Freight Shipping between US and Mexico | Rates – Transit times – Duties and Taxes

In a world where salsa music originates from New York and mariachi is popular in Chicago, isn't it funny how shipping between the US and Mexico can still make us pull our hair out? Indeed, complexities around determining accurate rates, estimating transit times, and untangling customs regulations often pose a major hurdle. This guide aims to break down those complexities and illuminate the process of freight transport between the US and Mexico. Here, you'll find succinct details on freight options such as air, sea, road, and rail, clearly explained customs procedures, an outline of duties and taxes, as well as relevant advice customized for your business needs. If the process still feels overwhelming, let DocShipper handle it for you! With our commitment to seamless international freight forwarding, we navigate the labyrinth of shipping procedures, turning challenges into success for your business.

Which are the different modes of transportation between US and Mexico?

Which are the different modes of transportation between US and Mexico? Choosing the best transport mode between the US and Mexico isn't always a no-brainer. Picture this: they're neighbors with a sprawling border over 3000km long, making road or rail transport seem like the obvious choice. But, it's not your one-size-fits-all solution. Distance to destination, accessibility, and cargo type matter, too. Imagine sending a crate of ripe avocados by a week-long train journey! Considering these factors helps align your shipping strategy to real-world challenges, ensuring your cargo arrives intact, on time, and cost-effectively. As every business is unique, so should be every shipping decision. Let's dive in!

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between US and Mexico

Ocean shipping connects the vibrant trade routes of the US and Mexico, with cargo ports such as Lázaro Cárdenas and Veracruz on the Mexican side, forging a path to US industrial powerhouses via ports like Port of Los Angeles and Port of Houston. As the pulse behind their robust trade relationship, sea freight offers an affordable solution for moving high-volume goods, albeit at a slower pace.

However, midst the waves of this transnational shipping, many shippers find themselves struggling against a tide of complexities. Mistakes are commonplace, frustrations mount, and the seemingly convoluted shipping procedures turn into daunting treks. But fear not! Just as a seasoned sailor navigates through choppy waters, businesses too can master the art of shipping between these two countries. Our guide unfurls the map to this journey, highlighting best practices, specifications, and secrets to make your sea freight voyage smoother and more manageable. Grab your compass and let’s set sail into the world of ocean shipping between the US and Mexico!

Main shipping ports in US

Port of Los Angeles:

Location and Volume: Situated in the second-largest city in the US, the Port of Los Angeles is North America’s leader in containerized freight, handling over 9.2 million TEUs annually.

Key Trading Partners and Strategic Importance: Its key trading partners are China, Japan, Vietnam, South Korea, and Taiwan. It serves as a gateway to the Trans-Pacific trade route, making it a strategic location for global logistics.

Context for Businesses: If you’re targeting the Asian market, the Port of Los Angeles is a vital conduit given its connectivity to key Asian economies.

Port of Long Beach:

Location and Volume: Located adjacent to Los Angeles, the Port of Long Beach is the second-busiest container port in the country, handling approximately 7.6 million TEUs per annum.

Key Trading Partners and Strategic Importance: Predominantly trading with Asia, its main partners include China, Hong Kong, South Korea, Japan, and Taiwan. It also holds tremendous strategic importance due to its modern infrastructure and efficient cargo-moving operations.

Context for Businesses: For businesses focusing on sustainable operations, the Port of Long Beach, with its commitment to environmental stewardship, could be an attractive logistics option.

Port of New York and New Jersey:

Location and Volume: Based on the East Coast, the Port of New York and New Jersey tags as the busiest port on the Atlantic seaboard. Annually, it shifts approximately 7.5 million TEUs.

Key Trading Partners and Strategic Importance: Trading primarily with China, Netherlands, Germany, Belgium, and Italy, this port significantly contributes to the economic landscape of the surrounding region.

Context for Businesses: If your business eyes expansion into the European market, the Port of New York and New Jersey, with its substantial throughput and European trade links, could provide a valuable channel.

Port of Savannah:

Location and Volume: Found in Georgia, the Port of Savannah boasts being the largest single-terminal container facility of its kind in North America, managing over 4.3 million TEUs annually.

Key Trading Partners and Strategic Importance: With China, South Korea, Vietnam, India, and Germany being its major trading partners, Savannah plays a crucial role in America’s international commerce.

Context for Businesses: This port holds particular relevance for businesses operating in consumer goods or the automotive sector, due to its strategic infrastructure and superior connectivity.

Port of Houston:

Location and Volume: Based in Southeast Texas, the Port of Houston is the most sizable Gulf Coast container port, handling around 2.9 million TEUs per year.

Key Trading Partners and Strategic Importance: It mainly trades with China, Mexico, Brazil, Netherlands, and South Korea. This port’s strategic importance is elevated due to its proximity to the massive domestic marketplace of Texas.

Context for Businesses: For businesses prioritizing accessibility to the US interior or a focus on energy sector logistics, the Port of Houston could be an integral part of your shipping strategy.

Port of Seattle:

Location and Volume: Nestled in the Pacific Northwest, the Port of Seattle manages about 1.9 million TEUs per year.

Key Trading Partners and Strategic Importance: Significant trading partners include China, Japan, Vietnam, South Korea, and Taiwan. Plus, it’s an important part of the North American West Coast shipping network.

Context for Businesses: If you’re exploring opportunities in the Pacific North West or look to leverage the booming tech industry’s logistics needs in Seattle and surrounding areas, the Port of Seattle can offer accessibility and trade routes to harness these potentials.

Main shipping ports in Mexico

Port of Veracruz

Location and Volume: Situated in the state of Veracruz, this port is vital for Mexico’s trade due to its strategic position on the country’s eastern coastline and handles around one million Twenty-foot Equivalent Units TEUs on an annual basis.

Key Trading Partners and Strategic Importance: The Port of Veracruz is a crucial gateway for trade between Mexico and the USA, Central and South America. It’s also essential for industrial and agricultural goods transportation.

Context for Businesses: If your operations involve importing or exporting from these regions, particularly products like auto parts, petroleum, or grain, this port could be a significant factor in your logistics strategy.

Port of Manzanillo

Location and Volume: Located in the state of Colima, on the Mexican Pacific coastline, this is country’s busiest container port, handling over 2.8 million TEUs per year.

Key Trading Partners and Strategic Importance: The Port of Manzanillo primarily facilitates trade to and from Pacific countries, particularly Asia. It is also an important cargo hub for diversified goods including vehicles, metal, and foodstuff.

Context for Businesses: If you’re aiming to tap into markets on the Pacific Rim, or your goods fall into the above categories, the Port of Manzanillo could be a significant component of your shipping strategy.

Port of Altamira

Location and Volume: Situated north of Veracruz, in the state of Tamaulipas, the Port of Altamira manages 1.1 million TEUs annually.

Key Trading Partners and Strategic Importance: Strengthening connections especially with the US, Europe, and the rest of Latin America, this port is notably important for the chemical and petroleum industries.

Context for Businesses: If you’re in the petroleum or chemical industries, or aiming to extend your foothold in the aforementioned regions, this port could be key to your logistics plan.

Port of Lázaro Cárdenas

Location and Volume: Located on the southwestern Mexican coast, the Port of Lázaro Cárdenas processes more than one million TEUs annually.

Key Trading Partners and Strategic Importance: Acting as a significant transit point from Asia, particularly China, this port accommodates a wide range of cargoes like minerals, vehicles, and machinery.

Context for Businesses: If you’re Goaling to capitalize on Asian markets or your shipping needs involve the goods specified above, the Port of Lázaro Cárdenas could be a vital part of your strategy.

Port of Progreso

Location and Volume: Located in the state of Yucatán, on the Gulf of Mexico, the Port of Progreso handles 200,000 TEUs per year.

Key Trading Partners and Strategic Importance: The Port of Progreso trades substantially with North America, known for exporting food products, and it also plays a role in tourism.

Context for Businesses: If you’re involved in food exports or looking to leverage the tourism industry, the Port of Progreso might aid your logistics plan, considering its warm coastal weather and inviting beaches.

Port of Ensenada

Location and Volume: Situated on the western coast in the state of Baja California, the Port of Ensenada manages approximately 200,000 TEUs per annum.

Key Trading Partners and Strategic Importance: Facilitating trade primarily with China, South Korea, and the USA, this port specializes in handling containers, bulk cargos, and fishery products.

Context for Businesses: If you’re planning to transport goods to or from the nations above, or if you’re involved in fisheries, this port is an aspect to consider when planning your shipping strategy.

Should I choose FCL or LCL when shipping between US and Mexico?

When shipping between the US and Mexico, understanding sea freight choices is crucial. Whether you opt for Full Container Load (FCL) or Less than Container Load (LCL) can greatly sway your cost, delivery time, and overall success. It’s all about aligning these options with your specific needs. In the coming section, we unveil the critical differences between FCL and LCL, aiming to equip you with the knowledge needed to make an informed and profitable choice. So, let’s dive in and explore what the best match for your business might be!

Full container load (FCL)

Definition: Full Container Load (FCL) shipping is the transportation of goods where a single consigner rents an entire container. It comes in two types; a 20'ft container and a 40'ft container.

When to Use: FCL is your go-to option when your cargo volume exceeds 13, 14, or 15 CBM. It is not only economical for high volumes but also ensures safety as the container is sealed at the origin and not opened until it reaches the destination.

Example: Let's suppose you run a furniture business and need to transport a batch of premium sofas from Los Angeles to Mexico City. With the volume exceeding 15 CBM, choosing FCL shipping would let you securely ship all your items in one go while maintaining cost-efficiency.

Cost Implications: Despite the higher initial FCL shipping quote, businesses often find the per-unit cost to be lower when transporting larger volumes. Rates vary based on whether you use a 20'ft or 40'ft FCL container, with the latter being more cost-effective for even larger consignments. Your costs also factor in the nature of the goods, the selected shipping route, and any additional customs duties you may be liable for.

Less container load (LCL)

Definition: Less than Container Load (LCL) shipping is a cost-effective method for shipping smaller quantities. It implies you're shipping goods that don't fill an entire container, pooling your shipment with other freight in the same container.

When to Use: LCL would be your best bet if you're transporting relatively small goods, particularly when the cargo is less than 13/14/15 Cubic Meters (CBM). LCL's principal advantages include cost efficiency and flexibility; you only pay for the space you use, offering flexibility for lower volume shipments.

Example: Consider a manufacturer based in Texas looking to export light machinery to Mexico and the consignment is only 10 CBM. Instead of bearing the cost of a full container, the manufacturer can opt for LCL shipment, sharing the container space with other exports to the same destination.

Cost Implications: While a full container has a flat rate, the cost of an LCL shipment is determined by how much space your goods take up, billed per cubic meter. LCL freight can allow significant savings, especially for smaller shipments. However, it involves extra steps like consolidation and deconsolidation, which might prolong your freight time.

Hassle-free shipping

Choosing between consolidation and a full container can feel like a tough call. As your trusted freight forwarder, DocShipper aims to transform complex shipping procedures into a breeze. Our savvy ocean freight experts evaluate vital factors such as cargo size, urgency, and destination to assist you in picking the most efficient method. Don't get tangled in the intricacies of shipping; leave that to us! Reach out today for a comprehensive, no-obligation freight estimation. Making international shipping as simple as a click is what we're here for!

On average, sea freight between the US and Mexico takes 10 to 15 days. However, one should remember that transit times depend on specific factors such as the exact ports of loading and discharge, weight, and the nature of your cargo. Hence, for a more personalized estimate, consider contacting accurate freight forwarders like DocShipper.

As for the marine port-wise shipping times, check the below table:

| US Ports | Mexican Ports | Transit Time (in days) |

| Los Angeles, CA | Manzanillo | 10 |

| Long Beach, CA | Veracruz | 12 |

| Houston, TX | Lazaro Cardenas | 14 |

| Miami, FL | Ensenada | 14 |

How much does it cost to ship a container between US and Mexico?

Shipping a container from the US to Mexico? Here’s a rough estimate. You can expect ocean freight rates to lie within a fairly broad spectrum (widely ranging per CBM), due to several variables like Point of Loading, Point of Destination, the selected carrier, nature of goods, and even monthly market fluctuations! Unfortunately, we can’t provide a concrete shipping cost upfront. Why? Because every shipment is unique! Rest assured, our experienced shipping specialists are ready to work with you, providing tailored, competitive quotes to ensure the best rates for each specific case. Shipping needn’t be a headache, let us help streamline the process for you!

Special transportation services

Out of Gauge (OOG) Container

Definition: An Out of Gauge (or OOG) container is a shipping method designed to transport large cargo that doesn’t fit into standard shipping containers due to its dimensions.

Suitable for: If you have oversized items or an out of gauge cargo, this might be the ideal choice for you.

Examples: Industries dealing with heavy machinery, construction equipment, yachts, or windmills usually opt for OOG containers.

Why it might be the best choice for you: If your business deals with cargo that can’t fit into standard dimension containers, OOG containers allow flexibility in managing your cargo.

Break Bulk

Definition: Break bulk is a shipping method wherein goods are loaded individually rather than in shipping containers – essentially, the loose cargo load is broken down into units.

Suitable for: If you’re dealing with cargo that’s sized uniquely or in diverse shapes, break bulk might suit your needs.

Examples: Items like construction equipment, timber, or steel beams are often shipped using this method.

Why it might be the best choice for you: Break bulk offers versatility and allows shipment of cargo that might not easily fit into containers.

Dry Bulk

Definition: Dry bulk refers to the shipment of unpackaged goods in large quantities, stored without a container, usually in a pile or heap.

Suitable for: If your business involves commodities in massive quantities, dry bulk could be the method for you.

Examples: This method is often used to ship raw material commodities like coal, grain, or metal ores.

Why it might be the best choice for you: Opting for dry bulk can lower shipping costs, especially when dealing with high-volume goods, making your supply chain more cost-effective.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/roll-off, or Ro-Ro, is a type of sea freight where vehicles are driven on and off a specialized ro-ro vessel.

Suitable for: If your business involves vehicles or wheeled machinery, Ro-Ro might be the shipping option you need.

Examples: Cars, trucks, trailers, and even railway cars can be shipped using Ro-Ro.

Why it might be the best choice for you: Ro-Ro provides a simple, efficient, and cost-effective way for shipping these types of goods, ensuring quick loading and unloading times.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers used to transport temperature-sensitive goods.

Suitable for: If your business deals with perishable items or goods that require a specific temperature range during transit, reefer containers are crucial for your supply chain.

Examples: Foodstuff like meat, dairy products, fruits, and pharmaceuticals are typically shipped using reefer containers.

Why it might be the best choice for you: Reefer containers give you control over the temperature throughout the shipping process, ensuring your goods are delivered fresh or in perfect condition.

Remember, considering the complexity of sea freight shipping between the US and Mexico, it’s important to work with an experienced freight forwarder like DocShipper. Don’t hesitate to contact us anytime you need assistance or for a free shipping quote within 24 hours!

Air freight between US and Mexico

For time-sensitive, high-value goods, air freight from the US to Mexico is a silver bullet. Think of lifesaving medical equipment or hot-ticket electronics; getting these items quickly and safely across borders is crucial. Speed and reliability are the clear hallmarks of air freight, making it a cost-effective choice for smaller shipments. But here’s where things get tricky — some businesses stumble when it comes to air freight, often underestimating key cost factors. It’s like having a fancy sports car but forgetting about its gas consumption; you might end up spending more than you thought. Some calculate the costs using incorrect weight formulas, while others overlook best practices that would save them a pretty penny. Let’s dig into these common errors to ensure your air freight doesn’t turn into a loss.

Air Cargo vs Express Air Freight: How should I ship?

It can feel like an uphill task to decide between express air freight and air cargo for your US-Mexico shipments, right? While air cargo makes use of space in commercial airlines for your goods, express air freight is like booking a whole plane just for your business needs – speedy and efficient. Let’s buckle in and explore which might be the perfect fit for your shipping strategy.

Should I choose Air Cargo between US and Mexico?

Delving into air cargo transit between the US and Mexico, it’s indeed a viable option for you, especially if cost-effective shipment and reliability are your top priorities. For instance, airlines like Delta and Aeromexico offer reliable services. However, you’d have to contend with longer transit times due to their fixed schedules. Still, this method becomes even more compelling once your cargo is above 100/150 kg (220/330 lbs). Such bulk shipments can reap the cost benefits, enabling you to maximize your budgetary allocation for freight transport.

Should I choose Express Air Freight between US and Mexico?

Express air freight is a premium service using dedicated cargo planes that only transport goods, not passengers. It’s ideal for shipments under 1 cubic meter (CBM) or 100/150 kg (220/330 lbs) of cargo. Firms like FedEx, UPS, and DHL specialize in it. Choosing express air freight between the US and Mexico provides quicker, more predictable delivery times. It could be just the solution if you’re running on a tight schedule or dealing with time-sensitive products.

Main international airports in US

Los Angeles International Airport

Cargo Volume: Over 2.2 million metric tonnes annually.

Key Trading Partners: Primarily Asia, followed by Europe and Australia.

Strategic Importance: Conveniently located on the U.S. West Coast, a primary gateway for transpacific freight.

Notable Features: Offers special handling for perishable goods, operates 24/7, and handles larger cargo aircraft.

For Your Business: If you often ship to or from Asia, considering LAX could help cut both transit times and costs.

John F. Kennedy International Airport

Cargo Volume: More than 1.3 million tonnes of air cargo each year.

Key Trading Partners: Europe, South America, and Asia.

Strategic Importance: Located in New York City, a major economic hub, facilitating access to the East Coast markets.

Notable Features: Comprehensive services for all types of cargo, including cold storage, and round-the-clock operations.

For Your Business: If your business heavily relies on European trade, JFK’s robust connections might be an ideal choice.

Miami International Airport(http://www.miami-airport.com/)

Cargo Volume: Handles over 2 million tons of cargo annually.

Key Trading Partners: Latin America, the Caribbean, and Europe.

Strategic Importance: Primarily serves as the major hub for shipments to Latin America and the Caribbean.

Notable Features: Served by over 40 cargo airlines, 24/7 operations, specializes in handling perishable goods.

For Your Business: If your clientele is largely based in Latin America or the Caribbean, exploring Miami International could significantly streamline your operations.

Chicago O’Hare International Airport

Cargo Volume: Over 1.9 million metric tonnes of cargo annually.

Key Trading Partners: Europe, Asia, and Canada.

Strategic Importance: Centrally positioned in the U.S. for convenient access to both coasts, and acts as a major hub for domestic cargo.

Notable Features: Exceptional cargo facilities, including cooled storage, and strong links to a robust road and rail network.

For Your Business: O’Hare’s central location and robust links to domestic road and rail networks could greatly aid businesses with heavy domestic demand.

Hartsfield-Jackson Atlanta International Airport

Cargo Volume: Moves more than 2.7 million tonnes of cargo annually.

Key Trading Partners: Primarily Europe, followed by Asia and South America.

Strategic Importance: Known as the ‘World’s Busiest Passenger Airport’, also offers extensive cargo services and is well-connected to the Southeast U.S.

Notable Features: Operates 24/7, special handling for different types of cargo including cold chain, and larger cargo capacity.

For Your Business: If your business encompasses high-frequency demand for various types of cargo, the extensive capabilities of Hartsfield-Jackson Atlanta should be beneficial.

Main international airports in Mexico

Aeropuerto Internacional de la Ciudad de México

Cargo Volume: AICM handled close to 610,000 metric tons of air cargo in 2023.

Key Trading Partners: The United States, Canada, China, and various countries in Europe and Latin America.

Strategic Importance: As Mexico’s busiest and most important aviation hub, AICM is crucial for businesses targeting Mexico City’s massive customer base and seeking easy connections to other destinations domestically and internationally.

Notable Features: This airport offers a dedicated industrial airport area, housing numerous logistics and cargo companies, and provides state-of-the-art infrastructure for efficient cargo handling and processing.

For Your Business: AICM’s extensive network and advanced cargo handling services could enhance your speed to market, especially if you’re shipping high-value cargo or perishable goods requiring careful handling.

Aeropuerto Internacional de Guadalajara

Cargo Volume: The airport processed 605,000 metric tons of international air cargo in 2023.

Key Trading Partners: The USA, China, Germany, and multiple Latin American Countries.

Strategic Importance: Being the main manufacturing and technology hub in Mexico, Guadalajara’s airport plays a significant role for businesses that focus on technology, electronics, and vehicle parts.

Notable Features: Offering 24/7 services and housing several cargo airlines, the Guadalajara airport is known for its excellent cargo handling capabilities.

For Your Business: With its focus on high-tech industries, your tech-related business could leverage this airport’s specialized cargo handling capacities to streamline operations and mitigate risk.

Aeropuerto Internacional de Monterrey

Cargo Volume: Monterrey International handled roughly 234,000 metric tons of cargo in 2022.

Key Trading Partners: Main partners include the USA, Canada, Spain, China, and Germany.

Strategic Importance: As one of Mexico’s leading business hubs and the commercial heart of the north, Monterrey International is critical for connecting northern Mexico with domestic and international markets.

Notable Features: Home to one of Fedex’s Latin America distribution centers, it’s well-equipped for handling various types of air cargo.

For Your Business: Thanks to its strong domestic network and key international partners, this airport could provide your business with reliable and efficient air cargo solutions to a wide range of destinations.

Aeropuerto Internacional de Cancún

Cargo Volume: More than 60,000 metric tons of cargo passed through Cancun in 2022.

Key Trading Partners: Strong ties exist with the USA, Canada, and European countries but it also handles Latin American cargo flows.

Strategic Importance: Cancun International offers key connections to tourist hotspots and has increasing importance for businesses linked with the hospitality industry or perishable goods.

Notable Features: It has dedicated facilities for delicate and perishable goods, with efficient services ensuring goods are rapidly cleared and dispatched.

For Your Business: Especially if you’re in the luxury goods or high-end perishable market, Cancun could offer streamlined exporting to a significant luxury and tourist market.

Aeropuerto Internacional de Tijuana

Cargo Volume: Around 25,000 metric tons of cargo was processed in 2023

Key Trading Partners: The airport mainly serves USA but also has strong trading relationships in Asia.

Strategic Importance: Positioned on the US-Mexican border, Tijuana’s airport is valuable for businesses seeking easy and quick access to both economies.

Notable Features: A unique feature is the Cross Border Xpress, a pedestrian bridge for direct terminal access between Mexico and the USA.

For Your Business: Leveraging Tijuana International’s border location, your business could enjoy accelerated shipping and customs processing, ideal for time-sensitive industries.

How long does air freight take between US and Mexico?

The average time to ship goods between the US and Mexico by air freight typically falls within 1-3 days. However, this isn’t set in stone as transit times may vary. Different factors come into play such as the specific airports of origin and destination, the weight of the shipment, and the nature of the goods. To obtain the most accurate transit times for your specific needs, it’s highly recommended to consult with a specialized freight forwarder like DocShipper.

How much does it cost to ship a parcel between US and Mexico with air freight?

Air freight shipping rates between the US and Mexico average between $3 to $5 per kg. However, pinning an exact price can be complex. Factors such as distance from departure and arrival airports, parcel dimensions, weight, and the nature of goods can heavily influence cost. Rest assured, our team provides custom quotes to ensure you get the best rates. Don’t let the cost deter you – we’re here to navigate these factors with you. Contact us and receive a free quote in less than 24 hours. Let’s simplify the shipping process together.

What is the difference between volumetric and gross weight?

Gross weight refers to the actual weight of your shipment, including packaging and all. For instance, the scale says 5kg, which converts to about 11lbs. Volumetric weight, also called dimensional weight, is a pseudo-weight derived from the size of the package, calculated irrespective of the actual weight.

When determining air cargo weight, the dimension formula used is length x width x height (in cm) divided by 6000. An example: a package measures 50cm x 50cm x 50cm. Its volumetric weight is 50 x 50 x 50 / 6000, equalling about 21 kg (or approximately 46lbs).

Express Air Freight, however, uses a slightly different method. The dimensional weight is calculated by dividing the volume (in cm) by 5000, not 6000. So, the same package’s volumetric weight would be 50 x 50 x 50 / 5000, producing approximately 25 kg (or around 55lbs).

Understanding these calculations is integral to predicting your shipping costs. Air freight services charge based on either the gross weight or the volumetric weight, depending on which is higher. This ensures that carriers get paid fairly, even for light but bulky cargo.

Door to door between US and Mexico

Navigating international shipping can be a maze, but Door to Door service can be your secret shortcut. It’s a comprehensive solution that covers every step of the journey, from a warehouse in the US to the final destination in Mexico. This method takes the stress off your shoulders, ensuring seamless, timely movement of goods. Eager to simplify your shipping? Let’s dive in!

Overview – Door to Door

Imagine kicking back as all your goods move seamlessly from the U.S to Mexico. Door-to-door shipping is the answer to that dream, eliminating typical shipping complexities and stress, transforming logistical puzzles into a convenient solution. Despite potential extra costs, the service shines with its simplicity and efficiency, earning it the title of the most sought-after solution among DocShipper’s clients. However, remember to weigh in on potential delays in delivery times. In essence, you get to focus more on your business, while we handle the rest! Now, isn’t that the peace of mind you’re looking for in your supply chain?

Why should I use a Door to Door service between US and Mexico?

Ready to take the hassle out of your international shipping woes? Count on Door to Door services to kick logistics stress to the curb! Here are five particularly crispy reasons why these services are your best bet for shipments between the US and Mexico.

1. Minimized Stress: Say adios to the headache of arranging separate carriage from the port to your destination. Door to Door services negotiate this labyrinth of logistics, freeing your mind and schedule for more pressing business endeavors.

2. Ensured Timeliness: With an urgency that matches yours, Door to Door services prioritize punctual deliveries. They pull out all the stops to make sure your cargo breezes through all checkpoints, ensuring it gets to the specified address right on schedule.

3. Specialized Cargo Care: Complex or delicate goods? Worry not! With Door to Door services, your cargo is treated with kid gloves from pick up to drop off. You don’t just get shipment; you get expert handling and care.

4. Full-Service Convenience: You have enough on your plate! Why juggle multiple service providers when you have one that covers the full range? From customs disinclination for confusing paperwork, Door to Door services handle everything from pick up to final delivery.

5. Local Trucking: Trusted local trucking partners navigate the tricky terrain from the US border down to even the remotest Mexican locations. This means less risk and more efficient delivery to your final destination.

So, why choose Door to Door when shipping from US to Mexico? Well, it’s your all-inclusive, stress-free, and über-convenient solution that guarantees your cargo’s safe and timely arrival. And honestly, who wouldn’t want their logistics served with a side of peace of mind?

DocShipper – Door to Door specialist between US and Mexico

Smooth, efficient, stress-free – welcome to DocShipper’s door-to-door shipping from the US to Mexico. We’re experts in global freight forwarding, taking away your worries with a seamless A-Z service. From packing to customs clearance, across all shipping methods, we’ve got it all covered. Your dedicated Account Executive is ready to handle your shipment, backed by our promise of proficiency in this domain. Reach out now for a free estimate in under 24 hours, or speak with our seasoned consultants at no cost. Let’s move your goods hassle-free.

Customs clearance in Mexico for goods imported from US

Customs clearance, the critical juncture where your goods pass into Mexico from the US, is a process fraught with potential hurdles. Multifarious fees, intricate customs duties, variable taxes, and elusive licenses can turn what should be a smooth process into a frustrating experience. Ignoring these could mean your goods getting trapped in customs limbo. Yet, understanding the ins-and-outs doesn’t have to be a solo endeavor. DocShipper is on hand to assist you through the process, no matter the type of goods or where in the world they originated from. To get started with an estimate, all we need is the origin of your goods, the value, and the HS Code. In the coming sections, we’ll dissect this further by uncovering the layers of this process, so gear up for an enlightening journey.

How to calculate duties & taxes when importing from US to Mexico?

Cracking the code of customs duties and taxes can be a challenging task, but with a bit of understanding, you’ll be navigating the waters with ease. The calculation of these duties hinges on a few crucial pieces of information: the country of origin, the HS Code (Harmonized System Code), the Customs Value of the goods, the Applicable Tariff Rate, and consideration of any additional taxes or fees that may apply. Each component plays a pivotal role in determining the final amount of duties and taxes – the country of origin dictates which duty/tariff rate to apply, the HS code identifies the item, and the Customs Value is the sweet price you’ve paid for your goods. Step one of this process is pinpointing exactly where your goods were produced or manufactured.

Step 1 – Identify the Country of Origin

Determining the Country of Origin is more than just pinning your product on a world map. It’s the compass guiding your shipping journey from the US to Mexico.

Here’s why:

1. Accurate classification: It helps you obtain the correct Harmonized System (HS) code. This ten-digit number is crucial for correctly declaring your goods to Mexican customs.

2. Trade Agreements: It allows you to understand how the North American Free Trade Agreement (NAFTA) and the subsequent United States-Mexico-Canada Agreement (USMCA) affect your shipment. These agreements often mean reduced taxes and more relaxed import regulations.

3. Import limits: Some goods have import restrictions based on their origin. Always cross-check the Mexican Secretariat of Economy’s recommendations.

4. Duty rates: The origin can impact how much duty you pay. Is there a preferential duty rate for your product?

5. Unexpected costs: If you misidentify your shipment’s origin, you could face unexpected costs. Keep this in mind when budgeting to avoid unpleasant surprises.

You’ve got this! Think of the shipping process as a jigsaw puzzle and the Country of Origin as your corner piece. You can’t complete the picture without it. Now, let’s sort out that HS code, shall we?

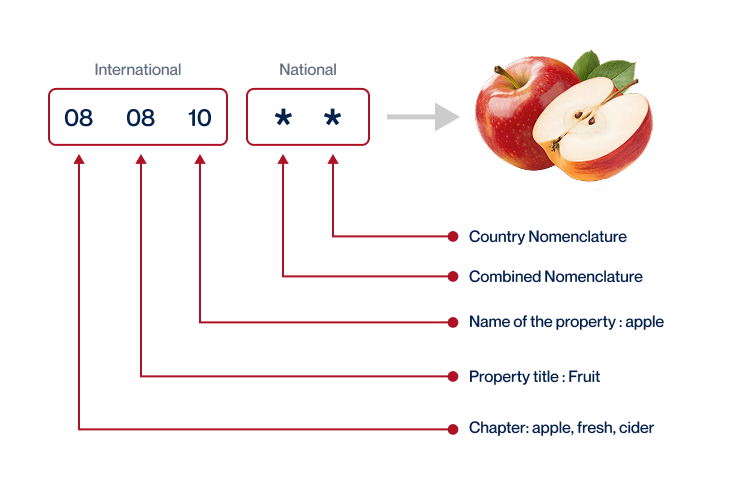

Step 2 – Find the HS Code of your product

The Harmonized System Code, more commonly known as the HS Code, is a six-digit number that classifies different types of products for international trading. Think of it like a universal language: it helps everyone involved in the trade, from the supplier to the freight forwarder, to the customs officer, understand what product they’re dealing with.

Typically, the easiest way to find your product’s HS Code is to ask your supplier. They should be well-versed with the products they’re importing and the associated regulations. But, if that option isn’t available, don’t worry – you can easily find it yourself!

To do this, use an HS lookup tool. We recommend the Harmonized Tariff Schedule. Simply type your product’s name into the search bar, then check the ‘Heading/Subheading’ column. Here, you should find the HS Code for your product.

Remember, accruing the right HS Code is crucial. A word of caution: entering an incorrect code can lead to delays, higher costs, and potential fines, disrupting your shipping process. Precision is key when dealing with international trade procedures.

Here’s an infographic showing you how to read an HS Code. A quick overview to get you acquainted with what the numbers in the code mean, simplifying your shipping needs even further.

Step 3 – Calculate the Customs Value

Knowing the correct Customs Value for your goods imported from the US to Mexico is crucial for seamless clearance. It’s different from your products’ price as it’s not just what you paid for your goods. Instead, it’s the CIF value: the total cost of goods, shipping, and insurance.

Imagine you bought perfume for $100 with $50 shipping and $2 insurance. The Customs Value isn’t $100 but $152. This value is what the Mexican Customs base their import duties and taxes on. It’s vital to get this right to avoid any customs issues and additional costly delays. Remember, always calculate in USD for standardization. This clarity will make your shipping experience smoother and more predictable.

Step 4 – Figure out the applicable Import Tariff

An import tariff is essentially a tax imposed on goods entering a country. In Mexico, the system that’s applied is known as the Harmonized System (HS) and it’s used globally. To identify the import tariff for your goods, you’ll follow these steps:

1. Access the Mexican Tax Administration Service (SAT) website, which hosts the current tariff system.

2. Look up your product using the HS code previously determined. This code corresponds to the specific category your product falls under within the HS.

Let’s look at an example for clarity – suppose you’re importing wooden furniture from the US, which has an HS code of 9403.60. You enter this into the SAT system and find an import tariff of 15%. This is the percentage applied to your Customs Value (CV) to calculate import duties.

Your CV is the addition of the product price, insurance, and freight costs (also known as CIF cost). For example, if the CIF cost is USD 10,000, your import duty would be 15% of 10,000, namely USD 1,500.

Remember to periodically check the tariff rate as they may vary based on trade agreements and international regulations. Factors affecting your final import duty amount may include the trade agreement status, product type, origin, and destination. Always consult a logistics or customs specialist for accurate calculations and procedures.

Step 5 – Consider other Import Duties and Taxes

While the standard tariff rate is a given, a variety of other import duties and taxes can also come into play, especially when shipping goods from the US to Mexico. You might come across charges such as excise duty, assessed on specific types of goods, or anti-dumping taxes, typically applied to imported goods sold below the fair market price.

One key charge you’ll encounter is VAT or Value Added Tax. This applies to most transactions where goods or services are sold. In our context, VAT is charged on the total value of the imported goods, including the cost of the goods, insurance, freight and any applicable duties.

Let’s consider an example where PST (Provisional Safeguard Tax) applies. Imagine you’re importing goods valued at $10,000. If the standard tariff rate is 20%, the import duty amounts to $2,000. Add shipping and insurance costs of say $500 and your total is $12,500. Suppose the PST is 15%, it’s levied on this total ($12,500), leading to an additional $1,875.

Remember, these examples are provided only for illustrative purposes and real-world rates might differ.

Do keep a lookout for these ‘extra’ charges to avoid any surprises during customs clearance. It’s all about planning your freight budgets effectively.

Step 6 – Calculate the Customs Duties

In this step, determining your customs duties is a critical aspect of the customs clearance process. It revolves around three core components: the customs value of your goods, the Value Added Tax (VAT), and anti-dumping taxes.

1. Customs Duties Only: Suppose the customs value of your goods is $10,000 and the duty rate is 10%, your customs duty will be $1,000. Simple!

2. Customs Duties and VAT: With the same customs value of $10,000 and duty rate of 10%, you’ll have a customs duty of $1,000. Now, if the VAT is 16%, you apply it to the total of customs value and customs duty: 16% ($10,000+$1,000) = $1,760. So, your total customs duty and VAT will be $2,760.

3. Customs Duties, VAT and Anti-Dumping Taxes: Here the calculation includes the cost of the goods, the customs duty, the VAT, and any anti-dumping taxes and excise duty. If the anti-dumping tax is 5% and the excise duty is 5%, these apply to the customs value only, adding another $1,000. So, your total customs duty, VAT, and other taxes will be $3,760.

Navigating these calculations can be quite confusing. At DocShipper, we handle it all – ensuring you’re charged accurately according to these rules and reducing your stress. We’re here to help whenever you need, with a free quote just a message away, delivered within 24hrs. Trust us to make your customs clearance a breeze, wherever you are in the world.

Does DocShipper charge customs fees?

While DocShipper, as a customs broker in the US and Mexico, caters to your customs clearance needs, we do not charge customs duties. There’s a clear distinction between clearance fees billed by us and the actual customs duties or taxes, which are direct payments to the government. Ensuring transparency, we offer documentation from the customs office verifying the charges, proving you only pay what’s legitimately demanded by customs. So, you can confidently ship, knowing your best interests are being looked after.

Contact Details for Customs Authorities

US Customs

Official name: U.S. Customs and Border Protection (CBP) Official website: https://www.cbp.gov/

Mexico Customs

Official name: Servicio de Administración Tributaria (SAT) Official website: www.sat.gob.mx

Required documents for customs clearance

Cracking the code of customs paperwork can be quite a hurdle! This guide will alleviate your burden by presenting a clear rundown on crucial shipping documents you’ll need: Bill of Lading, Packing List, Certificate of Origin, and CE standard Documents of Conformity.

Bill of Lading

A Bill of Lading (BOL) is like a ‘golden ticket’ for your goods traveling from the US to Mexico. As a legally binding document, it seals the deal on transferring ownership. BOLs aren’t just freight receipts; they’re your backup plan, providing detail on quantity, destination, and type of goods, ensuring that nothing gets ‘lost in translation.’ Don’t be puzzled by the phrase ‘telex release’. It’s just a jazzier term for electronic BOL, reducing paper trail and speeding things up for the digital savvy. And if you’re opting for air cargo, Aircraft Bill of Lading (AWB) will be your passport. In short, understand BOLs, use them wisely, and you’ll navigate smoothly through the customs clearance process.

Packing List

The Packing List is your ally in avoiding customs hang-ups when shipping goods between the US and Mexico. Picture it as a detailed account of your shipment – item names, count, materials, dimensions, weight – it’s like a biography of your cargo! Whether you’re shipping a cargo load of electronics by sea or a consignment of designer clothes by air, every detail is integral for a smooth customs clearance process. As a shipper, it’s on you to ensure the Packing List is comprehensive and accurate. Slipping up or cutting corners could lead to frustrating delays or costly fines. So take the packing list seriously, it’s your shipment’s passport for international trade!

Commercial Invoice

Navigating customs clearance when shipping goods between the US and Mexico hinges largely on your Commercial Invoice. Picture it as your product’s passport—it’s packed with critical details, like the buyer and seller’s names, item descriptions, quantity, price, and Transport Control Number. Errors or inconsistencies in this document are red flags for customs officers, which can lead to delays or extra charges. Aligning this with other shipping documents can save you unnecessary trouble. So, imagine you’re shipping car parts; ensuring the invoice’s EIN (Employer Identification Number) matches the one filed with the CBP (U.S. Customs and Border Protection) will streamline your shipment’s journey. Not just a piece of paper, your Commercial Invoice is the key to unlocking hassle-free shipping.

Certificate of Origin

When shipping goods from the US to Mexico, the Certificate of Origin (CoO) is your saving grace. Imagine this – You’ve manufactured top-notch electrical components in California. To benefit from the preferential duty rates offered by USMCA, your CoO is key, explicitly mentioning that your goods were made in the USA, unlocking lower customs duty. Also, don’t forget, Mexican customs officers are keen on accurate, stringent documentation, and messing up is not an option. So, take the time to correctly fill your CoO, homing in on those cost benefits and a smoother clearance process. Remember, success is all in the details.

Get Started with DocShipper

Prohibited and Restricted items when importing into Mexico

Taking important steps to ensure smooth customs clearance? Well, realizing what you can and can’t ship into Mexico is crucial. Shipments can stall, fines can accrue, all due to overlooked restrictions. Let’s clear those murky waters on Mexico’s import laws.

Are there any trade agreements between US and Mexico

Yes, the United States and Mexico participate in the United States-Mexico-Canada Agreement (USMCA), a Free Trade Agreement that replaced NAFTA. This alliance fundamentally shapes trade logistics, opening avenues for easier customs processes and tariffs. Currently, intriguing opportunities are emerging in the form of railway developments, enhancing overland freight options. Make sure to stay informed on these developments, as they can provide your business with significant shipping advantages and cost efficiencies.

US – Mexico trade and economic relationship

The US and Mexico share a rich history of economic cooperation, rooted in the 1994 North American Free Trade Agreement (NAFTA), replaced with the United States-Mexico-Canada Agreement (USMCA) in 2020. This symbiotic bond has seen key sectors like automobile manufacturing, agriculture, and electronics flourish. Majorly traded commodities include vehicles, machinery, mineral fuels, and agricultural products. As of 2020, U.S direct investment in Mexico stands at $113.7 billion, highlighting the strong economic ties. Significantly, the trading volume between these two nations was worth a staggering $538.1 billion in 2020 alone. This vibrant trading relationship signifies an essential avenue for your business expansion.

Your first steps with DocShipper

Additional logistics services

Warehousing

Finding a trustworthy space for your goods can feel like a maze, especially when conditions like temperature control enter the equation. Imagine trying to store chocolates in the scorching heat of Hermosillo! But no worries: we've got your back with top-grade, reliable warehousing solutions suited for every need. Want to get the specifics? Discover more about our services on our dedicated Warehousing page.

Packing

Clear the hurdles of shipping from the US to Mexico with precise packaging and repackaging solutions. Whether shipping auto parts or artisan goodies, secure packaging ensures goods arrive intact and on time. Trust a dependable agent to cater to your individual needs, right down to the last detail. Discover the difference appropriate packaging makes on our dedicated page: Freight packaging.

Transport Insurance

Safeguard your goods in transit, not just from fire, like traditional insurance. With Cargo Insurance, think protection beyond mere flames - from accidents to theft during shipping. For example, dock workers accidentally drop your delicately crafted pottery - Cargo Insurance got you covered. So, give your merchandise the full-cover, preventative shield it deserves. Find every detail you need on our dedicated page: Cargo Insurance.

Household goods shipping

Transporting personal belongings between the US and Mexico requires the utmost care and flexibility. From Grandma's antique china to your oversized couch, no item is too delicate or bulky. We handle it all in stride ensuring safe delivery. Curious about potential duties for your heirlooms? Find comprehensive guidance on our dedicated resource page: Shipping Personal Belongings.

Procurement in Thailand

Discovering reliable suppliers between the US and Mexico can be challenging but crucial in achieving cost-efficient and timely shipments. With DocShipper, hurdle language barriers and strategic complexities as we take over the entire procurement process, even in Asia and East Europe! Your global sourcing, simplified and managed professionally. Learn more on our dedicated page: Sourcing services

Quality Control

Ensuring your products meet standards while shipping from the US to Mexico is crucial. Quality inspections during manufacturing can save you from any unpleasant surprises later. An example? A furniture brand had to reroute a container because of low-standard wood detected during an on-site inspection. Avoid such instances. More info on our dedicated page: Quality Inspection

Conformité des produits aux normes

Ensuring your goods meet all necessary standards is essential for streamlined cross-border shipping. Our Product Compliance Services test your items in a laboratory to verify conformity, helping you secure the required certifications. Avoid the headache of returned shipments, or worst, legal issues with our expert team. Keen to learn more? Check out our Product Compliance Services.