock on the doors of the Ministry of Culture. You will require an export permit from them. You can check out their site to get started Ministry of Culture.

- Weapons and War Materials: In case you're considering the export of weapons and war materials, hold up! France requires you to secure an authorization from the General Secretariat for Defense and National Security. Check this site out General Secretariat for Defense and National Security.

Make sure to explore every requirement, not missing out on any detail, so you're all clear and good to go!

Prohibited products

- Narcotic substances and drugs, except for medical use and if accompanied by relevant documentation

- Counterfeit goods and counterfeit currency

- Indecent or obscene print materials, films, and other forms of media

- Goods bearing false indications of origin

- Illicit or obscene publications and media

- Weapons and ammunition, unless special permission has been granted

- Objects classified as national treasures in France

- Flick knives and other similar weapons

- Certain animal species and products, particularly endangered species as defined by the CITES agreement

- Plants, particularly endangered species, or species without a phytosanitary certificate

- Certain types of foodstuff, including meat and milk products from outside the EU

- All products containing the biocide dimethylfumarate (DMF)

- Wild fauna and flora (as per the Washington Convention)

- Radioactive materials

- Asbestos.

Please note that this is not a complete list and it is recommended to check with French customs for detailed and updated information on prohibitions, as they may vary or change over time.

Are there any trade agreements between US and France

While there isn't a specific Free Trade Agreement, significant trade arrangements exist between the US and France, both being WTO members. Currently, negotiations for the Transatlantic Trade and Investment Partnership (TTIP) are underway, holding the promise of reduced tariffs and expanded market access.

In 2018, bilateral trade between the nations reached $79 billion, with key sectors like machines and transportation equipment driving economic exchanges. French direct investment in the US amounted to $302 billion, bolstering American manufacturing and generating 47,500 jobs. Similarly, the US invests significantly in France, contributing to diverse sectors. This partnership extends to research and development, particularly in fields like artificial intelligence and cybersecurity, fostering innovation and patent creation. With job creation, regional development, and ongoing negotiations shaping their collaboration, the relationship between France and the US continues to offer promising opportunities for businesses on both sides. Stay tuned for updates on these evolving trade prospects.

US - France trade and economic relationship

Known for its long-established bond, the US-France trade and economic relationship boasts an intricate tapestry of historical milestones. It hailed its origins in the late 18th century during the Revolutionary and Napoleon periods and has since cultivated a dynamic partnership. With strategic investments exceeding $129 billion in 2020, France is a key destination for US investors. Simultaneously, French firms have poured over $78 billion into American markets, establishing a mutual flow of capital, innovation, and opportunity.

The exchange isn't limited to monies - a bounty of goods fuels this thriving economy. The US largely exports aircrafts, chemicals, and agricultural products to France and imports pharmaceuticals, wine, and machinery, amounting to $97.2 billion in total trade as of 2019. This symbiotic relationship spanning across oceans showcases the potent fusion of history and economy, making US-France trade intrinsic to global commerce. Whether through an air cargo bustling with pharmaceuticals or a ship carrying premium Bordeaux, this valuable partnership embodies the essence of international trade.

Your Next Step with DocShipper

Overwhelmed with complex customs procedures and logistics intricacies in your US-France shipments? Let our seasoned experts at DocShipper shoulder the burden. We provide comprehensive freight forwarding services, taking care of everything from transport, customs clearance to administrative tasks. Simplify your shipping. Reach out to DocShipper now and experience unrivaled expertise.

Additional logistics services

Embark on a hassle-free journey with DocShipper as we unravel a full suite of additional logistics services, streamlining your entire supply chain process beyond shipping and customs.

Warehousing and storage

Storing goods isn't just about space; it's about trust and specifics. If your chocolates melt en route, that's not just a loss; it's a disaster! Reliable, temperature-controlled warehousing can make all the difference. Keen to get more clued up? Check our explanation on tailored warehousing solutions.

Packaging and repackaging

When it comes to shipping between the US and France, proper packaging and repackaging aren't options, they're a must. Partnering with a reliable agent like us ensures that your goods, whether delicate porcelain or heavy machinery, are safely packed and repacked for their transatlantic journey. With expertise in handling diverse products, we offer peace of mind and unrivaled service. Dig deeper into our commitment to secure freight packaging on our dedicated page: Freight Packaging.

Cargo insurance

Shipping goods isn't like keeping them in a fireproof safe. Risks abound at sea, in the air, or on the road. That's where Cargo Insurance steps in, offering splints for shipping hiccups. Picture a mid-ocean collision or a customs hiccup delaying your delivery. With Cargo Insurance, potential setbacks won't ruin your day or budget. Turn ‘what ifs’ into ‘no worries’. For further details, discover how you can safeguard your goods on our dedicated Cargo Insurance page.

Supplier Management (Sourcing)

Ever dreamt of expanding your US or French business by sourcing goods from Asia or East Europe? Imagine bridging language gaps and negotiating deals effortlessly. That's where DocShipper's Supplier Management service steps in! From scouting reliable suppliers to managing the procurement process, consider it all done. Real-world example? Picture a US retailer wanting to source high-quality fabrics from France. We simplify the leap! To ease your journey, more info awaits on our dedicated page: Sourcing services.

Personal effects shipping

When moving personal effects between the USA and France, your delicate and bulky items require careful and flexible handling. Trust us to facilitate your transatlantic move as smoothly as possible. For instance, we specialize in shipping grandma's antique French armoire or your American-made surfboard. More info on our dedicated page: Shipping Personal Belongings.

Quality Control

Facing customs snags with less-than-perfect goods shipped from the US to France can be a nightmare. Opt for Quality Control to spot manufacturing glitches before your products hit the shipping line. Remember those French tumblers arriving with splotches? That's a setback Quality Inspections can help avoid. For the ins and outs of this indispensable service, head to our dedicated page: Quality Inspection.

Product compliance services

When shipping goods, adhering to product regulations is key. Our Product Compliance Services ensure you avoid potential legal issues by conducting comprehensive lab testing and obtaining the necessary certification. See how an electronics company shipped sensitive equipment safely, thanks to our services. Don't gamble on compliance, we've got you covered. More info on our dedicated page: Product compliance services.

FAQ | For 1st-time importers between US and France

What is the necessary paperwork during shipping between US and France?

For shipments from the US to France, the primary document we'll manage for you is the bill of lading for sea freight or the air way bill for air freight. You're responsible for preparing the packing list and the commercial invoice. Depending on the nature of your goods, other documents such as a Material Safety Data Sheet (MSDS) or certification may be required. We at DocShipper ensure a seamless process, guiding you through every step and helping with any additional paperwork so your goods reach their destination promptly and in compliance with laws. Count on us to make your international shipping hassle-free.

Do I need a customs broker while importing in France?

Absolutely, we at DocShipper highly suggest utilizing the expertise of a customs broker for importing goods into France. The customs process can be complex and requires precise details and documentation. Any missteps could lead to significant delays or issues. Our role at DocShipper includes acting as your representative in dealings with the customs authority. This ensures a smoother, more efficient process and takes the hassle off your shoulders. In most of the shipments we handle, we take on this responsibility, making sure your cargo clears customs swiftly and accurately. Take advantage of our expertise and let us navigate the complexities on your behalf.

Can air freight be cheaper than sea freight between US and France?

While there's no definitive answer because the cost is typically based on factors like route, weight, and volume, we've noticed that air freight could be a more affordable option if your cargo is under 1.5 cubic meters or 300 kg (660 lbs). Here at DocShipper, we understand these nuances and our dedicated account executives are committed to finding you the most competitive rates. Rest assured, we'll always present our clients with an optimal solution that's tailored to their requirements.

Do I need to pay insurance while importing my goods to France?

As DocShipper, we always advise securing insurance for your shipments, regardless of the destination, including France. While it's not legally required to insure your goods, doing so offers vital protection against unexpected instances such as damage, loss, or theft during transit. In the world of international shipping, these incidents can occur and having insurance can significantly minimize your financial risk. It's one of the best ways to ensure peace of mind throughout your shipping experience.

What is the cheapest way to ship to France from US?

Utilizing sea freight is usually the cheapest method to ship goods from the US to France due to the significant distance. However, the prices can vary based on the nature and size of your cargo. At DocShipper, we'll most likely recommend Full Container Load (FCL) for larger shipments, or Less than Container Load (LCL) for smaller items to ensure cost-effectiveness and efficient utilization of space. Keep in mind, slower delivery times are a trade-off for this cheaper alternative.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF often depends on the nature of your relationship with your supplier. Bear in mind, your supplier might not be a logistics expert. It's often more efficient to engage a professional logistics agent, like us at DocShipper, to manage the international freight and destination process. Suppliers typically sell under EXW (at their factory door) or FOB (including all local charges up to the origin terminal). Regardless of your choice, we assure you DocShipper can handle all your logistics needs, providing a comprehensive door-to-door service, ensuring smooth transit for your goods.

Goods have arrived at my port in France, how do I get them delivered to the final destination?

When your goods arrive in France, if our services were enlisted under CIF/CFR incoterms, you'll need to engage a freight forwarder or custom broker for customs clearance, import charges, and final delivery. Alternatively, we offer DAP incoterms, where we manage all these processes for you. Ensure to confirm these details with your assigned account executive.

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

DocShipper US | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!