Freight Shipping between the US and Spain | Rates – Transit Times – Duties & Taxes

Did you hear the one about a shipping crate who walks into a bar? Neither did we, because shipping is a serious business, especially when it comes to freight transport between the US and Spain. International freight shipping includes several complexities like understanding rates, transit times, and navigating through customs regulations. This guide is designed for exactly that – to help you unlock the intricacies of different freight options that range from air, sea, road, and rail, shed light on customs clearance, duties, taxes, and offer expert advice specifically for businesses. If the process still feels overwhelming, let DocShipper handle it for you! With our end-to-end services, we turn those shipping challenges into success stories, making your journey across continents smooth and successful.

Which are the different modes of transportation between US and Spain?

Which are the different modes of transportation between US and Spain? Shipping products between the US and Spain? It's a bit like planning a long vacation. You've got to consider distance, time, and cost. Despite the Atlantic Ocean separating these countries, ocean freight and air freight are your reliable travel buddies. Each has their perks - ocean freight is your economical but slow, scenic route, while air freight is your ticket to fast, but pricier deliveries. The right choice? That's like picking between an action-packed city break or a relaxed beach holiday, it all depends on what suits your business the best. It's all about aligning with your specific shipping needs.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between US and Spain

Ocean shipping between the United States and Spain forms a critical artery of international trade, with cargo vessels frequently journeying between bustling ports such as New York, Houston, Barcelona, and Valencia. As the Catalonian capital, Barcelona, buzzes with electronics and Valencia pulsates with agriculture, sea freight offers a cost-effective way to transport bulky, high-volume goods across the Atlantic.

However, transatlantic shipping isn’t all plain sailing. From complex customs regulations to a labyrinthine logistics network, shippers and businesses often navigate choppy waters, stumbling over obstacles that can cost time and money. Luckily, the ocean of confusion can be simplified with the right knowledge, strategic planning, and adherence to industry best practices.

In this part of our guide, we dive deep into these potential pitfalls and deliver helpful tips on how to streamline your processes, avoid common mistakes, and ensure smooth sailing for your goods all the way from the US to Spain. With our tips, ocean shipping won’t have to feel like learning a foreign language. Instead, it’ll be as easy as a sea breeze.

Main shipping ports in US

Port of Los Angeles

Location and Volume: Situated in Southern California, the Port of Los Angeles is the busiest container port in the United States. Handling over 9 million TEUs annually, it’s known as the Gateway to the United States.

Key Trading Partners and Strategic Importance: Significant trading partners include China, Japan, Vietnam, South Korea, and Taiwan. The Port of LA’s strategic position on the West Coast allows for effective Pacific trade.

Context for Businesses: If you’re aiming to expand your Asia-Pacific trade, the Port of Los Angeles, with its heavy Asia-Pacific shipping traffic and comprehensive infrastructure, might be core to your shipping strategy.

Port of Long Beach

Location and Volume: Located adjacent to the Port of LA, the Port of Long Beach handles about 8 million TEUs annually. The port’s trade value annually approximates $180 billion.

Key Trading Partners and Strategic Importance: The Port of Long Beach has high significance in trans-Pacific trade, with main trading partners including China, South Korea, Japan, Vietnam, and Taiwan.

Context for Businesses: As second in terms of volume after Los Angeles, planning your import/export endeavours to/from Asia through the Port of Long Beach might strengthen your logistics strategy.

Port of New York and New Jersey

Location and Volume: Situated on the East Coast, this bi-state-run port manages approximately 7 million TEUs annually, standing as the largest port on the East Coast.

Key Trading Partners and Strategic Importance: Key trading partners mostly include China, India, Germany, Italy, and Brazil. The port holds significant importance for transatlantic and South American trade lanes.

Context for Businesses: If your target markets are in Europe or South America, the Port of New York and New Jersey can be integral to your logistics network due to its strategic positioning.

Main shipping ports in US

Port of Los Angeles

Location and Volume: Situated in Southern California, the Port of Los Angeles is the busiest container port in the United States. Handling over 9 million TEUs annually, it’s known as the Gateway to the United States.

Key Trading Partners and Strategic Importance: Significant trading partners include China, Japan, Vietnam, South Korea, and Taiwan. The Port of LA’s strategic position on the West Coast allows for effective Pacific trade.

Context for Businesses: If you’re aiming to expand your Asia-Pacific trade, the Port of Los Angeles, with its heavy Asia-Pacific shipping traffic and comprehensive infrastructure, might be core to your shipping strategy.

Port of Long Beach

Location and Volume: Located adjacent to the Port of LA, the Port of Long Beach handles about 8 million TEUs annually. The port’s trade value annually approximates $180 billion.

Key Trading Partners and Strategic Importance: The Port of Long Beach has high significance in trans-Pacific trade, with main trading partners including China, South Korea, Japan, Vietnam, and Taiwan.

Context for Businesses: As second in terms of volume after Los Angeles, planning your import/export endeavours to/from Asia through the Port of Long Beach might strengthen your logistics strategy.

Port of New York and New Jersey

Location and Volume: Situated on the East Coast, this bi-state-run port manages approximately 7 million TEUs annually, standing as the largest port on the East Coast.

Key Trading Partners and Strategic Importance: Key trading partners mostly include China, India, Germany, Italy, and Brazil. The port holds significant importance for transatlantic and South American trade lanes.

Context for Businesses: If your target markets are in Europe or South America, the Port of New York and New Jersey can be integral to your logistics network due to its strategic positioning.

Main shipping ports in Spain

Port of Barcelona

Location and Volume: Located on the northeastern coast of Spain, the Port of Barcelona is an essential hub for Mediterranean and European trade, with a shipping volume of around 3 million TEU.

Key Trading Partners and Strategic Importance: The Port of Barcelona maintains strong trading partnerships with destinations all over the world, including key European countries, North America, and Asia. It’s identified as the best Europort for connecting Mediterranean arch routes and Atlantic arch lanes.

Context for Businesses: If you’re looking to extend your reach to Mediterranean or European markets, the Port of Barcelona could become a sizeable aspect of your logistics, thanks to its excellent connectivity and the ability to handle large volumes.

Port of Valencia

Location and Volume: Situated on the eastern coast of Spain, the Port of Valencia plays a significant role in domestic and international trade, with a shipping volume standing at over 5 million TEU.

Key Trading Partners and Strategic Importance: Specializing in container transport, the Port of Valencia has key trading partners in South America, North Africa, and the rest of Europe. It’s considered the leading Mediterranean port in terms of container traffic.

Context for Businesses: If your business is involved in containerized cargo, the Port of Valencia is a good choice due to its capacity, efficiency, and extensive trading connections.

Port of Algeciras Bay

Location and Volume: The Port of Algeciras Bay is located in the Strait of Gibraltar, positioning it strategically for international trade. It facilitates a substantial shipping volume exceeding 5 million TEU.

Key Trading Partners and Strategic Importance: This port has a global reach, with Africa, America, and Asia as key trading partners. The Port of Algeciras Bay is strategically important for transshipment activities.

Context for Businesses: Given its excellent transshipment facilities and strategic location, the Port of Algeciras Bay is ideal for businesses with high transshipment needs or target markets across several continents.

Port of Bilbao

Location and Volume: Situated in the north of Spain, Port of Bilbao is a versatile location accommodating a sizable variety of goods. Its shipping volumes reach approximately 1 million TEU.

Key Trading Partners and Strategic Importance: The port has key relations with countries in Northern Europe, America, and Asia, alongside possessing a major role in the Bay of Biscay.

Context for Businesses: If you deal with diverse types of cargo and require versatile port services, the Port of Bilbao might be an integral part of your shipping strategy, due to its versatility and wide-ranging services.

Port of Las Palmas

Location and Volume: Approximately 2 million TEU pass through the Port of Las Palmas, which is strategically located in the Canary Islands.

Key Trading Partners and Strategic Importance: The port’s key trading partners largely lie in West Africa, Europe, and North America. It’s recognized as a major hub for refueling and supplying ships.

Context for Businesses: If your business requires frequent refueling or ship supply services, the Port of Las Palmas could form a key part of your logistical arrangements due to its top-notch facilities.

Should I choose FCL or LCL when shipping between US and Spain?

When shipping goods from the US to Spain, your choice between full container load (FCL) and less than container load (LCL) can be a game-changer. This pivotal decision influences cost, delivery time, and ultimately, your business’s bottom line. With LCL, you share space and cost. With FCL, you enjoy space exclusivity but at a higher price. Let’s dive in to understand how to make the choice that perfectly matches your shipping needs.

Full container load (FCL)

Definition: FCL or Full Container Load shipping refers to when a whole shipping container is exclusively used for shipping your goods.

When to Use: FCL is the ideal choice when your cargo volume goes beyond 13/14/15 CBM. Not only do you get a cost advantage, but there's an added safety element as your FCL container remains sealed from the origin to destination, mitigating the risk of damage during transit.

Example: Consider a furniture company transporting bulky items like sofas and beds from the US to Spain. Owing to the high volume, using FCL offers a more affordable and safer shipping choice.

Cost Implications: For FCL shipping, you pay for the entire 20'ft or 40'ft container, not the weight of the cargo. Thus, the more volume your goods take up, the cheaper your FCL shipping quote per unit will be. By reaching out to your freight forwarder for an FCL shipping quote, you can gauge the cost-effectiveness of choosing FCL over LCL, based on your shipment size.

Less container load (LCL)

Definition: LCL, or Less than Container Load, is a shipping method that consolidates goods from multiple shippers into a single container. An LCL shipment is optimal for modest freight volumes, as you only pay for the space your goods occupy.

When to Use: LCL freight is a more flexible and cost-effective solution when shipping less significant quantities of goods. When your cargo is less than around 15 cubic meters (CBM), LCL is likely your best option.

Example: For instance, if you're a craft beer manufacturer in the US looking to break into the Spanish market with a small initial supply of 10 CBM, LCL shipment would be ideal. You only pay for that 10 CBM, not an entire container.

Cost Implications: As LCL freight allows you to ship smaller quantities, you end up saving considerable costs. However, keep in mind that the consolidation and deconsolidation processes at both origin and destination ports incurs fees. While these additional costs may dilute the savings for larger shipments, for sub-15 CBM consignments, LCL remains the economical option.

Hassle-free shipping

Navigating international shipping can be complex. Make it easier with DocShipper, your reliable freight forwarder. Our team, specializing in ocean freight, can help determine the best choice between consolidation and full container shipping for your US-Spain route. We look at factors like your budget, cargo volume, time constraints, and specific requirements. Ready to simplify your shipping? Reach out to us for a hassle-free experience and a free cost estimation.

In general, sea freight from the US to Spain could take around 20 to 35 days. These transit times depend on various factors such as the specific ports of loading and offloading, the weight, and the type of goods being shipped. For a precise and tailored quote best suited to your individual business needs, it is recommended to consult with a freight forwarder like DocShipper.

Let’s now dive into the transit times from major ports in these two countries. Here is a quick overview:

| US Ports | Spanish Ports | Average Transit Time (Days) |

| Port of Los Angeles | Port of Barcelona | 30 |

| Port of Long Beach | Port of Valencia | 30 |

| Port of New York & New Jersey | Port of Bilbao | 25 |

| Port of Savannah | Port of Algeciras | 25 |

Note that the above are approximate figures, and actual transit times may vary. Contact DocShipper for the most accurate information.

How much does it cost to ship a container between US and Spain?

Deciphering the cost to ship a container between the US and Spain can feel like a labyrinth, and it’s essential to know that rates can greatly fluctuate. Costs per CBM can range widely, influenced by factors such as Point of Loading, Point of Destination, your chosen carrier, nature of goods, and the ever-changing ocean freight rates due to market fluctuations. But fear not! You aren’t alone in this journey. Our shipping specialists thrive in complexity and are experts in tailoring the best shipping cost for you, quoting on a case-by-case basis. Your business, after all, deserves nothing less than a finely tuned, cost-effective approach to shipping.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is a special type of container designed to carry out of gauge cargo which is too large to fit into standard containers.

Suitable for: Oversized items such as machinery, industrial parts, and large construction materials.

Examples: Large construction equipment like cranes, industrial generators, wind turbine propellers.

Why it might be the best choice for you: If your cargo is too wide, tall, or long for standard containers, going with an OOG container allows you to ship without disassembling large pieces, reducing the risk of damage and additional handling costs.

Break Bulk

Definition: Break bulk refers to goods shipped in packages, bags or boxes, and not contained within a shipping container.

Suitable for: Various types of goods, including machinery, steel products, construction equipment, and grains.

Examples: Bagged cement or grains, boxed auto parts, machinery pieces.

Why it might be the best choice for you: Break bulk can offer more flexibility for loose cargo loads, making it the preferred method for goods that are difficult to partition into individual containers or don’t suit a continuous container load.

Dry Bulk

Definition: Dry bulk shipping involves the transport of unpackaged bulk cargo, like grain, coal or fertilizer, in large quantities in the cargo holds of a ship.

Suitable for: Commodities in large quantities, such as sand, cement, coal, grains, and other similar products.

Examples: A shipment of grain from a farm supplier or a large quantity of coal for an energy company.

Why it might be the best choice for you: The economic efficiency of dry bulk shipping is unmatched when moving extremely large quantities of material goods that don’t need packaging.

Roll-on/Roll-off (Ro-Ro)

Definition: The Ro-Ro method involves cargo that is driven on and off a ro-ro vessel. It is simplified shipping for self-propelled, wheeled or tracked vehicles.

Suitable for: Various types of vehicles, heavy equipment and machinery.

Examples: Automobiles, trucks, semi-trailer trucks, trailers, rail cars.

Why it might be the best choice for you: If you’re shipping self-propelled or wheeled items, the Ro-Ro option simplifies the handling process, reducing the risk of damage and making cargo easier to track.

Reefer Containers

Definition: Reefer containers are temperature-controlled shipping units that maintain a chosen temperature range, perfect for perishables.

Suitable for: Perishable items like fruits, vegetables, dairy products and also non-food items like flowers, pharmaceuticals and chemicals.

Examples: Shipping fresh produce from Florida, transporting pharmaceutical products from a factory.

Why it might be the best choice for you: If your products are sensitive to temperature and need cold, freezer or even warm temperature control during transport, reefers are the ideal match for your shipping needs.

Every shipping scenario is unique, and finding the best solution for your cargo needs can be a challenging task. Luckily, the DocShipper team is ready to guide you through each step of your sea freight shipping process from the US to Spain. Contact us today and receive a free shipping quote within less than 24 hours!

Air freight between US and Spain

Air freight between the US and Spain gives your business the competitive edge of speed and consistency. Imagine sending premium olive oil from Spain to gourmet restaurants in New York, or shipping high-tech gadgets from Silicon Valley to trendy Barcelona shops – air freight ensures they reach swiftly and safely. This method is like your fleet-footed courier for smaller, high-value goods, making it a cost-effective choice.

Unfortunately, many companies slip on the banana peel of complications. Underestimating the ‘chargeable weight’ of their goods, they balloon their costs. Without proper knowledge about best shipping practices, they might as well throw their money into the windy skies. In this guide, we’ll help you avoid those costly missteps and fly high with your air freight!

Air Cargo vs Express Air Freight: How should I ship?

Puzzling over whether to slot your goods into a commercial airline’s scheduled cargo flight or to feel the wind beneath your wings with a dedicated express freight plane to move your goods from the US to Spain? Air cargo offers spacious room but ties you to the airline’s itinerary while express freight zips across the skies on its own schedule, delivering your goods pronto. Let’s weigh these options to meet your business’s specific shipping needs.

Should I choose Air Cargo between US and Spain?

When shipping goods between the US and Spain, air cargo is a smart choice for reliability and cost-effectiveness, especially for shipments over 100/150kg (220/330 lbs). Key players in this arena include American Airlines and Iberia. Despite the slightly longer transit times, these airlines provide a predictable schedule that can seamlessly fit your business needs. American Airlines runs a comprehensive cargo network. Similarly, Iberia offers robust freight services . Keep air cargo in your shipping mix; it may pave the way for a balanced budget and reliable delivery.

Should I choose Express Air Freight between US and Spain?

If you’re planning a shipment that’s under 1 CBM or weighing in the ballpark of 100-150 kg (220/330 lbs), express air freight could be the perfect match for you. This specialized service swiftly transports goods through dedicated cargo planes without any passengers. Think playmakers like FedEx, UPS, or DHL. Partner with such household names and you’ll enjoy superior speed, tracking transparency, and hassle-free customs clearance. Ideal for urgent or high-value shipments, express air freight puts express in every sense of the word.

Main international airports in US

Los Angeles International Airport (LAX)

Cargo Volume: With over 2 million metric tons of cargo handled annually, LAX ranks 10th in the world for cargo volume.

Key Trading Partners: Major trading partners include China, Japan, Australia, South Korea, and New Zealand.

Strategic Importance: LAX’s location on the Pacific coast makes it a strategic hub for freight coming from or going to the Asia Pacific region.

Notable Features: Dedicated cargo facilities accommodating express couriers to large freight shipments, with advanced handling systems and around-the-clock operations.

For Your Business: If your shipping strategy involves frequent exchanges with Asia-Pacific markets, then LAX’s high cargo capacity and strategic location may streamline your operations and reduce transit times.

Chicago O’Hare International Airport (ORD)

Cargo Volume: Annually, ORD handles nearly 1.8 million metric tons of cargo.

Key Trading Partners: Europe, Asia, and South America comprise the most significant trading partners.

Strategic Importance: As a central US hub, ORD is uniquely positioned for domestic and international freight, especially advantageous for transatlantic and Latin American trade routes.

Notable Features: An expansive cargo area facilitating multiple large aircraft simultaneously, 24-hour cargo operations, and a dedicated Cargo Development Program.

For Your Business: If your trade routes run through Europe or South America, ORD’s position and vast cargo capabilities can greatly improve your shipping efficiency.

Miami International Airport (MIA)

Cargo Volume: MIA deals with over 2.3 million tons of cargo each year.

Key Trading Partners: Mainly Latin American and European countries.

Strategic Importance: MIA acts as a significant gateway between North and South America, playing a crucial role in international freight.

Notable Features: ‘Cargo City’ is MIA’s expansive facility for handling all types of cargo, from perishables to high-value items.

For Your Business: If your business manages substantial trade with Latin American countries, MIA’s impressive cargo handling abilities and geographic position could optimize your shipping strategy.

Mercer Airport (GCK)

Cargo Volume: While not as voluminous as others, GCK nevertheless handles an essential cargo operation as UPS’s primary Mid-America Hub.

Key Trading Partners: Predominantly domestic routes within the USA.

Strategic Importance: As UPS’s main hub, GCK is an integral part of US domestic air freight transport, positioned centrally in the nation.

Notable Features: Specialized UPS facilities that manage a substantial number of daily flights.

For Your Business: If your shipping requirements are mainly domestic within the USA, you may benefit significantly from GCK’s strong connection with UPS operations.

Ted Stevens Anchorage International Airport (ANC)

Cargo Volume: While handling around 2.8 million metric tons annually, ANC ranks as the world’s fifth busiest cargo airport.

Key Trading Partners: Asia and the USA are the primary trading partners.

Strategic Importance: ANC is a critical midway point for trans-Pacific cargo flights, reducing trip lengths and fuel consumption.

Notable Features: Rapid cargo transfer and round-the-clock operations plus expansive cold storage facilities.

For Your Business: If your business is heavily involved in trans-Pacific routes, ANC’s strategic location can offer substantial savings in fuel costs and transit times.

Main international airports in Spain

Madrid-Barajas Adolfo Suárez Airport

Cargo Volume: Madrid-Barajas handles over 546,000 tons of cargo annually.

Key Trading Partners: The primary trading partners are European Union countries, Latin America, the US, China, and UAE.

Strategic Importance: With its central location, Madrid-Barajas serves as the main connection point between Europe and Latin America.

Notable Features: It’s the largest and busiest airport in Spain, with four active terminals and two parallel runways.

For Your Business: If your company’s trading focus is between Europe and Latin America, Madrid-Barajas would be a key hub to consider for your logistic needs.

Barcelona El Prat Airport

Cargo Volume: Barcelona-El Prat manages over 177,000 tons of cargo annually.

Key Trading Partners: Key partners involve EU countries, Middle East, US, and Asia.

Strategic Importance: Being in Catalonia, Barcelona-El Prat enables easy access to the Mediterranean coastal areas and southern Europe.

Notable Features: It has two large terminal buildings and has been recognized for its efficient air cargo operation processes.

For Your Business: If your business operations involve southern European countries or the Mediterranean, then Barcelona-El Prat could offer you efficient cargo handling and access.

Zaragoza Airport

Cargo Volume: Zaragoza handles approximately 181,000 tons of cargo each year.

Key Trading Partners: Zaragoza airport engages primarily with EU countries, Asia, and the Americas.

Strategic Importance: Zaragoza is a major logistics hub within Spain due to its central location and extensive cargo facilities.

Notable Features: It hosts large freight forwarders and has impressive infrastructure for cargo such as a vast cargo terminal and cargo aprons.

For Your Business: The extensive cargo facilities at Zaragoza would facilitate your business in handling large cargo volumes effectively.

Vitoria Airport

Cargo Volume: Vitoria manages more than 52,000 tons of cargo yearly.

Key Trading Partners: The primary partners are EU member countries, Asia, and North America.

Strategic Importance: Despite its smaller size, Vitoria is significant due to its strategic location in the Basque Country, a major industrial region of Spain.

Notable Features: It’s recognized for efficient processing operations and its capacity for oversized cargo.

For Your Business: Its location in a key industrial region could make Vitoria an important distribution point for your business, especially if you have oversized cargo.

Valencia Airport

Cargo Volume: Valencia Airport can manage around 16,000 tons of cargo each year.

Key Trading Partners: Main trading partners involve EU countries, besides Marshall Islands, Qatar, UAE, and the US.

Strategic Importance: Valencia’s value lies in its proximity to the country’s eastern seaboard and its established road network to Western Europe.

Notable Features: It is known for easy integration with other transport methods, and it operates a separate cargo terminal.

For Your Business: Valencia’s integration with other transport methods might allow your business to benefit from multimodal shipping options and efficient distribution to Western Europe.

How long does air freight take between US and Spain?

Shipping from the United States to Spain by air freight typically takes between 1-3 days. However, it’s crucial to note that the exact transit time can fluctuate due to several factors. These include the specific airports involved, the weight of your consignment, and the type of goods you’re shipping. For accurate and personalized transit details, turn to a trusted freight forwarder like DocShipper.

How much does it cost to ship a parcel between US and Spain with air freight?

Estimating a broad average, air freight between the US and Spain may range between $3 to $7 per kg. However, numerous factors influence the exact cost, including departure and arrival airport proximity, parcel dimensions, weight, and goods’ nature. Therefore, precise pricing is case-specific. Don’t let this deter you. Our dedicated team collaborates with you to ensure we deliver the best rate tailored to your specific needs. Contact us and receive a free quote in less than 24 hours.

What is the difference between volumetric and gross weight?

Gross weight refers to the physical weight of your shipment, including the packaging and pallets. On the other hand, volumetric weight is a calculation method indicating the amount of space your shipment requires.

To calculate the gross weight in air freight, simply weigh your shipment including all of its packaging materials. For instance, your shipment might weigh 200 kg or 440 lbs.

For volumetric weight, first measure the dimensions of your shipment. Multiply the length, width, and height (in centimeters). Then, divide the result by 6000 in Air cargo service, whereas in Express Air Freight service divide by 5000.

For example, let’s say your shipment measures 100 cm x 100 cm x 100 cm. In Air cargo, the volumetric weight is: (100 x 100 x 100) / 6000 = 166.67 kg or 367.42 lbs. However, for Express Air Freight it’s (100 x 100 x 100) / 5000 = 200 kg or 440 lbs.

These calculations are critically important because freight charges are based on the higher of the two weights. This ensures carriers are paid either for the actual weight or for the space the parcel occupies.

Door to door between US and Spain

Understanding Door to Door shipping is crucial for businesses planning to transport goods between the US and Spain. Essentially, it’s a comprehensive service that handles the entire shipping process from pick-up to delivery, offering peace of mind with fewer responsibilities. In this case, it simplifies complexities and speeds up the shipping process. Ready to unravel the mystery of Door to Door shipping? Let’s dive in!

Overview – Door to Door

If you’re looking to simplify shipping from the US to Spain, our door-to-door service may be your best bet. Covering all crucial logistics stages, it eliminates hassles, allowing you to focus on growing your business. Though slightly pricier than other options, its stress-free nature outweighs this—no fretting about customs procedures, different transportation modes, or multiple providers. A client-favorite at DocShipper, it sidesteps complex shipping intricacies, ensuring your cargo’s journey is smooth every step of the way. Practicality merged with efficiency, just what your business needs.

Why should I use a Door to Door service between US and Spain?

Picture this: shipping goods from the US to Spain feels as simple as booking a pizza delivery. Sounds absurd, right? But with Door to Door service, this is no laughing matter. Let’s dive into the top five reasons why it’s your best shot.

1. De-Stress Your Business: Ever felt like a juggler handling countless shipping tasks? With this service, the operator picks your goods right from your location (yes, even if it’s a warehouse full of barbecued chips), handles all the paperwork and gets them to the destination. Your juggling days are over.

2. Timely Deliveries: Sandwiched between pressing schedules and urgent international shipments? Door to Door ensures that your cargo is not just another fish in the ocean. It prioritizes your shipments to meet your business needs. So, remember that important delivery you needed yesterday? Consider it done.

3. Special Care for Complex Cargo: Every cargo is a unique snowflake and some require extra care. Whether it’s fragile art or temperature-sensitive medical supplies, this service ensures your cargo is handled with kid gloves all the way to Spain.

4. Convenience is the Key: The whole process, from trucking in the US to managing customs in Spain, is taken care of. Forget the countless coffee cups while tracking your shipments. Just sit back, relax, and get notified when the delivery reaches its destination.

5. Cost Efficiency: Lastly, but equally essential, is the cost. With this service, you pay an upfront fee, eliminating any surprise costs along the way. So, you can keep your budget intact and your finance department very happy.

Simply put, Door to Door offers a seamless shipping experience from pickup to drop-off, rolling out the red carpet for your cargo all the way to Spain.

DocShipper – Door to Door specialist between US and Spain

Experience seamless door-to-door shipping from the U.S. to Spain with DocShipper. Our comprehensive service handles everything – packing, transport, customs clearance, for all shipping modes. You don’t need to lift a finger! Our proficient team, backed by years of logistics expertise, ensures a hassle-free experience. Plus, a dedicated Account Executive stands ready to assist you. Reach out to us for a free and swift estimate within 24 hours or consult with our experts at no cost. Enjoy stress-free shipping from start to finish with DocShipper!

Customs clearance in Spain for goods imported from US

Venturing into the world of customs clearance, particularly in Spain for goods imported from the US, can feel like navigating a maze. This process is multifaceted and intricate, with the potential to ensnare the unwary in a web of unexpected fees and charges. Given the high stakes, understanding customs duties, taxes, quotas, and licenses is critical to avoid your goods getting stuck in customs. We’re here to demystify these complexities on your behalf. In the forthcoming sections, we’ll delve deeper into these areas and unravel the process. Remember, DocShipper is your partner in this journey, ready to assist with all types of goods, worldwide. Considering an estimate for your project? Just provide your goods’ origin, value, and HS Code. This essential trio will pave the way for an accurate project budget.

How to calculate duties & taxes when importing from US to Spain?

Determining duties and taxes when importing goods from the US to Spain requires careful consideration of a number of key details. To make an accurate estimate, you’ll need to identify information like the country of origin, the HS (Harmonized System) Code applicable to your goods, their Customs Value, the Applicable Tariff Rate, and any other taxes or fees that may uniquely apply to your product line.

To start, the first piece of the puzzle is pinpointing the country where the goods were actually manufactured or produced – this is referred to as the country of origin. It’s a critical detail as it influences both the classification of your goods and the duty rates that will be applicable to them.

Step 1 – Identify the Country of Origin

First and foremost, the Country of Origin is vital for five key reasons you can’t skip. The primary reason is trade agreements between countries significantly impact customs duties. Take the US and Spain, for instance. They are both part of the World Trade Organization (WTO), ensuring smoother and cheaper trade processes.

Second, import restrictions differ from one country to another. Spain may impose limitations on some goods from external countries, even from the US. You’ll want to be in the know to avoid an unexpected hiccup.

Next up, certain tax treaties, like Double Taxation Treaties, may be applicable. These treaties help prevent you, the importer, from being taxed twice.

Understanding the Country of Origin also assists with correct HS code identification, a vital tool in predicting your cost.

Lastly, regulations change, and being unaware isn’t an acceptable excuse with customs officials.

So, before you dive into the HS Code, make sure you identify the Country of Origin clearly. This knowledge saves you time, money, and potential headaches down the line, making your business more efficient and predictable. Enjoy smoother sailing on your global ventures!

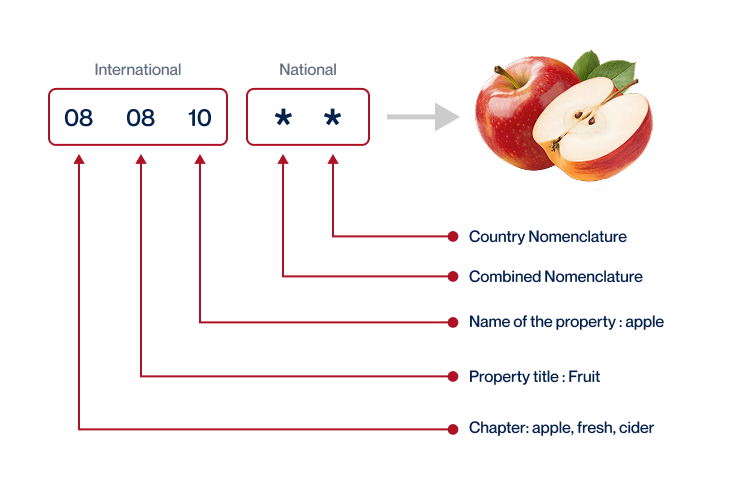

Step 2 – Find the HS Code of your product

Understanding the Harmonized System (HS) code of your product is crucial for global trade operations. The HS Code, or Harmonized Commodity Description and Coding System, is a universal economic language and code for goods, recognized and used by more than 200 countries. It plays a significant role in determining customs duties, taxes, and other import regulations.

Finding the HS code of your product is easier than it might seem. Your first point of contact should be the supplier of the goods. They’re well-versed with the product they’re providing and familiar with related import regulations, including the correct HS code.

But if reaching out to the supplier isn’t an option or doesn’t provide conclusive information, worry not. There’s a simple step by step process you can follow to identify it yourself.

Your starting point would be using an HS lookup tool such as the Harmonized Tariff Schedule. This tool allows you to search for your product with just the name. Once you put in your search, check the Heading/Subheading column to discover the HS code corresponding to your product.

It’s crucial to stress the importance of accuracy when determining the HS code. A key note to remember is that a mistake in the code can result in not only shipment delays but potential fines as well. Therefore, it’s always best to verify by cross-referencing to avoid any possible issues in the future.

Here’s an infographic showing you how to read an HS code. This visual tool simplifies understanding and ensures precise application, helping to navigate the complexities of international shipping.

Step 3 – Calculate the Customs Value

Diving into customs can be perplexing, so let’s break it down, starting with the customs value. It’s not merely the price tag you see on your product. The customs value is the CIF value- an amalgamation of the Cost of the goods, Insurance, and Freight.

Imagine your supplier charges you $1000 for the goods from the US. To this, you add transportation cost (let’s say $200), and insurance fees (let’s say $50). Your CIF, hence your customs value, becomes $1250, and not just $1000.

This could be a misstep that’s easy to make when diving into international trade, but knowing the correct calculations will save you from unexpected costs and delays. It’s all about having a clear understanding to swim rather than sink in the sea of global trade.

Step 4 – Figure out the applicable Import Tariff

Import tariffs, in simple terms, are taxes on imported goods, and they serve to protect domestic industries and maintain economic balance. In Spain, which is part of the European Union, a Common Customs Tariff (CCT) is applied. To ascertain the specific import tariff for your goods, you need the Harmonized System (HS) code for your product, and you can use the TARIC System – European Customs.

For instance, let’s imagine you’re importing bicycles with the HS code 8712.00. This should be entered into the TARIC tool, with ‘United States’ selected as the country of origin. The system will furnish you with the valid duties and taxes.

Next, we’ll compute the import duties. Assuming a CIF (Cost, Insurance, Freight) of $2000 for the bicycles, and the tool lists an import tariff of 14%. Your import duties would be $2000 0.14 = $280.

Remember, understanding tariff codes can be tricky, but it’s a vital step to ensure smooth and cost-effective shipping. After identifying the correct tariff, the door is open to a world of efficient international trade. Keep your codes and calculations in order, and the process will become straightforward and manageable.

Step 5 – Consider other Import Duties and Taxes

When importing goods from the U.S. to Spain, additional import duties and taxes may be applied depending on the product’s nature and country of origin. For instance, excise duty may be levied on specific goods like alcohol, tobacco, or energy products. Similarly, anti-dumping duties could apply if your goods are sold at less than their normal value, potentially harming European Union industries.

Perhaps most crucial is the Value Added Tax (VAT). For Spain, the general VAT rate is usually around 21%. It’s calculated on the sum of the assessable import value and the amount of duty payable. Here’s a simplified formula for better understanding: (Assessable Value + Duty) x VAT rate (%).

Remember, these are just examples – ensure you consult a logistics or custom expert for the accurate rates applicable to your products. By being aware of these potential additional costs, you can budget more accurately and avoid unexpected expenses, making your importing process smoother and more predictable.

Step 6 – Calculate the Customs Duties

Calculating customs duties for goods imported into Spain from the US involves three main elements: the customs value of the goods, VAT, and possible anti-dumping taxes and Excise Duty. Let’s run through three examples and see how each affects your total customs duty.

Example 1: Say you’re importing goods with a customs value of $10,000, and the duty rate is 10%. Without VAT, your customs duties will be $1,000.

Example 2: If you’re shipping goods valued at $20,000, with a customs duty rate of 5% and a VAT rate of 20%, your total customs charges will be $1,000 (duty) plus $4,200 (VAT), thus, a total of $5,200.

Example 3: Importing $30,000 worth of goods, with a 10% duty rate, 20% VAT, 10% anti-dumping tax, and a 5% Excise Duty, will lead to $3,000 (duty), $6,600 (VAT), $3,000 (anti-dumping tax), and $1,500 (Excise Duty), totalling to $14,100.

Remember, the formula to calculate customs duties is Customs Value x Duty rate + VAT + Anti Dumping tax + Excise Duty.

Having troubles in aligning all this? Allow DocShipper to assist. We provide comprehensive customs clearance services globally, ensuring minimal charges. Get a free quote within 24 hours, taking the guesswork out of your global shipping needs.

Does DocShipper charge customs fees?

While DocShipper serves as a customs broker in the US and Spain, it’s crucial to note we don’t charge customs duties. Our role involves charging customs clearance fees, while customs duties and taxes go straight to the government. Consider the fees we charge as payment for navigating the bureaucracy on your behalf! You’ll receive documents from the customs office as evidence of this separation, proving you only paid exact government charges. It’s like eating at a restaurant – you pay for the food (duties), and also for the service of cooking and serving it (clearance fees).

Contact Details for Customs Authorities

US Customs

Spain Customs

Official name: Spanish Department of Customs and Special Taxes Official website: https://www.agenciatributaria.es/

Required documents for customs clearance

Tangled in a paper trail during customs clearance processes? Understanding key documents like the Bill of Lading, Packing List, Certificate of Origin, or Documents of Conformity (CE standard) can turn the tide in your favor. Let’s simplify the paperwork complexities to keep your shipment smooth and hassle-free.

Bill of Lading

Navigating customs clearance between the US and Spain? The Bill of Lading is your best friend here. It’s an official document marking the transfer of ownership from the shipper to the receiver the moment your goods start their overseas journey. Stuck with paper bills? You might want to consider a ‘telex’ release – the digital version of the Bill of Lading. It streamlines your shipping process, saving you time and keeping you clear of physical paperwork hassles. For air cargo, the equivalent is the AWB (Air Waybill). An insider tip: double-check all details in these documents – even the smallest error could mean a delayed shipment and added costs. So get it right, get it tight!

Packing List

When shipping goods from the US to Spain, it’s essential to provide an accurate Packing List. This document is a comprehensive inventory of your shipment’s content, disclosing important details like weights, measurements, and descriptions of items. Suppose you’re a Tampa-based toy manufacturer shipping your best-selling teddy bears to a store in Barcelona. Your Packing List should include everything from each bear’s individual weight to the total number of boxes. It’s like your shipment’s ID card, crucial across sea or air freights. Missteps in this form could result in shipping delays, extra costs, or even rejected packages. So remember: taking time to fill out your Packing List accurately is investing in a smoother shipping experience.

Commercial Invoice

When shipping goods between the US and Spain, your Commercial Invoice is a key player. It’s the customs’ tell-all about your shipment – the what, where, why, and how much. A well-prepared Commercial Invoice should provide clear details about the buyer, seller, description of goods, and their total value. And remember, value here is not just about the dollar bill, but also includes charges such as freight and insurance. Need a tip? Ensure your Commercial Invoice aligns with other shipping documents like the Packing List. Misaligned info can trigger delays in customs clearance. So next time, take a moment with your Commercial Invoice, it might be your ticket to a smother, speedier shipment delivery.

Certificate of Origin

Navigating the customs maze between the US and Spain? A Certificate of Origin (CoO) could be your secret weapon. Often overlooked, this document verifies the country where your goods were wholly obtained, produced, manufactured, or processed. For instance, imagine your business is shipping Valencia oranges cultivated in Spain. Your CoO will confirm their Spanish origin. But here’s the kicker – this certificate can potentially unlock preferential customs duty rates, reducing your shipping costs significantly. Remember, every coin saved in logistics is a coin earned for your business. So, don’t forget to consider the CoO – it’s worth its weight in gold.

Certificate of Conformity (CE standard)

The Certificate of Conformity, or CE marking, is your golden ticket when shipping goods from the US to Spain, a member of the European Union. This isn’t a quality assurance claim but rather proof that your product complies with essential EU health, safety, and environmental legislation. Think of it like the FDA’s stamp of approval, verifying safety for consumers. Without it, you’ll hit obstacles during Spanish customs clearance. Be proactive: integrate CE certification into your product development process. This way, your cargo sails smoothly into Spanish ports, avoiding costly hold-ups. It’s your surefire way to stay competitive in the lucrative EU market where safety regulation compliance is non-negotiable.

Your EORI number (Economic Operator Registration Identification)

Delivering goods from the US to Spain? There’s a key ingredient you need: an EORI number. This identifier is essentially your passport for the world of international commerce. Without one, your products won’t clear EU customs. That’s because it’s used to trace every import and export transaction within the EU, along with several other countries. Registering for an EORI number isn’t a daunting task though – it’s as simple as applying via the local customs authority’s website. Note that each EORI number is unique to the business or individual, giving a clear, one-to-one tracking map for shipments. So, remember, if you’re planning on pushing products across the pond, securing an EORI number is a must.

Get Started with DocShipper

Prohibited and Restricted items when importing into Spain

Shipping goods to Spain can feel like a maze when taken aback by unexpected restrictions or prohibitions. Save yourself the unwelcome surprises and expenses by knowing what’s off-limits before your shipment heads to Spanish shores. Let’s talk about what you can’t, or must take extra steps to, import.

Are there any trade agreements between US and Spain

Indeed, while the United States and Spain don’t have a direct Free Trade Agreement, both are part of the World Trade Organization, promoting liberalized trade between them. Ongoing discussions aim to enhance the Transatlantic Trade and Investment Partnership, providing future opportunities for affordable and efficient goods shipment. So, for your international shipping needs, carefully consider these prevailing trade conditions, they might bring significant savings and easier business operations. Stay tuned for infrastructure upgrades too, they’re always a signal for future growth.

US – Spain trade and economic relationship

The US-Spain trade and economic relationship, initiated in the late 18th century, has been one of continual growth. As of 2024, Spain remains the US’s 16th largest trade partner with over $35.6 billion in two-way trade. Key sectors include agriculture, automobiles, and manufacturing, with major commodities such as fruits, meats, machinery, and vehicles leading the exchange. Spanish investment in the US is significant, totaling around $82.3 billion in 2024, which supports sectors like renewable energy and banking. The steady growth in ongoing trade relations highlights ample opportunities for shipping goods between the US and Spain. The data points above underscore the vitality of this trade bond, which continues to flourish across centuries. Businesses engaging in this growing trade stream can look forward to a promising horizon

Your first steps with DocShipper

Additional logistics services

Warehousing

Finding the right warehousing solution can be a real headache, especially when handling goods that require specific storage conditions, like temperature control. A reliable partner can make all the difference - ensuring your shipments remain in optimum condition while stored. Need more details? Check out our full range of services on our dedicated page: Warehousing.

Packing

When shipping from the US to Spain, securing your goods with proper packaging is crucial. A trusted repackaging service can turn a shipping challenge into a breeze, be it for bracing fragile ceramics or shielding valuable tech equipment. It's a game changer that adapts to your diverse product needs, minimizing potential damages. Learn more on our dedicated page: Freight Packaging.

Transport Insurance

Think of cargo insurance as the lifesaver during turbulent shipping adventures. Unlike fire insurance, which only protects against fire incidents, cargo insurance offers all-round coverage for your shipment. Transport-related mishaps like delays, theft, or damage, it's got it all! A must-have to mitigate unseen risks. Think the container toppling at sea or van collision? This should have you covered. Explore further on our dedicated page: Cargo Insurance.

Household goods shipping

Relocating between the US and Spain? Whether it's grandma's china or an oversized art installation, our personal effects shipping expertly handles your delicate and large items. For example, a New York musician once trusted us to gently and securely transport her treasured grand piano to her new home in Barcelona. More info on our dedicated page: Shipping Personal Belongings.

Procurement in Thailand

Looking to procure goods from Asia or Eastern Europe? DocShipper eases the process, from supplier discovery to closing the deal. We bridge language gaps, providing guidance each step of the way. Think bespoke goods from a Shenzhen factory or terracotta from a small Spanish artisan. More info on our dedicated page: Sourcing services.

Quality Control

Imagine shipping hundreds of custom products from the US to Spain, but upon arrival, they don't meet your expected quality standards, adding a host of complications and expenses. By leveraging our quality control service, you can address product disparities right at the manufacturing stage, ensuring your goods are ready and up to the mark before crossing the Atlantic. Avoid the surprise of defective items with proactive measures. Learn how - click here for our dedicated page: Quality Inspection A stitch in time, indeed!

Conformité des produits aux normes

Shipping overseas? Ensure your goods are in line with all necessary regulations with our Product Compliance Services. Send your products to our lab, we'll test them, and provide certification proving they meet destination rules. Forget about the hassle of compliance - our professionals have got you covered. Tap into the info here at Product compliance services.