Freight Shipping between US and India | Rates – Transit times – Duties and Taxes

Did you hear about the seahorse that failed his geography exam? He couldn't figure out the current! Much like our seahorse, the world of international freight transport can be a formidable ocean teeming with complexities like understanding rates, transit times, and customs regulations.

In our comprehensive guide, we'll sail through each of these aspects of shipping goods from the US to India. We'll decode the different types of freight options - air, sea, road, rail, and even divulge into the nitty-gritty of customs clearance, duties and taxes. You'll receive tailored advice to help businesses smoothly traverse these shipping corridors.

If the process still feels overwhelming, let DocShipper handle it for you! As your one-way ticket to effortless shipping, we turn these elaborate, often overwhelming challenges into straightforward success stories for your business. Welcome aboard!

Which are the different modes of transportation between US and India?

Shipping goods between US and India can feel like a complex chess match. Picture each shipping method as a chess piece, each with its own movement. The king can be air freight with its speedy delivery, yet high cost. The valuable queen might be ocean freight, slower but cost-effective, and ideal for large loads. The knights, rooks, and bishops take the form of road and rail freight, often out of the play due to geographical barriers. Understanding how to effectively use each piece on this transcontinental chessboard is key to your shipping strategy. Finding the right move makes all the difference.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between US and India

If you’ve ever wondered how appliances made in India appear on store shelves in the United States, the answer lies in the vast expanse of blue connecting these powerhouse nations. Life pulses daily on the busiest shipping lanes in the world, linking India’s bustling ports of Mumbai, Mundra, and Chennai to the giant US coastal gateways in LA, New York, and Virginia. It’s on these oceanic highways where bulk commodities, machinery, and electronics intertwine in a cosmopolitan dance of international trade.

Sea freight serves as the economical workhorse in this set-up, carrying high-volume cargo loads in mammoth vessels despite sacrificing speed for cost. But it’s not quite as simple as loading a container and sending it on its way. Choosing the right Incoterms, understanding tariff codes, getting your paperwork pitch-perfect… The devil is indeed in these details! It’s like assembling a jigsaw puzzle with pieces that don’t always fit. We’re here to explore these tricky points, offer clarifications, and present effective solutions to ensure your shipping operations run smoothly. Let’s unveil the complexities, stitch together best practices, and simplify your sea freight journey from the US to India!

Main shipping ports in US

Port of Los Angeles

Location and Volume: The Port of Los Angeles, located in the city of Los Angeles, California, is ranked as the top container port in the United States, handling a staggering 9.2 million TEU in 2019 alone.

Key Trading Partners and Strategic Importance: Some of the port’s primary trading partners include China, Japan, South Korea and Taiwan. It plays a vital role in facilitating trans-Pacific trade, being the leading gateway for trade to Asia.

Context for Businesses: If you’re planning to expand your business towards Asian markets, the Port of Los Angeles, with its major trading partners in Asia, could be a crucial component of your logistics strategy considering its robust infrastructure and strategic location.

Port of Long Beach

Location and Volume: Situated right next to the Port of LA is the Port of Long Beach, handling a considerable volume of 7.6 million TEU, making it the second busiest container port in the country.

Key Trading Partners and Strategic Importance: The Port of Long Beach has similar trading partners as the Port of Los Angeles; its strategic location enabling easy access to trans-Pacific routes.

Context for Businesses: Those looking to target Asian markets and considering the Port of Los Angeles as part of their shipping strategy should also take into account the adjacent Port of Long Beach, as both ports often share extensive transit networks and can offer enhanced shipping capabilities when used in conjunction.

Port of New York and New Jersey

Location and Volume: The Port of New York and New Jersey, is positioned on the east coast of the U.S., with a shipping volume of around 7.4 million TEU.

Key Trading Partners and Strategic Importance: This port is the main gateway for trade on the Atlantic seaboard, with a significant portion of trade exchange happening with European partners.

Context for Businesses: If your focus is on European markets, this port may be an indispensable part of your shipping strategy due to its strategic location and its reach of over 134.5 million consumers within 36 hours of truck journey.

Port of Savannah

Location and Volume: The Port of Savannah, located in Georgia and having the largest single container terminal in North America, handled over 4.5 million TEU in 2019.

Key Trading Partners and Strategic Importance: It enjoys a diversified and healthy trading network around the globe, making it a vital logistics hub in the Southeast region.

Context for Businesses: If your business requires a strong global network, the Port of Savannah might just be the fit, owing to its broad network and significant capacity.

Port of Houston

Location and Volume: Texas houses the Port of Houston, a key port in the Gulf of Mexico, handling more than two million TEU annually.

Key Trading Partners and Strategic Importance: Its primary trading partners include China, Mexico and Brazil. It serves as an essential hub for trade between the American mainland, Latin America, and beyond.

Context for Businesses: If you’re looking to tap into Latin American and local Texan markets, this port could serve as a significant lynchpin due to its strategic location and established connections.

Port of Oakland

Location and Volume: Positioned in the San Francisco Bay, Port of Oakland shifts over 2.5 million TEU.

Key Trading Partners and Strategic Importance: It has a strong trading link with Asian countries. It’s strategically important as it’s one of the few U.S. ports than can handle mega vessels due to its naturally deep harbors.

Context for Businesses: If your shipments involve larger vessels or if you’re targeting Asian markets, the Port of Oakland can be an ideal choice, given its physical capacities and direct trade links.

Context for Businesses: If your focus is on European markets, this port may be an indispensable part of your shipping strategy due to its strategic location and its reach of over 134.5 million consumers within 36 hours of truck journey.

Port of Savannah

Location and Volume: The Port of Savannah, located in Georgia and having the largest single container terminal in North America, handled over 4.5 million TEU in 2019.

Key Trading Partners and Strategic Importance: It enjoys a diversified and healthy trading network around the globe, making it a vital logistics hub in the Southeast region.

Context for Businesses: If your business requires a strong global network, the Port of Savannah might just be the fit, owing to its broad network and significant capacity.

Port of Houston

Location and Volume: Texas houses the Port of Houston, a key port in the Gulf of Mexico, handling more than two million TEU annually.

Key Trading Partners and Strategic Importance: Its primary trading partners include China, Mexico and Brazil. It serves as an essential hub for trade between the American mainland, Latin America, and beyond.

Context for Businesses: If you’re looking to tap into Latin American and local Texan markets, this port could serve as a significant lynchpin due to its strategic location and established connections.

Port of Oakland

Location and Volume: Positioned in the San Francisco Bay, Port of Oakland shifts over 2.5 million TEU.

Key Trading Partners and Strategic Importance: It has a strong trading link with Asian countries. It’s strategically important as it’s one of the few U.S. ports than can handle mega vessels due to its naturally deep harbors.

Context for Businesses: If your shipments involve larger vessels or if you’re targeting Asian markets, the Port of Oakland can be an ideal choice, given its physical capacities and direct trade links.

Should I choose FCL or LCL when shipping between US and India?

Shipping between the US and India? You may be pondering whether to opt for Full Container Load (FCL) or Less than Container Load (LCL), often referred to as ‘consolidation’. This choice is more than a toss-up – it could significantly affect your costs, delivery times and overall experience. This section unravels these two sea freight options, helping you make an informed shipping decision that aligns directly with your unique needs and contributes positively to your shipping story. Let’s dive in!

Full container load (FCL)

Definition: FCL or Full Container Load Shipping is a type of ocean freight where the entire container is used by a single shipper, either with a 20'ft, 40'ft, or larger FCL container.

When to Use: This shipping mode becomes a good option if your cargo is more than about 14 CBM. It is especially efficient for high volumes of goods, as the per-unit cost decreases with the increasing load, giving you a more attractive FCL shipping quote. Moreover, because the container is sealed, it ensures a high degree of safety during transit; the seal only breaks at the final destination.

Example: Consider a company exporting machinery parts from Chicago to Mumbai. The parts are quite large, filling up a significant portion of a 20'ft container. Going with an FCL shipment in this instance would be financially advantageous and would assure the secure transit of the goods.

Cost Implications: With FCL shipping, while initial costs may seem higher due to the private usage of the entire container, the price per unit ultimately goes down as you pile more goods into the container. This factor establishes FCL as an economical shipping solution for large-volume consignments.

Less container load (LCL)

Definition: LCL (Less than Container Load) shipment is a cost-efficient freight option when you don't have enough cargo to fill an entire container. It means your cargo shares container space with other shippers' goods.

When to Use: If your cargo volume is less than 13 to 15 cubic meters (CBM), the LCL freight option would be your best pick. Its flexibility due to frequent sailings and economy of scale makes it suitable for low volume shipments.

Example: Suppose you're a small-scale exporter of handmade crafts from the US to India with a monthly shipment of 10 CBM. Opting for LCL shipment allows you to ship more frequently without the need to wait and accumulate enough goods for a full container load.

Cost Implications: As you only pay for the container space your cargo occupies, LCL could be a more economic choice for smaller shipments compared to Full Container Load (FCL). However, the unit price might be higher due to shared costs, like the LCL handling fee. Yet overall, for small volumes, the total cost would likely be lower with LCL.

Hassle-free shipping

Discover stress-free cargo shipping with DocShipper, your reliable freight forwarding partner. Our ocean freight experts weigh vital factors like cargo volume, transit time, nature of goods, and budget. They help you choose between consolidation and a full container load when shipping between the US and India - the choice that perfectly fits your needs. Got logistics dilemmas? Tap into DocShipper's expertise. Reach out now for a free, no-obligation estimate!

On average, sea freight shipping between the US and India can range from 22 to 45 days. These transit times, however, are influenced by various factors, including the specific ports used, the weight of the cargo, and the nature of the goods shipped. You’ll need to rely on a freight forwarder like DocShipper, who can provide a tailored quote based on your particular requirements.

| US Port | India Port | Average Transit Time (Days) |

| Port of Los Angeles | Nhava Sheva Port | 35 |

| Port of Long Beach | Mundra Port | 40 |

| Port of New York | Chennai Port | 45 |

| Port of Savannah | Kolkata Port | 35 |

*Please note that these are average transit times and the actual time may vary depending on several factors. Always consult with a freight forwarder for precise shipping times.

How much does it cost to ship a container between US and India?

Estimating the shipping cost between the US and India can be complex. Ocean freight rates can fluctuate between a broad range, influenced by factors like Point of Loading, Point of Destination, carrier selection, the nature of your goods, and even monthly market volatility. But fret not! Rather than leaving you lost in estimates, our shipping specialists are always at hand. We analyze all these variables for every enquiry, providing you a tailored, competitive quote based on your unique needs. Rest assured, we’re committed to giving you the best rates for your specific shipping requirements.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is designed to ship oversized or non-standard cargo, like equipment or machinery that doesn’t fit inside standard containers.

Suitable for: Heavy machinery, large equipment, construction materials, and structures that exceed standard container dimensions.

Examples: Large machinery parts, boats, oversized steel beams.

Why it might be the best choice for you: If you’re shipping items like out of gauge cargo or heavy machinery from the US to India that’s too big for standard containers, an OOG container would provide an ideal solution for your shipping needs.

Break Bulk

Definition: Break bulk involves shipping large goods that aren’t containerized and are loaded individually onto a vessel.

Suitable for: Large items that can’t be easily categorized into certain container types, such as heavy machinery, construction materials, or yachts.

Examples: Windmill propellers, crane booms, transformers.

Why it might be the best choice for you: If you’re dealing with oversized or heavy goods, the flexibility of break bulk could help cater for your specific shipping requirements.

Dry Bulk

Definition: This involves the transportation of unpackaged goods in large quantities, typically poured into the ship’s hold.

Suitable for: Shipping raw materials such as coal, grain, or minerals.

Examples: Grains like rice, wheat, barley, or substantial amounts of coal, iron ore.

Why it might be the best choice for you: Dry bulk might be an ideal solution if your business involves shipping loose cargo load or large amounts of raw materials from the US to India.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-Ro involves shipping wheeled cargo, such as cars, trucks, or trailers, that are driven on and off the ro-ro vessel.

Suitable for: Vehicles, trailers, and machinery that can be rolled onto the ship.

Examples: Cars, trucks, tractors, buses, motorhomes.

Why it might be the best choice for you: If your business involves the transportation of vehicles or other wheeled equipment between the US and India, the convenience and efficiency of Ro-Ro shipping could be just what you need.

Reefer Containers

Definition: These are refrigerated containers used for the transport of perishable goods like fruits, vegetables, or meats side by side with ocean freight.

Suitable for: Temperature-sensitive goods, including food, pharmaceuticals, and certain chemicals.

Examples: Fresh fruits and vegetables, seafood, dairy products, medical supplies.

Why it might be the best choice for you: If you’re transporting perishable goods between the US and India that require temperature control, reefer containers can maintain the necessary conditions throughout the shipping process.

Have specific shipping needs? Let DocShipper help. Feel free to reach out for a custom-tailored free shipping quote in less than 24h. We are here to make your shipping process smoother and worry-free.

Air freight between US and India

Air Freight: Taking Your Business Sky-High from the US to India

When your high-value, smaller cargo needs to reach India from US with speed and reliability, air freight is the ace in your deck. Picture this – jewelry, electronic components, or pharmaceuticals neatly packed, zipping through the clouds, reaching your clients in just a matter of days. Yet, this method is more than just about speed; it’s about efficiency, predictability, and peace of mind.

However, sky-rocketing shipping costs can send your budget spiraling if you’re not careful. Missteps made in crucial areas – like not using the correct weight formula to estimate shipping costs – often blow holes in your pocket. Many businesses don’t realize these hidden factors, akin to stepping on a lego in the dark – it hurts but you don’t see it coming. Throughout this guide, we’ll illuminate those pitfalls and help you steer clear, making your air freight journey smooth and cost-effective.

Air Cargo vs Express Air Freight: How should I ship?

When your business needs to fly goods from the US to India, you’re faced with two options: you either book space in an airline’s cargo hold (that’s your air cargo option), or charter an entire dedicated plane (express air freight). Figuring out which one fits your needs, budget, and delivery timings? That’s where the challenge – and our guide – begins. Hang in there, folks, it’s going to be an epic journey. Ready to break it down? Here we go.

Should I choose Air Cargo between US and India?

Deciding to ship via air cargo from the US to India can be a cost-effective and reliable option, particularly if your shipment exceeds 100/150 kg (220/330 lbs). While transit times might be longer due to fixed flight schedules, the efficiency and dependability rivals other methods. Airlines such as Delta Cargo from the US, and SpiceJet Cargo from India, offer comprehensive services fit for your budget and timeline. Consider your needs carefully, as this choice might be the perfect fit for you.

Should I choose Express Air Freight between US and India?

Express air freight, a service using exclusive cargo planes without passengers, accelerates overseas shipping. Best suiting boxes less than 1 CBM or 100/150 kg (220/330 lbs), it’s perfect for swift international delivery. Renowned carriers like FedEx, UPS, or DHL lead this sector. Say you’re an electronics supplier rushing iPhone screens to a store in Mumbai – Express Air is your solution. Need medical kits delivered pronto to Pune? This ever-ready method ensures your package gets there, timely and hassle-free. This quick, efficient choice could be the ace up your sleeve in urgent scenarios.

Main international airports in US

John F. Kennedy International Airport

Cargo Volume: Handled over 2.3 million metric tons of goods in 2020.

Key Trading Partners: United Kingdom, China, Italy, India, and Japan.

Strategic Importance: Based in New York, one of the largest markets in the world and a major global financial hub.

Notable Features: It offers advanced cargo handling infrastructure and an animal handling facility.

For Your Business: Its location, paired with its advanced facilities, makes JFK a valuable port for businesses looking to reach North American markets fast, especially for high-value cargo.

Los Angeles International Airport

Cargo Volume: Processed 2.8 million metric tons of cargo in 2020.

Key Trading Partners: China, Japan, South Korea, Taiwan, and Hong Kong.

Strategic Importance: Acts as a primary gateway for U.S-Asia trade.

Notable Features: Hosts leading air cargo carriers and offers extensive warehouse and office space.

For Your Business: Its strategic location makes it ideal for businesses exporting goods to Asian markets.

Chicago O’Hare International Airport

Cargo Volume: Managed 2.1 million metric tons of cargo in 2020.

Key Trading Partners: Germany, China, Japan, United Kingdom, and Mexico.

Strategic Importance: Located centrally, it serves as a major hub for connecting international cargos within the U.S.

Notable Features: Exceptional cargo facilities with expeditious customs clearance services.

For Your Business: An optimal choice for turnaround activities and reaching inner American markets quickly, thanks to its central location.

Miami International Airport

Cargo Volume: Handled 2.7 million tons of freight in 2020.

Key Trading Partners: Brazil, Colombia, Costa Rica, Chile, and Argentina.

Strategic Importance: Major gateway to Latin America and the Caribbean.

Notable Features: The largest U.S. airport for international freight, offering a Foreign Trade Zone (FTZ).

For Your Business: A crucial entry point if you’re shipping into Latin or South American markets, offering advantages like deferred, reduced, or eliminated customs duties.

Memphis International Airport

Cargo Volume: Highest in the U.S., with 4.6 million metric tons in 2020.

Key Trading Partners: Hong Kong, China, Canada, Japan, and Singapore.

Strategic Importance: As FedEx’s superhub, it’s renown for its overnight cargo services.

Notable Features: It can handle any size or type of cargo, equipped with the FedEx Super Hub.

For Your Business: Linked to every national market daily, it’s ideal for businesses with shipments that need to reach multiple U.S. locations quickly.

Main international airports in India

Indira Gandhi International Airport

Cargo Volume: Approximately 2 million metric tons per year.

Key Trading Partners: USA, UAE, Germany, and China.

Strategic Importance: Known as the airport hub of India, this airport is strategically located near Delhi and plays a vital role in connecting India to the rest of the world.

Notable Features: The airport boasts state-of-the-art cargo handling facilities with specialized terminals for domestic and international cargo. It also has a dedicated terminal for perishable and temperature-sensitive goods.

For Your Business: If you are looking for a high-volume, high-frequency shipping route for your products, especially perishable goods, Indira Gandhi International Airport is an ideal choice.

Chhatrapati Shivaji Maharaj International Airport

Cargo Volume: Approximately 1.04 million metric tons per year.

Key Trading Partners: The Middle East, South Asia, and East Asia.

Strategic Importance: Located in Mumbai, the commercial and economic capital of India, this airport provides an efficient and convenient gateway for businesses to reach out to India’s vast domestic market.

Notable Features: Known for its modern cargo facilities and systems, including advanced automation and technology for smooth cargo operations.

For Your Business: This airport offers a multitude of cargo services and an expansive route network, making it an excellent choice if your business requires regular and high-volume shipments.

Kempegowda International Airport

Cargo Volume: Approximately 370,000 metric tons annually.

Key Trading Partners: Middle East, Europe, and Southeast Asia.

Strategic Importance: Positioned in Bangalore, a city known as India’s Silicon Valley, the airport serves as an important hub for trade in technology products.

Notable Features: The airport houses the first integrated, on-airport perishable cargo handling centre in India.

For Your Business: If your business specializes in technology or perishable goods, this airport offers extensive freight options well-suited to your needs.

Chennai International Airport

Cargo Volume: Averaging around 400,000 metric tons per year.

Key Trading Partners: Southeast Asia, the Middle East, and Europe.

Strategic Importance: Surrounded by several commercial and industrial areas, this airport is a critical gateway to South India’s vibrant export market.

Notable Features: Theairport features fully automated import and export cargo facilities.

For Your Business: It’s an excellent point of entry and exit for goods if you deal with the South Indian market.

Netaji Subhas Chandra Bose International Airport

Cargo Volume: Around 150,000 metric tons per year.

Key Trading Partners: Bhutan, China, and Nepal.

Strategic Importance: Located in eastern India’s Kolkata, this airport serves as an important trade link between India and its Eastern neighbors.

Notable Features: It’s the largest air logistics centre in eastern India and features advanced cargo handling equipment.

For Your Business: If you do trade with Eastern countries such as Bhutan, China, and Nepal, using this airport as a cargo hub could strengthen your business efficiencies while serving as a gateway to eastern India.

How long does air freight take between US and India?

Typically, air freight shipping from the US to India takes approximately 2-5 days. However, it’s important to note that this is just an average estimate. The actual transit time can vary significantly depending on various factors. These include the exact departure and arrival airports, the weight and dimensions of the consignment, and the specific nature of the goods being shipped. Thus, to obtain more precise, tailor-made timelines for your shipment, it’s recommended that you consult with a dedicated freight forwarder like DocShipper.

How much does it cost to ship a parcel between US and India with air freight?

Shipping air freight parcels from the US to India typically averages around $3-5/kg. However, multiple factors influence this, including distance from departure and arrival airports, parcel dimensions and weight, and the nature of goods. Consequently, providing an exact quote without accurate details is challenging. Rest assured, our dedicated team is committed to working closely with you, tailoring the best rates for your specific needs. We understand that each business is unique and operates differently, thus we quote on a case-by-case basis. Contact us today and receive a free quote within 24 hours.

What is the difference between volumetric and gross weight?

Gross weight refers to the actual weight of your shipment, including packaging materials, pallets, and all that goes in the box. On the other hand, volumetric weight, also known as dimensional weight, calculates the space an item occupies as opposed to its actual weight.

Let’s walk through the calculations. In air freight, the volumetric weight (kg) is determined by multiplying the package’s length, width, height in centimeters, then dividing the result by 6,000. Suppose you have a parcel with dimensions 100cm X 50cm X 50cm, the volumetric weight would be (100 X 50 X 50)/6,000 which equals 41.67 kg or 91.82 lbs in conversion.

In Express Air cargo, however, the calculation differs slightly. The package’s dimensions are first multiplied together, with the result divided this time by 5,000. Taking the previous dimensions, your volumetric weight would thus be (100 X 50 X 50)/5,000 = 50 kg or 110.23 lbs!

The actual gross weight is direct to calculate. If the parcel and contents weigh 70 kg, that is 154.32 lbs when converted.

From our example, the freight charges would be determined by the higher number between the gross weight and volumetric weight. In the case of air freight, the chargeable weight would be 70 kg as it is higher than 41.67 kg, while for Express Air Freight, the volumetric weight of 50 kg is chargeable as it is the higher of the two.

Understanding the difference between these weights is crucial for your logistics budget calculation because shipping prices depend on which is greater. This ensures you’re not caught off guard by unexpected charges!

Door to door between US and India

International door-to-door shipping puts your mind at ease, handling every little detail from your doorstep in the US to its new home in India. With its seamless process and undisputed convenience, door-to-door service is like your goods having a personal chauffeur. Ready to experience the ultra-convenient world of international shipping? Let’s dive in!

Overview – Door to Door

Looking to ship goods from the US to India but overwhelmed by logistic complexities? Fret not, our Door to Door shipping service can be the lifesaver you’re seeking. It’s a stress-free solution loved by our clients worldwide and for good reasons. Imagine transport, customs clearance, and delivery all handled by one provider, sounds soothing, right? However, it might come at a higher cost, but the perks outweigh this minor downside. Now, all you have to do is pack up your goods, patiently wait, and voila, they arrive at your Indian doorstep. It’s shipping made simple, your smooth ride through the rough terrains of logistics.

Why should I use a Door to Door service between US and India?

Spent too much time sweating over logistics headaches? Door to Door service between the US and India is your personal logistics butler; here are five reasons why:

1. Stress-Free Logistics: No need to juggle different carriers or negotiate with customs officials – that’s our job. From the warehouse at source to your customer’s doorstep, we handle everything so you can focus on your business.

2. Timely Deliveries: With a dedicated team ensuring smooth transition across borders and transportation modes, urgent shipments are delivered on-time without the risk of hold-ups.

3. Specialized Care: Transporting fragile, complex, or valuable cargo? Fear not! Door to Door doesn’t just mean transportation; it means safe, specialized handling so your goods arrive in optimal condition.

4. Convenience: Forget worrying about the nitty-gritty details of trucking, port handling, or final mile delivery. We’ve got you covered.

5. Complete Coverage: From the bustling streets of Manhattan to the dense markets of Delhi, Door to Door service ensures your cargo reaches even the most remote corners.

Ultimately, choosing Door to Door service means choosing peace of mind and productivity. It’s like hitting the ‘Easy’ button for your shipping needs.

DocShipper – Door to Door specialist between US and India

Journey your business from the US to India stress-free with DocShipper’s comprehensive, door to door shipping service. Unleash the power of our expertise in transportation, customs, and shipping methods to your advantage. We handle everything, from packaging to all the procedures, so you can focus on what matters. Benefit from the attention of a dedicated Account Executive and receive a free estimate in less than 24 hours. Need advice? Our consultants are available at the other end of a call, ready to help, without any cost. Discover the ease of international shipping with DocShipper today.

Customs clearance in India for goods imported from US

Navigating through customs while importing goods from the US to India can be a complex feat. Surprises such as unexpected fees and charges can add to the uncertainties, making it crucial to comprehend the nitty-gritty of customs duties, taxes, quotes, and licenses. Failing to grasp these actors may even risk your goods stuck in limbo. This guide will help you elude these dilemmas, breaking down each aspect with comprehensive detail. If it feels overwhelming, remember DocShipper is here to help. We assist in streamlining the process for all kinds of goods globally. Feel free to reach out to our team with your goods’ origin, value, and HS Code for a precise estimate. Together, we can ensure your shipping journey is as smooth as possible.

How to calculate duties & taxes when importing from US to India?

Understanding the cost of importing goods from the US to India involves more complexity than what you might see at a cursory glance. The calculation of customs duties is not a simple equation, but rather, a combination of several factors: knowing the country of origin (which is the place where the goods were manufactured or produced), understanding the Harmonized System (HS) code, determining the Customs Value, and being aware of the Applicable Tariff Rate. Additionally, keep in mind that other taxes and fees may apply to your products. Now, to set the ball rolling on this exciting trade journey, start by identifying the country where your goods were crafted. This is crucial as it forms the backbone of your shipment cost estimation.

Step 1 – Identify the Country of Origin

Knowing your product’s country of origin is a jump-off point in estimating duties and taxes for US-India imports. Here are five reasons this is vital:

1. Country of Origin Impacts Duties & Taxes: The country where your goods are produced effects import costs, due to differing trade policies.

2. US-India Trade Agreement Factor: Under the Generalized System of Preferences (GSP), some India-bound American goods are eligible for duty reductions or zero duties. Confirm if your items are under this agreement.

3. Import Restrictions Variances: Rules for restrictions vary from country to country. For instance, some US-made electronics have specific import restrictions when shipped to India.

4. Regulation Differences: Different rules and regulations apply to products according to their origin. These may relate to packaging, labelling, or safety standards.

5. Easy HS Code Identification: Country of origin helps pinpoint the correct Harmonized System (HS) code – the universal language for product classification in imports/exports.

Before plunging into the shipping process, verify your product’s origin, understand relevant trade agreements, be savvy of import restrictions, and keep aligned with regulation nuances. This initial step makes strides in ensuring a smooth, surprise-free import experience.

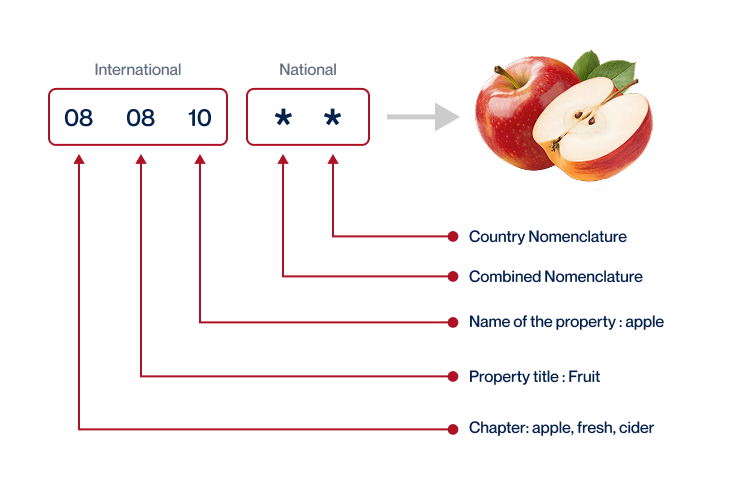

Step 2 – Find the HS Code of your product

The Harmonized System (HS) code is a standardized numerical method of classifying traded products. It is used by customs authorities present worldwide to categorize and monitor the flow of goods across borders. This system allows your goods to be classified during the customs clearance process, ensuring that the correct duties are applied to your shipment.

In most cases, the simplest way to find your HS code is to ask your supplier. They are typically well-versed about the products they manufacture and export, along with the associated regulations and classification requirements.

If contacting your supplier isn’t an option, don’t worry! You can easily find the HS code yourself. Here’s a simple process:

1. Visit this Harmonized Tariff Schedule lookup tool.

2. In the search bar, input the name of the product you’re looking to ship.

3. Once the results appear, look at the ‘Heading/Subheading’ column. There you’ll find the product’s HS code.

Please note, it’s crucial to select the correct HS code with utmost accuracy. Errors in HS code selection can lead to shipping delays, increased costs due to hold-ups at customs or even potential fines for misdeclaration. So be careful and double-check your code!

To wrap up, accuracy in your HS Code is essential, not only for customs clearance but to avoid unnecessary expenses. Here’s an infographic showing you how to read an HS code. Save it for future reference!

Step 3 – Calculate the Customs Value

Ever scratched your head over the difference between the product value and the customs value? Well, while the product value merely reflects the price of the goods, the customs value is a bit more comprehensive. The customs value, known as CIF value, includes the value of the goods, the cost of international shipping, and the insurance costs.

Picture it this way, you bought product X from the US for $100. Add to that, say $20 for shipping and another $10 for insurance. So, the CIF Value here would be $100 (goods) + $20 (shipping) + $10 (insurance) = $130. That’s your customs value! This figure is used by Indian Customs to ascertain the exact duty you must pay for importing your goods into the country, keeping your business compliant and your operations smooth.

Step 4 – Figure out the applicable Import Tariff

An import tariff is a tax imposed by a government on goods being imported into its jurisdiction. For India, the type of tariff used is known as ‘ad valorem’ where the tariff is calculated as a fixed percentage of the value of the imported goods.

To find the duty for your product, begin by using the Indian Custom’s ICEGATE . Enter the HS code, for example, ‘9405’ for Lamps and Lighting Fittings. You’ll then see the corresponding Basic Duty, which is the tariff rate applicable to your goods.

Suppose your product from the US is a Lamp worth $2000, and the freight and insurance (CIF) cost is $500. If the Basic Duty for the commodity is 20%, you calculate the import duty as follows:

Import Duty = Duty%(Value of goods + CIF)

= 20%($2000 + $500)

= $500

This way, you can determine the import duties payable for your goods being imported from the US to India. Remember, getting the HS code and tariff rates right will help ensure the smooth clearance of your goods through customs and avoid any potential delays or penalties.

Step 5 – Consider other Import Duties and Taxes

In importing goods to India from the US, it’s essential to be aware that, beyond the standard tariff rate, additional import duties can apply, determined by factors such as the product nature and country of origin. For instance, an excise duty could be levied, primarily aimed at certain luxurious or harm-inducing goods.

Anti-dumping duties present another potential cost. These are charged when goods are imported at a price less than their normal value in the exporter’s country, to protect domestic industries.

For example, if bicycles were bought for $100 in the US but sold in India for $70, anti-dumping duties may be incurred.

Lastly, the Value Added Tax (VAT) necessitates attention. In India, the standard VAT rate is 18%, implying that on a product valued at $1,000, you would pay around $180 as VAT.

Keep in mind; these examples are illustrative and rates can vary. Using a formula can offer more accuracy: Product Value + Standard Tariff + Additional Duties VAT rate.

Smoothly managing these layered charges requires detailed knowledge and strategy, which is crucial to ensure cost-efficiency in your import process.

Step 6 – Calculate the Customs Duties

Navigating customs duties can be as daunting as decoding a cipher. Yet, understanding this calculation is a key step in your customs clearance process in India.

The crux of the calculation is this: Customs Duty = Customs Value (cost of goods + transport + insurance) x Duty Rate. Let’s explore this with examples.

Scenario 1: Assume you’re shipping a $500 product with no VAT applied. If the customs duty rate is 10%, then your Customs Duty equals $500 x 10% = $50.

Scenario 2: Say the same product incurs 18% VAT. Now, your Customs Duty climbs to $500 x (10% + 18%) = $140.

Scenario 3: Amping up complexity, let’s add 12% anti-dumping tax and a 5% excise duty. Your new Customs Duty becomes: $500 x (10% + 18% + 12% + 5%) = $225.

Remember, tax rates vary, so these examples may not mirror your personal shipping experience. Understanding this calculation not only determines your final costs but assists in checking if you’re overcharged in duties.

That said, why burden yourself with these complex calculations? DocShipper offers complete customs clearance solutions globally, erasing borders and ensuring you’re never overpaying. Contact us for a free quote in less than 24 hours and say goodbye to customs calculations.

Does DocShipper charge customs fees?

Navigating the world of customs can be tricky! DocShipper, being a customs broker in the US and India, will charge a fee for handling your customs clearance, but directly customs duties, taxes? Those are paid to the government, not us. Confusing, right? Think of it this way: The extra espresso shot is our service fee, while the cost of coffee beans goes to the government. With our transparent process, we provide you with all the documents produced by the customs office. This way, you can surely know that you’ve only paid the official customs charges, nothing extra!

Contact Details for Customs Authorities

US Customs

Official name: U.S. Customs and Border Protection Official website: https://www.cbp.gov/

India Customs

Official name: Central Board of Indirect Taxes and Customs (CBIC), India Official website: https://www.cbic.gov.in/

Required documents for customs clearance

Overwhelmed by the paperwork needed for customs clearance? Fear not, we’ll simplify the often misunderstood documents – Bill of Lading, Packing List, Certificate of Origin, and Documents of conformity (CE standard) – playing pivotal roles in your shipping journey, ensuring your goods swiftly reach their destination. Buckle up for this enlightening guide!

Bill of Lading

If you’re shipping goods from the US to India, obtaining the Bill of Lading is non-negotiable. This pivotal document acts like a baton in a relay race, marking the transfer of ownership from sender to receiver. Still wondering why it’s crucial? Think of it as your official receipt, a contract with the carrier, and proof of shipment.

Times are evolving, so is the role of technology in shipping. Embrace the telex release, a digital alternative to paper Bill of Lading, for quick, fuss-free transactions. With telex release, speed meets convenience. Say hello to faster document transmission and bye to lost or delayed paper documents.

Wait, are you dispatching goods by air? Then an Air Waybill (AWB) becomes your new best friend. The Bill of Lading of the skies, it functions similarly but is strictly exclusive to air cargo. Remember, understanding these documents better prepares you for seamless transnational shipping. Prepare, present, proceed! Don’t let documentation hiccups slow you down.

Packing List

In your shipping journey from the US to India, the Packing List will be your quiet MVP. Regardless of whether you choose the skies or the seas, it’s the document that details precisely what’s in your shipment, alongside important specifics like weights and dimensions. Imagine you’re shipping auto parts from Texas to New Delhi – customs officials will rely on your Packing List to verify the package contents. It’s the shipper’s responsibility to nail down accuracy because a discrepancy between your declared contents and actual items could lead to delays or penalties. Given this, it’s essential to ensure your Packing List is complete, correct, and clear – Dodge those detentions, businesses!

Commercial Invoice

When shipping goods from the US to India, a Commercial Invoice is pivotal. It’s not just your ticket to sail through customs, it’s also a shield against untimely shipping hitches. This document serves as a record of the transaction between the exporter and importer. It should include crucial details like the description of goods, pricing, H.S. code, and the terms of trade (Incoterm). Fudging the facts on this form isn’t a risk worth taking, as discrepancies may lead to delays at the customs. For instance, if your Commercial Invoice states that you’re shipping 50 LED TVs each priced at $200, but your Bill of Lading, another vital document, says it’s 60 units each at $250, expect hiccups in the clearance process. Your actionable tip? Double-check, align, and maintain consistent details across all your shipping documents.

Certificate of Origin

Navigating the shipping landscape between the US and India might seem daunting, especially when it comes to paperwork. The Certificate of Origin is essential and serves as your shipment’s birth certificate. This handy document specifies the ‘birthplace’ of your goods, i.e., the country where they were manufactured. Why is it important? Consider this. The US has a concessional duty agreement with India: if your goods originate from the US, you could potentially enjoy lower customs duty rates. It’s like an exclusive pass! To unlock this benefit, make sure to mention ‘USA’ as the country of manufacture on your Certificate of Origin. It’s a simple step, but it could drastically reduce your shipping costs – and who doesn’t love savings!

Certificate of Conformity (CE standard)

Ready to ship your goods from the US to India? You’re on the right path! A vital document involved in this process is the Certificate of Conformity (CE standard). While this mark is mandatory for products in the European market, it’s not directly applicable for our US-India lane. Rather, this signifies that the product meets high safety, health, and environmental protection requirements. Quality assurance, on the other hand, is more of an internal process implemented by companies to assure the quality of their products. Meeting the CE standard is akin to satisfying a regulatory body, akin to US standards like the FCC for electronic devices. For seamless shipping, check your products for applicable US or Indian standards. Always stay compliant to avoid hiccups at customs and make your shipment smooth and efficient.

Your EORI number (Economic Operator Registration Identification)

If your business often ships to Europe, you’ve likely heard of the EORI Number, a unique identifier for importers and exporters. While the EORI Number came to life in the European Union, it still applies to other regions, including the US, when dealing with EU shipments. Your company moving goods between the US and Europe would need one to clear customs efficiently. It’s essential for tracking the movement of goods, aiding quick customs clearance. You may register for your business’s EORI Number online via your national customs website. Yet, when it comes to trade between the US and India, the EORI Number isn’t required. Choose the right documents for the journey, remembering that each shipping route comes with distinct regulations.

Get Started with DocShipper

Prohibited and Restricted items when importing into India

Understanding the rules for importing goods into India can be a real headache. There are goods that India simply won’t allow, while others come with limitations. To avoid delays, fines, or seizure of your shipment, here’s what you need to know about prohibited and restricted items.

Are there any trade agreements between US and India

Currently, there are no official Free Trade Agreements (FTAs) or Economic Partnership Agreements (EPAs) between the US and India. However, businesses should be aware of the ongoing Trade Policy Forum (TPF), which covers multiple business sectors. Also note that potential infrastructure projects, including a proposed new railway line, might significantly alter the shipping landscape in the near future. Despite the lack of comprehensive trade agreements, there’s certainly momentum in US-India trade discussions – a positive sign for businesses shipping between these countries.

US – India trade and economic relationship

The US-India trade relationship, roots stretching back to 1799, continues to strengthen through various trade agreements and economic collaborations. In the 2000s, bilateral relations moved from passive engagement to strategic partnership, seeing a fast-paced growth, including a four-fold increase in total trade value from $25 billion (2002) to over $100 billion (2019). Key sectors of partnership span from textile and apparel, precious metals to machinery and mineral fuels representing the major commodities exchanged.

In 2022, the United States exported goods worth $47.2 billion to India, marking a significant increase of 17.9 percent ($7.2 billion) compared to 2021 and a remarkable surge of 113 percent since 2012, while imports from India totaled $118.8 billion, resulting in a trade deficit of $45.7 billion between the two countries.

Your first steps with DocShipper

Additional logistics services

Warehousing

Finding the right warehouse can feel like finding a needle in a haystack. You need one that's reliable and can handle specialty goods – for instance, if you're shipping chocolate from the US to India, temperature control is crucial. Avoid headaches, save time, and keep your products at their best by considering our tailored options. They could just be the solution you're looking for. Dive deeper into our warehousing options here().

Packing

When exporting goods from the US to India, the stakes are high for packaging. Whether it's furniture, electronics, or perishables, your shipment deserves utmost protection. Trust us, there's no room for mishap. A solid boxing, appropriate cushioning, or even a temperature-controlled package can do wonders. It calls for an agent you can rely on to safeguard your goods.

Transport Insurance

Cargo insurance packs a punch, covering all transport risks, unlike fire insurance which handles only one risk. Picture this: you've got a container packed with premium gadgets. Mid-journey, rough seas cause damage, or worse, total loss. With cargo insurance, you're covered, cushioning your business from unexpected costs. So why dice with danger? Preventing losses has never been easier. Elevate your peace of mind, secure your shipments!

Household goods shipping

Moving across continents? It's no easy task, especially when your precious goods are involved. Picture this - your grandmother's vintage mirror or the bulky piano, delicately wrapped, seamlessly sailing from the US to India. Our personal effects shipping is tailored to handle your cherished items with utmost care and flexibility. Discover a stress-free move.

Procurement in Thailand

Looking to manufacture overseas? DocShipper has your back, smoothing your path to suppliers in Asia, East Europe, and beyond. Leave language barriers and procurement complexities to us – we'll guide your goods from fabrication to freight. Picture an easy life, sourcing stainless steel utensils from India, minus the miscommunications and mistakes.

Quality Control

Keeping a tight leash on quality inspections holds great importance when shipping from US to India. It's your shield against unfortunate surprises like incorrect product specifications or faulty manufacturing. For instance, checking a shipment of custom-made mechanical parts before they're packed can dodge potential costly re-shipments.

Conformité des produits aux normes

When shipping goods, ensuring product compliance with destination regulations helps you avoid import hassles. Our comprehensive lab testing services certify that your items align with all necessary rules, so unexpected regulatory issues don't stall your deliveries.