Why did the package go to the Congo? Because it Congo where it pleases! But seriously, the process of transporting goods from the US to the Democratic Republic of Congo (RDC) can be riddled with complexities like deciphering freight rates, fluctuating transit times, and intricate customs regulations. This destination guide is your compass in the world of international freight, exploring different types of logistics solutions, elucidating the customs clearance process, providing insights into duties and taxes, and offering tailor-made advice for businesses operating in our featured countries. If the process still feels overwhelming, let DocShipper handle it for you! We're here to turn these shipping challenges into your business's success, managing every detail from pickup to delivery.

Table of Contents

ToggleWhich are the different modes of transportation between US and RDC?

Crossing continents to ship goods from the US to the Democratic Republic of Congo (RDC) isn't like taking a stroll across the street, is it? On this long journey, air and sea are your main navigators; think of them as the superheroes of international trade! With oceans and thousands of miles between these countries, road or rail freight will drown before reaching halfway. Now, whether air or sea should wear your trade cap depends on your goods, budget, and speed of delivery. Let's dive further into how these caped crusaders can save your trading day!

How can DocShipper help?

Shipping goods from the US to RDC can feel like a Herculean task. Fortunately, DocShipper is here to lighten your load. We handle everything from arranging transport to tackling customs duties and red tape. Want peace of mind with your logistics? Contact us for a free estimate within 24 hours. Have a question? Our expert consultants are just a call away!

DocShipper Tip: Sea freight might be the best solution for you if:

- You are shipping large volumes or bulky items, as sea freight offers the most space at a cost-effective rate.

- Your cargo doesn't have an urgent deadline, as sea freight typically has longer transit times compared to air or rail.

- Your shipping routes are between major ports, allowing you to leverage the extensive global network of sea shipping lanes.

Sea freight between US and RDC

As a hub of global commerce, the US shares a vibrant trade relationship with Democratic Republic of Congo (RDC). Ocean shipping acts as a lifeline connecting the key industrial centers of these nations, with bustling cargo ports like Los Angeles and Matadi making for smooth logistics. For businesses shipping high-volume products, sea freight shines as a cost-effective choice, albeit a slow one.

Transitioning smoothly from the rosy picture, let's dip our toes into the challenges businesses face. If you've ever shipped goods between the US and RDC, the word 'tough' probably sums up your experience. Missing a seemingly minor detail can plunge you into a maze of issues, right? Drawing parallels, imagine leaving one ingredient out of a cake recipe, and you ending up with a baked disaster instead of a delicious delight. It's pretty much the same with international shipping. But hey, you're not alone. Truckloads of insightful tips, specifications, and best practices are waiting for you in this guide, promising to untangle that complicated knot of international shipping. So, sit tight as we make your journey as clear as a summer's day!

Main shipping ports in US

Port of Los Angeles

Location and Volume: Located in San Pedro Bay, 20 miles south of downtown Los Angeles, this bustling port is a leading gateway for trade between the United States and Asia, with a shipping volume of over 9 million TEUs annually.

Key Trading Partners and Strategic Importance: China, Japan, and South Korea are key trading partners. The port’s strategic importance lies in its comprehensive infrastructure, with a total of 27 cargo terminals, and it is the largest container port in the United States.

Context for Businesses: If you're looking to ship goods to the booming Asian markets, the Port of Los Angeles could be a key part of your logistics strategy given its robust infrastructure and leading role in trans-Pacific trade.

Port of Long Beach

Location and Volume: Located adjacent to the Port of Los Angeles, the Port of Long Beach moves over 7.6 million TEUs annually, solidifying Southern California’s status as a major hub for global shipping.

Key Trading Partners and Strategic Importance: Key trading partners include China, South Korea, and Australia. This port is strategically important due to its deep-water harbors, making it accessible to some of the world’s largest container ships.

Context for Businesses: If your shipping concerns involve large tonnage and accessibility, the Port of Long Beach's deep harbors and proximity to major Asian exporters could provide significant advantages.

Port of New York and New Jersey

Location and Volume: Positioned in the heart of the U.S. Northeast corridor, this port is the busiest on the Eastern Seaboard. It handles over 7 million TEUs annually.

Key Trading Partners and Strategic Importance: Primary trading partners are China, India, and Germany. With access to one of the most concentrated and affluent consumer markets in the world, the port holds strategic importance.

Context for Businesses: If your shipping strategy involves reaching affluent northeastern U.S. markets or engaging with Indian and European markets, the Port of New York and New Jersey may be an ideal partner.

Port of Savannah

Location and Volume: Located in Savannah, Georgia, this port moves over 4.6 million TEUs annually.

Key Trading Partners and Strategic Importance: Main trading partners are China, Germany, and India. The port’s strategic importance is its advanced infrastructure and status as the fastest-growing port in the U.S.

Context for Businesses: If you're targeting growth in the southeastern U.S. or need efficient logistics operations, the Port of Savannah’s advanced infrastructure and growth momentum could be valuable.

Port of Seattle

Location and Volume: Situated in Seattle, Washington, this port handles nearly 3.5 million TEUs per year.

Key Trading Partners and Strategic Importance: Key trading partners are China, Japan, and South Korea. The port’s strategic value comes from its position as a key hub for trans-Pacific trade.

Context for Businesses: If trans-Pacific trade with North Asian markets is a part of your business model, the Port of Seattle's strong links with these markets could be crucial to your logistics strategy.

Port of Houston

Location and Volume: Located in Houston, Texas, this port handles over 2.9 million TEUs per year.

Key Trading Partners and Strategic Importance: Primary trading partners include China, Mexico, and Brazil. Its location provides access to the large Texan and Midwestern markets, giving it strategic significance.

Context for Businesses: If your business is looking to serve the growing southern U.S. markets or expand in Latin America, the Port of Houston offers a prime location and suitable trading partners.

Main shipping ports in RDC

Port of Matadi

Location and Volume: The Port of Matadi, situated on the left bank of the Congo River, is the only international sea port in the Democratic Republic of Congo DRC. Serving as the main maritime outlet for Kinshasa, the country's capital and largest city, the port handles a substantial annual shipping volume of 3 million metric tons.

Key Trading Partners and Strategic Importance: Not only is it the main trading point with international players such as China, South Africa, and Belgium, but it’s also strategically placed to serve the landlocked Central African Republic and South Sudan. The port harbors important berths for general cargo, containers, and bulk cargo, predominantly minerals exported from DRC.

Context for Businesses: For businesses looking to venture into the DRC market, the Port of Matadi's extensive cargo handling capacity and strategic location providing access to the heart of the country can significantly streamline their logistics and trade processes. Moreover, regular container lines from Europe, America and Asia make it a highly connected entry point.

Port of Boma

Location and Volume: This port is located approximately 100 kilometers upriver from the mouth of the Congo River. Being the second-largest port of the DRC, it also facilitates substantial import and export activities. While primarily functioning as a lighterage port—a key point for the transfer of cargo—it has a shipping volume of around 2.5 million metric tons annually.

Key Trading Partners and Strategic Importance: Its top international trading partners are China, Zambia, and South Africa. The port holds strategic importance as it serves many inland destinations and is equipped to handle a variety of cargo, including minerals, oil, and agricultural products.

Context for Businesses: If your business involves transporting goods that require special handling or you are targeting the central regions of DRC, the Port of Boma, with its specialized cargo handling abilities, can be an effective entry of choice. Its ability to cater to lighterage requirements can facilitate safe and efficient cargo transfers for specific business needs.

Should I choose FCL or LCL when shipping between US and RDC?

Choosing between consolidation (LCL) or a full container load (FCL) for sea freight between the US and RDC presents a strategic decision that greatly impacts cost, delivery time, and overall success of your shipment. This guide will help you understand the differences and benefits of each option. Without a doubt, the right choice could make your shipping process smoother and more effective. Dive in to make an informed decision that aligns beautifully with your specific needs.

LCL: Less than Container Load

Definition: LCL (Less than Container Load) shipping involves pooling your goods with others in a single container. This can be a cost-effective, flexible option if you're shipping a low quantity.

When to Use: LCL is ideal when your cargo is less than 13-15 CBM (cubic meter). This method offers you the flexibility of shipping goods whenever ready, rather than waiting to fill a full container.

Example: Consider a business shipping a small quantity of merchandise from New York to Kinshasa. Instead of waiting for more items to fill a full container, they can ship immediately using LCL. Additionally, if they have a buyer waiting in Kinshasa, using LCL can help them meet their delivery commitments while maintaining cash flow.

Cost Implications: LCL shipping often incurs lower upfront cost due to shared container space. However, it's crucial to account for additional expenses such as pre-carriage, on-carriage, and customs clearance. Therefore, while LCL provides a convenient lcl shipping quote and efficient lcl freight, it's essential to balance these factors while choosing this method.

FCL: Full Container Load

Definition: FCL or Full Container Load is a form of ocean freight where a single shipper monopolizes the container's space for its goods. In FCL shipping, your cargo enjoys exclusive occupancy, increasing its safety as the container remains sealed from origin to destination.

When to Use: FCL is particularly useful when your cargo volume exceeds 13/14/15 cubic meters (CBM). In such cases, FCL becomes a more cost-effective option as it makes better use of each container's full capacity. You can choose between a 20'ft container or a larger 40'ft container based on your needs.

Example: Suppose a furniture retailer is exporting large quantities of goods from the US to the Democratic Republic of Congo (DRC). Given there is sufficient volume (say, 18 CBMs), choosing FCL shipping would ensure the safe and cheap transportation of goods without sharing space with other shippers.

Cost implications: Since FCL involves the leasing of the entire container, the cost is often higher than LCL (less than container load). However, for high volume shipments, FCL can be cheaper on a per unit basis, making it a more economically viable option. Also, getting an FCL shipping quote is often straightforward as costs are based on per container rather than per CBM.

Unlock hassle-free shipping

Unsure how to choose between consolidation or a full container for your ship freight from the US to RDC? Let DocShipper simplify the process! Our ocean freight experts consider important factors such as volume, weight, and urgency of shipment to guide you through the choices. At DocShipper, we strive to make cargo shipping transparent and painless. To explore your options and let us optimize your shipping strategy, reach out to us for a free estimation. Take the guesswork out of international shipping today!

How long does sea freight take between US and RDC?

Sea freight between the United States and the Democratic Republic of Congo (DRC) typically takes around 30 days. Transit times vary depending on several factors that include the specific ports used, the volume and weight of your goods, as well as their individual nature. To get the most accurate estimate, we recommend reaching out to a seasoned freight forwarder like DocShipper for a customized quote.

For quick reference, here's a snapshot of the average transit times for sea freight between the four primary ports in each country:

| | US Port | DRC Port | Average Transit Time (days) |

| Port of Los Angeles | Port of Matadi | 35 |

| Port of Long Beach | Port of Boma | 32 |

| Port of New York and New Jersey | Port of Matadi | 27 |

| Port of Savannah | Port of Boma | 30 |

*These times represent averages and may vary, so we insist on contacting a freight forwarder for exact timings and logistics.

How much does it cost to ship a container between US and RDC?

Ocean freight rates and shipping between the US and the RDC can be as broad as $50 to $500 per CBM. Why such a wide latitude? Range, carrier used, the nature of goods, along with notorious monthly market nuances make it impossible to pinpoint an exact shipping cost. No worries though, you're not left to navigate this wide ocean alone. We have a team of shipping specialists ready to dive into the details and tailor a quote for your unique needs. Every container, every route, every piece of cargo gets bespoke treatment. Your trust means the world to us, just as delivering your world is our business.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container represents one of the most reliable methods of shipping out of gauge cargo – items too large to fit inside standard shipping containers. Extra-large machinery or equipment often falls into this category.

Suitable for: Oversized or irregularly shaped cargo that doesn’t fit within the standard shipping container dimensions.

Examples: Industrial heavy machinery, construction equipment, large-scale energy sector components.

Why it might be the best choice for you: Choosing this method allows for secure transport of your large-scale commodities between US and RDC, reducing the risk of damage during transit.

Break Bulk

Definition: Break bulk refers to goods shipped individually or in tranches, not in shipping containers. These are often stowed directly onto the vessel.

Suitable for: Large items such as timber, pipes, cement, or machinery that is too large to fit into containers, or loose cargo load that doesn't require the entire space of a standard container.

Examples: Construction equipment, building materials, logs, steel beams.

Why it might be the best choice for you: It offers flexibility for oversized or irregular-shaped commodities, where allocating them in a container might be unsuitable or cost-prohibitive.

Dry Bulk

Definition: Dry Bulk is a type of shipping where commodities like grain, coal, and minerals are transported in large quantities in the ship's hold.

Suitable for: Large volume, loose commodity goods that don’t need individual packaging.

Examples: Grains, coal, cement, minerals.

Why it might be the best choice for you: This method is highly cost-efficient for moving large quantities of unpackaged raw material goods.

Roll-on/Roll-off (Ro-Ro)

Definition: The Ro-Ro is a specialized sea vessel that allows wheeled cargo like cars, trucks, construction equipment, etc., to be driven on and off the ship on their own wheels (or using a platform vehicle).

Suitable for: Any wheeled or tracked cargo that can be driven or towed onto the ro-ro vessel.

Examples: Cars, trucks, tractors, trailers, motorhomes, railway carriages.

Why it might be the best choice for you: Increased efficiency and ease of loading and unloading makes Ro-Ro a viable option for businesses with rolling cargo that would be impractical with other methods.

Reefer Containers

Definition: Reefer Containers are refrigerated containers used for transporting goods needing a specific temperature control throughout the transit.

Suitable for: Perishable goods or any cargo that needs temperature control.

Examples: Frozen food, pharmaceuticals, fruits, vegetables, dairy products, and certain chemicals.

Why it might be the best choice for you: When it comes to shipping perishable goods from US to RDC, Reefer Containers guarantee optimal temperature control, preserving the quality of your products from pickup to delivery.

Sea freight shipping options can be complex, and it's vital to understand the implications on your cargo. At DocShipper, we are always ready to answer your queries and provide expert guidance. Contact us today for a free shipping quote in less than 24 hours.

DocShipper Tip: Air freight might be the best solution for you if:

- You are in a hurry or have a strict deadline requirement, as air freight offers the fastest transit times.

- Your cargo is less than 2 CBM (Cubic Meter), making it more suitable for smaller shipments.

- Your shipment needs to reach a destination that is not easily accessible by sea or rail, allowing you to tap into the extensive network of global airports.

Air freight between US and RDC

For businesses seeking a swift and reliable option for shipping smaller, high-value goods between the US and the Democratic Republic of Congo, air freight is the ticket. Imagine it like squeezing the shipment into a jet plane instead of a cargo ship as it's well-suited for items such as electronics, pharmaceuticals, and perishable goods.

But wait - the plot thickens. It's not all about packing and waving goodbye. Unawareness of key factors during the air freight process can crank up costs. Like an artist mistakenly using a gallon measure for paints, many shippers misjudge by estimating shipping costs based purely on physical weight, ignoring the 'volumetric weight' formula. Shoddy practices lurk in the shadows, ready to pounce on your profit margins. But don't fret - we'll delve into these potential pitfalls and ways to steer clear of them in what follows.

Air Cargo vs Express Air Freight: How should I ship?

Looking to ship goods between the US and RDC? Your choice lies between Air Cargo – where your items hitch a ride within regular airlines, or Express Air Freight – where your goods are king, aboard their own dedicated plane. This piece unravels the what, why, and how, to empower you to make the right choice for your business needs. Let's dive in.

Should I choose Air Cargo between US and RDC?

Opting for air cargo between the US and the Democratic Republic of Congo (RDC) could be an efficient solution that meets your budgetary needs. Major players like Delta Airlines and Ethiopian Airlines offer frequent flights, enhancing accessibility and bridging vast distances with ease. Whilst this method showcases reliability, bear in mind, transit times can extend due to predetermined schedules. Moreover, air cargo becomes increasingly cost-effective for loads ranging from 100 to 150 kg (220 to 330 lbs), adding more value to your logistics strategy.

Should I choose Express Air Freight between US and RDC?

When you're shipping small quantities between the US and RDC, express air freight becomes your go-to option. This service, offered by top international firms like FedEx, UPS, and DHL, uses dedicated cargo planes with no passengers. It's ideal for shipments under 1 CBM or that weigh between 100 and 150 kg. Quick, reliable, and efficient, express air fright is perfect if you're looking at a fast turnaround while also wanting to track your shipment every step of the way. So, when time is of the essence, consider express air freight.

Main international airports in US

Los Angeles International Airport

Cargo Volume: Approximately 2.2 million metric tons of cargo annually.

Key Trading Partners: East Asia, partially driven by the strong ties of Los Angeles with China and Japan.

Strategic Importance: Enjoying a strategic location on the west coast, it serves as one of the key gateways for trans-Pacific trade.

Notable Features: Its specialized cargo facilities, cool storage for perishable items, and comprehensive security measures.

For Your Business: Given the high volume of cargo handled and its robust infrastructure, LAX can potentially help streamline your transport to and from East Asia, particularly if your cargo includes perishable goods.

John F. Kennedy International Airport

Cargo Volume: Around 1.3 million tons of cargo annually.

Key Trading Partners: Europe, with a significant amount of cargo also transported to and from Latin American countries.

Strategic Importance: As one of the country's main international gateways, JFK provides a crucial connection to the European market.

Notable Features: Its extensive cargo facilities include cold storage for temperature-sensitive goods, and dedicated areas for valuable and dangerous goods.

For Your Business: Its specialized handling options, and its operations 24/7 can be a great boon, if your business deals with a variety of product types and values fast, round-the-clock shipping.

Miami International Airport

Cargo Volume: Handling more than 2.3 million tons of cargo annually.

Key Trading Partners: Latin America and the Caribbean, riding on Miami's position as a hub for these regions.

Strategic Importance: MIA plays a critical role in bridging the U.S. with the Southern Hemisphere.

Notable Features: Renowned for being a global hub for perishable products, with one of the largest refrigerated cargo complexes in the US.

For Your Business: This is an invaluable option if your operation centers around perishable goods export to Latin America or Caribbean countries.

Chicago O’Hare International Airport

Cargo Volume: More than 1.8 million tons of cargo handled annually.

Key Trading Partners: Primarily Europe and East Asia, given Chicago's central location in the continental U.S.

Strategic Importance: Serves as a key connection point for goods traveling between the coasts, as well as from North America to Asia and Europe.

Notable Features: O'Hare has a fully automated cargo handling system which allows efficient processing of large and small shipments.

For Your Business: The airport is a prime choice if your business entails shipping goods spanning various continents, enabling smooth trans-continental logistics.

Memphis International Airport

Cargo Volume: In excess of 4.6 million tons of cargo annually.

Key Trading Partners: Covers both domestic and international deliveries, with a major share of goods going to North America, Europe, and Asia.

Strategic Importance: It is the global “SuperHub” of FedEx Express, making it one of the busiest cargo airports in the world.

Notable Features: Aside from its mammoth handling capacity, it also boasts outstanding connectivity with an extensive road and rail network.

For Your Business: If your business requires high frequency and large volume shipments across the globe, Memphis' immense capacity and its vigorous FedEx operation could amplify the efficiency of your logistics.

Main international airports in RDC

N’djili Airport

Cargo Volume: As one of the busiest airports in the Democratic Republic of Congo, N'djili airport handles a significant share of the country’s cargo traffic. Hundreds of tons of freight pass through its cargo terminals each year.

Key Trading Partners: Key trading partners operating through N'djili airport include China, the United Arab Emirates, South Africa, and Belgium, reflecting the diversity of Congo’s global trade relationships.

Strategic Importance: Located in the nation's capital, Kinshasa, N'djili airport serves as a critical hub for goods bound for Europe, Asia, and other African countries. It also bridges the trade gap within the vast expanse of DR Congo, serving as the central shipping point for goods to and from most parts of the country.

Notable Features: The airport boasts modern cargo facilities with well-equipped warehousing and cold storage capacities. The airport is well-known for its high level of goods security and efficient cargo handling processes.

For Your Business: If you’re considering a shipping route that transits through this part of Africa, N'djili airport's solid infrastructure and broad trading partner base could make it an excellent choice to factor into your supply chains. Its central location in Kinshasa also makes it a convenient drop-off point for goods heading to different parts of DR Congo.

Lubumbashi International Airport

Cargo Volume: Lubumbashi International Airport has an annual capacity of tens of thousands of tons of cargo, making it an important logistical hub in southern DR Congo.

Key Trading Partners: The proximity to Zambia, Tanzania, and other nearby southern African countries makes them key trading partners. This extends to other global partners like China and Belgium due to the rich mineral industry in the region.

Strategic Importance: Given the airport’s role in serving the mineral-rich Katanga Province, its strategic importance is hard to understate, especially for businesses within or connected to the mining industry.

Notable Features: Lubumbashi International Airport has a dedicated cargo terminal suited to heavy-duty mining transportation. The airport has customs on-site, making it convenient for freight forwarding.

For Your Business: If you are in the mining sector or dealing with heavy machinery, Lubumbashi's specialized infrastructure makes it an ideal choice for facilitating the seamless transportation of your goods. The airport’s location in Congo’s mining heartland provides unique opportunities for resource trade.

How long does air freight take between US and RDC?

The timeframe for shipping goods via air freight between the United States and the Democratic Republic of Congo typically ranges between 5 to 8 days. However, it's important to understand this estimated period can fluctuate depending on factors such as the specific airports in use, the weight of your cargo, and the type of goods you're shipping. In order to receive an accurate estimate tailored to your specific shipment, partnering with an experienced freight forwarder like DocShipper is highly recommended.

How much does it cost to ship a parcel between US and RDC with air freight?

Air freight costs from the US to the Democratic Republic of the Congo can broadly range between $5 and $10 per kg. However, an exact rate isn't feasible to state upfront due to numerous factors, such as distance to and from departure and arrival airports, parcel dimensions, weight, and nature of goods. We assure you that our team evaluates all these elements to offer the best possible quotes tailored to your specific needs, as every shipment is unique. Don't hesitate, contact us and receive a free quote within less than 24 hours!

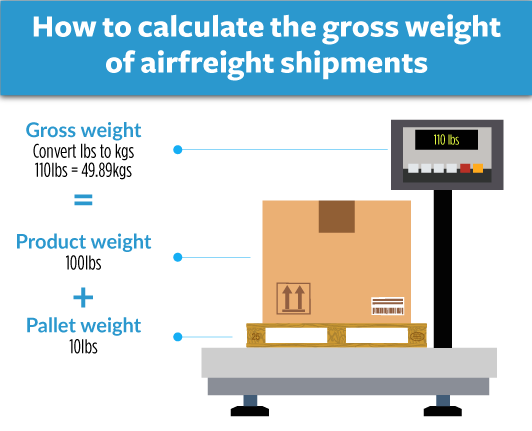

What is the difference between volumetric and gross weight?

Gross weight is the actual weight of your shipment, including packaging and pallets. To state it simply, it's how much your shipment physically weighs when placed on the scales. On the other hand, volumetric weight, often called dimensional weight, considers the size of the shipment. It's calculated based on the space your cargo will take up on a plane, not its actual weight.

To calculate the gross weight in air cargo, weigh your shipment, including any packaging or containers, using a freight scale. Just make sure everything is packed as it will be when shipped. For instance, if your shipment weighs 120 kg, that’s the gross weight. In pounds, this converts to approximately 264 lbs.

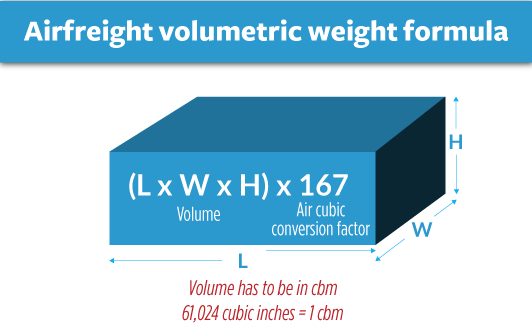

Volumetric weight calculation is slightly different. It's calculated as (Length x Width x Height in centimeters) / 6000 for Air Cargo and (L x W x H in cm) / 5000 for Express Air Freight. Looking at an example, let’s say you’re shipping a large but lightweight box that measures 120cm x 80cm x 50cm. For Air Cargo, your calculation would be (120 x 80 x 50) / 6000, giving you a volumetric weight of 80 kg or approximately 176 lbs.

But why does this matter? Well, airlines charge by freight weight, and that could be either gross weight or volumetric weight, whichever is higher. This system, referred to as 'chargeable weight', ensures carriers are compensated both for the actual weight and for the space the package occupies during transit. So, whether you're shipping fluffy pillows or solid gold blocks, understanding these calculations helps in evaluating your shipping costs, and therefore your bottom line.

DocShipper tip: Door to Door might be the best solution for you if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You prefer a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want to minimize the handling of your goods, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between US and RDC

Door-to-door shipping is a polished solution that streamlines your international shipping experience. As the name implies, it assures delivery from your location in the U.S. straight to your recipient in the RDC. This method is often quicker and reduces the risk of miscommunication – it's the epitome of hassle-free logistics. So, if you're searching for all-around convenience, let's dive into this profound exploration together!

Overview – Door to Door

Looking to ship goods between the US and the RDC minus the shipping complexities? Door-to-door service might be your perfect hassle-free solution. This method relieves you from handling transport arrangement, customs procedures, or hustling for last-mile delivery. Though a bit more expensive than other options, its convenience is second to none, making it the most preferred by our clients. However, it's critical to stay aware of potential delays in customs or possible logistics setbacks. With door to door, you get peace of mind as we handle the fuss and you focus on what matters - your business!

Why should I use a Door to Door service between US and RDC?

Let's face it, logistics can be a head-scratcher, and nobody loves a good brain teaser when it's crunch time. So, what's the game-changer? Say hello to Door to Door service. Here are five reasons that'll make you facepalm and wonder why you didn't opt for this sooner.

1. Stress-Free Logistics: Ever played Tetris with your cargo? That's what logistics usually feels like. Fortunately, Door to Door service takes this puzzle off your hands. From pickup to delivery, every move is on them. This means less stress and more time doing what you do best - running your business.

2. Timely Delivery: If your shipment were Cinderella, Door to Door would be her fairy godmother, ensuring she reaches the ball (or in your case, RDC) on time. No more worrying about your shipment missing deadlines due to unexpected hitches along the way.

3. Specialized Care for Complex Cargo: Door to Door service snuggles your complex cargo and takes special care to ensure it doesn't get thrown around. What this means is that even your most delicate or valuable items will get the VIP treatment they deserve.

4. Ultimate Convenience: Imagine a world where you don't have to worry about handling trucking or coordinating the delivery point. Door to Door service makes this a reality by doing the heavy lifting (literally and figuratively), so all you have to do is wait for the goods at your doorstep.

5. Complete Compliance: Let’s not forget the headache of dealing with layers of laws, rules, and regulations surrounding international shipping. The Door to Door service handles all customs clearance procedures, ensuring your shipment travels in complete compliance with US and RDC regulations.

There you have it - Door to Door service is the aspirin for your logistics headache, serving a winning combination of efficiency, safety, convenience, and timeliness.

DocShipper – Door to Door specialist between US and RDC

Experience seamless door-to-door shipping with DocShipper from the US to RDC. As experts in this domain, we organize your goods' entire transportation journey – packing, shipping, customs clearance, and more. You don’t lift a finger. Our dedicated Account Executives ensure everything runs smoothly while you focus on your core business. Get a free estimate from us in less than 24 hours or consult with our experts with zero cost obligations. Enjoy stress-free, comprehensive shipping solutions tailored to your needs.

Customs clearance in RDC for goods imported from US

Customs clearance is a critical step when shipping goods from the US to the Democratic Republic of Congo (RDC); a labyrinth often filled with unexpected costs and delays. Navigating customs duties, taxes, quotas, and licenses can be tricky, making your carefully planned shipment prone to getting stuck at the border. But, fear not! The following guide will shed light on these areas and help you avoid common pitfalls. With DocShipper's expertise, we assist in simplifying the process and easing your shipping worries. Remember, to get an estimate, we need the origin, the value of the goods, and the HS code. With these three necessities, you're on your way to shipping success!

How to calculate duties & taxes when importing from US to RDC?

When importing goods from the US to the Democratic Republic of Congo (DRC), estimating duties and taxes is critical in planning your financials and operations. An efficient way to approach this is to decode it into several key factors: the country of origin, the Harmonized System (HS) code, the customs value, the applicable tariff rate, along with any additional taxes and fees that might apply to your products.

Kick-starting this process requires a clear identification of the manufacturing or production country of your goods. This knowledge forms a solid foundation for the accurate calculation of your import duties and taxes. This not only helps maintain a smoothly revolving wheel of international trade, but it also plays a significant role in keeping your business compliant with both U.S and RDC trade regulations. This acquisition of information enables your business to make informed decisions, maintain cost-effectiveness, and avoid any unnecessary government hurdles.

Step 1 - Identify the Country of Origin

Knowing your product's country of origin is the pivotal first step in estimating duties and taxes for imports from the US to the Democratic Republic of Congo.

1. Accurate Classification - It's fundamental in determining the product's correct Harmonized System Code, ensuring correct customs tariff treatment.

2. Trade Agreements - The US and RDC may have trade agreements that affect duty rates on certain goods. For instance, the African Growth and Opportunity Act (AGOA) offers duty-free treatment to specified goods originating from Sub-Saharan African countries like RDC, potentially lowering customs costs significantly.

3. Import Restrictions - RDC imposes varying import restrictions based on the country of origin. By identifying the origin, you can understand and navigate these limitations better.

4. Compliance - Properly declaring the country of origin is integral to aligning with international trade regulations and avoiding penalties.

5. Cost Estimation - Knowing the exact origin can help in detailed cost planning, from calculating the duty payable to understanding transport costs.

Remember, taking time for accuracy here not only safeguards against unexpected costs but also sets the foundation for a smoother shipping experience. Review potential trade agreements and import restrictions, start your shipping journey on the right foot and save yourself future headaches.

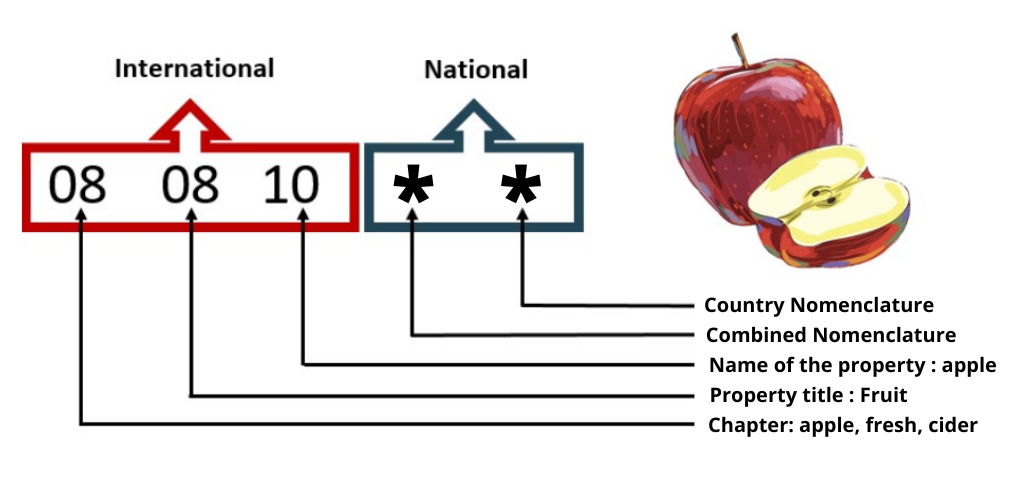

Step 2 - Find the HS Code of your product

The Harmonized System Code, commonly known as the HS Code, is a universally accepted classification system for goods. It serves as a standard language for trades, used by customs authorities globally to identify products when assessing duties and taxes. Having the correct HS Code for your product is crucial to ensure smooth customs clearance and accurate calculation of duties.

Now, the easiest way to figure out the HS Code of your product is to ask your supplier. They're usually quite familiar with what they're importing and the associated regulations. However, if that's not an option, don't worry. We have a straightforward step-by-step process to help you find it yourself.

First, navigate to the Harmonized Tariff Schedule website. Here, you can use their HS lookup tool to search for your product.

Next, once on the website, type the name of your product into the readily available search bar.

Finally, after hitting 'search', look under the Heading/Subheading column. You will find the HS code for your product listed there.

Please note that accuracy is of the utmost importance when dealing with HS Codes. An incorrect code may lead not only to delays in customs clearance but also to potential fines.

Here's an infographic showing you how to read an HS code.

Step 3 - Calculate the Customs Value

When shipping goods from the US to the Democratic Republic of Congo, you’ll encounter a term called 'Customs Value'. It's different from your products' market price. Simply put, 'Customs Value' is the total cost of your shipped goods – that includes not just the price of the goods, but also the cost of international shipping and insurance. Particular note should be taken since all these values need to be in US dollars (USD).

So if you buy goods for $1000, spend $200 on shipping, and $50 on insurance, your CIF (Cost, Insurance, and Freight) or 'Customs Value' would be $1000 + $200 + $50 = $1250. This figure is essential since other fees like customs duties will be calculated based on it. Understanding this will make all the difference in managing your shipping budget effectively.

Step 4 - Figure out the applicable Import Tariff

An import tariff refers to a tax imposed on goods transported internationally. It is dictated by the Harmonized Code also known as the HS Code of the product and varies from one country to another. To find the precise tariff for your goods intended for the Democratic Republic of Congo (RDC), designated local customs and trade portals would be the go-to sources.

Let's use an example. Suppose you're shipping iPhones, whose HS code is 8517.12, from the US to RDC. In order to identify the applicable tariff for this product, follow these steps:

1. Access the appropriate tariff consultation tool.

2. Input the HS code (8517.12) and US as your country of origin.

This will provide you with the specific tariff rate, let's say it's 25%.

Now, if you've spent $10,000 on the iPhones and $2,000 on insurance and freight for bringing them to RDC (commonly known as CIF costs amounting to $12,000), the import duty can be calculated as:

Import Duty = Import Tariff (%) CIF Value ($)

= 25% 12,000

= $3,000

This means, you will have to pay $3,000 as the import duty, adding to the cost mass of your shipment in RDC. Remember, modern business is all about knowing your expenses in advance and planning for them, ensuring seamless trade and harmony in your supply chain.

Step 5 - Consider other Import Duties and Taxes

When you're importing goods into the Democratic Republic of Congo (RDC) from the US, it's essential to understand that additional import duties may apply on top of the usual tariff rate. These costs can vary based on both the product's nature and its origin.

One such charge is the excise duty, which often applies to specific goods like tobacco or alcohol. Another possible fee is anti-dumping taxes. These can be levied to protect local industries: let's say you're importing inexpensive hardware from the US and it's threatening to undercut a similar RDC-based industry, you could be liable for an anti-dumping tax.

Perhaps the most significant additional charge is the VAT rate. Even though this varies, it's crucial to factor VAT into your cost plans. For instance, if the VAT rate is 16% on your $10,000 import, you'd need to plan for an additional $1,600 charge.

Remember, these are hypothetical examples and actual rates can fluctuate. Always refer to a customs expert or the local customs website to get accurate and up-to-date data. Planning for these additional costs will help ensure a smooth importing process, ultimately saving you time and stress.

Step 6 - Calculate the Customs Duties

Calculating the customs duties for your goods imported from the US to the Democratic Republic of Congo (RDC) can feel like a complex puzzle. But fear not! It's a matter of applying the right formula: Customs Duties = Customs Value x Duty Rate. Keep in mind, the 'Customs Value' of your goods includes the cost of the goods, insurance, and freight (CIF).

Consider three scenarios:

1. Goods valued at $5000 with a duty rate of 5% but no Value Added Tax (VAT). Here, your customs duties would simply be $5000 x 5% = $250.

2. Goods valued at $10000 with a duty rate of 10% and a 16% VAT. Your customs duties would be $1000 (10% of $10000), but add the VAT and you're looking at an additional $1600, leaving you with $2600 owing.

3. Suppose you're shipping specialized goods worth $50000, incurring a 15% duty rate, a 16% VAT, an anti-dumping tax of 25%, and an excise duty of 150%. Your customs duties would be $7500, VAT would be $9600, the anti-dumping tax $12500, and excise duty a hefty $75000. That's a cumulative charge of $104600. Sounds daunting, doesn't it?

By partnering with DocShipper, you can rest easy. We efficiently navigate this intricate landscape, ensuring you're never overcharged. Our global customs clearance service will handle every stage of the process for you. Get your free quote in under 24 hours, and let's start simplifying your customs journey.

Does DocShipper charge customs fees?

Sure, let's clear up a common misconception. As a customs broker, DocShipper charges for customs clearance services, which is distinctly different from customs duties and taxes - that's money you'd be directly paying the government. Think of it as hiring a lawyer who guides you through legal procedures, their fee isn't the fine or bail you'd pay to the court. Likewise, we handle your documentation and procedures, but you pay the duties to the customs office. Rest assured, we provide you with official documents verifying the exact charges from the customs office.

Contact Details for Customs Authorities

US Customs

Official name: U.S. Customs and Border Protection (CBP)

Official website: https://www.cbp.gov/

RDC Customs

Official name: General Directorate of Customs and Excise (DGDA)

Official website: https://douane.gouv.cd/

Required documents for customs clearance

Confused about handling customs paperwork? Learn about critical documents like the Bill of Lading, Packing List, Certificate of Origin, and CE Standards Documents of Conformity. Squash uncertainties and avoid shipping delays, getting your goods where they need to go without a hitch.

Bill of Lading

Imagine the Bill of Lading (BoL) as your shipment's passport between the US and RDC. It guarantees the contract between you (the shipper) and the carrier. Once the carrier issues it, ownership moves, signaling that your goods are now in transit. More common nowadays is the use of 'telex release' BoLs, a quicker form - transferring ownership electronically rather than physically. It dramatically expedites the clearance process, no waiting for the paper document to arrive. Don't confuse BoL with AWB (Air Waybill) - a similar document but for air cargo. For smooth shipping, verify all information on your BoL before the journey begins. It's your ticket to successful transport.

Packing List

Packing List, your silent knight in shipping, is a vital cog when you're moving goods from the US to the Democratic Republic of the Congo (RDC), be it by sea or air. Imagine this - you're sending a shipment of medical equipment. Your Packing List, painstakingly detailed with quantity, weight, and any specific markers, becomes the validator at each juncture. Picture customs officials scanning this doc, ticking off each item present physically against those on the list. Got mismatch? Boom, expect delays or even shipment rejection. So, your role? Create this document with utmost diligence and accuracy. It’s your gateway to a smooth customs clearance, safeguarding against hiccups - a markup of good faith in your transparency. It’s that crucial tie linking your business’ efficiency with successful international logistics.

Commercial Invoice

Preparing a Commercial Invoice for your US to RDC shipment? It's a must-have, crucial for smooth customs clearance. This detailed invoice includes essential information such as sold-to and ship-to parties, product description, quantity, tariff codes, and the total value of the merchandise. The trick is to ensure it aligns perfectly with your other shipping documents—like the Bill of Lading or Air Waybill—to avoid discrepancies that might lead to delays. Here's a pro tip: specify shipment terms (Incoterms) for clarity on costs and responsibilities. Remember, a well-prepared Commercial Invoice not only accelerates the customs process but also helps prevent unforeseen expenses. So, shipping goods between US and RDC? A flawless Commercial Invoice is your passport to success!

Certificate of Origin

Looking to crack the logistics puzzle from USA to RDC? Here's a gem - the Certificate of Origin. This document is like your goods' passport, recording their 'birthplace.' If your goods were made in the USA and you're shipping to RDC, this detail could unlock lower customs duties under preferential rates, sweetening the deal for your business. Think of it as a VIP pass for your shipment, easing its journey across borders. For instance, a Charlotte-based plastic manufacturer shipping to Kinshasa saw duties drop by 15% just by showing accurate proof with this document. So, remember to clearly mention your product's country of manufacture to leverage these benefits. The Certificate of Origin may just be the key to a smooth, cost-effective shipping experience!

Certificate of Conformity (CE standard)

A Certificate of Conformity (CE standard) is a vital document when shipping goods from the US to countries within the European market. This certification proves that your goods adhere to the European Union's product safety, health, and environmental protection standards. It's different from quality assurance, which primarily focuses on preventing product defects, whereas CE marking is about ensuring that the product abides by EU directives and regulations. 'CE' is not interchangeable with US certification standards, hence, if you’ve been exclusively dealing with the US market, you’ll need to obtain this certification to export to the European market. It's advisable to collaborate with a compliant agent or expert to navigate this process efficiently. However, remember to conduct due diligence in choosing an agent, as this can significantly affect your shipment's compliance and lead times.

Get Started with DocShipper

Stressed with the customs clearance for your US to RDC shipment? Let DocShipper streamline your experience. Our seasoned experts manage all complex steps guaranteeing fast, lawful clearance. No more time-consuming tasks or unexpected costs! Ready to take the hassle out of your shipping journey? Reach out today and receive your free custom quote within 24 hours. Let's make cross-border commerce simple together!

Prohibited and Restricted items when importing into RDC

When shipping goods to the Democratic Republic of the Congo, understanding which items are off-limits or subject to special rules can be tricky. These regulations may pose unexpected hurdles, potentially disrupting your business operations. Explore this guide to avoid fines and ensure your cargo successfully reaches its destination.

Restricted Products

Here's a list of items that require a special license or permit for shipping to RDC:

1. Pharmaceutical goods: If you're shipping pharmaceutical goods, you'll need a Pharmaceutical Import License from the Democratic Republic of Congo Ministry of Health.

2. Precious metals and stones: Shipment of precious metals and stones requires a license from the Democratic Republic of Congo Ministry of Mines.

3. Military equipment: In case you're looking to ship military equipment, you must obtain a Defense Equipment Import License which can be procured from the Democratic Republic of Congo Ministry of Defense.

4. Animals and animal products: If animals or animal products are on your shipment list, you have to apply for a Veterinary Health Import Permit from the Democratic Republic of Congo Ministry of Agriculture.

5. Hazardous materials: Shipping hazardous materials? You have to follow the stipulations set in place by the Democratic Republic of Congo Ministry of Environment and obtain a Hazardous Materials Shipping Permit.

Remember, obtaining the necessary permits and licenses isn't just a legal requirement - it's your due diligence to ensure the safe and accountable movement of goods across international borders.

Prohibited products

- Narcotics and illegal drugs

- Incendiary or explosive devices

- Endangered species of animals or plants

- Ivory products

- Radioactive materials

- Pornographic materials

- Weapons and ammunition

- Counterfeit products and piracy

- Cultural property and national treasures

- Harmful chemicals and pesticides

- Products with images or symbols that are politically or religiously sensitive in the Democratic Republic of Congo

- Unprocessed precious metals and gemstones

Are there any trade agreements between US and RDC

As of now, there are no established Free Trade Agreements (FTAs) or Economic Partnership Agreements (EPAs) directly between the US and the Democratic Republic of Congo (RDC). However, the African Growth and Opportunity Act (AGOA) facilitates certain trade benefits for eligible Sub-Saharan countries, including the RDC. Always stay in the loop about ongoing discussions or possible new agreements that could streamline your shipping with reduced tariffs or simplified customs procedures. Notably, ongoing infrastructure projects signal promising opportunities for future trade.

US - RDC trade and economic relationship

The US-RDC (United States - Democratic Republic of Congo) trade relationship has roots back to 1960 when the DRC became independent. Although fraught with political shifts, the bond has remained; a noteworthy highlight being the 'African Growth and Opportunity Act (AGOA)' where the US offered trade privileges in 2002. Key sectors underpinning this partnership are minerals, coffee, and oil-seeds, showcasing DRC's wealth of natural resources.

The United States is focused on strengthening its economic ties with the DRC by increasing investment and trade partnerships. This involves expanding the presence of U.S. private sector firms and goods in the DRC market. Bilateral trade between the United States and the DRC amounted to around $332 million in 2022.

Your Next Step with DocShipper

Shipping goods between the US and the RDC complex and daunting? Let DocShipper simplify it for you. Our seasoned team can organize your transport, handle customs procedures, and guide you through every step. Bid farewell to confusion and hello to seamless shipping. Reach out to us today - we're here to make your international shipping tasks effortless.

Additional logistics services

Explore our additional logistics services! At DocShipper, we handle every step of your supply chain journey, ensuring seamless end-to-end solutions. Unlock unparalleled support beyond shipping and customs clearance.

Warehousing and storage

Struggling to find reliable warehousing in the US or RDC? Not all storage solutions are created equal - especially when temperature control matters for your goods. Don't leave it to luck. We've got you covered with dedicated options to suit every need.

Packaging and repackaging

Ensuring your goods reach RDC from the US intact is all about proficient packaging and repackaging. A reliable agent is crucial - imagine a fragile microchip securely cocooned in anti-static bubble wrap, or robust machinery safely encased in custom crating. With the right guidance, each product receives tailor-made treatment for a hassle-free shipping experience.

Cargo insurance

Transporting goods across the seas without insurance is like living in a wooden house with no fire insurance - risky! Our trusty Cargo Insurance shields you from unexpected financial setbacks, covering potential damages during all shipping stages. Picture dropping a treasured Ming vase - a far-fetched example, but in the shipping world, accidents happen. Be smart, equip yourself with our Cargo Insurance.

Supplier Management (Sourcing)

Struggling to source and manufacture products for your business ‘across the pond’? Fret not. At DocShipper, we make it easy for you. We'll find suppliers in Asia, East Europe, and beyond, handling every step of the procurement process for you. Our multilingual team breaks down language barriers, taking the guesswork out of global operations. No more hurdles, just streamlined success.

Personal effects shipping

Shipping personal effects from the US to RDC? Be it your grandmother's heirloom or an oversized couch, our team ensures they reach their new home safely and efficiently. We blend professionalism with the required flexibility for fragile or bulky objects, turning the challenge into a seamless process. Tap into our expertise and make your move stress-free.

Quality Control

Ensuring product quality before shipping from the US to RDC is crucial. Quality inspections can prevent costly returns, prolong product life, and protect your brand reputation. Picture shipping a batch of electronics, only to find they malfunction due to a missed quality check. Curtail such disasters with our pre-shipment quality control.

Product compliance services

Facing complex regulations? Our Product Compliance Services ensure your goods sail through destinations smoothly. We test in labs, certify, and ensure all-in-one compliance to every quirk and tweak of regulation out there. Like fitting a heavy machinery component into the EU market with its CE marking requirements, we've got it covered – no surprises.

FAQ | For 1st-time importers between US and RDC

What is the necessary paperwork during shipping between US and RDC?

For your shipping needs from the US to the Democratic Republic of Congo (RDC), certain paperwork is essential. We, at DocShipper, take care of the bill of lading for sea freight or the airway bill for air freight. You're merely required to supply the packing list and the commercial invoice. Depending on your goods, additional documents like Material Safety Data Sheets (MSDS) or certain certifications may be necessary. Thanks for trusting our services; we're here to make your international shipping experience as smooth as possible.

Do I need a customs broker while importing in RDC?

Absolutely, working with a customs broker while importing goods into RDC (Democratic Republic of Congo) can greatly streamline the process. Customs clearance is complex and requires specific documentation and processes that a broker will be familiar with. Furthermore, essential details need to be correctly provided to avoid any custom issues that could delay your shipment. As part of our service at DocShipper, we provide representation for your cargo through customs in most of our shipments. Our goal is to make international shipping simpler and more efficient for you, sparing you from potentially tricky customs complexities.

Can air freight be cheaper than sea freight between US and RDC?

Whether air freight is cheaper than sea freight between the US and RDC can depend greatly on factors such as route, weight, and volume. For example, if your cargo is less than 1.5 Cubic Meters or 300 kg (660 lbs), air freight may actually be a more economical choice. Here at DocShipper, we work to ensure you get the best deal for your needs. Our dedicated account executives analyze the specifics of your shipping requirements to provide the most cost-effective and efficient option for your business. Your satisfaction and business success is our top priority.

Do I need to pay insurance while importing my goods to RDC?

While insurance isn't compulsory for shipping goods, we at DocShipper strongly advise safeguarding your imports to the RDC. Many unforeseen incidents such as damage, loss, or theft can occur during transit. By insuring your goods, you add an extra layer of protection, ensuring you're covered financially if any mishap befalls your shipment. It's essentially a small investment for peace of mind and the safety of your cargo.

What is the cheapest way to ship to RDC from US?

Shipping to the Democratic Republic of Congo (RDC) from the US, we suggest sea freight for the best balance of cost and efficiency, especially for large shipments. Its slower speed might be an acceptable trade-off, given the significant savings. For smaller, lighter items, we'd recommend air freight. Always remember, each shipment is unique and specific factors can affect the cost. It's worth using our DocShipper Price Calculator for an accurate quote tailored to your specific needs.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF largely depends on your relationship with your supplier. It's important to note that suppliers might not be logistics professionals, hence allowing us at DocShipper to manage the international freight and destination procedures could be in your best interest. Typically, suppliers sell under EXW (picked up from their factory) or FOB (inclusive of local charges to the origin terminal). But, no matter the terms, we can extend our expertise in logistics to offer a comprehensive door-to-door service, and ensure your shipment reaches you hassle-free, regardless of your supplier's incoterm choice.

Goods have arrived at my port in RDC, how do I get them delivered to the final destination?

Sure thing! If your cargo is under CIF/CFR incoterms, you’ll require a custom broker or freight forwarder to clear goods, pay import charges, and facilitate delivery. However, DocShipper can handle the entire process for you under DAP incoterms. Please verify these specifics with your account executive to ensure a smooth delivery process from the port to your desired location.

Does your quotation include all cost?

Our quotation covers all costs except the duties and taxes at your destination. However, our dedicated account executives can estimate them for you. At DocShipper, we emphasize utter transparency, eliminating the potential for any hidden expenses that may cause unexpected surprises.