Did you hear the one about the company that kept losing money shipping goods from the US to Italy? Turns out they were just pasta long their profit! But in all seriousness, moving freight between these two countries can be tough if you don't have a handle on rates, transit times, and customs regulations.

This guide has thus been curated to address these common challenges, aiming to fill the gaps in your knowledge by providing information on different types of freights, customs clearance procedures, applicable duties and taxes. We'll even throw in some handy tips and advice that are tailored to businesses. If the process still feels overwhelming, let DocShipper handle it for you! With us managing every step of the shipping process, your business can smoothly and successfully conquer the complexities of international freight.

Table of Contents

ToggleWhich are the different modes of transportation between US and Italy?

Shipping goods from the bustling markets of the US to the charming sceneries of Italy isn't a walk in the park. The wide Atlantic ocean and land borders provide just two options for transport: air and sea. Ground transportation by road and rail is off the cards. Imagine the sea as a relaxed, long-drive and air transport as the speedy motorway rush. The best method boils down to your good's nature and the urgency of your shipment. Let's hop on this journey and unfurl the pros and cons of these methods for a smooth sailing—or flying—experience in international shipping.

How can DocShipper help?

Struggling to ship goods between the US and Italy? Let DocShipper simplify your logistics. Our expert team handles all aspects, from transport organization to customs clearance. Why stress when we're here to ensure a smooth transition? Reach out now for a free estimate in under 24 hours or dial up our consultants for free advice – we're just one call away!

DocShipper Tip: Sea freight might be the best solution for you if:

- You are shipping large volumes or bulky items, as sea freight offers the most space at a cost-effective rate.

- Your cargo doesn't have an urgent deadline, as sea freight typically has longer transit times compared to air or rail.

- Your shipping routes are between major ports, allowing you to leverage the extensive global network of sea shipping lanes.

Sea freight between US and Italy

Ocean freight is a preferred choice for many businesses shipping from the US to Italy due to its cost-effective rates for bulky goods. The two nations harbor a flourishing trade relationship, with major cargo ports like the Port of Los Angeles in the US and the Port of Genoa in Italy acting as key connectors. Yet, the journey across the Atlantic isn't always smooth sailing. Many businesses encounter stumbling blocks due to lack of knowledge around shipping regulations and best practices.

For instance, if choosing sea freight feels like plotting a course through unfamiliar waters, you're not alone. Many shippers grapple with common mistakes, such as misdeclared cargo or misunderstood customs paperwork. In this section, we will share the necessary compass - a list of do's and don'ts - to make the transit from American to Italian ports less daunting. Just like learning the ropes on a tall ship, understanding these guidelines will make your sea freight experience smoother and more predictable. So, anchors away as we dive deeper into seafaring shipping details.

Main shipping ports in US

Port of Los Angeles

Location and Volume: Located in San Pedro Bay, 20 miles south of downtown Los Angeles, the Port of Los Angeles is significant for its ability to handle a variety of cargo, including containers, automobiles, and breakbulk. It has a shipping volume of over 7.1 million TEU per year.

Key Trading Partners and Strategic Importance: As the busiest port in the Western Hemisphere, it provides significant trade connections with major markets in Asia, including China, Japan, and Vietnam. This strategic position has been solidified with the recent completion of a $1.3 billion infrastructure program.

Context for Businesses: If you're looking to establish robust supply chain connections in Asia, the Port of Los Angeles may be critical to your logistics, given its massive capacity and functional versatility.

Port of Long Beach

Location and Volume: Situated next to the Port of Los Angeles, the Port of Long Beach has a shipping volume of roughly 5.8 million TEU. The port is internationally known for its innovative green port policies.

Key Trading Partners and Strategic Importance: The Port of Long Beach is a key node of the Trans-Pacific trade route, implying strong trade relations with prominent Asian economies. Moreover, its modernized facilities foster efficiency, and its deepwater seaport can accomodate even the largest vessels.

Context for Businesses: For businesses focused on environmental sustainability, the Port of Long Beach, with its distinguished green policies, might be a perfect choice.

Port of New York and New Jersey

Location and Volume: Located on the East Coast at the mouth of the Hudson River, this port has a shipping volume of approximately 7.59 million TEU.

Key Trading Partners and Strategic Importance: The port is a vital link to Europe and the Mediterranean due to the transatlantic trade routes. It also has strong connections with China and India, as reflected in its volume.

Context for Businesses: If your business seeks to expand its influence in Europe or Mediterranean markets, the Port of New York and New Jersey might be an optimal part of your shipping strategy due to its geographical position and large volume.

Port of Savannah

Location and Volume: Located in the southeastern state of Georgia, the Port of Savannah boasts a shipping volume of about 4.6 million TEU.

Key Trading Partners and Strategic Importance: The port is a key player in transatlantic trade, with important connections to Europe, Asia, and the Middle East.

Context for Businesses: If your business plans to navigate multiple markets, the Port of Savannah's strategic connections might be beneficial.

Port of Houston

Location and Volume: Located in the Southern US, this port has a shipping volume of over 2.5 million TEU. It's America's largest port in terms of foreign tonnage.

Key Trading Partners and Strategic Importance: The Port of Houston primarily trades with Mexico, China, and Brazil. Its proximity to the Panama Canal bolsters its significance for North-South trade routes.

Context for Businesses: If you're shipping to Latin American markets, consider the Port of Houston for your logistics needs given its prime location and considerable volume.

Port of Seattle

Location and Volume: Situated in the Northwestern US, the Port of Seattle has a shipping volume of about 3.74 million TEU.

Key Trading Partners and Strategic Importance: Major trading partners include China, Japan, and South Korea, positioning it as an important player in transpacific trade.

Context for Businesses: If your business is looking to tap into Pacific Rim markets, the Port of Seattle might be the key to your logistics plan owing to its established Asian connections.

Main shipping ports in Italy

Port of Genoa

Location and Volume: Situated in the northern region of Liguria, the Port of Genoa is the busiest port in Italy and one of the most vital in the Mediterranean. It handles over 2.5 million TEUs every year.

Key Trading Partners and Strategic Importance: Key trading partners for the Port of Genoa include Spain, Greece, China, and USA among others. This port is of strategic importance due to its direct access to the Ligurian Sea and its major role in the country's economic activities.

Context for Businesses: If your business is seeking expansion into European markets, incorporating the Port of Genoa into your logistics network could offer significant advantages, considering its central role in Mediterranean trade pathways and the comprehensive range of cargo handling services it provides.

Port of La Spezia

Location and Volume: On the western coast of Italy, nestled in the Ligurian Sea, is the Port of La Spezia. While not as large as Genoa, it still manages impressive traffic, handling 1.3 million TEUs annually.

Key Trading Partners and Strategic Importance: Major trading partners include other European countries, Asia, and the Americas. Its strategic importance lies in its proximity to major transport routes across Europe.

Context for Businesses: If your aim is to reduce costs while effectively reaching European and Asian markets, the Port of La Spezia might serve as a viable component in your shipping chain, given its efficient operations and broad network reach.

Port of Naples

Location and Volume: Nestled in the southern coast of the country, the Port of Naples handles roughly 500,000 TEUs makes it one of the bigger ports in Italy.

Key Trading Partners and Strategic Importance: The port has significant trading activities with the Mediterranean countries, as well as with countries in the Middle East and Asia. It is strategically important due to its extensive container terminal and its location, which provides direct access to the Tyrrhenian Sea.

Context for Businesses: If your business is engaged in trade with Middle Eastern countries, incorporating the Port of Naples in your logistics plan could provide necessary efficiency and geographical advantages.

Port of Gioia Tauro

Location and Volume: In the south of Italy, located between Straits of Messina and the Gulf of Gioia Tauro, lies the Port of Gioia Tauro. It's an Intercontinental Hub Port in the Mediterranean with an annual capacity of 3 million TUEs.

Key Trading Partners and Strategic Importance: With extensive dealings with the Middle East, India, and the Mediterranean, its strategic importance arises from its transshipment handling capacity which is the largest in the Mediterranean.

Context for Businesses: If your business model involves significant quantities of transshipments through the Mediterranean, using the Port of Gioia Tauro as a part of your logistics scheme could be beneficial.

Port of Ravenna

Location and Volume: On the northeastern coast of Italy, the Port of Ravenna is another critical port with an annual volume of more than 260,000 TEUs.

Key Trading Partners and Strategic Importance: Handling trade with various European and Middle Eastern countries, its important positioning on the Adriatic Sea makes it a strategic point of entry into Italy and other European markets.

Context for Businesses: If you are aiming to penetrate European and Middle Eastern markets more effectively, the Port of Ravenna could be a sensible addition to your logistics chain, thanks to its positioning, handling capabilities, and connections.

Port of Cagliari

Location and Volume: Situated in the southern part of Sardinia Island, the Port of Cagliari handles up to 1 million TEUs annually, highlighting its significance in Italian maritime trade.

Key Trading Partners and Strategic Importance: Main trading partners include the Middle East, the Americas, and Asia. Its strategic importance stems from its capacity to act as a transshipment hub in the Mediterranean region.

Context for Businesses: If your logistics strategy involves transshipments in the Mediterranean or trade with Middle Eastern and Asian countries, the Port of Cagliari could be a crucial part of your operations plan. Its transshipment expertise and well-lined routes to various international markets certify its importance.

Should I choose FCL or LCL when shipping between US and Italy?

Making an informed decision between Full Container Load (FCL) and Less than Container Load (LCL), or consolidation, can make or break your sea freight experience from the US to Italy. This choice determines your cost, delivery times, and ultimately, the triumph of your shipping process. Let's dive into the intricacies of FCL and LCL to help your business strategically choose the optimal shipping method that's tailored to your specific needs. The ocean's vastness shouldn't cloud your shipping strategy. Let's clear the mist together.

LCL: Less than Container Load

Definition: Less Container Load (LCL) shipping, also known as consolidation, is when your cargo shares a container with other shippers' goods.

When to Use: LCL shipping is ideal when you're dealing with low-volume freight, typically less than 13 to 15 CBM. This option offers flexibility, as you only pay for the space you use, and there's usually more frequent departure times compared to shipping a full container (FCL).

Example: Take the scenario of a US-based furniture company exporting high-end tables to Italy. They only ship about 10 CBM per month. An LCL shipment is the most practical as they avoid unused wasted space in a full container and get their product to market more frequently.

Cost Implications: With LCL freight, you pay according to the volume that your cargo occupies, making it a more affordable option compared to paying for a whole container when you're not utilizing all the space. However, keep in mind that the cost per CBM is higher than FCL, and you might face additional handling charges due to the consolidation and deconsolidation process.

FCL: Full Container Load

Definition: FCL or Full Container Load shipping refers to renting an entire container, typically a 20'ft or 40'ft sized one, for a single shipment. This mode of transport is the go-to choice for large shipments as it promises optimum convenience, security, and cost-effectiveness.

When to Use: If you're shipping volumes larger than 13, 14, or 15 cubic meters (CBM), going FCL would be more economical. Besides, if your shipment's safety is paramount due to high-value items or delicate cargo, FCL is preferable as the container remains sealed from the origin to the destination, reducing the number of hands touching your goods.

Example: Consider a furniture manufacturer in the US shipping a large consignment to Rome, Italy. Given the volume of units and space they occupy, the order would likely exceed 15 CBM. The company should, therefore, consider booking an FCL container to lower costs and ensure the safe arrival of their inventory.

Cost Implications: While FCL's initial cost seems higher than LCL often, keep in mind that FCL provides a per unit cheaper price for high volume, reducing your overall expense. Remember to ask for an FCL shipping quote based on container size to assess the savings compared to other options.

Unlock hassle-free shipping

Choosing between consolidation or a full container for ocean shipping between the US and Italy can leave you in knots! DocShipper exists to untangle those knots. Our ocean freight specialists evaluate key factors like your cargo volume, budget, and time constraints to guide you towards the best shipping method. Save time, reduce stress, and potentially reduce your business costs. Ready to let DocShipper find your ideal shipping solution? Reach out for a free estimation today!

How long does sea freight take between US and Italy?

The journey from the US to Italy by sea freight generally takes about 15 to 33 days, depending on various key factors. These include the specific ports of origin and destination, the weight of the shipment, and the types of items being transported. For a more detailed and customized quote, it's recommended to get in touch with a freight forwarder like DocShipper.

How much does it cost to ship a container between US and Italy?

Shipping a container between the US and Italy comes with multiple variables, making it impossible to guarantee a strict cost range per CBM. These factors span from the Point of Loading and Destination to the carrier, the nature of your goods, and the monthly market fluctuations affecting ocean freight rates. Despite these variables, rest assured our shipping specialists are committed to securing the best rates for your specific needs. We don't offer one-size-fits-all pricing but tailor quotes uniquely for each client's situation. Remember, when it comes to shipping cost, awareness and adaptability are key to navigating this fluid landscape.

Special transportation services

Out of Gauge (OOG) Container

Definition: This type of shipping is specifically designed for the Out of Gauge cargo that cannot fit within the dimensions of standard containers due to their size or shape.

Suitable for: Oversized items like heavy machinery, construction equipment, or specialized industrial components.

Examples: If your business needs to ship a large wind turbine, architectural structures or an airplane engine from the U.S. to Italy, an OOG container might be right for you.

Why it might be the best choice for you: You can protect and securely transport your bulky items without disassembling them, saving both time and costs.

Break Bulk

Definition: This is a method of shipping where goods are bundled into units before loading onto a vessel.

Suitable for: Generally speaking, break bulk is suitable for larger quantities of homogenous goods that can be handled individually.

Examples: This method is common for products like cardboard, paper, or bags of coffee beans, which don't require the full load capacity of a container for their overseas shipping.

Why it might be the best choice for you: If your goods don't perfectly fit into standard containers but aren't oversized, this might be an ideal solution for your shipping needs.

Dry Bulk

Definition: This refers to the transportation of free-flowing, dry commodities in large quantities termed the loose cargo load.

Suitable for: This type of shipment is ideal for transporting goods such as sand, cement, coal, grains, or metal ore.

Examples: If you're a company that exports minerals from the US to Italy, dry bulk shipping would be recommended.

Why it might be the best choice for you: Handle large quantities of unpackaged commodities with convenience and minimal handling costs.

Roll-on/Roll-off (Ro-Ro)

Definition: This type of shipment involves wheeled cargo, driven on and off the ro-ro vessel for efficient transportation.

Suitable for: Businesses shipping cars, trucks, trailers, and other self-propelled or towable machinery.

Examples: Car manufacturers or construction equipment providers would find the Roll-on/Roll-off method ideal.

Why it might be the best choice for you: As the cargo remains mobile throughout the journey, Ro-Ro allows easy handling and ensures the safety of your valuable equipment.

Reefer Containers

Definition: Refrigerated containers, or Reefers, are used for shipping temperature-sensitive cargo across long distances.

Suitable for: Reefers are perfect for businesses that move perishable goods like fruits, meat, fish, or dairy products. Also suitable for certain types of pharmaceuticals.

Examples: An Italy-based supermarket that sources fresh meat from the US would find reefer containers critical to maintaining product quality.

Why it might be the best choice for you: Because temperature control can be customized for your shipment, you can trust reefers to protect the quality of your temperature-sensitive goods.

Remember, choosing the right shipping option is critical for your business's efficiency, and DocShipper is here to help. Please feel free to contact us for a free shipping quote in less than 24 hours. We'll guide you in selecting the best method based on your specific needs.

DocShipper Tip: Air freight might be the best solution for you if:

- You are in a hurry or have a strict deadline requirement, as air freight offers the fastest transit times.

- Your cargo is less than 2 CBM (Cubic Meter), making it more suitable for smaller shipments.

- Your shipment needs to reach a destination that is not easily accessible by sea or rail, allowing you to tap into the extensive network of global airports.

Air freight between US and Italy

When shipping goods between the US and Italy, speed and reliability are vital - and that's where air freight shines! Perfect for smaller items with big price tags (think luxury watches, tech gadgets, or specialized medical equipment), it's a cost-effective way to get your high-value cargo swiftly to its destination. But watch out, as many businesses fumble with the fine details of air freight.

Are you using the right weight formula when calculating costs? Are you aware of the insider tactics that can save a pretty penny? Many shippers lose out here, like showing up to a football game without knowing the rules. But don't worry - we're here to coach you through the intricacies and ensure you score a smooth and successful shipment. Stay tuned as we unravel the nitty-gritty of your air freight journey from the US to Italy.

Air Cargo vs Express Air Freight: How should I ship?

Looking to ship from the US to Italy, but caught in the dilemma of Air Cargo vs Express Air Freight? Let's break it down casually- Air Cargo involves flying your goods via an airline, leaving room for potential stopovers and layovers, while Express Air Freight shoots your goods directly to the destination using a dedicated plane, offering speedy delivery. Stick with us as we dive into the pros and cons of each method, understanding how they fit into your specific business needs.

Should I choose Air Cargo between US and Italy?

Opting for air cargo between the US and Italy can indeed strike a balance between cost-effectiveness and reliability. Leading airlines like Delta Airlines and Alitalia service this route, offering regular cargo schedules, ensuring your goods arrive on time. However, keep in mind that transit times may be longer due to such fixed schedules. Particularly for shipments above 100/150 kg (220/330 lbs), this method becomes more attractive, providing a feasible solution tailored to your budgetary needs.

Should I choose Express Air Freight between US and Italy?

Express air freight utilizes dedicated cargo planes to rapidly transport smaller shipments, typically less than 1 cubic meter or between 100/150 kg (220/330 lbs). Such services excel in speed and reliability, making them an optimal choice when you have urgent or high-value items to ship between the US and Italy. Well-known providers include FedEx, UPS, and DHL, all offering extensive international networks and door-to-door services. For time-sensitive or valuable shipments, this swift mode of delivery might just be an ideal match for your business needs.

Main international airports in US

Los Angeles International Airport

Cargo Volume: 2.6 million metric tonnes annually.

Key Trading Partners: Asia (China, Japan, South Korea), Europe, Latin America.

Strategic Importance: LAX is the main international airport in Los Angeles, one of the busiest ports in the world. It has proximity to major highways and rail networks, making it efficient for subsequent road or railway freight.

Notable Features: LAX has specialized equipment for handling large and unusual shipments, along with state-of-the-art cargo facilities.

For Your Business: If you're trading mainly with Asia or importing high-value goods, LAX's location and significant cargo handling capacity should be a key consideration in your logistics plan.

John F. Kennedy International Airport

Cargo Volume: 1.46 million metric tonnes annually.

Key Trading Partners: Europe, China, Japan, Canada and South America.

Strategic Importance: JFK is a major international gateway into North America, particularly the Northeast region. It is well positioned to supply goods to populous areas like New York City.

Notable Features: JFK has a full-service USPS office on-site, and its Air Cargo Center handles all types of freight.

For Your Business: With extensive connectivity and infrastructure, JFK can be a favorable option if your supply chain involves Europe or the densely-populated northeast U.S.

Chicago O’Hare International Airport

Cargo Volume: 2.2 million metric tonnes annually.

Key Trading Partners: China, Germany, Japan, United Kingdom, South Korea.

Strategic Importance: Located in the heart of the country, O'Hare, America's 'third coast', offers connectivity to various U.S. cities and beyond. It is a central network point for domestic and international shipping.

Notable Features: O'Hare houses a facility dedicated to perishable commodities, ensuring rapid movement of time-sensitive goods.

For Your Business: O'Hare's extensive network and dedicated facilities make it an ideal choice for critical or perishable shipments and businesses that require frequent, fast domestic distribution.

Miami International Airport

Cargo Volume: 2.7 million metric tonnes annually.

Key Trading Partners: South America, Europe, Asia.

Strategic Importance: MIA is considered the 'Gateway to the Americas', serving extensive routes to Central and South America.

Notable Features: MIA features a dedicated cargo area and is respected for its efficiency in handling and transferring goods.

For Your Business: If your business involves high levels of trade with Latin America, MIA's strategic geographic location would be a major advantage.

Memphis International Airport

Cargo Volume: 4.61 million metric tonnes annually.

Key Trading Partners: Asia, Europe, North America.

Strategic Importance: FedEx's superhub is located at Memphis, making it an essential pivot point of e-commerce and express courier services globally.

Notable Features: Memphis is home to the World's second-largest cargo airport. Thanks to its FedEx connection, it guarantees overnight deliveries within the U.S.

For Your Business: If your operation relies heavily on express shipments or e-commerce, Memphis is a beneficial choice due to its tie-up with FedEx's vast network and reliability.

Main international airports in Italy

Leonardo da Vinci–Fiumicino Airport

Cargo Volume: Handles over 2.3 million tonnes of cargo annually.

Key Trading Partners: Major connections with the USA, UAE, and the UK.

Strategic Importance: As Italy's busiest airport by passenger and cargo traffic, its strategic location in Rome makes it a hub for international businesses.

Notable Features: World-class facilities including advanced cargo handling systems and the FCO Airport App that assists with logistical processes.

For Your Business: Your shipping processes can be fast-tracked due to the airport's well-established links with major international hubs, extensive cargo handling capacity, and advanced technology.

Milan Malpensa Airport

Cargo Volume: Annually processes nearly 559,200 tonnes of cargo.

Key Trading Partners: Prominent partnerships with China, Saudi Arabia, and the USA.

Strategic Importance: Located in Lombardy, the richest and most populous region of Italy, it's key for trans-European and global connections.

Notable Features: It offers express cargo services and has decent infrastructure for perishable goods.

For Your Business: Excellent for businesses prioritizing speed and efficient logistics, particularly for perishable goods or urgent shipments.

Bologna Guglielmo Marconi Airport

Cargo Volume: About 50,900 tonnes of cargo are processed annually.

Key Trading Partners: Significant relationships with Germany, France, and Spain.

Strategic Importance: Positioned in the heart of Italy's Motor Valley, it's primely located for shipping automotive parts and related goods.

Notable Features: Distinguished for its Marconi Express, an automated electric train linking the airport to Bologna city center.

For Your Business: Ideal for businesses in the automotive industry due to the airport's strategic location, or those requiring a seamless connection to northern Italy.

Pisa International Airport Galileo Galilei

Cargo Volume: Annually manages close to 23,800 tonnes of cargo.

Key Trading Partners: Operates major cargo routes with the USA, Spain, and Germany.

Strategic Importance: As Tuscany's main airport, it's crucial for commerce in the region.

Notable Features: Owns a dedicated cargo terminal and provides an array of logistical services.

For Your Business: A perfect fit if your cargo destinations are within Tuscany or nearby regions, given its good road connections and comprehensive logistical services.

Turin Airport

Cargo Volume: Treats approximately 12,000 tonnes of cargo each year.

Key Trading Partners: Predominantly trades with Germany, France, and the UK.

Strategic Importance: Favors the industrial and export-led economy of Turin, a city known for automobile manufacturing.

Notable Features: It has a dedicated Cargo Center and is equipped with cold storage amenities.

For Your Business: Could be the right choice if you need to deliver goods to businesses in Turin, particularly in the automotive sector. The availability of cold storage facilities could be beneficial for certain types of commodities.

How long does air freight take between US and Italy?

On average, air freight shipment between the US and Italy takes approximately 8-12 days. This timeframe, however, is not fixed and may vary depending on a plethora of factors. Important considerations are the specific departure and arrival airports, weight of the goods, and their nature, all of which can significantly affect the duration of transit. For precise timelines tailored to your shipping requirements, consult an experienced freight forwarder like DocShipper.

How much does it cost to ship a parcel between US and Italy with air freight?

Shipping an air freight parcel from the US to Italy might approximately cost $3-$5 per kilogram. Remember, this is a broad average - actual costs are influenced by factors like distance from departure and arrival airports, parcel dimensions, weight, and the nature of goods. Providing an exact price isn't feasible due to these dynamic aspects. However, rest assured that our team is here to provide the best rates, tailoring quotes to each specific circumstance to ensure consistency and value. Eager to get started? Contact us and receive a free, bespoke quote in less than 24 hours.

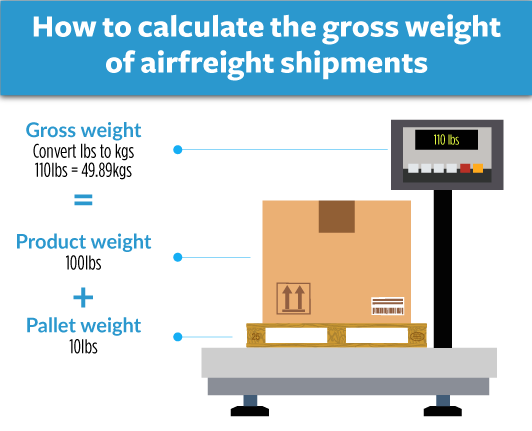

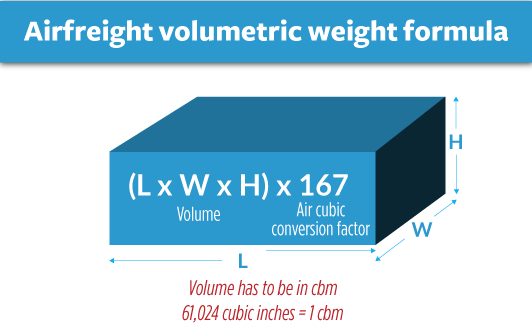

What is the difference between volumetric and gross weight?

When it comes to air cargo, understanding two critical terms—gross weight and volumetric weight—is fundamental. 'Gross weight' simply refers to the overall weight of your shipment, that is, the actual physical weight in kilograms. On the other hand, 'volumetric weight', also known as 'dimensional weight', factors in the size of the item, not just its weight.

In air cargo, to calculate the volumetric weight, you multiply the dimensions of your parcel (length x width x height in cm) and divide it by a volumetric factor; typically, 6000 in the case of air freight. For example, a shipment measuring 60cm x 50cm x 40cm would yield a volumetric weight of (60 x 50 x 40) / 6000 = 20 kg.

In Express Air Freight services, they usually use a slightly different factor, generally 5000. Therefore, using the same dimensions, the calculation would look like (60 x 50 x 40) / 5000 = 24 kg. Quick conversion note: 20 kg equates to approximately 44 lbs, and 24 kg is about 53 lbs.

The importance of these calculations arises when determining the freight charges. Shipping costs are calculated using whichever is highest between the gross weight and the volumetric weight. This allows carriers to ensure they're properly compensated not only for the package's weight but also the space it occupies in their vehicle.

DocShipper tip: Door to Door might be the best solution for you if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You prefer a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want to minimize the handling of your goods, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between US and Italy

Venturing into the realm of international shipping, 'Door to Door' service is a real game-changer. This efficient method ships your cargo right from your doorstep in the US to the recipient's address in Italy. Convenience, time-saving, and fewer hassles - just a few pros of this service. Ready to learn more about this seamless shipping solution? Let's dive in.

Overview – Door to Door

Shipping goods between the US and Italy can be overwhelming, with complex logistics and customs clearance. But, DocShipper's door to door shipping service is your stress-free solution. It's reliable, fast, and designed to tackle cross-border hassles head-on. This service is especially popular among our clients due to its ability to streamline operations. However, be aware, this premium service may cost more than other options. Despite this, businesses love door to door shipping for its simplicity, saving them time for other vital tasks. Choose this service for your peace of mind and leave logistics to us.

Why should I use a Door to Door service between US and Italy?

Ever thought lugging a hefty package from the U.S. to bella Italia was as tricky as twirling spaghetti on a fork? Banish that thought with Door to Door service that essentially holds your hand (or package) through the process. Here's why:

1. Adios, Logistics Stress: Unload the logistics burden on experts and relax as they organize pickup, handle transport, and manage customs clearance. It's a stress-banishing miracle!

2. Timely Delivery for Urgent Shipments: When you have deadlines tighter than a nonna's pasta recipe, Door to Door services shine. They specialize in quick turnarounds, ensuring your time-sensitive goods meet their deadlines.

3. Specialized Cargo Care: Got a complex cargo situation? No worries. Expect bespoke solutions for those awkward items. Whether it's bulky machinery or delicate art, consider it delivered with utmost care.

4. Convenience from Source to Destination: Imagine tasting a Milanese cappuccino while your goods journey from Memphis to Milan. Door to Door services handle everything from pickup to delivery at the final destination, giving a new meaning to convenience.

5. Consistency in Quality: Experience reliable quality standards with services that work with trusted local partners. From Tampa to Turin, you'll receive the same excellent service throughout the journey.

Remember, Door to Door service makes shipping as simple as saying ciao! to your goods at home and benvenuto! at the destination. So, why not spare yourself the spaghetti tangle of international shipping and choose Door to Door service?

DocShipper – Door to Door specialist between US and Italy

Experience hassle-free door-to-door delivery from the US to Italy with DocShipper. We take the stress out of shipping, managing every step from packing to transport, handling all shipping methods, and breezing through customs. Rest assured, our expert team is skilled and proficient in dealing with international freight. Plus, you also get a dedicated Account Executive to aide you in the process. To get started, reach out for a complimentary estimate within 24 hours or connect with our consultants at no cost. Your seamless shipping journey is just a call away!

Customs clearance in Italy for goods imported from US

Customs clearance can often feel like a maze, especially when importing goods from the US to Italy. It's a complex labyrinth encompassing various procedures, possible financial setbacks, and risks of delay due to unfulfilled requirements. An in-depth understanding of duties, taxes, quotas, and licenses is vital to avoid your goods getting trapped at the border. But, don't worry - our guide will demystify this convoluted process and equip you with the knowledge to navigate smoothly. With our partner DocShipper at your side, you can wave your bureaucratic worries goodbye. Reach out with your goods' origin, value, and HS code for a professional assist in your venture. This triad is crucial to initiate a budget estimation and get the ball rolling.

How to calculate duties & taxes when importing from US to Italy?

Understanding customs duties and taxes when importing goods from the US to Italy is key to avoid unforeseen costs and to streamline your shipping processes. Essentially, accurate calculation of these fees relies on a few factors, including the country of origin, the Harmonized System Code (HS Code) of your product, its established customs value, the applicable tariff rate, and any extra charges that may apply.

Starting off, the first step when estimating your import duties and taxes is pinpointing the country where your goods were manufactured or produced. Identifying the true origin of your goods is crucial, as this aids in determining the tariff rates under trade agreements and international customs laws.

Step 1 - Identify the Country of Origin

Grasping the importance of identifying the Country of Origin paves the way for smooth shipping from US to Italy. Five points underscore its significance in calculating duties and taxes.

1. Variances: Duties differ based on origin. Spotting your product's origin can help forecast the overall cost.

2. Trade Agreements: The US and Italy enjoy trade pacts, impacting your customs duties. The lower the duties, the more profit you make.

3. Customs Rules: Both countries have unique obligations. Compliance keeps your goods from being stranded at the border.

4. Restrictions: Certain products face specific import restrictions. Knowledge of these helps streamline the process.

5. HS Code Accuracy: To get an accurate HS code, you need to know the origin. Misclassifications result in fines, penalties, or impoundment.

Special bonds like the EU-US preferential trade agreement can decrease duty rates significantly. Also, restrictions on items such as firearms and other regulated items can delay, or stop, the shipping process. Staying informed and planning accordingly makes your shipping process more efficient and more profitable, whether your goods are high-tech machinery or organic macadamia nuts.

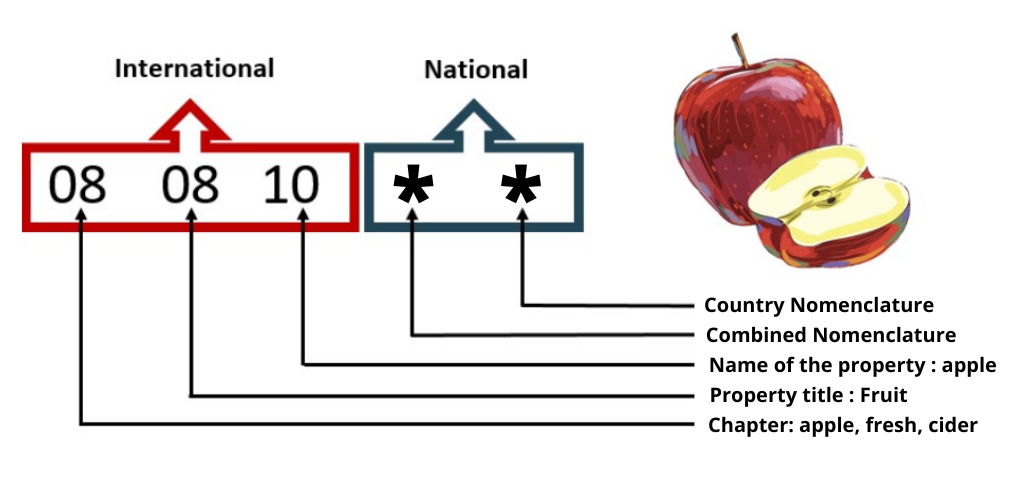

Step 2 - Find the HS Code of your product

The Harmonized System Code, often referred to as the HS Code, is a globally recognized classification system used for traded goods. This comprehensive system uniquely assigns each type of product a specific number, forming the basis for customs tariffs, gathering global trade statistics, and for countries to negotiate the scope of trade agreements.

One of the easiest ways of obtaining the HS Code is to approach your product's supplier. Suppliers usually have a firm understanding of their products and the respective international trade regulations, including the appropriate HS codes.

However, in cases where asking the supplier isn’t plausible, there's a quick and straightforward way to find your product's HS Code. Here's a step-by-step guide:

1. Click on this Harmonized Tariff Schedule to navigate to an HS lookup tool.

2. Key in your specific product name into the search bar.

3. Review the 'Heading/Subheading' column to find your HS code.

While this process is relatively straightforward, it's essential to note the importance of accuracy when selecting an HS code. Misclassification can lead to severe consequences such as customs clearance delays and could even amount to costly fines. Be sure to review your product characteristics thoroughly against the code description to avoid common classification errors.

Understanding an HS code is equally crucial. Here's an infographic demonstrating how to read an HS Code. Remember, the detailed knowledge of product classification not only keeps you on the right side of customs laws but also helps to streamline your international shipping experience.

Step 3 - Calculate the Customs Value

It's important to distinguish between the simple market price of your goods and the customs value. They could be different! In the shipping world, your customs value is your cost, insurance, and freight (CIF) value.

Here's how it works: buy a product for $100, spend $20 on shipping, and add $5 for insurance – your customs value becomes $125. That's the figure Italian customs authorities will use to compute your duties. Mind you, any variation in this formula can significantly alter your final payout. Think of it like a recipe: you get the best results when you carefully measure every ingredient, right? Just like your grandmother's secret sauce, mastering the calculation of your CIF value will make your import experience a whole lot smoother!

Step 4 - Figure out the applicable Import Tariff

Import tariffs are taxes imposed on imported goods, and the exact rate depends on the product type and country of origin. For products imported to Italy from the US, the tariff used is the Common Customs Tariff of the European Union.

To identify your product's tariff, use the TARIC System - European Customs consultation tool. First, enter the HS code identified in previous steps, and select the US as the country of origin.

Let's illustrate this with an example. If you're importing bicycles (HS Code 871200), the TARIC consultation tool might reveal a duty rate of 14%. To calculate your import duties, you start by determining the Cost, Insurance, and Freight (CIF) value. Let's say your CIF value is $10,000. The import duty payable would be 14% of $10,000, equaling $1,400. However, remember this is just a generic scenario - the actual tariff rate and calculation might vary depending on your specific product and circumstances.

Guiding businesses through shipping intricacies is our specialty, and getting familiar with import tariffs greatly reduces surprises and potentially, costs. Never underestimate the potential impact of customs duties. It's always better to be prepared.

Step 5 - Consider other Import Duties and Taxes

Completing the customs clearance process in Italy involves more than just paying the standard tariff rate. In fact, several other import duties may come into play based on your product and its country of origin.

For instance, you may have to pay excise duty for certain goods like alcohol. Let's say you're importing whiskey. The excise duty in Italy could be roughly $3 per liter (just an example; consult the customs authority for precise rates).

Then there's the anti-dumping tax, which Italy, like many countries, imposes to protect its domestic manufacturers against cheap imports. Say you're importing steel from the U.S., and the price is significantly lower than local Italian steel. Anti-dumping duties could then inflate your final cost.

Most notably, you must factor in the Value Added Tax (VAT) that Italy levies on most imported goods. For instance, if the standard VAT rate is 22%, and your shipment is valued at $5000, you'll need to pay a VAT totaling $1100.

Remember, these are broad examples, and exact rates will vary based on a myriad of factors. Be sure to consult an expert for accurate calculations.

Step 6 - Calculate the Customs Duties

Calculating customs duties on your goods imported from the US to Italy can sometimes feel like an accountant's job. Don't worry, it's actually quite straightforward. The primary elements used are the customs value of the goods, VAT (Value Added Tax), Excise Duty if applicable, and sometimes anti-dumping taxes if needed. To compute, you multiply these elements with the goods' customs value.

Let's consider three scenarios:

-In the first instance, your textiles have a customs value of $2000 and a duty rate of 5%, ending in outgoing duties of $100 ($2000 x 5%).

-If they qualify for VAT (20% in Italy), the bases increase to $2200 with the total duty and VAT equalling $440.

-In cases where anti-dumping taxes and Excise Duty apply, assuming these are 10% and 15% respectively on a garment item costing $5000, you'd find yourself paying $500 in duties, $550 in VAT, and an extra $750 for the anti-dumping and excise duty combined.

Still sounds complicated or you just don't have the time? That's where DocShipper steps in. We're here to navigate these complex procedures, ensuring you're not overpaying on your import processes. Why not let us handle everything? Let us give you a free quote in less than 24h. We are one click away and available worldwide!

Does DocShipper charge customs fees?

Rest assured, when shipping with DocShipper, the customs clearance fees we charge are separate from the customs duties and taxes you pay to the government. These payments might often get mixed up, but they're definitely not on the same receipt. To ensure transparency, we'll provide you with the official documents from the customs office indicating exactly what you're paying for. So, you're never in the dark about the costs associated with your shipment. After all, shipping internationally should be easy, and we're here to make sure of that.

Contact Details for Customs Authorities

Italy Customs

Official name: Agenzia delle Dogane e dei Monopoli

Official website: www.agenziadoganemonopoli.gov.it/

Required documents for customs clearance

Sorting through export documents can feel like hiking through a paperwork jungle. Don't fret, we're here to clear the confusion. In this guide, we'll dive into vital docs like the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard) to streamline your customs clearance process. Buckle up, we're about to make your international shipping journey a little less bumpy.

Bill of Lading

Navigating the waters of US-Italy shipping? The Bill of Lading is your navigator. It's a legal document that seals the deal between shipper and carrier, tracking your cargo from port to port. When ownership shifts - that's where the Bill of Lading kicks in. But who loves paperwork? Here's a win: the electronic, or 'telex', release. It's greener, faster, and pandemic-proof – no waiting for couriers.

For airfreights, the AWB (Air Waybill) pops in. It shares the Bill of Lading’s duty but soars high in the skies. Your takeaway? Pay keen attention to these documents and consider telex for smooth operations. They're not just proofs, they're your cargo’s protectors. Choose wisely.

Packing List

Navigating US to Italy shipping? Then, your Packing List is your best friend. It's the ultimate proof of what's inside those shipping crates, whether you're using sea routes or jetting through the air. It's your responsibility to jot down every item that goes onboard and be accurate — the Italian Customs doesn't accept vagueness. Miss out on a single item? You could be fined or delayed at customs. Picture the scene: your new Tuscan retailer is waiting for 500 'Chianti Classico' wine glasses but the Packing List only shows 400 - a logistical and financial nightmare! Treat your Packing List as the 'golden truth' of your cargo to ensure a smooth shipping journey from the US to Italy.

Commercial Invoice

Navigating through custom clearance? Your Commercial Invoice is your best ally, especially when shipping from the US to Italy. It's your detailed declaration of what you're shipping, its value, and where it's made. However, ensuring accuracy is vital: mismatched data between your Commercial Invoice and other shipping documents could trigger costly delays. Take, for instance, the description of goods: An ambiguous 'car parts' description won't cut it; you need to be specific, like 'brake pads for Ford Musting 2023 model.' Aligning these details across your documents will enable smoother clearance, saving you time and funds. Remember, successful shipping isn't always about the quickest route, but the smartest paperwork.

Certificate of Origin

When shipping goods from the US to Italy and vice versa, the Certificate of Origin is your hero document, ensuring smooth sailing through customs. This document testifies where your goods were produced, often giving them a preferential customs duty rate, helping your bottom line. Imagine you're exporting California wines to Rome – stamping 'Made in USA' on your Certificate of Origin could significantly reduce the duties applied because of trade agreements between the two countries. It’s a simple yet powerful step to save money and time, making this key paper essential for hassle-free, cost-effective shipping. Keep the country of manufacture transparent to make the most of preferential trade terms.

Certificate of Conformity (CE standard)

The Certificate of Conformity (CE standard) is your golden ticket when shipping goods from the US to Italy. Why? Because it confirms that your goods meet all EU health, safety, and environmental protection standards. It's not about quality per se but rather about compliance. Contrast this with the US, where standards are typically industry regulated and vary more by product. If your product doesn't have the CE mark, it's a closed door to Italy and the broader European market. So, to ease your shipping process, check your product categories. If they fall under the CE standard, get them certified before shipping. your ease in shipping becomes a smooth sail. Remember, it's all about compliance, not quality.

Your EORI number (Economic Operator Registration Identification)

An EORI number is like your business's passport for international trade. When shipping goods between the US and Italy, an EORI number is essential. This unique code identifies your business to customs authorities, simplifying the tracking of imports and exports throughout the EU. Think of it as your VIP pass for smoother, faster clearance processes. To register, simply apply through your respective customs website. Keep in mind, no EORI, no trade. It's that important and it applies not only in Italy but also in other EU countries. Remember to make the registration part of your shipment plan, right up there with addressing and packing. Get your number and turn the hassle of customs clearance into a streamlined procedure.

Get Started with DocShipper

Navigating US-Italy customs clearance got you tied up in knots? Unwind with DocShipper - your dedicated logistics partner. We tackle every customs hurdle, ensuring a smooth and hassle-free transport of your goods. Ready for a stress-free shipping experience? Contact us today and receive a free, no-obligation quote within 24 hours. It's your turn to experience seamless global shipping.

Prohibited and Restricted items when importing into Italy

Directly shipping goods to Italy? Beware, some items are off-limits or require extra paperwork. It's not just the usual suspects – you might be surprised at what's on the list. Let's illuminate the do's and don'ts of Italian imports to sidestep hurdles and expensive hiccups. Avoid shipping snags and unnecessary hold-ups with this handy guide.

Restricted Products

- Pharmaceutical Products: You have to get an Import License from the Italian Drug Agency (AIFA).

- Firearms and Ammunition: There's a special license you need from the Department of Public Security.

- Plants and Seeds: To bring these in, you'll need a Phytosanitary Certificate from the National Plant Protection Organization.

- Alcohol and Tobacco Products: These need an import permit from the Italian Customs Agency.

- Animal Products: Importing these requires a Veterinary Certificate from the Ministry of Health.

- Radio and Telecommunication Equipment: A special authorization from the Ministry of Economic Development is required.

- Cultural Goods: You have to apply for a permit from the Ministry of Culture.

- Precursor Chemicals: To ship these, apply for a License from the Ministry of Health.

- Endangered Species (plants and animals): An Import Permit from the Ministry of Environment and Protection of Land and Sea is required.

Prohibited products

- Live animals and by-products, except with special authorizations.

- Firearms, explosives, and ammunition without appropriate permits.

- Counterfeit currency and goods.

- Drugs and narcotics, including substances used in their manufacture.

- Offensive weapons, such as flick knives.

- Pornographic material.

- Protected animal and plant species, along with their by-products, covered by the Convention on International Trade in Endangered Species (CITES).

- Soil and any items that may have come into contact with soil, such as farm equipment.

- Cultural artworks and antiques without export licenses.

- Certain foodstuffs, including meat and dairy products from outside the EU.

- Products containing psychotropic substances.

- Goods infringing upon intellectual property rights.

Are there any trade agreements between US and Italy

Yes, while there isn't a direct Free Trade Agreement (FTA) between the US and Italy, they both are part of the World Trade Organization (WTO), creating a cooperative trading framework. Their businesses have likely been affected by fluctuations in duty rates and customs clearance procedures. Trade dialogue is always ongoing, presenting potential for future agreements. It's crucial for you, as a business owner, to stay updated on these discussions as they could significantly impact your shipping costs and timelines. These might also offer new opportunities, such as expanding your market reach or diversifying your supply chain.

US - Italy trade and economic relationship

The bond between the US and Italy stems from centuries of cultural and economic intermingling. The alliance blossomed after WWII, with key sectors such as machinery, vehicles, pharma, and optical and medical instruments bolstering mutual growth. Incredible strides in Italy's fashion and luxury goods have showered the US market with la crème de la crème of style.

As of 2022, bilateral trade equated to $72.5 billion. In the same vein, US direct investment in Italy totaled $38.4 billion, while Italian direct investment in the US stood at $54.7 billion. This commerce paints a vibrant portrait of longstanding cooperation, merging Old World mastery with New World innovation. It's a symbiotic relationship, each keeping pace with the other, for the benefit of their economies and the world at large.

Your Next Step with DocShipper

Tackling your first import/export operation between US and Italy? Overwhelmed by customs regulations, paperwork and logistics planning? You're not alone! Let DocShipper simplify your shipping journey. Our dedicated team handles everything, making your freight forwarding seamless and stress-free. Ready for smoother shipments? Contact DocShipper today!

Additional logistics services

Explore how DocShipper takes care of your entire supply chain journey, going beyond simply shipping and customs. We're your one-stop partner for logistics, always ready to tailor our services to your unique needs. Discover more in this section!

Warehousing and storage

Finding the right temperature-controlled warehouse for your goods can feel like navigating a maze. Here at DocShipper, we've got you covered. Whether it's fashion pieces or fine Italian wines, ensuring environmental safety is key for us. Dive deeper into our trusted warehouse services and see how we can solve your storage nightmares. More info on our dedicated Warehousing page.

Packaging and repackaging

Don't let poor packaging ruin your US-Italy shipping dreams! It's crucial to have an expert prepare your items, whether it's delicate ceramics or bulky furniture. Partner with a seasoned agency — like us, to ensure your goods arrive damage-free. We've got experience packaging all sorts of products. See how we can secure your shipment on our dedicated Freight Packaging page.

Cargo insurance

Wrestling with the uncertainties of shipping? Unlike fire insurance, transport insurance goes beyond covering fires on the sea. It factors in the host of unexpected incidents that can occur on the journey. For instance, it'll have your back when a container gets lost or goods get damaged due to rough handling. Prevention is paramount, and this service is your safety net. Commence a worry-free shipping experience with us today! More info on our dedicated Cargo Insurance page.

Supplier Management (Sourcing)

Want to manufacture goods in Asia or Eastern Europe, but faced with language barriers and supplier search? DocShipper takes care of that, comprehensively handling your procurement process. We'll help you find trusted suppliers, break down language walls, and guide you throughout the journey. Real-world example: We aided an Italian company in sourcing electronic parts from China, smoothing over hiccups due to Mandarin. More info on our dedicated Sourcing Services page.

Personal effects shipping

Moving to Italy from the US? Our Personal Effects Shipping service ensures your bulky, precious possessions get there safely and efficiently. Count on us for that grand piano or priceless antique. Take comfort knowing your move will be handled with expertise and adaptability. More info on our dedicated Shipping Personal Belongings page.

Quality Control

Ensuring your products meet standards during manufacturing is key when shipping from the US to Italy. Quality Control (QC) helps avoid any unpleasant surprises, from faulty designs to shipping damage. A real-world example? A toy producer saved 10,000's of dollars in potential penalties by catching compliance issues during QC. Gain peace of mind and let us examine your goods before they set sail. More info on our dedicated Quality Inspection page.

Product compliance services

Ensuring product compliance can feel like a puzzle. Our Product Compliance Services help decode it. We offer lab tests to certify your goods meet destination regulations. Picture transporting a batch of electronics only to face denial at customs due to incompatible standards– oops! With our services, you dodge such slip-ups. More info on our dedicated Product Compliance Services page.

FAQ | Freight Shipping between US and Italy | Rates - Transit times - Duties and Taxes

What is the necessary paperwork during shipping between US and Italy?

During both sea and air freight shipment from the US to Italy, one critical document we take care of is the bill of lading for sea freight or airway bill for air freight. However, your responsibility includes providing us with your packing list and commercial invoice at the very least. Other essential documents, such as Material Safety Data Sheets (MSDS) or certifications, may be required depending on the specific nature of your goods. This ensures a smooth clearance process on arrival in Italy.

Do I need a customs broker while importing in Italy?

While it is not an absolute requirement, we at DocShipper highly recommend using a customs broker when importing into Italy due to the complex processes and mandatory documentations involved. We aim to simplify your journey, acting as your representative in front of the customs authorities for the majority of shipments. By doing so, we ensure that all procedures are followed correctly, reducing the risk of delays, extra costs, or legal issues. Working with a customs broker, like us, can provide you with the peace of mind knowing your goods will reach their destination safely and legally.

Can air freight be cheaper than sea freight between US and Italy?

While it's quite challenging to pinpoint a universal answer due to variable factors like route, weight, and volume, we can share a general guideline. When your cargo is less than 1.5 Cubic Meters or weighs under 300 kg (660 lbs), air freight becomes a potential cost-effective alternative to sea freight. Regardless of your shipping needs from the US to Italy, at DocShipper, we assure you that your dedicated account executive will strive to offer the most competitive and suitable option tailored to your specific requirements.

Do I need to pay insurance while importing my goods to Italy?

While we at DocShipper confirm that insurance isn't obligatory during the shipping process to Italy or any other destination, we highly advise opting for it. With numerous factors potentially leading to theft, loss, or damage of your goods during transport, having an insurance policy can undoubtedly provide you a safety net. Therefore, incorporating insurance during your shipment process might heighten your peace of mind and safeguard your goods' value in the face of any unforeseen circumstances.

What is the cheapest way to ship to Italy from US?

We recommend sea freight as the most cost-effective method for shipping goods from the US to Italy, especially for heavier shipments or larger volumes. While it may take more time compared to air freight, it offers significant savings due to the considerable distance between the two countries. Be sure to factor in potential customs costs and ensure you're aware of any restrictions on items you intend to ship.

EXW, FOB, or CIF?

Your trading terms choice typically reflects your rapport with your supplier. However, it's key to note that suppliers may not be logistics experts, hence, it's advisable to let a seasoned agent like us at DocShipper mediate the process, especially pertaining to international freight and destination procedures. Ordinarily, suppliers trade under EXW, whereby the goods are made available at their factory or FOB terms that incorporate all local fees until the origin terminal. Regardless of these variables, we at DocShipper can cater to all your needs through our door-to-door services, streamlining your shipping experience.

Goods have arrived at my port in Italy, how do I get them delivered to the final destination?

Here at DocShipper, if your cargo falls under the CIF/CFR incoterms, you will need to get a customs broker or freight forwarder to manage the terminal clearance and import charges on your behalf. Alternatively, you can opt for our DAP incoterms service, where we handle the entire process for you. Always double-check these details with your account executive for clarity. Less hassle for you, more efficiency for your business!

Does your quotation include all cost?

Absolutely, we ensure our quotations encompass all costs, leaving no room for hidden fees or unwelcome surprises. The only extra charges you might encounter are duties and taxes at the destination, but even these can be estimated for you by your dedicated account executive. Transparency and predictability in pricing are our priorities.