Customs clearance is the process of obtaining approval from Customs to allow the import or export of goods into the United States.

Customs and Border Protection (CBP) is the primary agency responsible for customs clearance in the United States.

It is necessary to provide them with multiple documents and pay the required fees.

DocShipper can handle your U.S. customs clearance and ensure that the import and export process runs smoothly, saving time and reducing the risk of customs-related problems.

Do I really need a Customs Broker?

Customs brokers are highly trained industry experts who are responsible for ensuring that all international shipments meet the legal requirements of the U.S. Customs and Border Protection (CBP) agency.

They are also responsible for obtaining the necessary permits, licenses, and documents to facilitate the movement of goods.

Customs brokers are essential to ensuring that your goods are properly declared and clear customs as quickly and efficiently as possible.

You need to know these two criteria for entering goods into the United States :

- Shipments valued over $2,500 require a customs broker (any value if the shipment is controlled goods).

- The customs broker has not required if the shipments are valued under $2,500.

You must apply for informal entry with U.S. Customs and Border Protection to bring your goods into the country.

If the merchandise is subject to regulation by the FDA or other authorities, is restricted, or has anti-dumping charges, you will need formal authorization. It is essential to complete the documents before the import or export process. Don't waste time and money, our agents can take care of your project, and focus on your business.

Export declaration

An export declaration is a document that provides information about goods exported from one country to another. It usually includes details such as the type and quantity of goods, their value, the name, the address of the exporter and importer, and the country of destination.

The declaration is submitted to U.S. Customs and Border Protection (CBP) to ensure compliance with regulations and laws regarding the export of goods.

The purpose of an export declaration is to monitor the movement of goods across borders and prevent the export of prohibited or restricted items. It is an important part of the overall process of exporting goods and is required for customs clearance in the destination country.

How are customs and tax duties calculated?

Customs duties and taxes are generally calculated based on the value of the import or export goods, as well as the type of product.

The most common method of determining the value of goods for customs purposes is the “transaction value” approach, which is the price actually paid or payable for the goods, including any taxes and fees.

At the time of the transaction, the type of product imported or exported determines the rate of duty or tax applied, which may be based on a specific amount, a percentage of the value of the goods, or a combination of both.

These rates are determined by the government of the importing country and are specified in the U.S. Harmonized Tariff Schedule, also known as HTS for the United States.

Step 1: Obtaining the HS Code

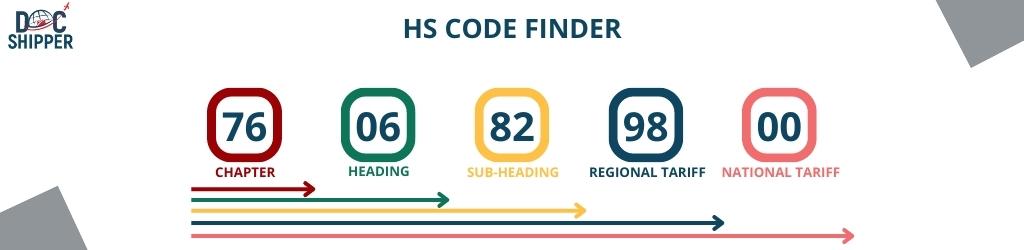

The Harmonized System (HS) code is a standardized product classification method used by most countries for customs purposes. It is a numerical code assigned to each type of product, giving it a reference, which then determines the rates of duty and taxes applicable to that product when it is imported or exported.

The U.S. uses a Harmonized Tariff Schedule (HTS), which is a classification system, to help identify the import duties payable. The United States uses this 10-digit HTS code, with the first 6 digits being the HS code of the goods, and the other 2 digits being determined by the country of import.

The HTS is published by the U.S. International Trade Commission (ITC).

The importing country's tariff schedules may be consulted, or an HS code search tool or method may be used.

An incorrect HS code may result in the application of incorrect taxes and duties, as well as a delay or even denial of entry of the goods into the territory concerned.

Step 2: Determine which customs duties are applicable

Customs duties are taxes imposed on products imported into a country.

They may be established for a variety of reasons, such as :

- protecting domestic industry

- regulating the balance of trade

- implementing specific trade policies.

Governments may set higher import tariffs on certain products, but these levels are subject to limits set by trade agreements.

- The United States has the lowest tariff in the world at 3.4%

- China has a higher rate of 7.5%, but it is not the highest.

These tariffs depend on the origin of the product.

Step 3: Calculating Customs and Tax Duties

There is no single equation for calculating U.S. customs fees, as the exact amount that must be paid can vary greatly depending on several factors.

The following formula can be used for an approximate calculation of customs fees :

Duties = (value of goods) x (duty rate)

Or the “value of goods” and the total cost of the imported goods, including transportation and insurance costs, and the “duty rate” is the percentage of duty applicable to the goods according to their classification in the Harmonized Tariff System (HTS).

This is only an approximation, and the exact amount of duty may vary considerably depending on various factors, such as trade agreements or applicable tariffs.

Additional taxes, such as value-added tax (VAT), may also apply to an imported product in addition to customs duties.

VAT is generally calculated as follows:

VAT Percentage = (VAT / (Value of Goods + VAT)) x 100

It should be noted that customs duties and taxes may vary depending on the current trade policies, political and economic situation of the importing country.

DocShipper will assist you with all the steps involved in determining the exact costs of importing, using our tax and duty experts.

Value-added tax (VAT)

Value Added Tax (VAT) is a tax levied on the value added to goods and services during production and distribution.

In the context of customs clearance services, VAT is often applied to services provided by customs brokers and other intermediaries involved in the import and export process. The exact amount of VAT due varies depending on the country and jurisdiction in which the services are provided, as well as the nature of the goods being imported or exported.

State and local governments set and collect their respective sales taxes.

The United States does not have a VAT because the government collects funds primarily through the income tax system and local governments.

The VAT (value-added tax) is a fixed tax levied on a product. The total amount due to the government is paid by the consumer at the time of the transaction. On the other hand, value-added tax (VAT) involves the payment of a portion of the VAT cost by different parties to the same transaction.

It is recommended to consult a tax professional or an international trade expert.

The amount of customs duties will depend on several criteria:

Product value

National regulations

Description of the product and its end use

Manufacturing country

Trade agreement

Product's Harmonized System (HS) code

How can I pay less taxes when importing to the US?

There are several ways to potentially reduce the amount of taxes you pay when importing goods into the United States, including:

- Duty drawback: If you have already paid duties on imported goods that are later exported or used in the production of goods for export, you may be eligible for a refund of some or all of the duties paid.

- Free trade agreements: If the goods you are importing are from a country with which the United States has a free trade agreement (such as NAFTA), you may be eligible for reduced or zero tariffs on those goods.

- Tariff classification: The duty rate applied to imported goods is determined by the classification of those goods under the Harmonized tariff schedule. Working with a customs broker to ensure that your goods are classified correctly can help reduce the amount of duties owed.

- Record-keeping and documentation: Proper record-keeping and documentation can help ensure that you are paying the correct amount of duties and taxes, and can also support any duty drawback or free trade agreement claims you may make.

- Consult with a tax professional: It is always a good idea to consult with a tax professional or an expert in international trade when importing goods into the United States. They can help you understand the various tax laws and regulations that apply to your situation and help you take advantage of any opportunities to reduce your tax burden.

Documents you need for Customs Clearance in the USA

To import goods into the United States, the following customs documents are typically required:

- Commercial Invoice: A detailed bill of sale that lists the goods being imported and their value.

- Bill of Lading: A shipping document that serves as a receipt for the goods and evidence of the contract of carriage.

- Import Declaration (Customs Form 7501): The primary document used to declare goods and to determine the duties, taxes, and fees owed to the U.S. government.

- Entry Summary (Customs Form 7501-A): A document that provides a summary of the goods being imported, their value, and the duties, taxes, and fees owed.

- Certificate of Origin: A document that certifies the country of origin of the goods being imported.

- Packing List: A detailed list of the goods being imported, including their quantity, weight, and dimensions.

- Hazardous Materials Declaration (for hazardous goods): A document that identifies the hazardous goods being imported and their class, division, and identification number.

FAQ | How long does customs clearance take in the US?

How to pay customs clearance fee?

Customs clearance fees for importing goods into the United States are generally paid through a broker or directly to the U.S.

Customs and Border Protection (CBP) at the port of entry.

These fees may vary depending on the value, type, and quantity of goods being imported. Common methods of payment for customs fees are credit cards, electronic bank transfers, and checks. It is recommended that you confirm specific payment options and procedures with your broker or CBP.

DocShipper is also a customs broker and can assist you with the entire import and export process.

Can I do customs clearance myself?

It is possible to do the customs clearance process yourself, but it is not recommended if you are not familiar with customs regulations and procedures.

As an importer, you must ensure that all required documentation is in order and that all relevant duties, taxes, and fees are paid.

This is a complex process that requires a thorough knowledge of the applicable regulations and requirements. Most importers choose to use a customs broker to manage the clearance process, as it saves time and reduces the risk of errors or delays.

Which Incoterms include customs clearance?

Incoterms are a set of trade terms used in international trade to specify the responsibilities of buyers and sellers in a shipment of goods. Incoterms do not include customs clearance as a specific obligation. However, incoterms used to describe the delivery of goods to the port of entry (CIF, CIP, DDP) imply that the seller must ensure that the goods are ready for clearance at the port of arrival.

Incoterms that include customs clearance as part of the seller's responsibilities are :

- CIF (cost, insurance, and freight): The seller is responsible for delivering the goods to the port of shipment and arranging customs clearance at the port of arrival.

- CIP (Carriage and Insurance Paid To): The seller is responsible for delivering the goods to the port of shipment and arranging customs clearance at the port of arrival, but is also responsible for obtaining marine insurance for the shipment.

- DDP (Delivered Duty Paid): The seller is responsible for the delivery of the goods to the destination designated by the buyer, including arranging customs clearance at the port of arrival.

How much does custom clearance cost in the US?

When you import goods into the United States, you usually have to pay for transportation, customs clearance, and other related fees.

The standard rate for customs clearance is about $50 for clearance through China Customs and an additional $100 to $120 for clearance through Customs and Border Protection (CBP).

However, for informal entries (goods imported by mail, etc.), the MPF is a fixed fee and varies from $2.22, $6.66, or $9.99 per shipment.

Customs clearance fees are charged by the customs clearance agent or customs broker to cover the cost of preparing and filing customs documents.

They may be charged as a flat fee, a single price for a package of services, or a percentage of the value of the shipment.

DocShipper USA | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!